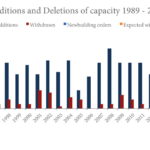

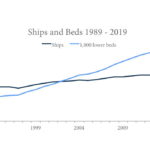

The total cruise ship tonnage and bed capacity leaving the active fleet is less than that of one large new vessel. Will this trend continue in 2019 and beyond? By Arnulf Hader

During 2018 the growth of the fleet by number of ships has, nevertheless, not been as fast as expected because[ds_preview] several ships could not be completed as planned. The 5-masted »Flying Clipper«, the hybrid »Roald Amundsen«, the luxurious »Scenic Eclipse« and the »World Explorer« are all no big ships, but they are »firsts« for their shipyards. New technologies provide high hurdles for their builders and, therefore, they could not be delivered in time. Meyer Werft also faced a delay of some weeks due to the new LNG technology but could transfer the »AIDAnova« to the owner just before the end of last year. Other newbuildings will leave their shipyards several months later and miss a whole season. This reduced the number of deliveries in 2018 to twelve plus one delayed from 2017.

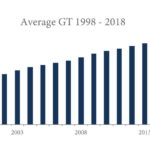

The total tonnage and bed capacity which left the active cruise fleet since 2017 is definitely less than that of one big new vessel. Worth mentioning is the »Aegean Queen«, better known as »Louis Aura«. This 349 cabin vessel was delivered 1969 by AG Weser Seebeckwerft in Bremerhaven under the name »Starward« to Norwegian Cruise Lines. The »Superstar Libra« (42,276 GT, 1,464 Pax) left the active fleet to become a home for shipyard workers in Wismar, Germany. A few small ones left the oceangoing fleet for retrofit into a yacht or their capacity and/or status as ocean ship was redefined or reduced. The »Marella Spirit«, ex »Nieuw Amsterdam«, (33,930 GT, 1,120 Pax) was sold for scrap at the relatively young age of 35 years. Rui Alegre made the experience that a collection of famous classics is no more in the interest of passengers and sold the laid up small »Porto« (ex »Istra«, 5,888 GT, 320 Pax) for scrap and the »Funchal«, which never changed her name since 1961 (9,563 GT, 481 Pax), as stationary hotel vessel on the Thames. Thus, at the end of 2018, the fleet counted 309 ships with 22.00mill. GT and 552,000 beds. The average ship size climbed to 71,170 GT. This jump of 2,330 GT is not only caused by the elimination of a few small ships but also by the late delivery of some new small ships last year while the big ones were delivered on time.

This year, the list of new deliveries might include up to 23 vessels summing up to 1.649mill. GT with 42,700 lower beds. This compares to the 13 new ships with 1.321mill. GT and 33,300 lower beds which were completed during 2018. Next year’s ships cannot all be mentioned individually here. A short overview is given as follows brand by brand beginning with the largest group:

• The Carnival group adds the 5,200 bed giant »Costa Smeralda« to the European and the 4,200 bed »Costa Venezia« to the Chinese market, the 3,660 bed »Sky Princess« to Princess Cruises and the 4,000 bed »Carnival Panorama« to Carnival Cruise Lines.

• Hurtigruten expects to commission the »Roald Amundsen«, the first of a series of 530 bed expedition ships with hybrid engines.

• Mediterranean Shipping Co. gets again two big additions, the 4,500 bed »MSC Bellissima« and the 4,888 bed »MSC Grandiosa«.

• The Portuguese Mystic Cruises is keen to introduce the delayed »World Explorer« (176 Pax) as first of up to ten sisters. Two more are already fixed.

• Norwegian Cruise Lines await the 4,200 bed »Norwegian Encore« from Papenburg before one switches over to Fincantieri for several new series.

• Ponant Yacht Cruises & Expeditions expects a pair of new ships like the year before, the 184 bed »Dumont d’Urville« and the »Bougainville«.

• The Royal Caribbean group expects the fourth of five ships of the »Quantum« class, the 4,000 bed »Spectrum of the Seas«.

• A very special case is Saga Shipping because it is a small company which has decided to order two new ships. The first to come from Meyer in 2019 is the 999 bed »Spirit of Discovery«

• The river cruise operator’s Scenic Tours of Australia’s »Scenic Eclipse« was delayed last year and will now be the first of two 225 bed luxury expedition yachts.

• SunStone Ships starts a new series with the 175 bed »Greg Mortimer«.

• TUI Cruises has already started this year’s long queue of new ships with the recent delivery of »Mein Schiff 2« which doesn’t replace the former one. Anxious to provide not enough capacity TUI Cruises retained the old one under the new name »Mein Schiff Herz«. Hapag-Lloyd Cruises is increasing the expedition fleet: this year the 239 bed »Hanseatic nature« and »Hanseatic inspiration« will replace the »Hanseatic« and by 2021 a third one will be added.

• Viking Ocean Cruises will commission the sixth of the 928-bed series.

In former years, a few elderly ships had been in lay-up for different reasons and came back again someday. This development seems to come to an end. The German »Delphin«, formerly the Russian »Belorussiya« (1975), which came into Indian hands later, is since several years said to come back to service, but finally the deals didn’t realize. With increasing pressure from many new ships her time seems to be over after more than 40 years.

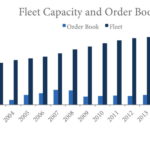

The total number of ships and tonnage on order is higher than ever before. Together with a few new orders reported just days after the start of 2019, there are now again more than 100 ships on order. Including options, MoUs, LoIs. etc. there are about 140 new cruise vessels in the books of the shipyards, excluding river and coastal vessels. Most passenger shipyards are fully booked over several years and the first slots in 2027 are taken. It’s good that the capacity of experienced shipyards is limited, otherwise newcomers would enter the business faster and destroy the market balance.

The leading brands last year

Since the Carnival Group fleet passed the milestone of 100 ships, further growth is relatively slow regarding the number of ships; the tonnage and capacity, however, are going up steadily. At the end of 2018 there was only one ship more in the fleet but 13,000 beds more than one year before. The brands Carnival Cruise Lines, Holland America Cruises, Seabourne and AIDA got a new ship. The last-named is the most interesting one, because it is the first big passenger ship worldwide relying on LNG as fuel and it is the first 5,000 beds giant for the group. Eight more such LNG giants are in the order book of the Meyer Group for various Carnival brands, the next one is for Costa Crociere. As long as only two or three ships are being phased out per year, the fleet growth is secured for some more years.

The Royal Caribbean group has 12,000 beds more compared to last year, but also eleven ships more due to the acquisition of two thirds of the shares of Silversea Cruises. This is why the average size of the ships is not the highest anymore (133,088 GT) but just below 100,000 GT. Further additions to the fleet include the first ship of the new »Celebrity Edge« class and the fourth of the »Oasis« class. This »Symphony of the Seas« (228,081 GT, 5,518 lower beds) is currently holding the title for »largest passenger ship of all times«. The fifth one of the series and some more large ships are under construction. Luxury brand Silversea Cruises will also follow the growth path in the Royal Caribbean Group.

Norwegian Cruise Lines has introduced the sixth of the 4,000-beds ships of which one more will follow from Meyer. Afterwards, NCL switches over to Fincantieri as supplier of new tonnage. The coming »Leonardo« series with 3,300 beds was meanwhile increased to six contracts and a few weeks ago the planning for the luxury brands was made public: Regent Seven Seas will have two new 750-bed ships by 2020 and 2023 and Oceania Cruises two new 1,200-bed vessels by 2022 and 2025. If no ship is retired, the fleet will grow from 26 to 37 ships.

No. 4 of the world’s cruise companies is the Mediterranean Shipping Co. The company has »only« 15 ships now, but they have the largest average size by GT and by capacity. Last year, the 4,140 bed »Seaview«, the second newbuilding from Fincantieri, was commissioned. The order book of MSC is larger than the existing fleet. And on top of these big ships the company has signed an MoU with Fincantieri for the building of four higher rated ships for 1,000 guests last autumn.

The fleet of the German operator TUI sums up to just 10% compared to Carnival’s capacity and the average size is also smaller. But the group includes some facts worth mentioning. In January 2019 the TUI/Royal Caribbean joint venture TUI Cruises commissioned the sixth new ship since 2014 resulting in one of the youngest fleets. One more will follow 2023 and two bigger LNG ships 2024 and 2026. The sister brand Marella Cruises for the British market operates older ships which are being replaced by somewhat younger former RCL ships and other vessels. Two charter ships were returned to the owner Louis who surprised the market by sending the »Marella Spirit« ex »Nieuw Amsterdam« to the scrap yard. With 35 years she is relatively young but lacks balconies and other modern features. Hapag-Lloyd Cruises continues operating the high-rated »Europa« and »Europa 2« and brings the expedition fleet to a similar standard, soon. The »Hanseatic« was already sold and will be replaced this year by two new »Hanseatics« with 230 beds. A third sister will replace the smaller »Bremen« by 2021.

The newbuilding programme of the Malaysian Genting group is taking shape at their MV Werften in Germany. Their long-standing cruise company Star Cruises is cannibalized by transferring the »Superstar Libra« (1988, 732 cabins) to Wismar as accommodation for newly hired shipyard workers and by upgrading the »Superstar Virgo« (1999, 1,800 beds) for the Dream Cruises fleet, which already includes two larger vessels. Star Cruises will later be pushed by new 5,000 bed vessels. These are under construction at MV Werften as well as the 200-bed luxurious expedition vessels. More new ships for the Crystal brand are still in the design phase. Their designs were reduced from 100,000 GT to 65,000 GT with lower capacity and their building slots will follow the two other types.

All other cruise fleets have less than half a million GT currently. The next to surpass the 500,000 GT level is Disney Cruises with three 135,000GT ships on order for delivery in 2021, 2022 and 2023. Viking Ocean Cruises has no big ships, but their fleet plan will make them surpass a fleet size of half a million tons by building 48,000 GT cruisers in a long series. Five of them are in service, five more will follow until 2023 and two smaller ones too. The list of options includes six more of the larger type and two more of the smaller type. The plan is to operate 20 ships by 2027.

Virgin Voyages have ordered a fourth ship of 110,000 GT for 2,770 passengers while the first one is not in service, yet. The ordering activity in the small ship range also does not face a real slowdown. In Portugal the delivery of the »World Explorer« was postponed to 2019, but Mystic Cruises fixed already the delivery of two 9,300 GT sister ships from WestSea Shipyard. Sunstone also fixed some sister vessels of »Greg Mortimer« at a Chinese shipyard. The completion of the »Scenic Eclipse« (16,500 GT, 220 beds) at Uljanik (Croatia) has been postponed to this year. In spite of the delay, the Australian river cruise operator has already ordered a sister vessel from the same shipyard. Following several years of delay, the story of the third sailing ship for Sea Cloud Cruises should find a happy ending with the completion of the »Sea Cloud Spirit« by the Spanish shipyard Metalships & Docks by 2020. The delay was caused by the bankruptcy of the first shipyard.

The shipyards

Regarding the fast growing fleet, it’s good to see that no shipyard worldwide is able to built large cruise ships for thousands of passengers without experience. The Japanese and the Koreans have tried it or were about to do it but had no success. The Chinese are not timid to spend much time and money and have announced to enter the business, which is the last domain of the Europeans, but not immediately. They know that they do not have the required supplier industry, which contributes all the high quality interiors which are needed for a luxury design. They can’t deliver a complete ship at a much lower price if they have to buy the costly interiors in Europe. Moreover, only a few European shipyards have experience with the correct installation of all these components which to acquire and install in a trial and error system is extremely costly and time consuming. No wonder that they calculate several years until the first delivery of a big cruise ship. Fincantieri who contributes to several cruise ship projects in China is of great assistance for the chinese Industry. The Europeans can only hope that the Chinese market needs many cruise ships that keep shipbuilders busy for several years. It will not be a European domain forever.

Meanwhile, the European builders could build up an order book like never before. Together with the French and the Norwegian subsidiary Vard, the group around Fincantieri is now clearly leading the world cruise ship construction scene. Hardly more than 50%-owned by the Italians, the leading French shipyard got back its former name Atlantique. Their share is larger than noted in the table, since the size of the smaller cruise ships for Viking Ocean Cruises is not yet disclosed. The total figures are striking: The World cruise fleet just surpassed the 22mill. GT mark and the Fincantieri Group alone has 6mill. GT more in its order books. Both shipyards of Meyer in Germany and Finland together have 3mill. GT and the East German group MV Werften, which was bought back from a Russian investor, sums up to 0.6mill. GT. Except the Chinese shipbuilder Waigaoqiao who started building big cruise ships, no further cruise ship builder has more tonnage on order than one mid-size vessel.

Parallel to the fleet, the demand for cruises is expected to rise faster than ever before. Having surpassed the 25mill. passengers threshold by 2016, Cruise Lines International Association (CLIA) reported 26.7mill. in 2017. For 2018, the preliminary figure is 28.2mill. and the expectation is to count 30mill. passengers by 2019 – and CLIA is not even covering the whole World.

Arnulf Hader