Denis Morais explores the trends in the relative adoption of a number of technologies including laser scanning, digital prototyping and shop floor 3D

1. Introduction

Shipbuilding is one of the most complex and demanding of the manufacturing industries combining aspects of[ds_preview] both direct product manufacturing and capital project development. Because of this complexity, shipbuilders could benefit from the adoption of various productivity enhancing tools. The adoption of sophisticated technology is particularly important in high-wage countries which are under competitive pressure from shipbuilders in low cost emerging markets.

The shipbuilding industry is full of bright and qualified people yet it lags other sectors such as the plant, aerospace and automotive industries. Sometimes there are technical reasons for this lag and other times the reasons have more to do with the structure and the culture of the industry. Fortunately, there are strategies and technological developments on the horizon that could assist shipbuilders to cost-effectively implement cutting edge tools and techniques.

2. Laser scanning (High Definition Surveying)

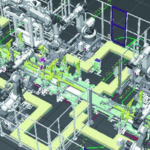

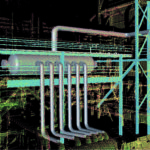

One technology that is sometimes used in shipbuilding but could not as frequently as it could is laser scanning (High Definition Surveying). High definition surveying is a non-intrusive means of rapidly collecting detailed and accurate as-built data. This technique uses a narrow laser beam to sweep across a target object so that hundreds of thousands of closely spaced measurements can be taken in a matter of minutes. When these scanned measurements are displayed on a computer, a dense representation of the target results (a point cloud) can be viewed. This can be viewed and navigated much like a 3D model. CAD objects can be modeled around this background or the point cloud can be used to generate a CAD model. In a manufacturing context, key applications for this technology are to aid assembly, validate manufacturing and to assist repair and refit activities.

2.1. History of laser scanning in other industries

3D laser scanning was first used for industrial purposes back in the late 1980s. The scanners were small »table-top« units which were used for a variety of purposes such as reverse engineering of small objects. Larger scale laser scanning (high definition surveying) for commercial purposes started in the late 1990s. In 1998 Cyra Technologies (now Leica Geosystems) introduced the Cyrax 2400 laser scanner and other companies such as Mensi and Riegl entered the market at approximately the same time. Riegl initially focused on using laser scanning for the mining industry while Cyra and Mensi had close connections to plants. Plants became the most enthusiastic customers in the early years and the technology spread so widely that by the year 2005 it became mainstream to scan as-built models. Offshore oil and gas platforms, being essentially floating plants, are now commonly scanned by contractors constructing and repairing oil rigs.

The automotive and aerospace industry also regularly use high definition surveying for retrofitting factory floors and have long used laser scanning in general to measure parts for accurate fit.

In recent years, the cost of a laser scanner has come down to about $ 30,000. Due to the mission-critical nature of plant operation, $ 30,000 is a paltry sum since it can cost $ 500,000 to lease an oil rig for a single day. If the rig needs to be repaired, every day it is out of commission is a substantial loss of money. A power plant or factory can also not be »down« for very long without significant repercussions.

If repairs need to be done and no CAD model previously exists, a scan will be done to generate an accurate as-built model. Even if a CAD model has previously been created, laser scanners are used to check what was actually constructed because this almost always varies from what was originally planned.

2.2. Laser scanning in shipbuilding

The shipbuilding industry has similar reasons to adopt laser scanning as in other industries. Just as in the aerospace industry, putting the parts and blocks of a ship together is analogous to connecting the assemblies of an aircraft. Accurate measurement helps ensure that everything fits. Quality control is naturally always important but perhaps the biggest benefit comes in repair and refit activities. Today, an average large tanker or military ship will be in the water for anywhere from 35 to 50 years.

The majority of these vessels lack basic engineering drawings and blueprints, let alone computable design data for designers and engineers to reference when attempting to repair damaged or aging vessels, convert vessels for other uses, or retrofit them for more efficient and safe operation. Even the safe disposal of older ships has become a significant challenge as potential dangers from lead paint and other chemicals were not adequately documented when the ships were built or repaired. Today’s shipbuilders and manufacturers need fast, accurate, and cost-effective methods to redesign, recreate, reinvent, salvage, and even destroy ships.

Several progressive shipyards such as Meyer Wert GmbH, Signal International, and Babcock International use laser scanning but the utilization of this technology is not standard amongst shipbuilders and is often opposed. For instance, when Norway’s Marathon Petroleum Company was modifying its FPSO »Alvheim«, Project Manager Bryan Wallace noted in a »Marine Log« case study about the project that the use of laser scanning was resisted by various individuals, Greaves (2006). However, according to Ole Martin Dahle, a member of the engineering team working on the project, laser scanning showed several benefits. Laser scanning was used to create a model of the piping and structure and the model information was used to determine the piping that would be demolished to put in reserve volumes for new equipment. This had to be completed before sending the ship to the Keppel Shipyard in Singapore for the actual modifications. Applying topside clash controls methodology to the scanning-based 3D model revealed significant piping clashes. As this was found early in the design process they were easy to fix, saving significant late »field modifications« which would have been costly and much more difficult without the scan data.

2.2.1. Signal International’s usage of laser scanning

Even though most shipbuilders do not use laser scanning technology, one shipyard that does use this technology is Signal International, a shipbuilder with multiple facilities in the US Gulf Coast. Signal uses a Faro laser scanner on as-built models to check both new production as well as to generate CAD models for refit projects. After going through some intermediary software, point cloud information is ultimately imported into the AutoCAD based ShipConstructor CAD/CAM application to create:

• accurate bill of materials

• general arrangements

• pipe arrangements

• pipe ISO’s by system

• pipe spool drawings

• equipment details

• structural arrangement

2.2.2. Lack of use in shipbuilding

Shipyards building and repairing oil and gas platforms regularly use laser scanners but a question that needs to be answered is why this technology is not used more frequently in the construction and repair of ships? Why is less accurate and more time consuming hand-measuring still the norm?

This is somewhat surprising in that the shipbuilding industry was intimately involved in the early history of the technology. The prototypes of the Cyrax 2400 back in the late 1990s were developed in conjunction with the US Navy and one of the specifications for the product was that it had to be able to fit through a standard manhole on a naval vessel. The shipyard, Babcock International was also one of the first customers ever to purchase the Cyrax 2400.

Another point to be noted is that the shipbuilding and repair business is similar to the construction and repair of a plant if one considers the economic cost of inaccuracies. Shipbuilders often face massive consequences for delays; penalties of hundreds of thousands of dollars per day are not unheard of. That means that a single day’s penalty would thus cost more than the purchase of a scanner. Shipbuilders could benefit from more widespread adoption of laser scanning technology. Reasons why they do not do so will be examined in a later section of this paper.

3. Digital prototyping

Another cutting edge technology is digital prototyping. A quick perusal of shipbuilding magazines over the last decade will reveal that there has been much talk about the application of 3D models and utilizing Virtual Reality. This all presupposes the existence of a »digital prototype«, in other words, a digital or virtual mock-up of a ship. The concept behind using digital prototypes is to do as much work, analysis, and communication as possible within a 3D digital environment, rather than in the physical world. This involves using computer simulations more than physical models and viewing videos and fly-throughs, rather than interpreting paper drawings.

The concept of digital prototyping goes beyond simply creating product designs in 3D. In other industries, it would involve product development teams assessing the operation of moving parts to determine whether or not the product will fail and seeing how the various product components interact with subsystems. In a shipbuilding context, it would involve activities such as FEA and CFD analysis of hulls. It also extends into detail design and production and even into PLM activities.

3.1. The aerospace industry

The aerospace industry is in the forefront of the push towards digital prototyping and operating in the virtual world. Digital mock-ups appear to have been standard in the industry since the early 1990s. The automotive industry is following while in shipbuilding, digital prototyping is not used as extensively.

3.1.1. Boeing 777 and 787

The Boeing 777 and Boeing 787 are commonly considered to be »poster children« for the concept of digital prototyping. The Boeing 777 is often advertised as being the first paperless designed aircraft since the 777 was the first commercial aircraft to be designed entirely on computer. Boeing extended the use of the digital prototype into all aspects of the company. They developed their own high-performance visualization system, FlyThru, later called IVT (Integrated Visualization Tool) to support large-scale collaborative engineering design reviews, production illustrations, and other uses of the CAD data outside of engineering. The result was an enormous success. The use of CAD / CAM / CAE software allowed a virtual aircraft to be assembled in simulation to check for interferences and to verify proper fit of the many thousands of parts, thus reducing costly rework. In fact, over 3000 assembly prototypes were eliminated. Virtually all of the company’s aerodynamic modelling was also done without using physical models in a wind tunnel. The development of the Boeing 787 Dreamliner further extended this success story. Only a dozen prototypes were needed for aerodynamic testing and the extension of the digital prototyping concept saved time and money in other areas as well.

Being able to virtually simulate not just the parts, but the plane’s processes was a great boon for Boeing, giving them more flexibility to make adjustments during the design phase. For example, at one point, the chief pilot for the 787 was doing a virtual test flight and was able to see some issues related to fin control. Using a digital prototype, designers were able to evaluate 50 new possible fin configurations, test them and make the appropriate changes to the rest of the design in only about four weeks. With the old way of working, Boeing might have been able to evaluate three or four new fin configurations and it would have taken at least three or four months. Boeing’s success with digital prototyping has led to this process being the standard in the aerospace industry.

3.2. The automotive industry

The automotive industry has not as fully integrated digital mockups into their entire organizations as the aerospace industry but the use of virtual representations of vehicles for analysis and training purposes is still fairly advanced. Indeed several interesting applications of the concept have appeared in the last few years.

3. 2.1. Jaguar Land Rover’s digital cave

One recent application of Virtual Reality is the »digital cave« from Jaguar Land Rover. In 2008, Jaguar Land Rover unveiled this tool. As with other digital prototyping systems, it allows engineers to simulate testing in wind tunnels, drive vehicles in a variety of conditions and to design mechanical components, Weaver (2010). Instead of looking at a computer terminal however, it lets engineers enter a »cave« surrounded by four acrylic screens and uses eight Sony SRX-R104 projectors to create an image with 4096 x 2160 resolution – more than four times the definition of a 1080 p HDTV. Two projectors on each wall create the stereoscopic perspective. The Virtual Reality cave allows an operator wearing 3D glasses to manipulate images using a wand, similar to a modern games console controller. According to Jaguar Land Rover, the digital cave has saved more than £ 8 m in development costs.

Ian Anderson, Advanced Engineering Programme Manager, said in a UK Automotive Council publication, »While the time taken to develop a car is still about three years, the greater complexity of vehicles has significantly increased the amount of work required. The Virtual Reality system helps us to ensure that we still deliver the highest quality products, because we’re using our time in a much more efficient way.«

3.3. The use of digital mock-ups in shipbuilding

As previously mentioned, references to Virtual Reality, and »digital ships« etc. are common within the shipbuilding industry though these tools do not have universal usage. Shipbuilders are utilizing digital prototyping for Finite Element Analysis (FEA) as well as for Computational Fluid Dynamics (CFD) calculations. They are also using Virtual Reality for design review. However, none of these tools is used as extensively as in the airline or automotive industry at the moment.

3.3.1. FEA and CFD

The usage of FEA is quite common in the shipbuilding industry but CFD, though gaining in popularity, is currently less frequent. Examining the situation with CFD more closely, one might consider wind tunnel testing for aerodynamics to be roughly analogous to tank testing of a ship model for hydrodynamics. CFD algorithms are used in both cases to approximate results and to reduce the amount of physical prototypes needed. One difference is that there has never been anywhere near the amount of tank testing done on new ship hull designs as there has been with airplane wind tunnel testing of wings. After all, the performance of a hull is not nearly as critical as the ability of a plane to lift off the ground. Consequently, it is of no surprise that less CFD analysis on digital prototypes is performed in the shipbuilding industry.

However, due to the rising cost of fuel and constant pressure for yards to construct »green ships«, one might think that there would be more demand for this technology than there currently is. The United States Navy, for instance, is spending large sums of money researching algae based biofuels and there is talk of ideas for cold ironing in harbours. Therefore, one might think that analysis that could be done to improve the fuel efficiency of a hull could give a shipbuilder a significant competitive advantage. If CFD could be proven useful, surely it would be regularly used rather than expensive tank testing or no tank testing at all.

In defence of the industry on the other hand, one can legitimately point out significant limitations in the current CFD algorithms used for marine applications. Analyzing a ship hull’s motion through waves is a massively more complex problem to solve than analyzing the flow of air over a wing. CFD is currently where FEA was twenty years ago so it could be argued that it is not surprising that shipbuilders do not use CFD tools as much as aerospace manufacturers. Having said that, future developments in technology may mitigate this problem and these will be explored later on in this paper.

3.3.2. Virtual Reality for design review

The use of Virtual Reality (VR) for design review is becoming more common as CAD vendors keep promoting the concept. ShipConstructor Software Inc., for example, has encouraged its clients to utilize the Autodesk Navisworks VR viewer to check designs and numerous clients have adopted this tool into their 3D design process.

3.3.3. VR case study: Chetzemoka Project

A good case study regarding the use of Virtual Reality for design review is the design and construction of the most recent Washington State Ferry, the »Chetzemoka«, launched in 2010. Washington State Ferries was actively involved in the design and construction process which involved multiple different companies including Guido Perla & Associates, Todd Pacific Shipyard, Jesse Engineering, Nichols Brothers Boat Builders and Everett Shipyard. The 3D CAD model was created in the ShipConstructor AutoCAD based application from which a Navisworks VR model was derived. All the different parties involved had regular meetings to view the Navisworks model and this viewing of the Navisworks model significantly aided the multiple organizations to work together to complete the project.

3.3.4. Commonality of older methods

Notwithstanding the strides being taken by numerous shipbuilders to adopt the digital approach, simple two-dimensional, paper drawings created in basic software are still the backbone of the shipbuilding industry, especially in lower wage countries. Even when 3D models are used for design review it is usually only managers and engineers who are using the data. Workers in the shipyard rarely participate in these reviews as they do in the aerospace industry. Because of this lack of inclusion, designs are not optimized for efficient production.

4. Shop floor 3D

Having engineers view digital prototypes on a screen in their office is one thing but getting the 3D model down onto the shop floor extends the concept even further. This goes beyond simply having production workers view the design. It involves labourers utilizing the CAD model on a day to day basis. The idea behind shop floor 3D is to allow the manufacturing team to better understand their jobs. To truly integrate the digital prototyping concept, the 3D model cannot be stuck in the office.

Autodesk Inc. is promoting the use of the shop floor 3D concept as a logical extension of its digital prototyping tools used in the Inventor Publisher Program. There are limitations on the number of parts that Inventor can handle so Inventor Publisher would not be as suited for the large 3D CAD models utilized in shipbuilding. However, unfortunately, few shipbuilders have even been asking for this functionality at the present time. Only limited strides have been taken in the direction of shop floor 3D at even the most progressive shipbuilding companies.

In shipbuilding, a 3D model is transformed into 2D drawings which must be interpreted by workers in the yard. Engineers who create the instructions determine what the amount of detail they think is required and draw objects the way they think is best. The use of 3D data would be a more effective method of communication and a more powerful tool for production workers.

4.1. Japanese manufacturing – Shintec Hozumi

By contrast, Japanese manufacturers have truly brought the benefits of digital prototyping to the shop floor. An example of a company using what a Japanese Manufacturing textbook calls a, »familiar use of 3D data at the workplace,« is a company named Shintec Hozumi, Hiroshi (2009). Shintec Hozumi is a company with 400 employees whose business involves both manufacturing of automobile production facilities and factory distribution systems, as well as documentation services for digital content. The company converts facility design data from 3D CAD to XVL, and then displays that data without needing the CAD platforms. Large monitors and displays on carts are installed across the plant so that staff can search for required manufacturing information as well as refer to 3D data. As a result, production staff members are able to directly access information that shows the 3D shapes of products being as¬sembled alongside information such as parts names, and so on. The company has found that this tool aids in communication and productivity.

4.2. Shop floor 3D in shipbuilding Royal Huisman case study

Even amongst the most sophisticated Asian shipbuilders, shop floor 3D is still considered to be exotic. One shipyard is known to use this technique however and that company is the prestigious yacht builder, Royal Huisman from the Netherlands. It makes use of a Navisworks terminal in its production facilities. The terminal is not used to show assembly sequences but shipyard workers can use it to fly-through, zoom in and check items in a Navisworks 3D model.

4.3. Future directions in shop floor 3D

Simply allowing production staff to view the 3D model is only a first step. Showing complete build sequences via 3D animations would dramatically aid in communication compared to simply viewing static models. The use of tablet computers would also allow mobile shipyard workers to bring the digital prototyping experience with them, further enhancing productivity. Currently, other industries are starting to investigate these types of cutting edge tools and it is hoped that shipbuilders can further embrace this technology. It is true that due to the size and complexity of 3D CAD models utilized in shipbuilding, currently there are limitations imposed by the software and hardware that affect the viability of this approach. However, other technological developments may possibly overcome this difficulty and they will be explored later on in this paper.

5. Reasons why shipbuilding lags other industries

It has been shown in this paper that the shipbuilding industry often lags other industries in the adoption of cutting edge technologies. There are multiple reasons why this is the case. Some of the reasons have to do with the limits of hardware and software and the current state of CFD algorithms. Shipbuilding is far more complex than most other manufacturing challenges and technology is often not available to meet shipbuilders’ needs. In other cases however, the challenges have more to do with the structure of the industry itself. This affects the culture of shipbuilding and also affects the money available to develop and implement cutting edge solutions.

5.1. Complexity of shipbuilding

The most obvious reason why shipbuilders have not always been the first to adopt cutting edge technology is that the technology has not always been suitable for shipbuilding. The CAD models required for shipbuilding are far more complex than in other industries, especially on naval projects. For instance, a car consists of about 3,000 parts and a Boeing 777 has 103,000 parts but a SSBN submarine consists of over one million different pieces! The software and hardware required to handle the complexity of digital prototyping can therefore be dramatically different from what is required in other industries. This is a significant issue that should not be minimized. Sometimes naive observers underestimate the problem with virtual simulation by comparing shipbuilding fly-throughs to a video game but this is a false comparison. Despite the apparent complexity and detail of a video game, the information displayed in a video game uses simple surfaces. Objects do not have as much detailed information associated and more importantly, objects do not have to be exact, they just have to fool the eye.

Meanwhile, the motion of a large hull through waves is a far more difficult problem to analyze than airflow over a wing. The CFD algorithms simply have not been developed to handle this level of complexity and unlike with FEA, throwing more computing power at the problem will help but will not solve the underlying mathematical issue since CFD analysis does not converge to a solution in the same way.

5.2. Design and engineering a smaller proportion of cost

The Automotive Council in Britain says that it can take three years to develop a new car model. However, other sources note that a car only takes 23 hours to build. It takes between five to ten years to develop a new airframe but according to Boeing, only about a year to build a plane. Material costs are high but design and engineering costs are much more important. Design is not as significant to the budgets of a shipbuilder as it is to an aerospace or automotive manufacturer who is going to spend proportionately a longer amount of time in research and development. It is understandable then that shipbuilders tend to focus more on the cost of materials and labour, rather than on implementing the most innovative systems for initial design and production engineering. The affect of this issue goes beyond just money. From a cultural standpoint, design and engineering are not seen to be as critical as they are in other industries.

5.3. Smaller series runs

Using the Boeing 747 as an example, over 1,000 planes in this series have been produced since 1969. As for cars, hundreds of thousands of vehicles are produced for a single popular model each year, e.g. about 500,000 Toyota Corollas were produced in 2009. This means that the cost of design and engineering can be amortized over a large number of vehicles in other industries but in shipbuilding this is usually not the case. Often, only a single ship is produced from a design. An order for ten vessels would usually be considered large in most contexts. It is therefore considered less justifiable to spend more money on design and engineering because the cost cannot be spread out as much as in other types of businesses.

5.4. Requirement to make money on each ship

Closely related to the previous point of amortizing costs is that in shipbuilding, companies are expected to turn a profit on each vessel being produced. There is therefore less opportunity to invest in implementing a new technological solution that will only pay off in the long run but in the short term will eat into profitability.

5.5. Build before design is complete

Unlike with the automotive industry, shipbuilders are still designing as they are building. This means there is less opportunity to plan and implement the best methods of design and production.

5.6. Lack of payment during the design phase

In the aerospace industry and automotive industry, a company can more readily raise money for the design phase. Meanwhile in shipbuilding, payment is tied to certain milestones in design. There is therefore an incentive to quickly reach each individual milestone instead of taking the time to implement a new solution that will benefit that shipbuilder in the long run.

5.7. Smaller industry

Shipbuilding is a niche industry in terms of the overall CAD Market. According to Ed Martin, Sr. Industry Manager of Autodesk Inc., the automotive industry makes up about 25 % of the CAD market and aerospace makes up an additional 20 %. Shipbuilding only constitutes a tiny percentage of the customer base. Thus, there is less incentive for CAD vendors to cater to the needs of a complex industry when more money can be made in other market segments. An aerospace manufacturer is almost always going to have more pull than a shipbuilder ever will.

5.8. High fragmentation of the shipbuilding industry

There are 34 aerospace companies listed in the Yahoo directory and 50 companies that are listed as members of the International Organization of Motor Vehicle Manufacturers. These numbers include just about everyone in the business, large and small though both industries are dominated by a much smaller number of firms. Meanwhile, there are 1574 shipbuilders doing new buildings listed in the Worldwide Shipyards 2011 Directory. This means that any individual shipyard has less buying power to convince a CAD vendor to listen to its needs. It also means that there is much more room for an inefficient shipyard to survive. If Boeing adopts a certain technology, Airbus is forced to adopt it as well in order to compete. This is not as pressing a demand in the shipbuilding industry.

5.9. Many shipbuilding CAD/CAM software vendors

Just as there are numerous shipyards, there are several different CAD programs used in the shipbuilding industry including ShipConstructor, AVEVA Marine, Nupas Cadmatic, Foran, CATIA, Intergraph Smart Marine, MATES, Autoship, PTC, CADDS4, MasterShip, Bentley etc. While there are complaints in the automotive industry that there are too many different software solutions used, there is still less fragmentation partially because there are less car manufacturers. In aerospace, a large company such as Boeing can simply mandate that all suppliers use a particular software application. Because there are so many CAD/CAM vendors in the shipbuilding market, each company is by consequence smaller and thus has less capital available for the R & D needed to implement cutting edge solutions.

5.10. Lack of large immediate payoff for change

As noted before in the section on laser scanning, there is a sense of urgency to complete the repair of an automotive factory or the retrofit of an oil rig. While there always is a cost to having any ship out of commission and there is always a cost to inaccurate designs, these issues are felt less strongly in the general shipbuilding industry. Indeed, the shipbuilders most likely to implement laser scanning are those involved in the offshore industry.

6. Overcoming challenges

If you examine each of the above reasons for not implementing cutting edge technology, you will see that they can be broken down into four different underlying themes:

1. Lack of money available to CAD vendors to develop shipbuilding solutions

2. Culture of the shipbuilding industry

3. Lack of money available for shipbuilding design and engineering

4. Complexity of shipbuilding

Solutions have to therefore address those four fundamental issues. It has been noted that currently there are progressive shipbuilders who are utilizing laser scanning, digital prototyping and shop floor 3D so there is reason to believe that others will join them in the future. It is believed that the strategies and trends mentioned below will help make the adoption of the technologies mentioned in this paper more widespread throughout the shipbuilding industry.

6.1. Utilizing shipbuilding specific software tied to a large generic CAD vendor

The first development that will aid the adoption of advanced technology is the growing popularity of shipbuilding software tied to a larger generic CAD vendor. As mentioned before, there are numerous different CAD applications used in the shipbuilding industry. Often these are produced by relatively small companies compared to those that dominate the aerospace and automotive sectors. Unfortunately, small niche companies by themselves do not have the R & D budgets to implement solutions such as the integration of laser scanning point cloud data. On the other hand, there are undeniable advantages to picking a software package that is tailored towards shipbuilding rather than another industry. A way to get the best of both worlds is to purchase a software package specialized in shipbuilding but yet is tied to a larger more generic CAD vendor developing cutting edge technologies. If the tie between the niche shipbuilding CAD company and the larger vendor is close enough, the shipbuilding-specific CAD vendor can help influence the development of the larger company so that it transfers technologies from larger industries into shipbuilding. For example, ShipConstructor software is a niche shipbuilding application built on top of an AutoCAD foundation, tied to Microsoft SQL Server as well as other Autodesk products such as Navisworks. Autodesk is actively pursuing development of all of the technologies described in this paper.

6.2. Implementing a scalable solution

It is becoming widely recognized throughout the business world that a common denominator in the successful implementation of new processes and technology is a high level of engagement from all levels of the workforce. This can be aided if the implementation of a new process is done in a cost-effective, non-threatening, step-by-step fashion whereby new technology is seen to benefit everyone involved. The cost of any new technology mentioned in this paper is usually not that expensive in and of itself because purchasing new software and hardware is relatively inexpensive. The real cost comes with the implementation of those tools which is why a scalable solution is generally recommended.

The Royal Huisman example mentioned earlier is an example of how a scalable approach was successfully utilized to implement the shop floor 3D concept. First, Royal Huisman made black and white Navisworks drawings available to workers on the shop floor and this proved to be immediately popular. The workers liked the black and white drawings but found that they had difficulty differentiating various objects so they asked to have colour printouts instead. This request was granted and the drawings were produced for them in colour. From there it was a simple transition to providing a Navisworks terminal on the shop floor. The process was a natural evolution which was seen to benefit everyone. Extrapolating from this scenario, after shop floor 3D has been implemented and the manufacturing team starts using virtual models for production, there will likely be more communication between the design and manufacturing team. Shop floor workers would more likely be included in the design process and designers will start recognizing the value of their input. These are cultural issues and they are best addressed via scalable software solutions. A scalable approach also helps from an economic perspective because the costs can be spread out over time. ShipConstructor prides itself on being lightweight and scalable. Users can adopt more and more digital prototyping functionality, and adopt shop floor 3D and laser scanning as they grow in sophistication.

6.3. Cloud computing

Cloud Computing is a buzzword at the moment in the computing industry that has famously been mocked by Larry Ellison of Oracle. However, if one ignores the hype and hyperbole, there is actually something profound happening. One key benefit of Cloud Computing is the capability for »infinite computing« in that it harnesses the computing power of distributed computers around the world, scaling to the needs of usage at any given time. Data can be accessed and applications can be run from remote locations without expensive hardware and software. This has given rise to many applications being offered via a (Software As A Service) pay-per-use model. The potential applications of the various aspects of Cloud Computing are significant and could help solve the cost problems previously mentioned.

A perfect example of this is how Cloud Computing could spur the increased adoption of CFD analysis in the shipbuilding industry. As noted earlier in this paper, the underlying algorithms could still use improvement but this will happen over time. As CFD is used more frequently in shipbuilding applications, there will be increased incentive to improve the CFD programs which will create a positive feedback loop and Cloud Computing is possibly the technological development that will start this process in motion. The reason that CFD analysis will likely be used more is that the cost will come down via the adoption of a Software As A Service (SAAS) model. One reason why the shipbuilding industry performs CFD analysis less than it could is related to the cost of purchasing the hardware and software required. Since CFD would typically only be done on significantly different new hulls, at the present time, it might be difficult to justify the large, infrequent expense. On the other hand, if a naval architect accessed a CFD program on the cloud and only paid for the usage required, the cost could be noticeably less. No hardware and software would have to be constantly updated; the SAAS CFD company would look after that detail.

The »risk« would also be lower in that if one was not happy with the results of a particular experience, another vendor with a different algorithm could be chosen. Indeed, several different CFD programs could be used to perform analysis on the same hull and the results could be compared. In fact, the cost might be reduced to the point that multiple analyses could become much more common. The increased computing power available due to the cloud infrastructure could also scale to the complexity required as the CFD shipbuilding algorithms become more advanced. Therefore, Cloud Computing could help mitigate both the cost and the complexity problems hindering the adoption of some aspects of digital prototyping as identified earlier in this paper.

6.4. Parallel processing

Perhaps the most noteworthy technological development that could solve the complexity problem is the fact that new hardware is increasingly utilizing parallel processing. This is happening at the CPU level via multi-core technology and can also be seen with recent trends in Graphics Cards. The performance improvement of the additional processing units is largely dependent on the implementation of the software program architecture. If CAD vendors adapt their software to take advantage of this development in hardware architecture, performance will be dramatically improved. Both Autodesk and ShipConstructor have recognized the importance of this issue and are developing software in such a way as to utilize the power of the increasing processing units.

7. Conclusion

Shipbuilding is a complex industry with a unique structure. While some shipbuilders are utilizing new technologies such as laser scanning, digital prototyping and shop floor 3D, these technologies are not as common as they are in other industries. There are several reasons why this is the case and these reasons involve complexity, culture and money. Fortunately, new technological developments are helping mitigate each of these factors. These factors include scalable shipbuilding software solutions tied to large generic CAD vendors with high R&D budgets, Cloud Computing and Parallel Processing. Together, these factors could help shipbuilders cost effectively adopt cutting edge processes and tools.

Denis Morais, Mark Waldie, Darren Larkins