It is not the good results of the operators, the increasing optimism of the CLIA regarding the development of bookings or the higher daily rates, it is the huge cruise order book on which our attention focuses this year, writes Arnulf Hader

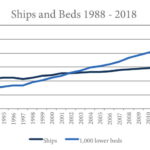

The world cruise fleet is growing faster than ever before. The expected figures for 2018 are 322 ships (oceangoing with[ds_preview] more than 100 lower beds), 558,000 beds and 22.2mill. gt. 17 newly built ships will join the fleet in 2018 and – up to now – only one is known to leave the fleet of the past year. The average size rises to 68.840 gt per ship. This is nearly the size of the »Norway« when she entered the cruise market as largest cruise ship of the world in 1980.

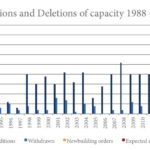

The total capacity of the fleet in lower beds is always climbing up independent of a small or large order book. The number of ships was in stagnation for a few years when more old ships went out of business, but now it is increasing faster than ever.

In 2016 and 2017 many new vessels were added to the fleet and the newbuilding activity is further increasing in the years to come. Due to the small number of new ships around 1980 and the expected life span of 40 years of cruise vessels the order book will nearly completely result in net additions to the fleet capacity.

Industry trends

Last December, the Cruise Lines International Association (CLIA) has again published the 2018 »State of the Cruise Industry Outlook and Cruise Travel Trends«. Mentioned are a greater focus on sustainable tourism, multigenerational cruising and the younger generation embracing river cruising among others. Most interesting for the industry seems to be the short statement that »all budgets will cruise«. The report found »that almost all income brackets are cruising. In fact, a third of the cruisers surveyed who have taken a cruise within the past three years, have a household income less than 80,000$. While the data show cruising does skew a bit more to the affluent consumer than other types of vacations, the report indicates almost all levels of income enjoy cruise vacations.«

This is clearly due to the low basic tariffs on the many big ships and finally results in more and more diversified ship types. The mass market ships are becoming bigger and bigger – 5,000 beds is the new standard for operators not only in America but also in Europe and Asia – while the more affluent consumer looks for more individual trips on a fast growing number of small excursion vessels or on luxury ships with less than 1,000 beds.

More and more operators of large cruise vessels offer a special club class on the upper decks of the ships with improved service and own restaurants, bars and spa. This reminds of the old days of liners with two or more separated classes for passengers where highest luxury and pure transport were offered in separate departments of one vessel. Nowadays there are again different levels of cabins, food and service, but much more entertainment and animation is available for all.

The CLIA also published the new estimations for demand. The number of cruises sold in 2016 was confirmed to be 24.7mill. The preliminary result for 2017 is 25.8mill. and the expected figure for 2018 is 27.2mill. This is an increase by 1.4mill. but, like in the years before, the final figure could be even higher regarding the huge number of new beds on the market.

In the final count China jumped up to the second rank reporting 2.1mill. passengers. The USA top the statistics with 11.52mill. guests and the Germans fell to the third rank with 2.02mill. However, Germans still spend more cruise days at sea because of the shorter Chinese trips. Otherwise, the Chinese already represent 12% of all passengers making landings in Antarctica. This ranking is also led by the Americans (33%) while Australia, Germany and the UK follow on ranks three to five.

Not an industry trend but heavily affecting it has been the weather recently. The hurricanes in the Caribbean Sea not only caused many deviations from regular cruise routes but also to heavy damages in port facilities and destinations. Some ports remained closed for weeks and months for repairs. Royal Caribbean Cruise Line alone calculates the losses suffered to 55mill. $.

Several big operators used the overall good development to increase the service charge which has to be paid by the passenger if he has no objections. Smaller companies which are not trying to calculate lowest tariffs, prefer to include this service charge in the fares.

The environment consciousness is growing: While more and more new big ships will use LNG as fuel this is not yet intended for the new expedition ships. The reason for the difference is just the availability in remote destinations. Norwegian Cruise Line has meanwhile installed scrubbers on seven ships of various types, new and old ones, to reduce air emissions. This looks like more than some test installations and nourishes hopes that the entire fleet can be fitted with such devices.

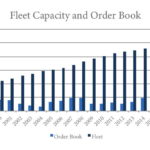

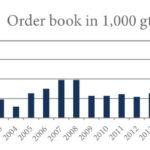

The growing order book

The order book is once more the highest ever summing up to 222,000 lower beds in the end of 2017, the options and letters of intent not included. It stood above 80,000 beds just before the terror attacks of New York and close to 100,000 before the world financial and economic crisis. For a deeper analysis, it is worth to take a closer look at the world order book according to operator groups and some single brands (see p.39). The brand AIDA had twelve ships with 25,000 beds and an order book of 10,000 beds at the end of last year. This means a fleet growth of 40% until the delivery of the last vessel in four years. The average age of the ships will be 9,3 years in 2018.

The Carnival group as a whole shows a growth of 32% over a wide span of years for the individual brands. The companies of the European and Chinese markets have a larger order book spanning over more years than the companies on the more saturated English speaking markets. The average age is not considered as a reason for investment; however, exchanges of ships between the brands happen in the group.

Royal Caribbean Cruise Line, the largest brand of all, plans a growth of 38% by adding some more of the largest ship (types). RCL still has two ships of the Oasis class and two of the Quantum class on order. In the beginning of 2022 the group will also introduce 5,000 pax giants from Meyer Turku. By extending the deliveries over seven years the annual growth of capacity will be limited. This looks more dramatic in the case of Celebrity (50%), but when a smaller company adds one series of ships to two existing series, this may easily result in a growth of 50%.

Norwegian Cruise Line also has 50% more capacity on order with deliveries spread over eight years. Moreover, NCL is heavily engaged in the Chinese market. The order book included three more Breakaway-Plus class vessels for 4,200 pax last year. One of them, the »Norwegian Joy« was delivered during the last twelve months and NCL signed contracts with Fincantieri for four 3,300 pax ships and two options for delivery between 2022 and 2027. Together, it is a huge number of 28,200 new beds, but in fact only one new ship per year. A single further vessel is currently on order for the affiliated brand Regent Seven Seas and none for Oceana.

Really breathtaking are the activities of Mediterranean Shipping Cruises (MSC). Having lengthened the four smallest of their twelve existing ships, they have started two series of newbuildings including orders and options. The first of these ships commissioned is the »MSC Meraviglia« with 171,598 gt and 4,500 beds. She will be followed by a sister and two increased units of this class. »MSC Seaside« with 4,140 gt – a type with more open decks and spaces to better enjoy the sunny seas like the Caribbean – was delivered a few months after »MSC Meraviglia« in 2017. The construction of the sister ship »MSC Seaview« had been fixed while a third one remained an option for a long time. At the occasion of »MSC Seaside’s« delivery MSC not only confirmed the option but turned it into a contract for two further vessels with increased size of 169,000 gt, all four to be built at Fincantieri. STX France had further options for a third class of 200,000 gt and 5.500 beds. The maximum capacity of 6,850 is said to be the highest of any cruise ship. Meanwhile, at least two of them are also confirmed. At the end 2017 the MSC fleet amounted up to 40,000 lower beds. The capacity of the eight ships under construction sums up to 40,700 beds and the MSC fleet is already now among the youngest big fleets.

The German TUI group fleet shows the highest age and the lowest growth. The three brands are very different: Hapag-Lloyd has two elderly expedition vessels of which one will be replaced by two new ones. TUI Cruises will have the youngest fleet of all in 2019 when the last two newbuildings will replace the two oldest ships. Then all six ships of the brand will have been delivered within the last six years. Marella Cruises – the new name of English TUI subsidiary Thomson Cruises – will give back elder charter vessels and instead get the oldest TUI ships. Also the transfers from Royal Caribbean do not have the age to change the average age positively.

Smaller players in the game

So far concerning the analysis of the bigger groups. There are also some smaller companies in the newbuilding market, but their growth rates cannot be compared with the other ones because of their small size or lack of history resulting in irrelevant growth rates. Some highlights of these are:

• No big news came from the Genting Group. The first two six stars »Rhine«-class river cruise ships were introduced and two more will follow in 2018. The »Crystal Endeavour« and two sisters with 200 beds/20,000 gt for Crystal Yacht Expeditions are confirmed as well as the first two 200,000 gt giants with 5,000 beds for the Asian brand Star Cruises, all to be built on the East German MV Werften. The 3,360 bed »World Dream« inaugurated in 2017 for the sister brand Dream Cruises came from Papenburg.

• Disney Cruises, currently having four ships with 8,500 beds in operation and two more with 2,500 beds under construction in Papenburg for completion 2021 and 2023, has extended the order book. The third new order could be placed between the two others.

• The newcomer Virgin Voyages has laid the first keel. The three ships will be for »adults only« and are predicted to have the happiest crews on the oceans.

• Viking Ocean Cruises, sister company to the largest and fast growing river cruise operator, is also becoming the largest small ship ocean cruise operator. The fourth of the 48,000 gt/930 bed ships was completed in 2017. No. 5 and 6 will follow in 2018 and 2019. Now VOC has confirmed the sister vessels seven to ten coming in 2021 to 2023.

• An even smaller small ship operator is the French company Ponant. Adding four 180 pax expedition vessels to an existing series of four 264 beds ships until 2018/19 is already a respectable project, but shortly before Xmas they presented a real surprise: In 2021, a 30,000 gt icebreaking cruiser with 270 beds for Polar cruises will follow. Nothing less than the North Pole will be amongst the new routes.

• The fact that the German river cruise operator nicko Cruises is expanding into expedition cruises with the 200 bed »World Explorer« is hardly worth mentioning. It becomes more interesting if the Portuguese Mystic Invest which already owns Douro Azul and nicko realises the intentions to build four or even ten such ships.

• A similar project was published by SunStone ships, an operator of older expedition ships chartered out to various tour operators. To renew the fleet Niels-Erik Lund ordered four 200 bed units with another six on option. While Norwegian shipyards are normally first choice, SunStone is cooperating with China Merchants Industry.

• The hotel group Ritz-Carlton has signed one order and two options for 24,000 gt/298 bed ships. Shipyard Hijos de J. Barreras in Vigo, Spain, won the order. The operator has no Polar expeditions in mind but wants to offer a yacht experience.

Regarding the huge number and wide spectrum of modern ships, the niches for revivals of elder tonnage become rare. Moreover, the availability of ships suitable for modernisation is dwindling. One of the few new developments is the »Prince Vladimir« in the Black Sea. Sovfracht and Rosmorport have indeed opened a new service Sochi–Yalta–Novorossijsk–Sevastopol and Istanbul since the EU has banned cruises in the Northern Black Sea. The ship was bought from Israel. The Mexican hotel group Vidanta has bought the »Voyager« from the bankrupt All Leisure Group and plans to use her as »Vidanta Alegria« for Latin America cruises. Alteza Cruises of Argentina has chartered the former German »Delphin«.

Shipyards

The list of cruise ship builders is a little bit longer than last year. Mitsubishi was deleted but a few smaller yards were added. The family-owned Meyer yards comprise the Papenburg shipyard, the Turku plant and the Warnemünde factory which contributes engine room blocks for the big vessels. A large investment program increases the building capacity of the then most modern shipyard in Turku. Fincantieri uses five shipyards in Italy. The affiliated VARD group, renowned for offshore vessels, includes besides the five plants in Norway also factories in Romania, Brazil and Vietnam. Following big losses in 2015, Fincantieri reported a small profit in 2016.

The Korean STX group is also definitely leaving the cruise ship scene. The sale of the part ownership of STX France to Fincantieri was already reported, but final details are not yet decided. France’s new president Emmanuel Macron is not satisfied with a minority ownership of France in the facility which is important for its naval constructions.

Fincantieri is also pampering the Chinese competitors. Following a technical assistance agreement with the repair yard Huarun Dadong and the joint venture Fincantieri/Carnival/CSSC, an agreement for a supply chain site was signed with Baoshan. The lack of such a supply chain in Asia has been the reason for not being able to compete with the Europeans in cruise ship building. This tight relation of Fincantieri with the state-owned ship builder CSSC is also a reason for not selling the majority of the French yard to the Italians.

More Chinese shipyards would like to build cruise ships and one more of them is already successful: China Merchants Heavy Industry Co. will build four expedition cruise vessels (six options) according to designs and with supplies and management of Ulstein. Mäkinen is to set up a cabin assembly plant on the shipyard site.

The group of three Norwegian expedition ship designers and builders is joined by two Croatian, a Spanish and a Portuguese competitor. These shipyards are losing the ferry and RoPax business to Asian builders and are also looking for promising business fields.

Worth mentioning is also the Chesapeake Ship Building Corp. The various series of river boats and coastal cruisers are operating under U.S. laws but the small company is providing all new ships for American Cruise Lines, the leading operator along the rivers and coasts of North America.

Ports

A growing number of ports and their hinterlands is suffering from too many tourists. While the local economy is happy about their visits or even heavily dependent on them, some inhabitants or long-standing tourists feel annoyed by the masses of day tourists. Bergen, Norway, now limits the number of cruise ships and passengers per day to four respectively 9,000 for future calls.

Other mainly larger cities are still happy about growing numbers of calls. Hamburg did not care very much about cruise ships for a long time. When AIDA Cruises planned to base a new ship for year-round weekly cruises in Hamburg, a new terminal was required. The terminal could be finished in time very fast and below the planned budget, only the ship was delayed. Between 2016 and 2018 the number of calls in Hamburg increased from 170 to 200 and the number of arrivals and departures from 722,000 to 810,000 and 880,000 are expected. This development should justify the replacement of the provisional terminal made out of containers. This will consist of four decks for subway, buses, taxis, shopping mall, hotel and departure/arrival facilities.

Epilogue

Let’s hope that no new crisis destroys the demand projections and all ships on order can be filled. Some solutions for a more environment conscious ship operation are found, at least for new vessels. But what will happen if small touristic sites are closed for the masses of visitors coming from the giant ships because of overcrowding? Are fewer port calls and more attractions and animation aboard an alternative? Or do the operators have to buy more »private islands« and provide their own destinations?

Arnulf Hader