Large container vessels, expansion of the Panama Canal, blockages challenging North American ports. For most ports 2015 was a good year, the East Coast is increasingly gaining importance

While the largest ports in Northern Europe are still busy preparing their own front door with fairway adjustments (Hamburg), new[ds_preview] terminals to be built (Rotterdam, London) or lock projects (Antwerp) to meet the ever bigger ships, the North American seaports are waiting for a »project of the century« to be finished beyond their sphere of influence.

Since the beginning of the expansion works in 2007 already, the ports have been waiting for the boss of the Panama Canal Authority – currently Jorge L. Quijano – to press the start button for a potentially new era. Since then, the enlargement of this major waterway bridging the Isthmus of Panama has been worked at. The original opening date coinciding with the channel’s 100th anniversary in 2014 had to be given up rather quickly. Meanwhile the early summer of this year is considered D-Day. Then container ships with up to 14,000TEU capacity are scheduled to pass the new locks between the Atlantic and the Pacific following the partly deepened fairway. Quijano will be celebrating the event extensively.

This mammoth project of officially more than 5 bn $ was initiated in order to keep pace with the development of ship sizes. So far, the Panamax class is limited to about 5,000TEU depending on the individual ship design. The number of container ships with at least 10,000TEU is steadily increasing, though. According to the current state of the order book it will rise from 377 units today to 582 in 2019.

North American ports are affected by the development as they function like a gateway to a huge consumer market supplied with goods via routes from Asia and Europe. The »new« Panama Canal has a deep impact on them and defines a great challenge. Especially on the East Coast the industry has not been ready for ultra large container ships, yet. Bound from Asia these vessels docked on the West Coast most of the time, and the cargo was then transported by road and rail inland to destinations off the Pacific coast.

Up to a certain extent, this is about to change. Some shipowners have already announced to send larger vessels to the East Coast after a passage of the channel. The necessary infrastructure is still not there to some extend.

»Investment in seaport infrastructure is paying off,« said Kurt Nagle, President of the American Association of Port Authorities (AAPA) recently. This was necessary because the trend in ship sizes and the expansion of the Panama Canal would exert strong pressure.

In some places there are expansion projects. For easier access of large container ships in New York/New Jersey, the Bayonne Bridge is raised to 66m. This passage has been open to freighters with maximum 8,500TEU so far. In Charleston the port is to be deepened to 52 ft while investment in hinterland infrastructure and a new container terminal are envisaged. This expansion programme totals 2 bn $. In Seattle another expansion is on the agenda. Here, Terminal 5 is to enable the handling of more bulkers.

On the West Coast, a multibillion dollar expansion programme is proceeding in Long Beach currently to enable the port to check in vessels with up to 24,000TEU. Shipowners are expected to advance to this dimension.

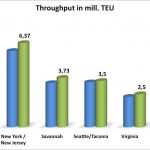

For the Atlantic ports, the recent past has been positive. Growing traffic volumes with partly historical highs were reported e.g. by New York/New Jersey (+ 10.4%), Savannah (+ 11.7%), Charleston (+ 10.1%), and Virginia (+ 6.5%). As for the past eight years, consulting firm Jones Lang LaSalle reported an increasing combined share of the ports on the East Coast and the Gulf of Mexico in the US handling. This combined share thus rose from 38.8% to 44.8% of all respectively handled US cargo. The western ports on the other hand had to cope with a slight decline from 61.2% to 55.2%.

The port of New York is confident: »We expect turnover to increase by 2%,« the Port Authority announced, whose main customers include the shipping companies Maersk, MSC, CMA CGM and Hapag-Lloyd. Thus, a strategic location with access to large consumer markets as well as very good rail links to the hinterland proof beneficial to the port.

On the one hand, the overall positive development of US ports is based on an economic upturn in the United States. On the other hand, ports on the East Coast cashed in on problems in the Pacific. The difficulties are well known: congested terminals and long idle time due to labor disputes with trade unions and bottlenecks in handling and inland transport. Los Angeles and Long Beach were affected by this, together they are the most important port complex of the USA. Many ships were redirected to other locations or the cargo shipped by smaller freighters directly to the East Coast – with a positive side effect on the container ship fleet and its charter rates which are still pressed by overcapacities.

Meanwhile, many problems have been solved, also on the West Coast where the indicators are mostly pointing to growth in 2015, even if Los Angeles suffered a loss of 2.15% as largest port in terms of handled goods and Oakland lost 4.9%. The ports of the Northwest Seaport Alliance (NWA, Seattle/Tacoma) recorded a plus, too, (+ 4%) which is also true for Long Beach (+ 5.4%), the port closest to leader Los Angeles.

Right before the end of year the French shipping line CMA CGM caused a sensation with the first calling of port of a 18,000TEU ship »CMA CGM Benjamin Franklin« in Los Angeles and Oakland. The ports claimed to be well prepared for this class. In February this vessel called the port of Long Beach. Seattle is also hoping to be chosen on the route and according to the NWA this port is in talks on test calls.

Generally, it is hard to predict which ports will benefit from the expanded Panama Canal in the future and to what extent. The West Coast is likely to remain the most import location. However, the Atlantic ports are likely to reap a bigger piece of the pie in order to reduce the lengthy and ecologically more adverse land transport, experts assume.

The port of New York is not relying on the Panama Canal exlusively. »The effects of the development are still unclear,« the Port Authority says. It is rather expecting increasing volume via the Suez Canal route. Their share would continue to have a »large proportion« of the overall handling of goods. Long Beach continues to rely on the role of a hub for imports: »Our value proposition is that we offer the shortest, fastest and most cost-effective route for trans-Pacific trade to reach most major US markets. The Port of Long Beach is capable of handling the largest ships and with our extensive railway and trucking networks we are able to quickly and easily transport cargo throughout North America, saving our clients time and money,« CEO Jon Slangerup says. This is why those responsible expect further growth in 2016. From the expanded Panama Canal they expect a »minimal effect« on their business. The costs of diverting volumes to the East Coast or Gulf ports would grow and increase transit time to market by 20 to 40%, he adds. »Moreover, over half of the container vessels currently on order will be too big to fit through the expanded Canal.«

Even among container shipping companies, there is no unanimous opinion. While some decide under pressure to better use their fleet to capacity and have concrete plans for larger vessels to call ports, others claim there is no need for immediate action. Rolf Habben Jansen, CEO of Germany’s largest shipping line and G6 member Hapag-Lloyd, does not expect short-term large-scale adaptation of the service structure. Not much will happen before the end of 2016, he said recently in Hamburg.

In any scenario the North American ports are facing an eventful second half-year. As for them, the motto continues to be: Waiting for Quijano.

Michael Meyer