On the agenda of the classification societies there are familiar topics and new business areas. The nature of regulation does not meet with approval everywhere. Two players are gaining market share. The annual HANSA report

It is not surprising that the major classification societies are clearly feeling the effects of the current, sometimes very drastic[ds_preview], developments in ship operation. Their customers – the shipowners – have to deal with an abundance of new regulations. The most important example is the »Sulphur Cap«, which will come into force in January 2020. But also the big topic Cyber Security occupies the industry. This is confirmed by the top 8 classes of the International Association of Classification Societies (IACS) in HANSA’s small questionnaire, as can be seen from the extracts of their statements on the following pages.

The classes try to support their customers with advice and analysis and invest in research and development. Some are considering entering new fields of business, possibly even outside shipping.

Some shipowners are still uncertain about how to deal with individual regulatory aspects in detail. It is therefore not surprising that some of the classification societies advocate an adjustment of regulation. With all due respect to socio-ecological challenges, a little more pragmatism and realism is suggested, especially as further regulation is expected.

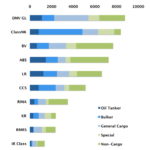

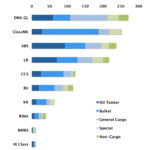

Meanwhile, very little has changed in the market shares of IACS members – with one exception, as current figures from Clarksons Research show. No actor has gained or lost tonnage in all fleet segments, and the willingness of shipowners to switch does not appear to be particularly pronounced.

The top 4 still are DNV GL, ClassNK, ABS and Lloyd’s Register. The development of the China Classification Society (CCS) is noticeable. With the exception of the General Cargo market, the Chinese were able to grow in all Clarksons segments. This is also reflected in the market share, which has grown by one percentage point. The importance of Chinese shipyards and financiers – with gouvernmental support – in newbuilding projects is likely to play a role in this respect.

According to Clarksons Research the CCS fleet saw the biggest growth: 8.9%. The Chinese were followed by Russia’s RMRS (7.7%), RINA (6.2%) and Bureau Veritas (3.2%).

»We should not forget that shipping is already the most efficient means of transportation.« – Knut Ørbeck-Nilssen, CEO, DNV GL – Maritime

The past few years have been demanding. Our focus on reducing costs and improving productivity remained very much in place, while we prioritized investments in digital processes and services. The main challenge, not only for DNV GL, is to adapt quickly enough to a rapidly changing future. Therefore, we will continue investing 5% of our revenue on R&D. Innovate yourself out of a crisis!

In a world increasingly defined by speed and complexity, co-creation with customers and other stakeholders is vital to stay ahead of developments. We are now intensifying our collaborative efforts to enhance safety and efficiency of designs and operations. We also collaborate more broadly, connecting with academia, research institutions, regulatory authorities and other businesses through joint industry projects and digitally enabled ecosystems.

To bolster our understanding and expertise in new technologies, we acquired a stake in the Singapore-based blockchain company VeChain. We launched My Story, a blockchain solution designed to enhance consumer trust in products and supply chains. Several other projects are underway to explore new business models in digital assurance. We neither favour nor oppose any regulation. As class, our role as a neutral third party is crucial. In general, more regulation is likely – be it regarding other types of emissions to air, noise and vibration etc. Societal expectations towards a more environmental friendly shipping are growing. However, in this context we should not forget that shipping is already the most efficient means of transportation.

Managing the impact of environmental regulations now entering into force is one of the most challenging tasks for shipowners, while also keeping their vessels running in a highly competitive business environment. Needless to say, lifting their eyes from the day-to-day concerns and trying to think strategically about what is going to happen in five- or ten-years’ time is challenging.

Regarding the date 1 January 2020, we don’t really see a difference in our role and work before and after the entering into force of the sulphur cap. The whole industry and the big energy picture is transforming, thus the 1st January 2020 is just one step into a future that will be much different than today.

We at DNV GL are addressing cyber security by offering several services. We can help to secure and improve the integrity of IT and control systems on board and on shore by identifying possible vulnerabilities, testing their robustness, and verifying that the implementation of new components and designs is safe. For this purpose, we employ a dedicated team of what are known as certified ethical hackers.

»The right regulation needs to stimulate and support problem-solving, rather than stymying it.« – Gisbert de Jong, Marine Marketing and Sales Director, Bureau Veritas

Marine is an extremely diverse market and we are always looking at ways to enhance our presence throughout the sector.

It seems clear that the regulatory ratchet on the question of decarbonisation will inevitably tighten. The real question is the form that this regulation takes. The right regulation needs to stimulate and support problem-solving, rather than stymying it.

We believe in being prepared for a decarbonized future and, starting now, the next decade will be critical for making the necessary investment.

On the fuels side, the development of new fuels is key. Biofuels, hydrogen, ammonia and synthetic fuels produced with renewable energy are the apparent options, while on the power side work needs to be done on fuel cells and batteries. All these alternative fuels and propulsion solutions need to be considered and explored, which is why we are working with industry partners on ambitious pilot projects in order to develop the regulatory framework.

Our colleagues at VeriFuel are working at a pan-industry level to share their expertise on such importance technical considerations as fuel compatibility.

We are also very active in the LNG market. There have been increasing numbers of orders at shipyards for gas-fuelled vessels, bunkering vessels and investment in LNG bunkering infrastructure, which will encourage more owners to consider LNG for future projects. We have been proactive in developing notations for alternative fuels and in 2018, we had 60 LNG-fuelled vessels on order.

In addition, we believe that LNG will be a significant element in a multi-pathway fuel future, with LNG playing an important role in the marine fuel mix, alongside other traditional fuel options and new alternative fuels.

Whilst all ship owners need to be ›cyber safe‹ and ›cyber secure‹ in the face of growing cyber threats, what ship owners actually want from the digital revolution is ›cyber performance‹. These are the transformative cyber benefits that can unlock new levels of efficiency and performance for owners, whether through remote condition-based maintenance and surveys, smart shipping, autonomous vessels, optimised fuel consumption and route planning solutions, 3D digital modelling to support asset management and much more.

»We believe our expertise & experience can be applied to other industries.« ClassNK

As our mission is to help ensure safety and environmental protection, we proactively support the industry in overcoming these challenges through our verification methods and R&D, and we are ready to expand our portfolio in sectors where we can utilize our accumulated expertise.

As for digitalization, we will strategically utilize our newly opened Digital Transformation Center to enhance survey activities and support the Internet of Ships – Open Platform (IoS-OP) initiative of our subsidiary known as ShipDC.

A variety of research in areas including robots and analytic technology is also being conducted in line with our Midterm R&D Roadmap. Once these technologies are ready, we will apply them in our work.

We believe our expertise and experience (for example with GHG emissions verification) as a verification body can be applied to other industries and we hope to expand our business portfolio to contribute on a larger scale. To meet IMO 2020 requirements, it is anticipated that compliant fuel oil will include more low-sulphur blendstocks than ever before in addition to light distillates. We have already identified five properties of compliant fuel oil that should be taken into consideration with its use: Compatibility; low viscosity; cold flow properties; cat-fines; and ignition/combustion quality.

As ships become more connected and automated, the boundaries separating OT and IT systems are becoming increasingly blurred and it is no longer possible to tackle one without tackling the other. This necessitates a response that balances physical, technical, and organizational mitigations.

This has been distilled into the ClassNK Cyber Security Approach. ClassNK is now regularly adding to these foundations, most recently publishing its Cyber Security Management System for Ships. This guidance includes management measures to protect against cyber risks in not only the navigation stage, but also in the construction/design stage of ships through Security by Design.

»Future regulation will be more goal-based and less prescriptive, giving multiple means to comply with defined targets.« – Vassilios Kroustallis, Vice President, ABS Europe

ABS has undergone a transformation over the past two to three years to adjust the organisation’s size and resources. With that process completed by the move last year to our new headquarters in Houston, Texas, we are well-positioned and right-sized for new challenges that the industry poses. Our core class and safety mission will be supported in future by additional services and solutions driven by industry, chiefly in the areas of sustainability, safety and digitalisation, which we identify as the critical issues in the coming decades.

From what we can observe, many clients still find value in workshops and webinars on regulation that is coming into force soon, such as BWM and IMO2020 which will require ongoing technical support – as well as subjects such as cyber security. One of the main focus areas for ABS is to ensure that the embrace of new digital technologies happens in a way that prioritises safety and manages emerging risks.

We advocate for rules agreed under IMO auspices, that are global in nature and enforced on a level playing field. What the industry should grasp is that future regulation will be more goal-based and less prescriptive, giving multiple means to comply with defined targets. That will work, provided there is good alignment between the technology required, support for the human element and the necessary resources for enforcement.

The changes post-2020 are really issues for owners and operators as procurement, training, handling and technical operations (for compliant fuel and scrubbers) all have to be co-ordinated up and down the supply chain. For class, the technical advisory work and support will continue; we expect a steady stream of feedback on both compliant fuel and scrubber options. Entry into force will also probably mean that the IMO can turn its attention to the topic of how to combat emissions of Black Carbon, which is another significant challenge for the industry.

The principle focus for ABS in cyber security is on Operational Technology – the ships machinery and systems rather than its IT network – and the threats that result from the interaction of people, machinery and communications systems.

»We also encourage industry and regulators to keep the overall safety of ships at the forefront of our minds.« – Nick Brown, Marine Director, Lloyd’s Register

As an industry we need to become more balanced about the way we regulate the hardware, the design of the equipment onboard ships and the human element. There is a growing feeling that STCW training standards have not necessarily had the necessary review in recent years given the increase in digitization and connectivity of ships and systems onboard ships.

We expect continued focus on regulations to enhance the environmental credentials of the industry. The priority will be following-up on the ambition in the Initial IMO Strategy for the Reduction of GHG Emissions from Ships. This will entail new requirements to enhance the technical and operational efficiency of ships to achieve the carbon intensity ambition for 2030, and more radical requirements to deliver on the absolute emissions reduction ambition for 2050. Other environmental issues on which regulation is anticipated include underwater noise, bio-fouling and grey water.

There is no doubt that once the IMO’s regulatory scoping exercise is completed in 2020, work on requirements to address the safety of automatic and autonomous systems used on board ships will commence. We anticipate those requirements to be goal-based.

We also encourage industry and regulators to keep the overall safety of ships at the forefront of our minds. The challenges of improving shipping’s environmental performance are necessary and they are significant – in the case of GHG emission reductions, we need step changes not evolution. This necessary work should not obscure the need to continue evaluating and improving the safety of ships for the benefit of those who work on board.

Digitalisation carries risk – as the ship itself becomes more connected to the shore, various stakeholders whether they be equipment makers, or service providers who can carry out remote diagnostics or undertake software upgrades on assets without physically going onboard. And those engineers that do go onboard are armed with laptops, cables and other kit used inspect systems. As a result there is the opportunity for the reliability and performance of a system to be degraded, whether it’s been through a malicious act, such as a targeted attack, or more likely, in my opinion, through the unintended consequences of someone either inserting a USB cable or a memory stick, or perhaps one piece of operating technology having it software upgraded, and the manufacturer of that piece of technology, not understanding how the technology fits within a wider system on board the ship.

To help our clients address cyber threats, we last year acquired Nettitude which has significant cyber security domain expertise.

»We are not excluding the possibility of us performing focused M&A activities going forward.« – Paolo Moretti, EVP Marine Strategic Development, RINA

We are improving our operational model by delocalizing expertise and competencies, and creating technical and commercial structures close to clients, with dedicated, single points of contact. We also have big investments planned in Northern Europe, China and for passenger ships in the USA.

Over the next few years we see good opportunities, especially in cruise and ferry passenger ships relating to the global 2020 Sulphur cap and convention for sound ship recycling. Also smart ship solutions are a very promising area.

To grow in the value-added advisory services market for designers, shipyards and shipowners, we further intend to define agreements with specialized companies in such niche segments. With this in mind, we are not excluding the possibility of us performing focused M&A activities going forward.

We see environmental regulations that cover the entire life cycle of the ship being a strong area of influence in the shipping industry in coming years. Smart shipping and the »digital ship« are also becoming reality and need new regulations. The first testing of remotely controlled ships have recently taken place, but the final objective is to have completely unmanned ships. This development will need a whole new set of internationally approved regulations.

In the short term, we do not see the role of class societies changing. In the slightly longer term, we see the need to develop new tools for the safe use and consequent certification of steps required to reduce pollution in the maritime world in line with the ambitious greenhouse gas emissions reduction plan for 2030 and 2050.

»A SIP (Ship Implementation Plan) would help the industry plan, but it is very difficult to develop one because the market is so unprepared.« – Jeong-kie Lee, President & CEO, Korean Register

Holistic inter-committee work on the subject of maritime autonomous surface ships (MASS) and the lack of clarity about the correct application of the existing IMO instruments is now on-going and expected to continue for several more years. The IMO could ensure that stakeholders across the maritime sector have access to a clear and consistent regulatory framework and could respond proactively to the growth in the use of MASS in a timely manner.

In addition to MASS, the IMO is currently reviewing the reduction of GHG emissions from ships, and a proposal for energy efficiency regulations for existing ships was presented at MEPC 74.

The proposal for energy efficiency regulation for existing ships also includes an amendment to the MARPOL convention and the mandatory application to all ships. Although the IMO has not yet made any decisions, if the regulations are decided, it is expected that the impact on ships engaged in international voyages will be greater than any previous regulations.

No one doubts that the biggest concern for shipping companies at the moment is the sulphur cap 2020 and companies are doing their best to prepare for it. An SIP (Ship Implementation Plan) would help the industry plan, but it is very difficult to develop one because the market is so unprepared. For example; No.4 in the SIP is »Procurement of compliant fuel oil« but we don’t know where such fuel will be available. Even planning for preparation is almost impossible at the moment because none of the related industries are ready.

New fuel will be available from the fourth quarter of this year, and then ship owners and operators will only have a couple of months for their »real« preparation. Moreover, the instructions for unusual cases have not been established. Although MEPC74 approved many guidelines and guidance for »contingency measures« and »recommended actions for EGCS failure«, the instructions overall are still unclear and have many possible ways of implementation. It will cause a lot of conflict and confusion.

»Mandatory requirements for improvement or even retrofit with energy efficiency technologies may also be introduced.« – Jianhui Mo, President, China Classification Society

Although we had no substantial merger expansion plans in recent years, there has been expansion in inspection types and scopes. In order to fulfill the social responsibility and accelerate the development of domestic shipping, CCS has formally accepted to perform statutory inspection duties for ocean-going fishery vessels and marine products of fishery vessels since last year. In addition, we have undertaken inspection work of domestic ships, marine products and water-based facilities in domestic parts.

Technological progress has always been the booster of the development for the shipping industry. It is a responsibility that classification societies must all bear. Therefore, we have set up the Science & Technology Innovation and Test Center to strengthen the research and development.

Fields such as greenhouse gas emission (GHG) reduction, further improvement of the energy efficiency and marine plastic litter from ships are expected to be regulated in the near future.

IMO will adopt relevant reduction measures/regulation after impact assessment in the near future to meet 2030 targets set out in the IMO Initial Strategy.

As we know, the IMO already established the mandatory requirements of the energy efficiency, the design efficiency of new ships, i.e. EEDI, and has introduced it into MARPOL Annex VI. With the aim to encourage the usage of the innovations and new technologies, early implementation of phase 3 (until 2015) and EEDI phase 4 requirements may be introduced, and for the existing ships, mandatory requirements for improvement or even retrofit with energy efficiency technologies may also be introduced.

Talking about marine plastic litter from ships, since dumping of plastics into the sea is still a problem and recognition of the urgency to address marine plastic litter from ships, the IMO initiated the works last year and it is expected that measures of reducing marine plastic litter from ships will be developed after the completion of the relevant study, analysis and assessment.