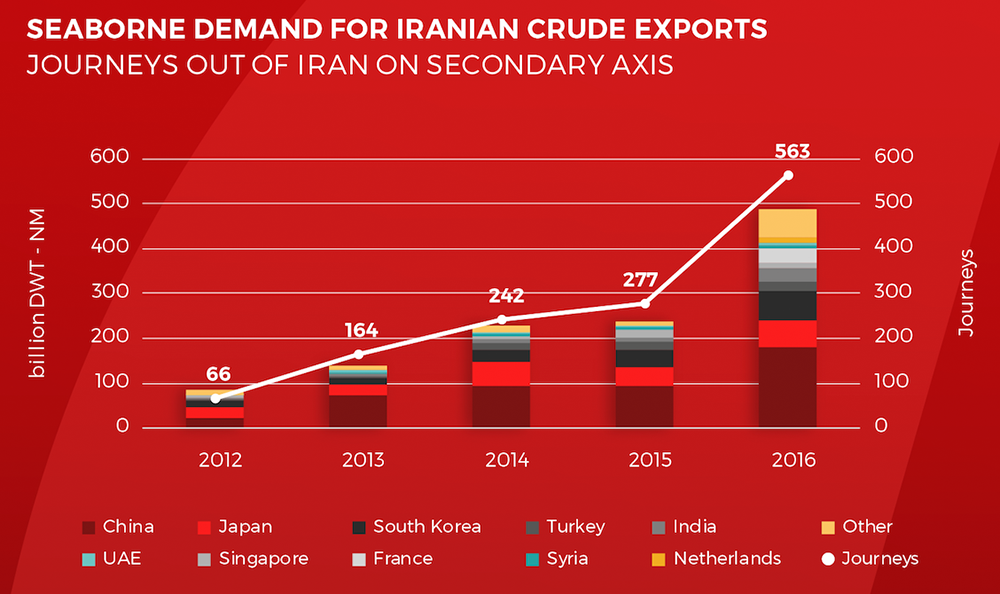

With the loosening of Iranian sanctions last year, there has been a marked increase in the seaborne demand for Iranian crude exports. Volumes have doubled, but nothing is certain, and with new sanctions on Iran announced on 3rd February 2017, tensions are high. Can Iran keep increasing their[ds_preview] exports?

Following the lifting of sanctions against the islamic Republic of Iran in early 2016, seaborne demand for Iranian crude has more than doubled. In the past five years, the greatest demand for Iranian crude has come from China, Japan and South Korea respectively, says VesselsValue Senior Analyst, William Bennett.

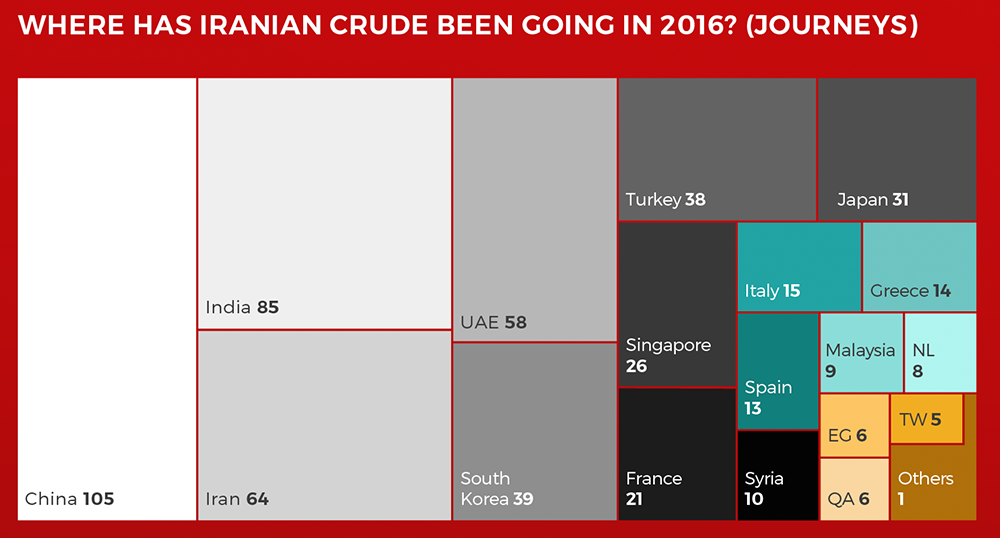

Excluding the Iranian domestic trade the most journeys of crude were made to China with 105 journey recorded in 2016. Next was India at 85 journeys and this was followed by the UAE at 58 journeys. Shipments last year were made using VLCC, Suezmax and some Aframax tonnage.

China, India and UAE have always been stalwart importers of Iranian crude. New players in the mix following the removal of sanctions include France who rose from zero to 21 journeys in 2016, says Bennett. Italy took 15 shipments, up from zero and it was a similar story from Greece (14 shipments) and Spain (13 shipments).

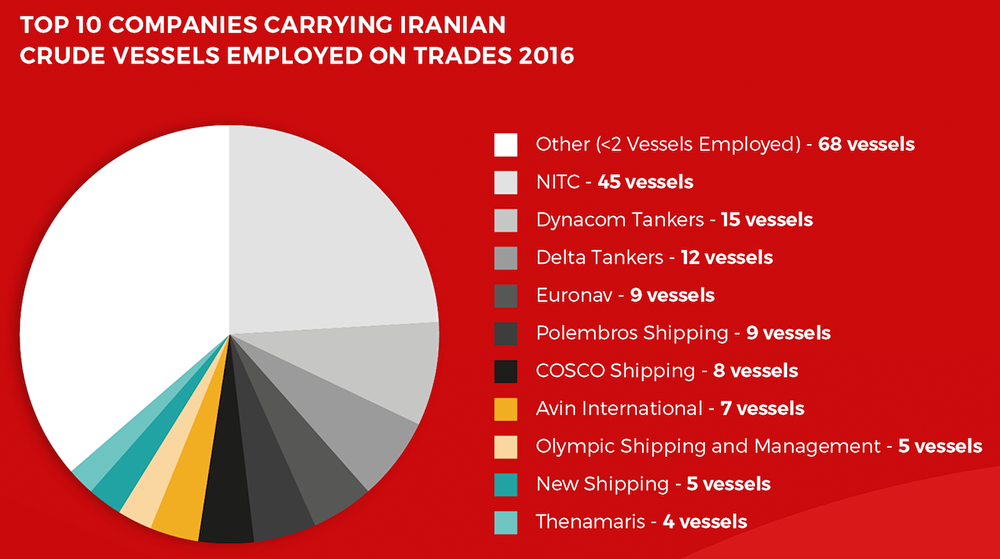

»In 2015 companies operating on the trades out of Iran came from a very different demographic to after the sanctions.«

It is no surprise that historically Iran’s national tanker line, NITC, is the largest provider of tonnage. According to Bennett in 2015 companies operating on the trades out of Iran came from a very different demographic to after the sanctions. Top operators in 2015 besides NITC included COSCO, Idemitsu, Irano Hind, JX Ocean and K Line. In 2016 this group changed dramatically to begin to include owners from Greece and Belgium. The influx of Greek owners has also significantly increased the number of Suezmaxes on the trade rising from 15 to 81 vessels employed.

In the face of OPEC cuts Iran has increased production over January by over 50.000 bbl/day. And with shipments almost doubling Iran is regaining considerable market share. On February 3rd US President Donald Trump announced the new sanctions on Iranian and Chinese interests following a missile test by Iran in January. Tensions are hot between Iran and the US and any further provocations from Iran could find their crude export programme curtailed once more, the analyst says.