Oslo vs. New York – which stock exchange is more attractive for maritime investors and owners? Over the course of the last years, Oslo has gained more and more attraction both from investors and owners. By Jens Rohweder, Notos Consult

From an investor’s perspective, the »ideal« stock exchange offers good market depth with ample liquidity, a broad variety of instruments[ds_preview] and a solid regulatory framework. Supplementary bond- and derivatives markets would then add to a perfect market place.

Like New York, the Oslo stock exchange is a well-established market place with a high attraction for the maritime industry. Though, it has a certain handicap through the fact that investors need to trade in Norwegian kroners and brokers need access to this market. Meanwhile, these issues can be more easily overcome with the evolvement of online brokers who facilitate access to the Oslo and other local markets for their customers.

Market cap makes the difference

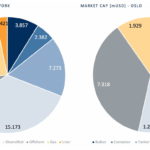

Turning to the importance of both stock exchanges for the shipping industry, we gathered some data from both exchanges to make a comparison. Currently, 69 shipping companies of Notos’ shipping universe are trading on the New York stock exchange and 58 in Oslo. Some companies have dual listings both in Oslo and New York, for example Frontline. So number-wise, both markets appear nearly equal.

But there is an important difference: The total market capitalization of shipping companies in New York is 44 bn $, whereas shipping companies’ total market cap in Oslo amounts to 20 bn $. This means that the average size of shipping companies in terms of the market capitalization in New York is approximately double the size compared to those listed in Oslo.

Different focus in Oslo

The aforementioned finding on an aggregate level has to be put into perspective when it comes to the different shipping sectors as shown by the first graph. The big gas carrier companies like Gaslog, Golar or TK LNG are trading mainly in New York. The listings of tanker companies are evenly spread between New York and Oslo. Offshore companies are mainly listed in Oslo; this is also a result of Norway traditional focus on its oil reserves and the oil industry.

One quarter of the shipping market cap in New York comes from the gas carrier companies, and also the diversified companies like Navios Maritime Holdings, Teekay or Ship Finance International seem to prefer New York. In Oslo, the market is clearly dominated by tanker companies and offshore supply owners (as shown in the second chart). Despite this historical bias towards the oil & offshore market, the Oslo stock markets offer »soft factors« which during the past two years have attracted new IPO candidates like Navios Containers, Good Bulk or MPC Container Ships.

Flexibility comes at a price …

The main reason for a company to list on the Oslo markets seems to be the time- and cost-efficiency of the listing process and the fast »time-to-market«. It is quite easy to comply with the regulatory requirements to list a company in the Oslo over-the-counter or Merkur market. For instance, there is no need for an extensive and costly prospectus.

However, this flexibility comes at a price: Such a »fast track« approach is not comparable to a fully-blown public offering and such stocks can only be offered in private placements with a limited number of investors. Consequently, there is limited liquidity in the stocks.

Growth stories attract investors

There are well-established and highly experienced shipping investors in Oslo, London and New York who are generally known to be willing to invest in shipping startups if they feel that the time and idea is right. These investors aim to invest mainly in growth stories and market opportunities of entrepreneurial companies with a small initial fleet.

Once these companies have built a track record – like MPC Container Ships did – they still can opt for follow-on private or public offerings to reach out for the main market in Oslo. After a successful start in Oslo, Flex LNG is now rumored to move further forward to a dual listing in New York in the next months.

Usually, such a step is accompanied by a certain change in the ownership struc-ture. In the beginning of their »listed« life, these companies attract mainly opportunistic investors as mentioned above. A listing in New York, however, has the advantage of broadening the investor base as long-term and yield-oriented investors and even retail investors can be targeted.

Shipping startups on the move

Recent offerings by Okeanis Eco Tankers or Hunter Group fall into this category of »incubator listings«. However, the rumored IPO of Polaris in Oslo would be somewhat different. Polaris owns a fleet of 35 dry bulkcarries in the water and 17 newbuildings with an asset value of nearly 2.5 bn $ in aggregate. Such an IPO would further strengthen Oslo’s reputation as a specialized maritime investors hub.

Jens Rohweder