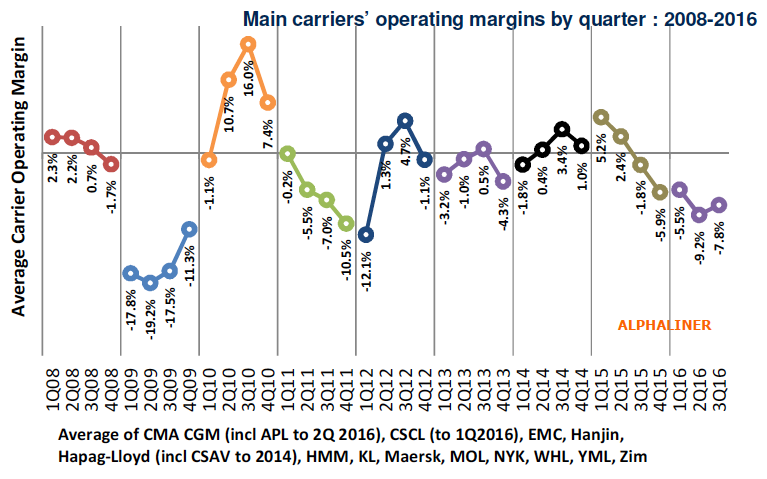

The main container carriers’ average opera[ds_preview]ting margins remained in negative territory in the third quarter of 2016 – the fifth successive quarter of operating losses, according to Alphaliner.

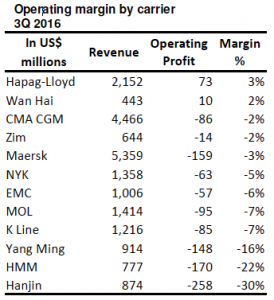

Core EBIT margins of the 12 main carriers surveyed by Alphaliner averaged minus 7.8% in the third quarter. Only Hapag-Lloyd and Wan Hai posted positive margins, while the ten remaining carriers surveyed all reported negative operating results.

The two beleaguered Korean carriers – Hanjin Shipping and Hyundai Merchant Marine (HMM) – posted the worst operating margins of the carriers surveyed, at –30% and -22% respectively.

The two beleaguered Korean carriers – Hanjin Shipping and Hyundai Merchant Marine (HMM) – posted the worst operating margins of the carriers surveyed, at –30% and -22% respectively.

Hanjin Shipping ceased taking new bookings after it filed for receivership on 31 August, resulting in a 25% plunge in total liftings in the third quarter to 884,100 TEU, compared to 1.18 mill. TEU in the same quarter last year and 1.17 mill. TEU in the second quarter. Total revenue for Hanjin’s container shipping business fell by 42% year-on-year to 874 mill. $, while operating losses reached -258 mill. $.

In the aftermaths of Hanjin’s sudden exit, spot freight rates surged by some 33% in September according to the Shanghai Containerised Freight Index (SCFI). The rate increase nevertheless came too late to salvage the other carriers’ dismal third quarter results.

Operating margins continued to show a strong correlation to the average China Containerised Freight Index (CCFI), especially after adjusting for fuel price movements. Although the CCFI has increased by 11% since early September, bunker fuel costs have increased by 22% due to the recent price surge following OPEC’s agreement to cut production last week.

Based on Alphaliner estimates, average carrier margins are expected to remain negative in the fourth quarter, despite the rate gains that shipping lines have obtained since September. The rate increases are still insufficient to bring margins above break-even and carriers are pushing ahead for further general rate increases on 2017 contracts, starting with the key Asia–Europe rate contracts from 1 January and the Asia–North America service contracts from 1 May.

The carriers’ success in securing and retaining rate increases will crucially depend on their willingness to curb ambitions to increase market share, said Alphaliner. Maersk for instance, has been especially aggressive in this respect and the carrier was able to generate a 11.2% increase in liftings in the third quarter.