The ports of the Northwest Seaport Alliance (NWSA) have seen their strongest May on record for total international container volume, including empties, at 255,817 TEUs. As new ocean carrier alliance services entered the gateway, volumes increased by 18 % compared to last year.

Th[ds_preview]e NWSA, a partnership of the ports of Seattle and Tacoma, is the fourth-largest container gateway in North America. Full imports grew 10 % to 115,960 TEUs compared to last year as retailers continue to rebuild inventory levels and a favorable market outlook fuels import demand. Despite the strong U.S. dollar, full exports were up 8 % to 78,086 TEUs.

Empty exports also grew 72 % as ocean carriers continue to reposition empties to Asia in preparation for peak season. The NWSA refers to the National Retail Federation’s recent June – October forecast which expects imports to continue their strong growth trend.

Domestic volumes decline

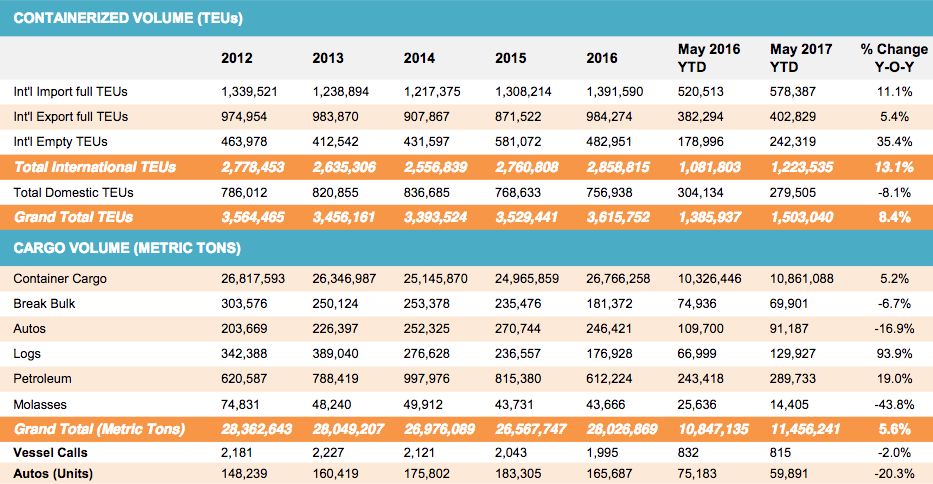

Year to date, full import volumes were up 11 % to 578,387 TEUs. Meanwhile, full exports grew 5 % to 402,829 TEUs. Total international containers, including empties, increased 13 % year to date to 1,223,535, the highest since 2006, NWSA stated.

Total container volumes for the gateway grew 12 % over the same month last year, and year-to-date volumes were up 8 percent.

Total domestic volumes for the month declined 8 % compared to the same month last year. Alaska’s year-to-date volumes declined 8 % and are expected to end the year 5 to 6 % lower due to soft market conditions. Hawaii volumes through the Pacific Northwest declined 7 % due to diversion to Southern California.

Car volumes down, logs up

Driven by consistent demand from China, log volumes were up 93.9 % to 129,927 metric tons over the same time last year. Breakbulk cargo was down 7 %, to 69,901 metric tons year to date, due to soft market conditions. Autos, at 59,891 units year to date, slipped 20 % compared to the same time last year, reflecting weakening U.S. demand and shifting manufacturing locations.