In the struggling container shipping industry, M&A activities went on mainly within the group of main line carriers till now. But, according to a new study, big consolidation in the feeder segment are to come, too. However, many of the protagonists stay tight-lipped for the time being.

One of the key findings of the study published by SeaIntel is that the feeder market might be the next[ds_preview] with bigger consolidation processes – provided that the deep-sea carriers discover the value of the aggregation of feeder volumes. Detailed analysis revealed that the average volume moved on feeder legs is by no means the only important element to consider in this context. In the study, the value pool for the feeder cargo in Europe associated with demand fluctuations, imbalances, schedule reliability, and risk profiles was analysed. »We arrive at the conclusion that these hidden value pools are as important as the more traditional value pool related to pure operational network costs. The hidden value is assessed to be 250mill. $ annually,« it is said. According to the analysis, weekly demand fluctuations result in both under-utilization of vessels and cargo overflow. Trade imbalances result in under-utilization of vessels. Schedule unreliability and buffer-time in the schedules result in loss of cargo value for the shippers. Therefore, pooling cargo from multiple carriers will reduce cargo fluctuations and imbalances, multiple weekly services would reduce the impact from schedule unreliability, it is concluded.

In the quantitative study a situation where every deep-sea carrier operates independently on the one hand and the full aggregation of cargo flows on the other was compared to calculate the magnitude of this hidden value pool.

The study was published at a time when some outsourcing of feeder services by Major Line Operators (MOL) could be observed. One prominent example was Marseille-based CMA CGM, No. 3 of the big liner carriers, redelivering dozens of feeder charter vessels, and with this putting some pressure on charter rates for small units. Reportedly, CMA CGM gave the volumes not to one big partner but to a group of feeder and shortsea operators.

Of course, the »hidden value« differs for each carrier, depending on costs, situation, cargo characteristics etc. However, SeaIntel concludes that the data also show that »for most carriers, the best way to tap into the hidden value pool is to aggregate feeder cargo. Once this is done, a decision can be made as to where to use own services and where to use feeder services.« Solely focusing on the traditional visible value pool related to the direct costs of operating a service, will leave a large value pool untapped, it is added.

Although the analysis is a mathematical and statistical one as SeaIntel emphasizes and although it is »merely« focussed on the European market, it is worth to take a look at the potential consequences. Especially, as »the question of own vs. third-party feeders is equally relevant in all parts of the world« and the concentration on Europe was done mainly »in order to provide a solid and detailed analysis,« as SeaIntel explains. One of the most important aspects in terms of a potential consolidation seems to be the aggregation of cargo from multiple carriers, be it through the deep-sea carriers or third-party feeder operators.

Commenting on the results, SeaIntel states that the majority of improvements could be reached if the number of main feeder carriers would be reduced to only a handful. Implied in this would be a potentially better vessel utilization through cargo aggregation and therefore a reduced tonnage demand. But, this in turn could have negative consequences for non-operating owner of feeder tonnage, as fewer vessels would be needed.

One of the very few shipping companies willing to comment on the study was German tonnage provider Leonhardt & Blumberg. Germany is still one of the dominant locations in terms of non-operating owners for the global feeder markets, aggregating a significant number of players despite the dramatic consequences of the crisis with the disappearance of vessels and companies.

Leonhardt & Blumberg operates a fleet of 39 vessels – half of them sailing in Intra-Asia trade – of which nearly 30 have a capacity of 1,700TEU. Managing Director Christian Rychly does not see any bigger consolidation processes, rather the opposite. Talking to HANSA (see more details on pages 34/35), he emphasizes the non-existing cascade effect on Intra-Asia routes with logistic chains getting more complex, even providing opportunities for newcomers. Rychly agrees that there is too much capacity in the market and explains that Leonhardt & Blumberg focuses more and more on 1,700TEU vessels, where owners can be ok with rates under certain circumstances. The company plans further investments in this segment, making its fleet more homogenous – with all advantages and disadvantages – because of some positive macroeconomic trends.

Seago and X-Press Feeders comment

From the group of feeder operators two of the leading actors commented on request of HANSA (others did not reply or refused to comment): Maersk’s subsidiary for European cargoes, Seago Line, operating 62 vessels, and X-Press Feeders, part of Sea Consortium, describing itself as the largest independent feeder operator worldwide with more than 100 vessels up to post-panamax size of which 25 are owned, operating throughout Asia, Middle East, Caribbean, Central America, Mediterranean and Europe with an annual throughput in excess of 5.3mill.TEU in 2015. Both are said to have benefitted from CMA CGM’s outsourcing arrangements.

Søren Castbak, CEO of Seago, says he would not be surprised if we see consolidation or at least a higher degree of operational collaboration between carriers to cut costs through increased utilisation as it would not appear as if demand will rebound in the near future. »Carriers will have to find ways to take significant cost out – or leave,« he commented. According to the manager, the feeder operator was quite active already in the consolidation process with partnerships with carriers in 2016. This might not be finished yet. »We are open to explore this avenue further,« Castbak says.

»We do not see a problem for the tonnage we need«

Søren Castbak, CEO of Seago Line

The potential influence on the market of non-operating owners seems to be slightly more difficult to foresee. Concerning an improved vessel utilization the CEO added that Seago Line’s advantages is that it has access to the Maersk Group’s fleet to participate in fleet optimisation. In addition, with the sister companies MCC for Intra-Asia trades and Sealand in the Intra-Americas segment Seago acts in a kind of unique structure, maybe difficult to compare with others. All in all, Castbak does not see a problem »for the tonnage we need« in terms of the balance of supply and demand. In the last months, there have been voices, asking whether there might be a shortage of tonnage in the future as only a few newbuilding orders have been placed and the feeder fleet is quite old.

Others agree with findings of SeaIntel’s study that third-party feeders can contribute to an improvement of cost structures. For X-Press Feeders, a spokesperson shared some opinions (page 34/35) seeing tonnage oversupply and room for consolidation, albeit there would be regional singularities. As well, some tasks and differences occurring from the characteristics of SOC and COC business should be taken into account while talking over possible consolidation activity, he said.

Rather small orderbook

A closer view on the fleet statistics in this segment partly underlines the perspective of some potential changes to see, irrespective even of a consolidation within the carrier and tonnage provider community. The feeder fleet below 3,000TEU in fact is quite old. Consultancy firm Alphaliner currently states 554 container vessels built in or before 1995, reflecting 4.1% of the global fleet. By the far the biggest share is represented by the segments below 1,000TEU and between 1,001 and 2,000TEU. In light of this, a fleet modernization indeed might come up.

Besides the normal »problems« of old ships and the regular cycle of scrapping due to lifecycle questions, another fact might trigger this process: the upcoming requirements due to environmental regulations for topics like ballast water treatment and emission control. Existing vessels need to be fitted with new equipment – or taken out of service. As several ship owners face huge financial problems and lack of liquidity is ever-present in these days, the industry might see a lot of vessels scrapped.

This fleet modernization in turn will probably have a significant impact on the ship owner community. The companies not being able to finance refitting measures might lose more relevance or even disappear from the scene, not allowed to run their old vessels and not able to order new ones. Bigger players with better liquidity or strong capital partners in the back might be able to overcome these challenges more easily. This situation could result in a larger concentration of tonnage providers. »Some smaller players will go to rack and ruin, because banks and financiers pull the plug,« a broker expects.

According to Alphaliner, vessels below 2,000TEU account for 12% of the global fleet. The 1,500 to 2,000TEU segment accounts for 5%, further 4% belong to vessels between 1,000 and 1,500TEU. Until the end of 2017 all in all 56 new buildings up to 2,000TEU are expected to join the fleet. Ordering parties in the segment of 1,500 to 2,000TEU were i.a. CMA CGM, Wan Hai and KMTC. Admittedly these numbers have to be seen in combination with scrapped vessels although this is nearly impossible to forecast in these troubled times.

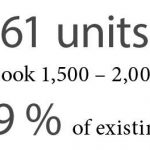

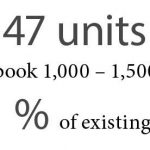

The global order book comprises 61 units between 1,500 and 2,000TEU capacity, reflecting 10,9% of the current fleet and 47 units in the 1,000-1,500TEU segment, reflecting 7,1% of the existing fleet. For comparison, the entire cellular fleet has an order book share of 16%. In combination with the fleet age a backlog might be visible.

Depending on how you read both the fleet data and SeaIntel’s study, there might be room for consolidation in the feeder market and further challenges coming up for tonnage providers. The market needs an overall improvement in freight and charter rates. Last but not least, the global macroeconomic and trade development will be the main trigger of the development, however easy to forecast this may be considering the current economic-political developments.

Michael Meyer