Russia’s largest shipping company, PAO Sovcomflot (SCF Group), has reported a 6.4% decrease in gross revenue in 2016 as the tanker spot market dropped by more than 40 % and time charter market was down 25 %.

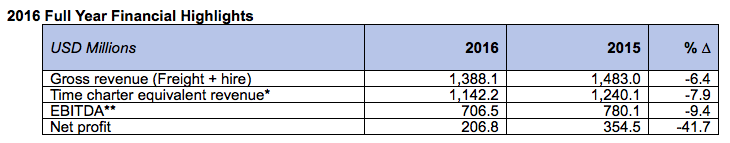

SCF Group’s gross revenue (freight and hire) in 2016 amounted to USD 1,3[ds_preview]88.1 million compared to USD 1,483.0 million in 2015. EBITDA was USD 706.5 million (2015: USD 780.1 million) and net profit was USD 206.8 million (2015: USD 354.5 million) (-41.7%). Time charter equivalent revenue (TCE) was USD 1,142.2 million (2015: USD 1,240.1 million).

Sergey Frank, President and CEO of Sovcomflot said: »Sovcomflot has delivered a solid set of results for 2016, despite market volatility in a year that has severely tested our industry. As growth in oil refinery throughput and up-front demand ran ahead of end-consumption underpinning tanker rates in 2015, so 2016 witnessed a material softening in demand that impacted negatively spot tanker freight rates, albeit with some respite in the final quarter.«

Chief Financial Officer Nikolay Kolesnikov commented: »Last year the Group was successful in raising an additional USD 1.26 billion in debt capital. This has enabled the Group’s debt repayment profile to be significantly improved, and has covered our capital expenditure requirements. The deals include USD 512 million of long-term bank loans from Russian and international banks raised for purposes of funding the fleet renewal programme and for the refinancing of maturing debt.«

He added: »Additionally last summer SCF Group returned to the international debt capital markets with a new USD 750 million seven year Eurobond offering to finance a simultaneous tender offer for the Group’s outstanding Eurobonds due in 2017. The new bond offering generated strong demand from investors and enabled very competitive pricing, with a coupon of 5.375 % which matched the coupon on the Group’s debut 2010 Eurobond issue, whereas the tender offer achieved one of the highest ever tender participation rates for borrowers from Russia of 83 %.«