Although the »fleet value position« could be maintained and despite a modern fleet, Norway’s shipowners association is looking back to a miserable year 2016. The outlook is not really much better – due to macroeconomic upheavals. A gallery of hope and sullen self-perceptions

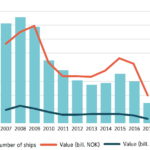

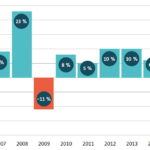

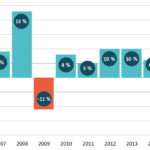

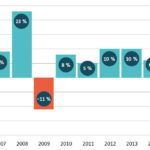

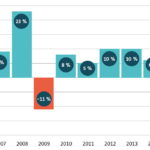

Shipowners s[ds_preview]aw increasing revenues from 2010 to 2015. This trend was dramatically reversed with a drop of 16%, to 234 bn NOK, weaker than expected, as they predicted only 3%

»We must not loose sight of the many opportunities that lie ahead«

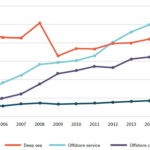

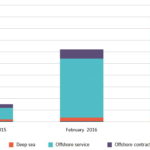

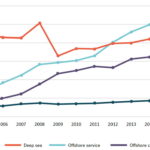

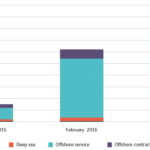

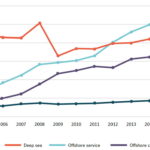

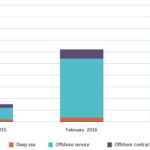

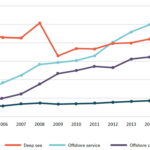

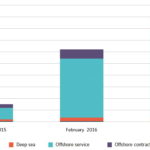

Short sea and deep sea shipowners together reported revenue of 117 bn NOK. These segments combined now have higher revenue than the offshore segments, for the first time since 2008

»We identify significant political risks. In an unstable world, we need unifying leaders who demonstrate integrity, calmness and wisdom, who pursue common solutions and cooperation«

Trends and challenges impacting shipping: While the U.S. turn more of their attention to domestic affairs, and Europe devotes considerable energy to the Brexit-negotiations, China appears increasingly more likely to assume a lead role.

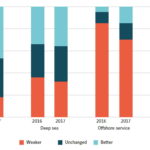

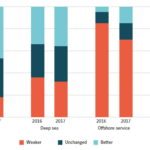

»Offshore contractors expect a further decline of 43%. If this proves correct, they will see income reduced by more than half in just two years«

50% of shipowning companies view access to capital as tight or very tight in today’s market. Unchanged from 2016

The Norwegian-controlled fleet is valued at 51 bn $, a decline of 21%. The offshore segment has seen the greatest decline with a drop of 29%

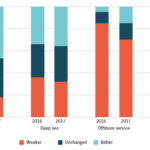

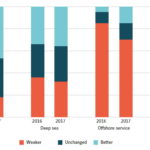

Half of the shipowners expect weaker results. In short sea and deep sea, a larger percentage anticipate improved results

»Shipowners are far more pessimistic and expect a decline in turnover of 10%. If prognoses are correct, the downward trend in revenues will continue, though perhaps with less force«

Staff cuts by 8,300, divided relatively evenly between seafarers, mobile rig crew and staff, and onshore employees. Largest reductions were in offshore contractor and offshore service companies. Deep sea and short sea companies had a net increase

Situation is most challenging for the offshore service fleet and offshore contractors. The fleet comprises 550 OSVs, of which 150 are in layup. 45% of the mobile offshore unit fleet is in layup. Members predict no significant change

»Traditional segments of Norwegian shipping have been burdened with weak demand and tight margins. Now, offshore markets have taken a severe and sudden turn for the worse, brought about by the crash of oil prices. This unfortunate situation seems likely to persist«

Average age of the ship fleet dropped to 9.9 years. Orders have fallen by half, both in volume and value

Income for offshore service shipowners has fallen by 21%. Further decline of 11% expected