The booming deepwater oil and gas market asks for larger and more sophisticated supply vessels. US shipyards specialized in building these OSVs currently have an orderbook of over 95 ships.

The offshore drilling industry and related shipbuilding industries in the USA are in the midst of a major transformation. Offshore[ds_preview] drilling operators have been pushing exploration and production into deeper waters and are demanding larger and more sophisticated supply vessels. Where the 3,000 dwt platform supply vessel (PSV) was the primary workhorse for deepwater support five years ago, today the premier PSVs are pushing 5,000 and 6,300 dwt and must have class-2 dynamic positioning. The smaller 1,000 dwt PSVs (without dynamic positioning), which were once the offshore workhorse of the 1980s, are being pushed into obsolescence.

US shipyards enjoy boom in workboat construction

The USA is at the end of a surge in shipyard orders for offshore supply vessels (OSVs) which consists most of medium to extra-large platform supply vessels. These workboats transport heavy cargo, fuel, supplies, and waste products back and forth from shore bases to offshore drilling rigs. In recent years the market for deepwater supply vessels has been growing. As the offshore industry moves further into the deep waters of the Gulf of Mexico,

demand for high-specification PSVs with class-2 dynamic positioning systems has dramatically increased.

The current swell in the orderbook for OSVs began at the end of 2011 as the US Gulf emerged from year-long lull in drilling activity caused by the drilling moratorium imposed in response to the »Deepwater Horizon« oil spill. During this moratorium, industry watchers worried that deepwater rigs would leave the Gulf of Mexico en mass. While a handful of rigs mobilized out of the region, the greater exodus came in form of supply vessels seeking more favorable markets in Mexico, Brazil, and West Africa. Many of these vessels found long-term contracts lasting four to eight years and might never return to US waters.

Influence of Jones Act

By the third quarter of 2012, deepwater drilling activity in the US Gulf had rebound considerably, quickly generating greater demand for large Jones Act qualified platform supply vessels. A smaller fleet of Jones Act supply vessels combined with unprecedented levels of deepwater drilling activity creates huge demand for larger and more sophisticated platform supply vessels.

The US offshore supply vessel industry is a protected market and falls under the federal jurisdiction of the Merchant Marine Act of 1920, popularly known as the Jones Act. US coastal trade is protected by the Jones Act, which in part stipulates that all vessels transporting goods from one

US port to another must be built in the USA, hold the US flag, be crewed by US citizens, and must be majority-owned by US citizens.

This has created a protected market for all coastal trade – resulting in continued demand for US shipbuilding capacity. The original objective of the Jones Act was to protect national security. Offshore facilities and drilling rigs are legally regarded as US ports and can only receive goods and materials via a Jones Act qualified vessel.

Shipbuilding capacity follows demand

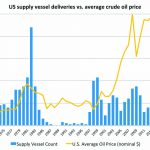

A number of US shipyards have come to specialize in building support vessels for the offshore oil and gas industry over the last forty years of boom and bust cycles. US shipyards specialized in building supply vessels for the oil and gas industry currently have an orderbook of over 95 supply vessels. In 2013, these shipyards delivered 23 supply vessels, mostly PSVs between 4,500 and 6,100 dwt. In 2014, supply vessel deliveries could top 35 units, as shipyards devote more capacity to current demand. To give some perspective, the current fleet of US supply vessels greater than 3,000 dwt is about 100 vessels.

After many decades of boom and bust cycles, most US shipyards have diversified to build for a wide variety of market sectors. Shipyards that build large supply vessels can also construct fishing boats, barges, push-boats for inland river traffic, tug boats, yachts, navy ships, and smaller oil field service vessels. Oil field service vessels can also include numerous small craft such as crew boats, fast supply vessels, minisupply and utility vessels, as well as other small OSVs.

The following information is focused exclusively on the larger offshore supply vessels, PSVs over 50.3m (165 ft) with the capacity to carry drilling fluids, as well as anchor handling towing supply vessels (AHTS) with 4,000+ brake horsepower (bhp).

How do US shipbuilders stack up with Brazil, Asia or Europe?

US shipyards have a reputation for good quality and reasonable prices. Building vessels in Brazil can be 20–30% more expensive than in the USA. Many Brazilian shipyards have been plagued by delays and high costs. Having supply vessels built in Asia can be 10–15% less than in the USA, but perhaps not of the same quality. Compared to the United States, Europe’s shipyard costs span a wide range, from more expensive Norwegian yards offering the highest quality equipment to Polish yards with highly competitive rates on par or less expensive than their US counterparts.

The leaders in supply vessel shipbuilding today are VT Halter Marine, Leevac Shipyards, Gulf Coast Shipyard Group, Eastern Shipbuilding Group, Bollinger Shipyards, BAE Systems Southeast Shipyards, and the Edison Chouest-affiliated shipyards (North American Shipbuilding, LaShip, Gulf Ship and Tampa Ship).

These shipyards have a long history of building supplies vessels for the oil and gas industry. Supply vessels built in the USA are currently in operation around the world, and are heavily represented in oil service fleets in Latin America, West Africa and the Middle East. The Bravante Group, based in Brazil, has ordered four 4,500 dwt PSVs from Eastern Shipbuilding in the USA, the first of which has been delivered and is currently available for work in Rio de Janeiro.

Top three players in the supply vessel market

Edison Chouest Offshore, Hornbeck Offshore Services and Harvey Gulf International Marine all have aggressive newbuild programs focused on large high-specification PSVs to meet the growing demands of the deepwater operators in the US Gulf.

Edison Chouest Offshore is the dominant force in the major supply vessel market of the US Gulf and Brazil. Edison Chouest owns the largest fleet of 3,000+ dwt supply vessels throughout the Americas. The group is an integrated supply vessel provider offering much more than just a boat. Edison Chouest-affiliated companies include shipyards, port operations, subsea services, marine equipment systems, and the most advanced shore-based facilities available in the western hemisphere. Its affiliated shipyards build almost exclusively for Edison Chouest giving them a competitive edge when it comes to shipbuilding costs and delivery time.

Hornbeck Offshore Services and Harvey Gulf International Marine are currently vying for the number two spot as the leading provider of deepwater supply vessels in the US Gulf. Hornbeck is pursuing an aggressive newbuild program with 19 large (5,700–6,300 dwt) PSVs under construction.

Harvey Gulf has grown from being a provider specialized in towing drilling rigs to one of the top three powerhouses in the US Gulf. In 2008, The Jordan Company, a New York-based private equity firm, acquired Harvey Gulf from the Guidry family. Harvey Gulf has since expanded through the acquisition of competitors’ entire fleets and a newbuild program focused on more environmentally friendly LNG-powered supply vessels. Over the last few years, Harvey Gulf has swallowed up Abdon Callais Offshore, Bee Mar’s fleet and most of Gulf Offshore Logistics. Further consolidation could be on the horizon with the purchase of another high-quality US fleet or one of the international vessel companies. Many believe Harvey Gulf is positioning itself to take the company public sometime in the future.

What will the future hold?

Some are concerned the industry is overbuilding, but it is more complicated than that. From the point of view of the drilling operators, it would be best if the market was slightly oversupplied, so that there is sufficient tonnage immediately available for all the active projects at lower prices. Spare capacity of three to four vessels creates greater competition among the supply vessel owners and reduces dayrates. Supply vessel owners prefer a tight market, where there is strong demand for their vessels at elevated day rates.

Supply vessel owners with older PSVs will feel the brunt of a saturated market, and deepwater dayrates will soften when the market reaches equilibrium. But that spare capacity could find its way to Brazil, West Africa, and Mexico – especially by late 2015/2016. Much of the older tonnage is likely to be retired from oil field service; some of the older supply vessels with strong management will continue to be the preferred choice for shallow water operators concerned with keeping costs low.

Author:

Richard Sanchez, Senior Marine Specialist

IHS Petrodata / MarineBase, Houston, Texas

Richard Sanchez