The past months have seen discussions about the rebalancing of the oil markets. Experts expect tanker rates to strengthen but remain cautious in the face of a fleet growth of almost 5 %

The global stocks of crude oil and oil products are being drawn down slowly, as the OPEC-led adjustments to[ds_preview] global oil supply affect less than one-third of global production. An important part of it, no doubt, but it still leaves two-thirds of the »rebalancing efforts« out of OPEC-control. This includes OPEC members like Nigeria and Libya, both nations that have increased their output in 2017. Another significant producer that has scaled up its production in 2017 is the US. By mid-October OPEC called upon US shale oil producers to help reduce the supply glut, as they react to a slow rebalancing of the oil market, Bimco said a recent report.

In Q4 2017, oil demand headed for a new all-time high at 98.7mill. barrels per day (bpd) in Q4 2017, up by 1.9% year-on-year. This demand is coming from an incremental growth of 1.87mill.bpd – 1.06mill.bpd (57%) of that growth is coming from Asia. This is good for shipping, particularly, if that demand is met by oil from African producers and not the relatively short-haul producers in the Middle East. 0.35m bpd (19%) comes from the Americas – this may impact shipping only slightly, whereas a further 0.23mill.bpd (12%) comes from the Middle East with no expected effects on shipping at all. Recurring turmoil in Libya means that the nation will stay a swing exporter, with a significant untapped potential until the unrest settles.

In the US, the last week of August and the first weeks of September were largely impacted by this year’s hurricane season. The immediate effects were refinery outages, and disruption to the Colonial pipeline which provides large parts of the East Coast US with gasoline, jet fuel and other refined oil products. International shipping assisted to ensure mainland US continued to receive supplies of oil products and the US Jones act was suspended for two weeks.

Refineries had to shut down or operate at a reduced rate. The prolonged downtime at Gulf Coast refineries had reduced crude oil throughput in the US. According to brokerage firm Charles A. Weber, a knock-on effect has been a large increase in seaborne US crude oil exports, as recent spot fixtures indicate. More than 3mill. dwt of crude oil tanker capacity was fixed in September, surpassing the previous high in May 2017, that saw 2.2mill. dwt engaged. Poten & Partners attributes the increase in US crude exports to the lower price compared to other crudes. This had boosted long haul oil movements especially during October, says Christian Waldegrave, Head of Research at Teekay. In total, US crude oil exports were up 59% year-on-year, for the first seven months of 2017. This equated to more than 900,000bpd being exported.

Bimco’s Chief Shipping Analyst, Peter Sand, commented on the Q4 figures: »The increased US crude oil exports during 2017 benefits the crude oil tanker shipping industry. The demand on that trade is up by 151% compared to last year. Not only are the volumes more than doubling, the sailing distances are increasing as well. Asia and Europe are the importers demanding most US crude oil in 2017. With Asia in particular being responsible for the longer sailing distances.«

In China, crude oil imports climbed in autumn. During the first nine months of 2017, China imported 33mill. tonnes more of crude than the same period last year. Bimco estimates that this equals a tonne-mile growth rate of 18% for Chinese crude oil imports alone.

Demolition might pick up

In total, the demolition of crude oil and oil product tankers in 2017 has not been impressive. But focussing only on product tanker demolitions in August – it reached a five-year-high at 472,000 dwt. For only the second time in seven years, more than 450,000 dwt were permanently removed from active trading. The demolition of two LR2 and five MR/handysize ships accounted for the greater part of this.

Bimco says it is confident that the poor freight markets will eventually result in increased demolition interest. It is now believed that the downturn will last longer than first anticipated which might result in a pick up of scrapping. »In terms of newbuild interest, we had owners shy away from the demolition market in the earlier part of the year, they were attracted to the newbuilding market instead as optimism was still solid«, the report says. Ordering of crude oil tanker tonnage was particularly high. However, September proved that the second half of the year reflected the first half. While newbuild orders will only affect the market one to two years from now, deliveries in 2017 are already deeply affecting the fundamental balance in a negative manner.

US shale as »wild card in the pack«

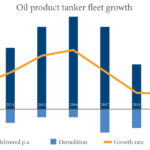

Fitch forecasts capacity to rise a further 4% in 2018 after a 5-6% increase y-o-y in 2017. »This reflects orders placed in 2015 when tanker rates were high, with a large share of orders coming from Greece and China.«

The market experts expect that the lossmaking freight rate levels seen during October 2017, due to maintenance at oil fields and oil refineries, will be somewhat reversed with the beginning of the peak season for oil tankers. This should benefit both oil product tankers and crude oil tankers. For crude oil tankers, rates are expected to go up, but not to reach the highs of the previous peak season in 2016/17. The market fundamentals are too weak for that to happen. »We are seeing the highest oil demand ever, but also a fleet growth of almost 5%,« Bimco says. Oil product tankers might expect a bigger tailwind to lift rates. However, the market remains fragile. Global oil stocks, built up in 2014-2016 must be drawn upon for tanker demand to normalise again, says Bimco. Shipbroking firm Gibson already sees that happening and attributes the development to discipline from OPEC and strong demand.

With the order book rolling off and scrapping going up, Christian Waldegrave of Teekay sees future tanker demand linked even closer to how the OPEC will decide to influence the market. »They are cutting production until March 2018 but there have been comments recently that may look to extend these cuts possibly to the end of the year.« However, a few recent events could make them rethink that.

Issues in countries like Venezuela, Iran, Iraq, Nigeria and Libya, which are all major oil producers, could lead to disruptions and a tightening oil market with high prices. Chances are that OPEC is not going to risk killing demand or losing market share to shale oil producers. Gibson calls US shale the »wildcard in the pack«. Waldegrave sees effects of this development more in the second half of the year with more sustainable recovery.

Rating agency Fitch expects rising global oil consumption, higher US exports and gradually moderating oil inventories to drive a moderate increase in tanker demand in 2018. »Demand could, therefore, rise by about 4%, potentially matching supply growth« – enough to stabilise rates but not to support a sustained increase.