The lifeboat market has not been spared from the coronavirus shake-up in the shipping and shipbuilding markets. The downturn of the cruise market and fewer newbuildings hit the sector, reports Felix Selzer

After a very promising start to 2020 in the lifeboat market the coronavirus pandemic affected demand because of restrictions on[ds_preview] port calls, Benny Carlsen, Senior Vice President Global Sales & Marketing, Viking Life-Saving Equipment tells HANSA. »However, the situation is almost back to normal for us now, and we are busy fulfilling orders that had been on hold. The downturn in new building orders for yards persists,« he says. Rob Wallace, Global Technical Sales Manager Lifeboats & Davits at Survitec also reports a good start into 2020 with Survitec focusing on product harmonisation and »making sure our service and products offerings cover all segments and categories and cross over to utilise or customer connection in each segment«.

»The Covid-19 situation has of course impacted the marine industry with numbers of ships working having reduced, but with careful planning and increased HSEQ measures, we have continued to offer our customers the vital inspection and repair work required,« he adds. Crew changes have been a challenge for the company and so has been keeping the global network up and running. »Some Classification Societies have managed to conduct some of their annual surveys remotely which has helped in keeping vessels safety certification up to date, so whether this will continue after the current pandemic is over will be interesting to see,« Wallace says. Looking forward to 2021 he expects to see a continuation of the social distancing and Covid-19 measures. Customers requiring a more »multi product focused approach« reduces the possible vessel touch points and multiple personnel visiting a vessel. »So, having a broad product portfolio will be even more important.«

German lifeboat maker Hatecke started into 2020 with a very high order backlog for lifeboats and tender boats. »The delayed ship deliveries caused by the Corona crisis are currently giving us the opportunity to relax a little, to sort out operational procedures and make overdue adjustments. In the coming months we will adjust our capacities to the changed requirements of our customers,« Managing Director, Peter Hatecke, tells HANSA.

Jens W. Hinsch, Director Product Line Boats and Davits at Palfinger reports a successful start into 2020, as long-term contracts have enabled the company to achieve good capacity utilisation already towards the end of 2019. This capacity utilisation is based on long-term orders from the cruise industry, which were placed with Palfinger as newbuilding orders unaffected by the Covid-19 crisis. However, Hinsch states that »in general, orders already placed are rescheduled. New short-term orders in the newbuilding business are only awarded on a long-term basis due to the postponements.«

Hinsch sees a decline in the area of newbuilding orders in the cruise and offshore industry, where new orders are mainly based on a refurbishment concept, life-time extensions or adaptation of the basic concepts/application areas of the ships. Meanwhile, the market for special purpose vessels is still growing and is »rather independent of the crisis. Basic concepts such as naval requirements, rescue and assistance concepts are still valid regardless of the crisis and continue to be in high demand worldwide.«

The pandemic particularly affected – and still affects – the offshore and cruise markets. As Carlsen confirms, the cruise industry has been hit especially hard. »Passenger ships have been out of action entirely, while offshore operations have continued to a degree and are already returning to normal. The other side of the coin is that the market for newbuilds has taken a hit in most sectors but remains strong in the cruise industry«.

According to Survitec’ Rob Wallace, recovery will depend on the timelines implemented by the respective industries. »The cruise industry will have a significant challenge to enable it to start sailing again, with many operators not looking to re-start till October 2020 or later, and we are seeing some cancellations till 2021, but the industry is awaiting a back-to-work strategy either in house or government backed, like the US Centers for Disease Control and Prevention report looking to grade the cruise ships depending on the Covid-19 status on board. But this will be a tricky segment to start up and energize. 90 countries have closed their ports to cruise operators – and a further 43 denying select visitors and/or turning certain ships away.«

»The offshore market has seen some renewed furlough schemes, but these are looking unlikely to stem the foreseen job losses. The oil price, at time of writing, hitting $40.00 per barrel is a nice relief but North Sea and the global activity is likely to remain depressed. There could be a positive effect for the offshore sector as the Covid-19 situation could kickstart a renewed focus to embrace digital technology and data analysis looking forward,« Wallace says.

Hatecke’s production of lifeboats for the cruise sector is secured by long-term contracts. »In the next one to two years, however, we will have to live on the order backlog,« Peter Hatecke says. During this time he wants to try to open up new markets for the company. »These include the naval sector, which we have neglected a bit in recent years due to the strong growth in the cruise market.

Challenges and Opportunities

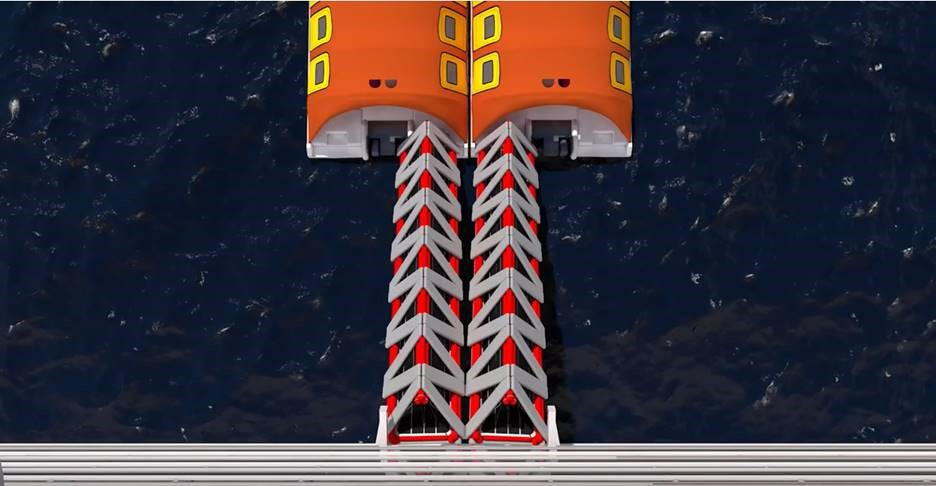

Due to the decreased demand in the new building sector, Hatecke is now working more on special projects and replacement deliveries, but expects that the market for newbuildings will recover in the course of 2021. Peter Hatecke states that the company is currently working on the development of new types of boats for the cruise sector with which it aims to adapt the product portfolio to new trends and to offer improved technical parameters.Survitec is looking into self-propelled alternative evacuation systems. Such systems, as Survitec’s slide-based Seahaven could possibly resolve some safety issues, Wallace says, as ship operators need a new solution to evacuate more people quickly, safely and comfortably. According to Wallace, these systems are »intrinsically safer to operate and operating costs are significantly lower.«

The adoption of electric propulsion systems is a significant current technological trend in the lifeboat market, confirms Viking’s Benny Carlsen: »We already have electric lifeboats in use at an offshore platform in the North Sea, for example. While a general driver behind the technology is of course sustainability, other benefits are surely worth highlighting as well.« Due to their high-torque engines, electric lifeboats can reach top speed quicker – which is potentially critical in rescue operations. Moreover, electric engines are much easier to maintain and test than diesel engines. While the customers expect beinhg offered »modern, environmentally neutral rescue and tender boat systems«, and »coherent concepts which can be integrated into modern ship systems as easily and cost-effectively as possible,« Palfinger’s Jens W. Hinsch sees challenges arise from cost pressure, »which has reached a new dimension as a result of the Covid crisis«. He assumes that new concepts will generally be more strongly questioned and that demand will increasingly move towards existing concepts and possibilities. An advantage, in his view, are »conclusive overall concepts, e.g. boats and davit systems from one source, which have proven themselves in their interaction and thus form a secure and sound basis even under high cost pressure«. This is something that Carlsen is seeing too: Greater demand for »truly comprehensive, end-to-end service with transparent pricing from a single provider.« Through its »Shipowner Agreement«, Viking offers a five-year, fixed-price contract covering everything from physical assets to support and maintenance.

Paul Watkins, Regulatory & Compliance Manager at Survitec thinks that being a turnkey solutions provider is not necessary for everybody to survive. »Certain ›turnkey‹ solutions may not meet the specific requirements of the client, such as design, delivery times, cost etc. That is why having flexibility of multiple sources of equipment may be important in meeting delivery of the vessel on time,« he says in line with Peter Hatecke who thinks that »for special solutions and niche products, there will continue to be a demand for smaller independent manufacturers. However, it can also be stated that historically grown family businesses are much better positioned in crises due to better capital resources and faster reaction times as larger companies with financial investors in the background.«

Felix Selzer