Newbuildings, shipyards, failures and new markets in Asia:

Arnulf Hader, Senior Researcher at the Institute of Shipping

Economics and Logistics (ISL) in Bremen, gives some insight

into the state of the cruise sector

MSC Cruises

In this year’s review of cruise shipping companies the only truly European firm amongst the major[ds_preview] companies, Mediterranean Shipping Cruises, is worth being mentioned first. The sister company of the big container operator MSC has bought and ordered twelve modern ships within ten years and got rid of the three elderly ships. The MSC fleet includes three classes: four with 3,300/3,500 beds, four with 2,500 und four with 1,560 beds. Since no new ships had been in the order book after the delivery of the latest ship, MSC ordered the lengthening of the smallest class. This winter they enter the docks of Palermo, one after the other, and leave them 24m longer and with 193 additional cabins. Already in 2014 MSC reported the ordering of a new series comprising two confirmed contracts plus two options, to be built as usual in St. Nazaire. While this was more or less expected, MSC surprised a little later with another order for two plus one ships from Fincantieri. Seven ships ordered in such a short period is not only a giant expansion for the Swiss-based Italian company, but also on world level.

German operators

All other big brands in Europe belong to one of the American groups. A fast emerging brand is TUI Cruises, the 50:50 joint venture of the Royal Caribbean Group and the German TUI Group. It started a few years ago in Hamburg with a former Celebrity Cruises ship. Meanwhile the brand found its niche in the German market, introduced the second used ship and is now commissioning a series of new vessels. All named »Mein Schiff«, the first new construction »Mein Schiff 3« of 99,000 gt with 2,500 beds was christened in June 2014 in Hamburg, and this year the Finnish builders will deliver the next one. The former STX Finland shipyard is meanwhile sold including the orders for »Mein Schiff 5« and »Mein Schiff 6«, all being of the same successful type. And another two are already under discussion.

Should the German market stop growing fast enough, TUI Cruises might expand into the British market. There, TUI is present with the wholly-owned Thomson Cruises with an ageing second-hand-fleet of five vessels. In Germany, TUI is well established with the traditional Hapag-Lloyd fleet. Rated as the best cruise ship in the world, the 5-Star plus »Europa« is the one known best. The 2013 built »Europa 2« with a similar level of comfort is luring for a younger, more international and less tradition-conscious clientele. Early in 2015, Hapag-Lloyd solved the problem of a charter rate too high for the privately financed »Europa 2«. They were able to buy the ship outright and reduce the yearly financial burden. Moreover, Hapag-Lloyd operates two smaller expedition vessels, thereof one owned.

More expedition ships are chartered by foreign operators in the TUI Group. During the reconstruction of the TUI Group rumors about a sale of cruise activities or assets came up, but now the future seems secured. TUI Cruises reports increasing day rates in full ships, the financial situation of »Europa 2« is recovering quickly and the expedition ships are booked a long time in advance.

TUI is only one owner within the German fleet which is one the most diversified in the world. Other fleets are much bigger, but in Germany more independent owners/operators have survived. And that is now their problem. Phoenix Reisen with three second-hand ocean ships (600 to 1,200 beds) and a large river cruise fleet demonstrates how smaller vessels can be operated successfully in a competitive market.

For one-ship operators, however, things become more and more difficult. The well-known German »Deutschland« is the latest victim. Before his death, founder Peter Deilmann had built up a fleet of two oceangoing vessels (»Berlin« and »Deutschland«) and ten river cruisers in the 5-Star category. Now only the »Deutschland« is left and waiting for a buyer while the company is insolvent and employees as well as most crew members have been given notice to quit.

»Astor« was the last ocean-going vessel of the Bremen-based Transocean Tours with a long history in ocean and river shipping. The company ran into difficulties when the already sold »Astoria« had engine problems and a world tour had to be cancelled. »Astor« was modernized but never more earned enough money to save the independence of Transocean. The company still exists in Munich, but now under the roof of the British Cruise & Maritime Voyages and ownership of the »Astor« by the Greek parent company Global Maritime.

The former Russian ship »Delphin« had a loyal following, but a careful expansion of the fleet unfortunately led to an arrest and insolvency. With an Indian investor the »Delphin« returned to the German market, but the new company Passat Kreuzfahrten is out of business again and the ship is laid-up once more. The young company Ambiente lost its first charter ship when the owner run into problems; for the last season too few tickets were sold and the company closed down. There are still some ships left and we hope that FTI Cruises, Plantours and Hansa Touristic will have better luck with their ships »Berlin«, »Hamburg« and »Ocean Majesty«.

The reasons for so many failures within a short period are varied and include management mistakes, market issues, unexpected technical failures or problems with partners, but the main threat for small companies which have not yet found their market niche, are the big players. Supported by economies of size they can offer so many beds at such low prices and they work with so much publicity that for the small operators the struggle to survive gets harder and harder.

The big three

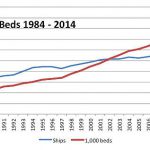

The big brands continue to enlarge their fleets by number of beds, not in any case by number of ships. The general fleet growth has been going on for so long that the oldest ships are just now being replaced by new ones, nearly inevitably bigger ones. Avoiding the boring reports of financial results we focus on newbuilding contracts which are a sign of confidence in an increasing market.

The Carnival Group with around 100 vessels and ten brands sees no need to expand as fast as before. Three to four new ships per year resulting from the framework contract with Fincantieri balance a similar number of withdrawals. The latter had been among the first newbuildings for Carnival Cruise Lines nearly 30 years ago. Such older ships usually first change to smaller brands within the group like P&O Australia or Iberocruceros before they leave the group completely later on. Currently, Iberocruceros is being closed because of the lasting Spanish economic crisis. The last unit, the former »Holiday« of CCL, was sold to Cruise & Maritime Voyages in the UK. The similar »Celebration« was converted into the »Costa Celebration« for a Costa sub-brand, but shortly before re-commissioning sold to the newly created Bahamas Paradise Cruise Line. It is an indirect replacement for the »Bahamas Celebration« of Celebration Cruise Line which grounded in January and was sold for scrap.

In 2014, the group ordered one ship each for Carnival Cruise Lines, Holland America Cruises, Princes Cruises and two smaller ones for Seabourn Cruises. All in all ten new ships will join the fleet until 2018. This may not be enough to keep the fleet thoroughly modern, but it avoids overcapacities in the own fleet and older ships keep the financial burden down.

The No. 2 in the world ranking, the Royal Caribbean Group, is more expansion-minded. The core brand Royal Caribbean Cruises will get two more of the largest cruise vessels worldwide, the Oasis class with 225,000 gt and 5,400 lower beds. Meyer Werft is just joining the blocks of the second of three units of the Quantum class with 168,000 gt/4.180 beds. In addition, the group is negotiating a new series for the Celebrity brand. The Spanish daughter Pullmantur is no more able to take over all the ageing ships. The »Celebrity Century« which was expected to join the group brand Croisieres de France was instead sold to Ctrip, a Chinese travel operator. Knowing that the vessel will operate from April in a 50:50 JV Royal Caribbean / Ctrip, the confidence into the Chinese market becomes evident. Two ships are already there and the new »Quantum of the Seas« will, after a first Caribbean season, also spend the next year in Chinese waters.

Norwegian Cruise Line expanded more than others last year. One way to do this is new ordering. The order book includes four new vessels with 164,000 gt/4,200 beds to be delivered by Meyer Werft between 2015 and 2019. They will follow two slightly smaller units delivered in 2013 and 2014. Before 2013, NCL only had one ship >100,000 gt which improved the profitability significantly.

NCL has also made a big step on the other way, by means of acquisitions. They have bought and integrated the Prestige Cruise Holding with the two brands Oceania Cruises and Regent Seven Seas Cruises. This way the NCL Group also provides a more upscale offer besides the mass market fleet. Regent Seven Seas Cruises has three ships and one on order. Oceania Cruises acquired three of the 700 bed »Renaissance« vessels as first fleet members. In 2011/2012, the double-sized »Marina« and »Riviera« followed as first newbuildings. Next year, Oceania will take over a fourth »Renaissance« sister from Princess Cruises, the »Ocean Princess«, then under the new name »Sirena«.

Since NCL is publicly listed, Star Cruises, the only big Asian player, has reduced its stake in NCL to 28%. Currently, the Star Cruises fleet consists of four second-hand vessels and the directly ordered flag ship, which was delivered from Meyer in the beginning of the Asian crisis in 1999. The second one was completed for NCL. Fourteen years later, Star Cruises returned to Papenburg for ordering two much bigger vessels for the fast recovering Asian market.

Smaller brands

Dazzled by the big players one should not forget the smaller companies. The British Cruise & Maritime Voyages is also revamping the fleet which now includes the »Marco Polo«, the »Astor«, the Portuguese »Azores« on charter and the recently bought »Grand Holiday« as »Magellan«. The Cyprus-based Louis Cruise Lines are re-branding their own cruise operation into Celestyal Cruises and taking the »Explorer« into a three year charter as »Celestyal Odyssey«. She is a sister of the »Chinese Taishan«, which was built as »Olympic Explorer« in 2001 and for some years served as a floating university.

Scrapping and new additions

The »Discovery« (1971/700 beds) was sold for scrap. Built as »Island Venture« she was the famous American Love Boat »Island Princess«. The Korean cruise venture Harmony Cruises has sold its only vessel, the former »Costa Marina«, for recycling – a setback for the Korean market. The »Bahamas Celebration« was already mentioned, and one or two ships more might make their final trips in the next months. So far, the scrapping potential per year is not yet bigger than a handful of ships or about 3,000 beds, respectively. Regarding increasing numbers of deliveries the total fleet can surpass the 300 vessel mark in a few years.

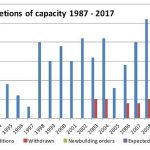

Disregarding the delayed »AIDAprima« the ocean cruise fleet will increase by six new vessels with 15,650 beds, measuring 629,000 gt, in 2015. In 2014, the fleet additions numbered six vessels with 693,000 gt and 18,160 beds. To get the net increase compared with 2013, the 159,000 gt and 4,980 beds of nine withdrawn ships are to be deducted. The average capacity of lower beds increased by 61 to 1,576 beds per vessel. The average capacity of the 2015 newbuildings is 2,609 beds.

Shipbuilders

In cruise ship construction the European shipyards still have the leadership. Several challenges of Asian competitors attempting to get a foothold were not successful. The leading Japanese passenger ship builder Mitsubishi acquired an important contract from AIDA Cruises, but in 2014 they had to admit that the first delivery would be delayed by at least six months and the building costs be much higher than expected. The new series will probably end after two vessels.

The most massive progress of the Koreans in this matter was the purchase of the Aker Group including two passenger specialists in Turku/Finland (best known as Wärtsilä Shipyard) and in St. Nazaire/France (Chantiers de l’Atlantique). They became STX Finland and STX France. Due to the financial and economic crises, however, the Koreans were never happy with the new acquisition. Not only did it reduce the demand for new cruise ships for a while, it also hit the group. Consequently, they had to get rid of several assets in order to survive. The first European shipyards to be sold were the container yards, followed by the offshore yards which in turn were taken over by Fincantieri. The Finnish group focused on ferry and cruise vessel construction in Rauma and Turku was sold too. Only the fate of STX France, where the state holds shares because of the military capabilities, is not yet decided.

The Chinese have reached the position of the leading shipbuilding nation in a surprisingly short period and they seem not to exclude any ship type from their portfolio. Last year, Xiamen Shipbuilding Industries reported the first contract for a 100,000 gt cruise vessel. Later reports put that contract in doubt. The MoUs between China State Shipbuilding Corporation, the Carnival Group and Fincantieri about cruise vessel construction in China for the Chinese market look like a breakthrough for the Chinese. Carnival wants to get Chinese vessels for a new Chinese brand.

STX Finland was saved from closure by Meyer Werft of Papenburg in Germany. The Finnish state asked Meyer for technical assistance and offered 70% of the shares of the Turku facility while 30% should be kept by Finland. Meyer agreed and both shipbuilders can now exchange their know-how in cruise vessels, ferries and gas tankers. Most interesting for Meyer is the large dry dock in Finland because of the size limitations in Papenburg and the river Ems. During the negotiations TUI Cruises increased the small order book by contracts for »Mein Schiff 5« and »Mein Schiff 6«. Earlier, Turku has lost the contracts for more Oasis-class vessels, because STX France offered more financial assistance. Including the new daughter Meyer Turku Shipyard, Meyer became the world market leader.

Fincantieri is No. 2 with five locations in the group being able to construct cruise ships of different sizes. They can rely on the Carnival Group, owners of smaller vessels like Ponant or the new Viking Ocean Cruises and got MSC Cruises as a new client. The fate of STX France is not yet decided and rumors tell about an interest of Fincantieri. From its – except military vessels – nearly empty order book the yard recovered again. Besides the two Oasis-sisters four new ships for MSC are on order and two for Celebrity Cruises are under negotiation.

Should Fincantieri buy a stake in STX France, only two independent groups able to construct large cruise ships would remain and the Chinese will become the third force. For Fincantieri and Meyer a fast development of the Chinese market is now desirable. If no new Chinese owner will order new tonnage for the own market, Costa Crociere or Royal Caribbean may buy ships for their Chinese passengers in China.

Arnulf Hader