The commodities industry expects a slightl[ds_preview]y recovery for dry bulk volumes and shipping markets, a new survey, done by the Singapore Exchange (SGX) indicates.

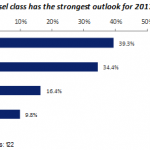

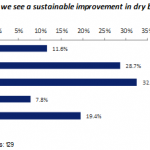

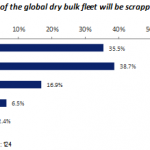

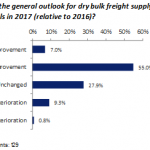

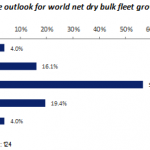

The surveys include responses from more than 250 industry participants across i.a. the iron ore & steel, coal and dry bulk freight markets. Through the course of 2016, dry freight rates on average rose, in line with their underlying commodities, with the Baltic Dry Index (‘BDI’) closing the year 101% higher. Larger vessel classes saw the strongest improvements on better-than-expected iron ore and coal trade. The survey results now indicate a majority of respondents expect a moderate improvement in supply-demand fundamentals for the dry freight market in 2017. On the supply side, a majority expect vessel demolitions of less than 5% of the global fleet in 2017, and general consensus of 0%-3% net dry bulk fleet growth during the year. More than half of respondents anticipate a sustainable improvement in dry bulk freight rates around 2018/19, though this has notably been pushed back from views a year ago (while the number of respondents seeing such an improvement beyond 2020 has crept higher). Detailed results are shown below.

Ore and Coal as Dry bulk cargo

The benchmark iron ore spot price increased 85% in 2016, closing the year at US$79.50 per tonne and more than reversing the losses seen in 2015. Steel also saw a strong rise in prices, with ASEAN HRC steel rising 82%. The steel vertical was one of the top performing sub-sectors in 2016 as Chinese stimulus resulted in significantly stronger-than-expected demand expectations.

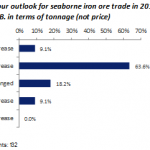

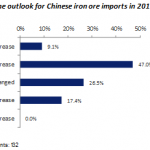

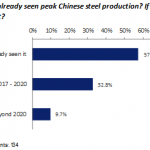

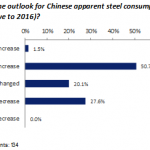

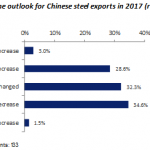

»Based on the results of our survey, a majority of respondents believe we have already seen a peak in Chinese steel production (though this proportion has interestingly decreased from a year ago), and similarly a majority anticipate a y/y increase in domestic Chinese steel demand in 2017«, SGX describes the results. Consensus opinion would be that Chinese iron ore imports will continue to increase in 2017, as will seaborne iron ore trade overall. Views are mixed however on the outlook for Chinese steel exports in 2017. Greater optimism is evidenced in price expectations, with a majority expecting iron ore prices to either remain the same or trend higher in 2017.

Coal markets were unexpectedly one of the strongest performers of 2016, with domestic production restrictions in China as well as supply constraints elsewhere leading to surging seaborne prices. Thermal coal (Newcastle) ended the year up over 100%, while coking coal ended the year up almost 200%, in stark contrast to bearish expectations at the start of the year.

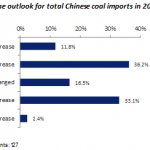

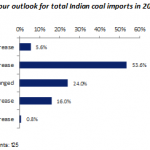

The results of our survey indicated mixed views on the outlook for Chinese coal imports in 2017, though with a slight majority of respondents expecting imports to either rise or remain broadly unchanged. On the other hand, a clear majority anticipate a rise in Indian coal imports in 2017. Views remain mixed on whether LNG will be able to compete with thermal coal on cost in the next few years, with a slight majority saying yes (up from a slight minority to the same question a year ago). Separately, on the traditional quarterly term contract pricing mechanism in coking coal, usage of which has been on a steady decline, less than half of respondents were confident that the quarterly term contract will persist beyond 2017. However, others like international shipping organization Bimco expect some bigger changes in coal trades as the US loose market share and transport distances shorten.