The present state of the global cruise industry is characterized by many positive

aspects but unfortunately also impacted by the tragic disaster of »Costa Concorda«.

Long-term perspectives, however, remain promising, write cruise market experts Helge Grammerstorf and Miriam Schmenner

Approximately 360 ocean cruise vessels sailed the oceans in 2011. This number varied throughout the year as newbuildings entered the[ds_preview] market, some vessels were laid up temporarily of which some are for sale and others were under repair for a defined period of time. Reliable official numbers of global cruise passengers are not available as cruise passengers are not registered centrally.

Furthermore, many cruise companies don’t publish their passenger numbers, which leads only to estimated global cruise passenger numbers. As an estimate, approximately 19 mill. cruise passengers cruised worldwide in 2011. The North-American source market still contributes the vast majority of passengers and is almost twice as large as the following European source market. As seen from historical development, the American source market seems to slowly reach saturation at 10–11 mill. cruise passengers per year and a very moderate average growth rate of 2.2 % within the past five years. The European cruise market on the contrary is still in a growth phase with an average growth of 11 % p.a. within the past five years. Emerging high potential source markets for the future may be South America (especially Brazil), China and India.

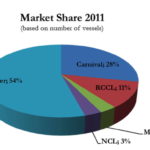

Looking at the 2011 market developments in the cruise sector, the big four players are Carnival Corporation with its brands (Carnival Cruise Lines, Holland America Line, Cunard, P&O Cruises, P&O Cruises Australia, Costa, Princess Cruises, Iberocruceros, Seabourn, Aida), Royal Caribbean Cruises Ltd. (RCCL) with its brands (Azamara Club Cruises, Croisieres de France, Celebrity Cruises, Pullmantur, Royal Caribbean International), MSC Crociere and Norwegian Cruise Lines (NCL).

According to capacity (lower berth / LB), the big four players in the market have a combined share of 80 %, as shown in Fig.1. Contrasting this to the amount of vessels, then the big four only have a market share of 45 %, as shown in Fig. 2. Hence, the average ship capacity of the big four players greatly exceeds the capacities of the category »other« cruise companies.

In 2011, Carnival Corporation had a market share of 28 % in respect of the number of cruise vessels, but a market share of 46 % in respect of capacity (LB) provided. RCCL had a market share of 11 % of units (number of vessels) but 22 % when it comes to the number of berths. MSC and NCL equal to the same market share of 3 % each with respect to the number of vessels and 6 % of worldwide capacity.

The proportions of the market did neither change in the category of number of vessels, nor in the category of capacity from 2010 to 2011. For 2012 the picture will again stay similar, however, the number of ships as well as capacity will grow.

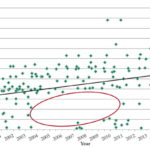

In total, the ocean going cruise fleet grew by 2.2 % in terms of vessels and 3.8 % in terms of capacity in 2011. For 2012 an increase of 2.5 % will be reached in numbers of vessels and an increase of 5.2 % in capacity. This again shows that cruise vessels presently on order are on average larger than average cruise vessels within the fleet. But, as shown in the Fig. 3, smaller vessels are also being ordered again to fill the gap caused by a lack of newbuilds of that size since 2004, when cruise lines obviously ordered vessels solely to meet »economies of scale« demands.

When looking at the individual cruise lines, Carnival Corporation grew by 4.8% according to capacity with the introduction of four vessels in 2011. In 2012 Carnival Corporation’s capacity will show an increase of another 2.5 % by adding three new ships to its fleet. Simultaneously, the Carnival Corporation fleet will be reduced by two vessels due to the loss of »Costa Concordia« and the sale of »Costa Marina«.

Royal Caribbean Cruises Ltd. faced an increase of capacity of 3.1% in 2011 and will additionally grow another 3.1% in 2012 with the introduction of the »Celebrity Reflection«.

MSC did not introduce a new vessel to the market in 2011, but will do so in 2012 with launching »MSC Divina«. Hence, capacity did not change in 2011, but will increase in 2012 by at least 14 %. Possibly, MSC might additionally take over an order of GNMTC (a Libyan company), which was not able to fulfill its liabilities concerning its ordered newbuilding anymore. If this happens the MSC capacity will climb approximately by 28 % in total in 2012.

Since the introduction of the »Norwegian Epic« in 2010, NCL has not introduced another newbuilding. The next addition to the fleet will be in 2013 with the »Norwegian Breakaway«. Consequently, no capacity increase took place in 2011 or will take place in 2012. But NCL started a large refurbishment programme throughout its fleet with an extensive upgrade of three vessels in 2011 and more extensive refurbishments following in 2012.

Although numbers of deliveries per year (eight in 2011 and nine in 2012) are not close to top delivery years from 2001 to 2003 with an average of 15 deliveries per year, the trend of extensive refurbishment programmes and upgrades of existing vessels is present throughout various companies of the industry. Not only NCL, but also Carnival Cruise Line (a brand of Carnival Corporation) introduced an extensive refurbishment program with an investment volume of 500 mill. $. Most frequented cruising areas are the Caribbean and Europe, although other cruising areas such as Australia, the east and west coast of America, Asia and the region of the Indian Ocean offer interesting itineraries. With increasing size of cruise vessels, cruise facilities need to be upgraded or created accordingly. Step by step investments into cruise facilities are being done throughout destinations worldwide.

Apart from the growing capacities and the need for appropriate port facilities, deployment-shifts are another observed development in the cruise industry. Within Europe a shift of deployment has taken place, which is predominantly caused by political instability in the southern Mediterranean region. Destinations in that area are not safe enough or the execution of excursions may be uncertain. Hence, cruise lines were looking for alternative destinations and shifted their itineraries further north. This situation does not seem to change soon. Therefore, it would not be surprising to see year round deployment of cruise vessels within northern Europe in the near future. This trend is additionally favored by the desire of cruise passengers to cruise close to their home countries with short distances and little travel required.

Conclusively, 2011 was again a very successful year for the cruise industry. Although the »Costa Concordia« accident in early 2012, which will be examined below, will have short- to medium-term impact on the entire industry, the long-term developments will not be influenced by much if cruise lines win back trust and confidence of cruise customers and take proactive steps in terms of safety and environmental issues.

»Costa Concordia« disaster

Talking about the cruise industry these days does not go without mentioning the »Costa Concordia« disaster, which occurred on 13 January this year. Although media coverage leveled out after being the top story for almost two weeks, this incident will most probably keep the cruise industry busy for at least several more months as bunker and other hazardous stuff removal proceeds, the salvage of the vessel itself is not accomplished and compensation for victims as well as survivors will have to be settled. A short recapitulation of the incident (status of 24 February 2012): On her journey from Civitavecchia (Rome) to Savona the »Costa Concordia«, carrying 4,229 passengers and crew on board, hit a rock with her port side close to the Italian island of Giglio. Apparently, this rock cut the underwater part of »Costa Concordia«’s hull, which caused immediate water inleakage. The vessel listed to port side immediately and to port after another maneuver. Finally the capsized and grounded vessel had to be evacuated. Reportedly, 32 people are feared to be dead, 25 bodies were found and seven are still missing.

It has to be mentioned that an analysis of the »Costa Concordia« accident can only profoundly be carried out by official investigators as all other parties will lack insightful information. The official analysis will take months till true reasons and findings can be judged on.

Four phases of the incident have to be looked at: The first phase is the pre-accident phase, which includes the maneuvers prior to collision with the rock including the contact with the obstacle. Imputing that no technical problem had occurred to put the vessel into the position extremely close to the coast line, the position of the vessel was not according to »common practice and good seamanship« and therefore far from being »safe«.

So far, only speculative reasons for such a maneuver were presented. Hence, official investigation is awaited and might reveal more details. If human failure was the main reason for this accident, it might be appropriate to discuss whether and how cruise lines can implement an improved control system. The most critical second phase is characterized by the handling of the crisis by the ship’s management and finally the evacuation. Everyone who has ever worked on board a vessel knows that the ship itself generally is its best lifeboat and evacuation is always considered to be the last resort after all other options are not feasible anymore. Once decided, everyone relies on whether or not the trained procedures will be executed and function properly. In this specific case of the »Costa Concordia« some lifeboats as well as life rafts obviously could not be used for evacuation anymore possibly caused by the vessel’s already too large list. Investigators will have to find out which options where available during the process and whether or not available options have been used carefully and in time. The third phase starts after people reached safe ground. The fact that more than 4,000 people were evacuated successfully shows that evacuation supported by outside rescue forces and locals, the inhabitants of Giglio, worked out for the largest proportion of people. The analysis of measures, which have been carried out by different official and self-constituted forces during this phase, will show if there is room for improvement of preparations in this respect.

Momentarily, we find the »Costa Concordia« in phase four, the »clean up« phase, which is characterized by the discharge of heavy fuel oil and other hazardous stuff from the storages of the vessel as well as afterwards the salvage of the vessel itself. These actions and topics will keep Giglio, the salvage companies as well as the whole environment of Giglio busy for months. All efforts are made to prevent from an environmental damage. The different phases of the incident will have to be looked at and judged separately, especially when it comes to the question of consequences, which will have to be drawn from the results of the official investigations.

The industry’s public communication turned out to be a challenge as the leading industry associations CLIA (Cruise Lines International Association), ECC (European Cruise Council) and PSA (Passenger Shipping Association) in a joint comprehensive effort had to put in place crisis plans at very short notice and to arrange a global press briefing only within days. Although similar disasters hopefully will not happen again, the industry now will even more prepare itself to respond in a future case by putting in place standard emergency procedures.

The predominant question arising from the findings of the official disaster analysis shall be: What can be learned? The industry itself has approached IMO (International Maritime Organization) to advise and assist with an overall review of safety procedures, especially SOLAS (Safety of Live at Sea), Live Saving Appliances Code (LSA Code), and other regulations.

Some cruise lines already proactively took action concerning safety issues and procedures. The leading associations CLIA, ECC and PSA adopted a new muster drill policy, where a main issue is addressed, which includes that muster drills with passengers in the future shall be carried out prior to departure. This is more than regulations require, where it may be executed within the first 24 hours of the voyage. Various other proactive actions could be taken by cruise lines to win back the trust of customers into a statistical very safe recreational transportation medium. The new muster policy changes the general approach to regulation by trying to positively interpret demands instead of just fulfilling it. As on the occasion of major disturbances that affected other industries, people might expect precautionary measures being in place covering all and every possible incidents. After a disaster like the »Costa Concordia« more efforts are required to communicate with potential customers and to plausibly explain what is in place for their safety. The safety standard of cruise vessels remains to be one of the highest compared with other means of transportation and accommodation, which is impressively documented by statistics. But for the time being people will ask questions they did not raise before. The cruise industry has a good chance to provide the right answers.

»Booking hesitation is expected to only be a short- to medium-term effect. In the long-term perspective the cruise industry is expected to overcome this dent«

Since the accident, various cruise lines suffer short term effects on bookings. This assumption is supported by an online poll of »The Wall Street Journal«, where 52.2 % of 3,156 total voters say that the »Costa« accident will make them less likely to cruise. When comparing this online poll to another one conducted by the »Cruise Log« of »USA Today«, where only 32 % of 3,120 total voters – whereof 95 % are cruise affine – will be less likely to take a cruise or do not want to cruise at all, a hypothesis may be that cruise affine people reading specialized cruise sites, such as the »Cruise Log« of »USA Today«, are less influenced by the accident than people reading less specialized sites such as the general forum of »The Wall Street Journal«.

This assumption is backed by reactions of travel agents, which do not see big changes in bookings, whereas direct bookings seem to slow down more significantly. This may be caused by the fact that experienced cruisers differentiate between human failure within the accident and the general industry, but first time cruisers develop a natural hesitation as they put the information received less easily into the right context. Booking hesitation is expected to only be a short- to medium-term effect. In the long-term perspective the cruise industry is expected to overcome this dent and return to the success path of generating even higher passenger numbers worldwide.

Helge Grammerstorf, Miriam Schmenner