The Norwegian flagged fleet of 794 vessels is currently valued at 17.05 bn $. Compared to 2018 on[ds_preview] a year-on-year basis, it has lost ten ships and decreased in value by 1.4 bn $. Most notably, 21 OSV type ships have left the fleet (see table) while the tanker segment welcomed six additional units. The OSV segment is still by far the biggest in size, comprising 252 vessels worth 2.35 bn $. In terms of value the tanker segment, which is also the second largest in size with 185 units, comes in first, being worth 4.09 bn $. The OCV segment comes in second looking at fleet value at 3.13 bn $. But there is a hidden champion: the MODU segment with its 13 units is valued at 2.77 bn $. LNG and LPG carriers also have an interesting fleet size to value ratio.

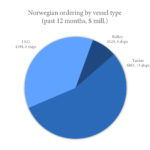

Norwegian newbuild ordering is picking up again after a massive decline in 2015 and 2016. Spending is back from the record lows of 2016 (0.76 bn $) to 2.55 bn $, but is still far away from the record highs of 2011 and 2012 (10.24 bn $). In the past twelve months, Norwegian owners have ordered vessels for a sum of 1.6 bn $ that was mainly spent on tankers and LNG carriers as well as some bulkers.

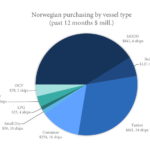

After a record high purchasing activity in 2017 and 2018, interest seems to have slowed down quite a bit in 2019. Over the past twelve months, Norwegian money mainly went into used module carriers and tankers with containerships and bulk carriers coming in second and third.