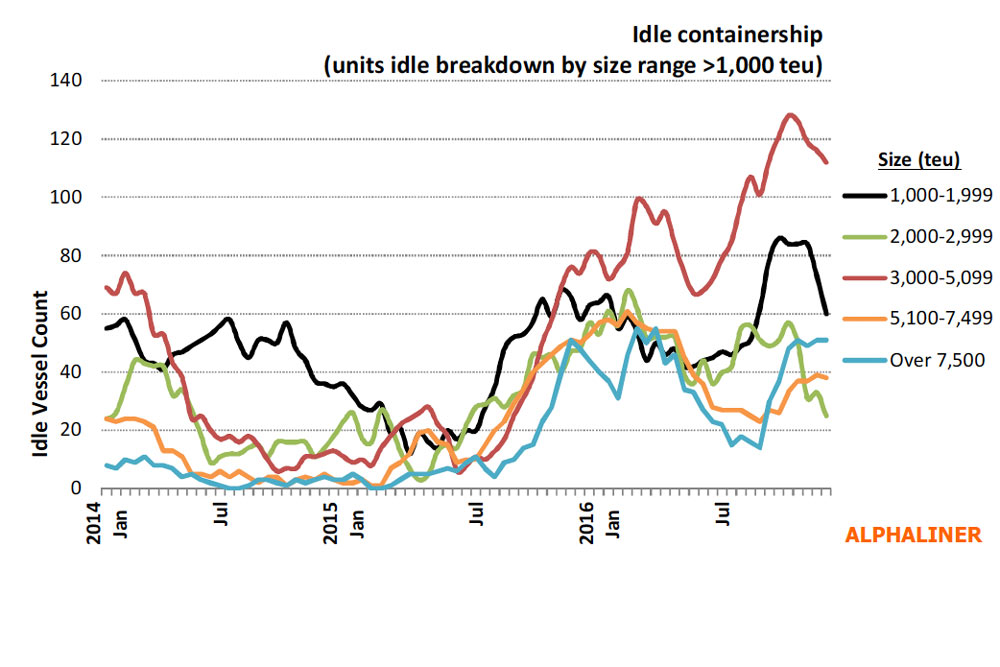

The number of idle ships in the container [ds_preview]segment above 500 TEU has fallen to 336 ships with a capacity of 1,44 mill. TEU in mid December. The main reason is the higher scrapping activity.

According to Alphaliner the number of idle ships of 1,000-3,000 TEU has fallen from 141 units in October to 85 units as at 12 December, with a pick-up in charter activity and scrapping of mostly German-owned units in the last two months. In this size range, 16 ships were reported sold for scrap, including twelve units of beleaguered German non-operating owners.

The number of idle 4,000-5,100 TEU panamax ships also fell from 98 units in mid-October to 88 units currently, with demolition sales that also mopped up redeliveries in-between. In this category, 17 ships were sold for scrap in November and December.

In the larger sizes above 5,100 TEU, the idle fleet shows no sign of receding, with 89 ships currently unemployed, compared to 81 units in October. Six vessels of 5,300-6,000 TEU were sold for scrap in November and December.

Two weeks ago the idle fleet has grown a bit. Despite this, weak demand and the overhang of ex-Hanjin ships have continued to cast a pall on this sector. Currently, 34 ships of 7,000-13,000 TEU formerly operated by Hanjin are idle. This includes 28 units that have been redelivered to, or recovered by, their owners

and that are currently without employment. Prospects appear dim in the short term, with no fresh demand expected to emerge until April 2017.

Reduced oversupply in the panamax segment

Oversupply in the classic panamax segment is receding slightly as demolition sales continue. Currently, there are 72 panamax units seeking employment, versus 75 vessels two weeks ago.