Ferry operator DFDS has seen a 10 % freight volume growth in North Sea. Revenue and profit grew and confidence grows to beat last year’s all-time high results.

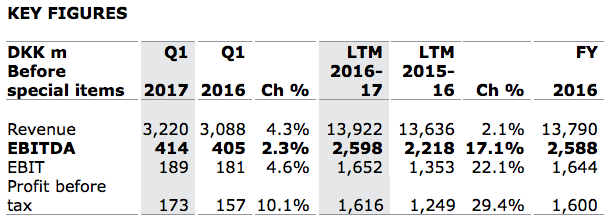

Revenue increased by 3 % in Q1 adjusted for non-comparable items. Reported revenue was up by 4 % to 3.2 bn DKK.

EBITD[ds_preview]A before special items increased by 2 % to 414 mill- DKK following higher earnings in the Shipping Division. The result was negatively impacted by non-comparable items vs 2016, including the late Easter in 2017. Q1 is the low season of the year for DFDS due to a low level of passenger activity.

Freight volumes in the Shipping Division‘s route network were up 7 % and up 5 % excluding the Hanko-Paldiski route acquired in October 2016. Passenger volumes were 10 % lower than last year mainly due to Easter falling in Q2 in 2017 vs Q1 in 2016, DFDS stated.

The Logistics Division‘s EBITDA was 11% below last year at 48 mill. DKK following a lower result in the Nordic business unit. Extra costs were incurred from startup of new logistics contracts and traffic imbalances and activity levels in some markets were below last year. The performance of the Continent and UK & Ireland business units were in line with expectations.

DFDS distributed a total of 826 mill. DKK to shareholders through share buybacks and dividend in Q1 2017. The total distribution for 2017 is currently expected to be 1.3 bn DKK.

As the European growth outlook continues to be supportive of DFDS‘ infrastructure of ferry routes and the logistics operations the Group confirmed its full-year revenue growth expectation of around 4 %, excluding revenue from bunker surcharges. EBITDA before special items is still expected to be within a range of 2,600–2,800 mill. DKK (2016: 2,588 mill. DKK).

»We achieved a Q1-result ahead of last year. Combined with a continued positive outlook for growth in Europe, we are on track in 2017 to further improve on the all-time high results of last year,« said Niels Smedegaard, CEO.