LNG shipping is suffering from an expanded fleet. An ambitious export market could compensate for this problem – the USA. However, there is much uncertainty. A recent initiative towards protectionism caused further confusion

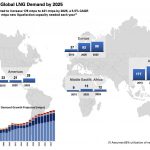

There can be no real assurance for the parties involved. Quite a long time there have been signs for an[ds_preview] important and significant impulse from the United States for the LNG market. The US wanted to turn from an importer to a net exporter, mainly for the Asian market thanks to the volume of the emerging fracking industry.

This would have been very beneficial to shipowners of LNG tankers. Based on the forecast by the industry service Drewry, they will be plagued by similar concerns as their colleagues from the container and bulk shipping this year, and this will only partly be owed to a slowdown in demand in China. Because even on the market for shipments of LNG dark clouds have formed. Analysts have identified the reason for this – it is a circumstance which for years has also affected the container and bulk markets and which is an integral part of industry talks: tonnage overcapacity. Although investments in ship newbuildings have recently been declining, they are expected to double in 2016 with 53 newbuildings and a fleet growth of 12%, according to Drewry. In the fourth quarter 2015, supply exceeded demand by 38 ships. »Vessel oversupply is the key problem for LNG shipping in 2016,« said Shresth Sharma, Drewry’s lead LNG shipping analyst. »Meanwhile, growing LNG supply in Asia-Pacific will reduce the dependency of Asian buyers on Middle Eastern supply which will weigh on tonne mile demand, diminishing overall LNG shipping demand. Hence, we see no let-up in vessel overcapacity, which will continue to put pressure on earnings through 2016.«

A large new export market – in addition to currently emerging projects in Australia and the Middle East – would do the market good. However, it is unclear when this will come true. Thus, delays in US plans have become obvious for some time. One crucial factor is the price of crude oil which is still codetermining the natural gas price development to a certain degree. Crude oil has slumped to a price level just over 30$ for Brent through the aggressive promotion and pricing policies of countries like Saudi Arabia or Russia. This is hitting the US industry hard. For many oil producing regions, the time-consuming production of oil and natural gas is not paying off anymore, plants have to be shut down, planned projects are put on hold.

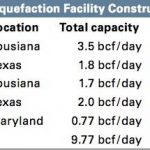

This is naturally affecting the export industry. Projects are already designed more medium-term and cannot move large volumes immediately. The preparations, however, are going on. Over 30 companies have received an approval for large-scale exports of US LNG. Five liquefaction facilities are under construction or already working, whose capacities of 9,77 bcf/day – by their own accounts – are sold mainly through 20-year contracts.

The reality is quite different, and the company Cheniere Energy, one of the major players in the LNG production and exportation, gives an example of this. By 2025, the US wants to be one of the largest exporters and is aiming for a market share of 14%. Those responsible, however, are in a struggle with the recent development and had to postpone the original date for the official opening of the terminal »Sabine Pass« to »end of February/beginning of March.« The signaling effect of this prestigious project is anything but helpful. Cheniere immediately got to feel the consequences. The difficulties on the coast probably had a large share of the market decline which hit the company. So, the price temporarily fell to 22.70$ and below in February – the lowest level in nearly three years. After that the price stabilized somewhat – albeit on a low level. The US policy is having an additional share in the internal difficulties of the sector. In the United States there are always protectionist approaches or for alleged promotion of the domestic industry.

An advance by a small parliamentary group was rejected – it would have been a boon for the US shipbuilding industry, but would have resulted in a deep cut in LNG export. Among others the Californian Democrat John Garamendi belongs to this group. With his colleagues he is working towards a legal regulation inspired by the »Jones Act«, according to which the US LNG export US may only take place on US-built ships, flying the US flag and manned by US sailors. The initiative could initially not organize a majority. It was also not the first time such a project failed. Early in 2015, there was another approach to incorporate an equivalent scheme into the »LNG Permitting Certainty and Transparency Act«. In the vote there was a majority of 237 against. However, there were 175 votes in favor, which suggests that the proponents are not a marginal group.

For the shipbuilding industry such a proposal makes sense. Like their European competitors the US shipyards have long lost touch compared with Asian shipbuilding. Standard shipbuilding does not exist, mainly military units are manufactured plus a small number of newbuildings which fall under the Jones Act. Although the order for gas-powered vessels of shipping companies Crowley & TOTE Inc. attended a stir, these orders are too little to utilize the industry to capacity. For a time and cost-efficient construction of LNG tankers US yards are lacking know-how, experts say.

This suggestion suffered a major setback by US Government Accountability Office (GAO) expertise, which provides some statements on the state of the US shipbuilding industry. It has therefore been read in the industry with great interest.

The report says, among other things, that about 4,000–5,200 sailors would be needed if the required estimated 100 LNG carriers would operate according to the US regulations, so there is no decline in shipments. These freighters would still have to be built because they are not currently found in the US fleet. However, the shipbuilders lack experience and productivity. The additional costs for newbuildings made in the United States (instead of made in Korea) are estimated to be about 200 mill. to 450mill. $. This would be two or three times the costs. LNG carriers have not been built in the US since before 1980. 250 of the 350 LNG carriers delivered in the last 20 years were built in Korea. US shipyards would need to invest in equipment. »Although some are currently gaining experience building LNG-powered vessels, shipbuilders stated that this experience is not comparable to building the large containment systems required for transporting LNG for trade«, the GAO said.

Only two shipyards have sufficient capacity (docks), which are utilized until 2018. Based on the latest state of events the US-shipbuilding industry would need a total of 30 years to built the required fleet, the experts say.

Looking at the situation of the US shipbuilding industry it seems quite coherent that the policy is trying to send shipbuilders some government support. In Asia, it is also widely common to help the shipyards – even if this is done primarily by large-scale subsidy programs. On the other hand this policy helps only little which is another finding of the GAO report: if US shipyards are unable to process orders because of staff and professional problems, the desired LNG export will not be achieved and this will cause orders to decline or at least decrease medium-term.

These difficulties and other costs in fleet operation under US regulations convince the GAO to assess a quite problematic situation for the US industry competitiveness in case such rules will be adopted. Since a sufficiently large number of LNG cargo vessels would not exist at the beginning in any case, customers looking for alternatives must be included in the calculation. All this – according to the GAO – could eventually lead to job losses.

Garamendi holds on to his fundamental conviction: »These are investments we need to make anyway to ensure future shipbuilding capacity and military readiness, and for our long-term economic and national security. Requiring that LNG be transported on American ships won’t just create and safeguard US jobs: it will force us to address our infrastructure deficiencies, rather than simply outsourcing the work to foreign countries that have the capacity we currently lack. If we are serious about maintaining our maritime industrial capability and military readiness, we should not be deterred by the potential obstacles identified in this report but seize the broader opportunity laid out before us,« he said after the publication oft he GAO report.

Whether the initiative will have consequences or disappear in the political offices’ drawers is not decided, yet. The arguments provided by the GAO are very strong. »Given the reports and the reservations of the LNG industry therein, and all the reservations and uncertainties, I do not expect such a scheme will shortly be adopted,« said Dr. Björn-Axel Dißars, specialist solicitor at Latham & Watkins’ law office in Hamburg. Christoph Schemionek from RGIT, the Washington DC liaison office of the Federation of German Industries (BDI) and the Association of German Chambers of Commerce and Industry (DIHK) comes to a similar conclusion: »At present, there seems to be no corresponding law in a queue situation.«

Garamendi continues to keep a low profile and all options open. He is not responding to questions about his controversial initiative.

Michael Meyer