Looking at spending by Chinese Leasing companies reveals a mixed picture. While some organisations such as Bank of Communications, ICBC[ds_preview] Financial Leasing, China Development Bank or China Merchants Bank focus primarily on second hand purchases, others like AVIC Leasing have a focus on newbuild orders. CSSC Shipping is by far the largest player in terms of portfolio (1.1 bn $) and finances only new build tonnage.

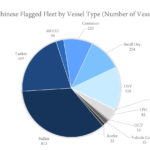

The age profile of the Chinese-flagged fleet shows that the majority of vessels is relatively young, ranging between zero and 14 years, with a clear emphasis on the 5-9 years age group. The Chinese flagged fleet is dominated by bulkers in terms of number of vessels as well as in terms of value (813 ships, 7.9 bn $). Tankers come in second at 485 ships worth 5.4 bn $. Third in terms of value is the Module Carrier segment at 2.5 bn $ with only 59 ships. The 220 Chinese flagged containerships are worth 2.5 bn $ followed by the Small Dry (254 ships, 1.2 bn $) and the OSV (328 ships, 1.1 bn $) segments. It gets interesting again in the gas carrier, vehicle carrier and OCV segments that are all relatively small in terms of number of vessels but disparately valuable.

Looking at trade patterns and cargos, top import ports for capesize cargos are Caofeidan, Jingtang, Rizhao, Qingdao and Ningbo. The most important capesize export region into China is by far West Coast Australia. Far behind, South America North Coast and East Coast, West and South Africa follow. Another interesting picture is revealed by a looking at the Chinese container export growth, which shows a quite steady upward trend that has picked up significantly since 2015.