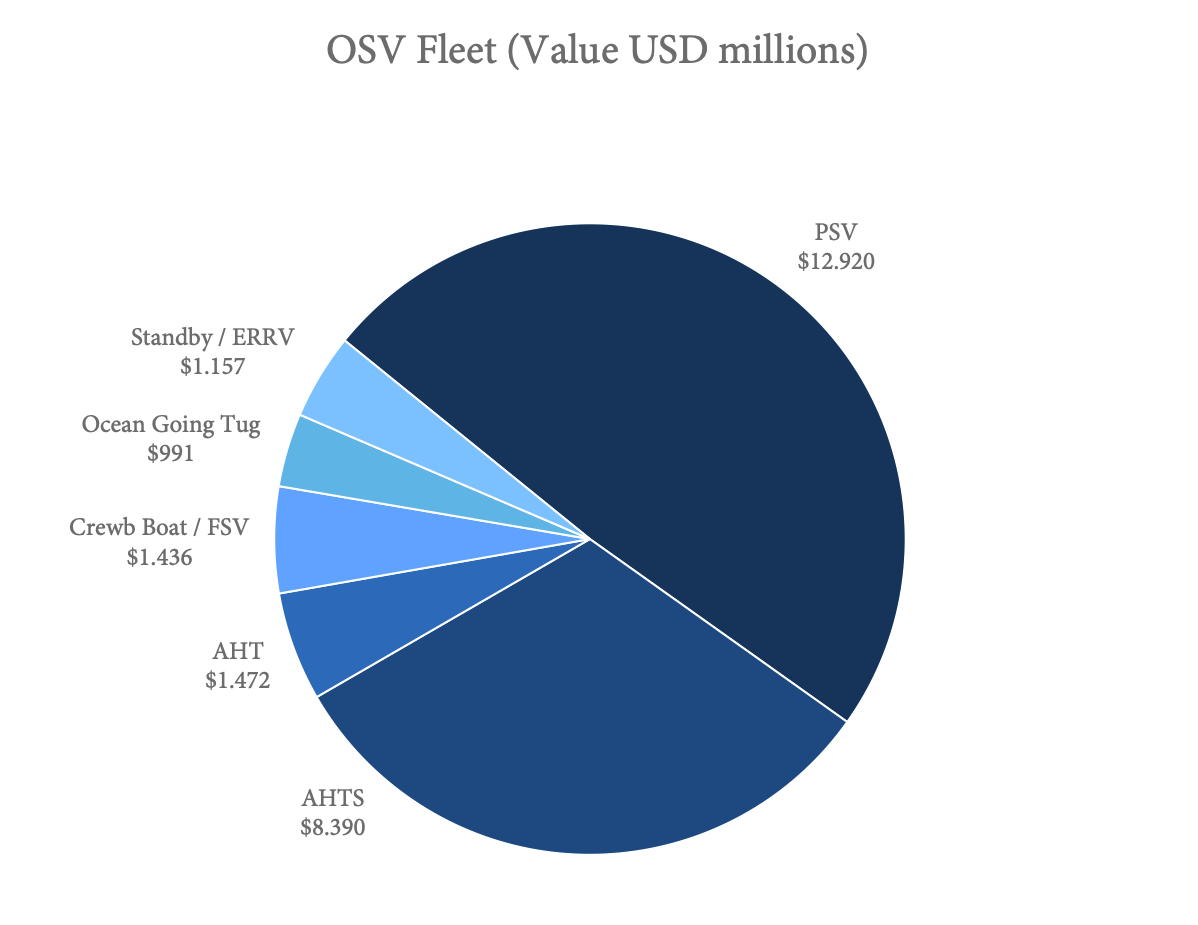

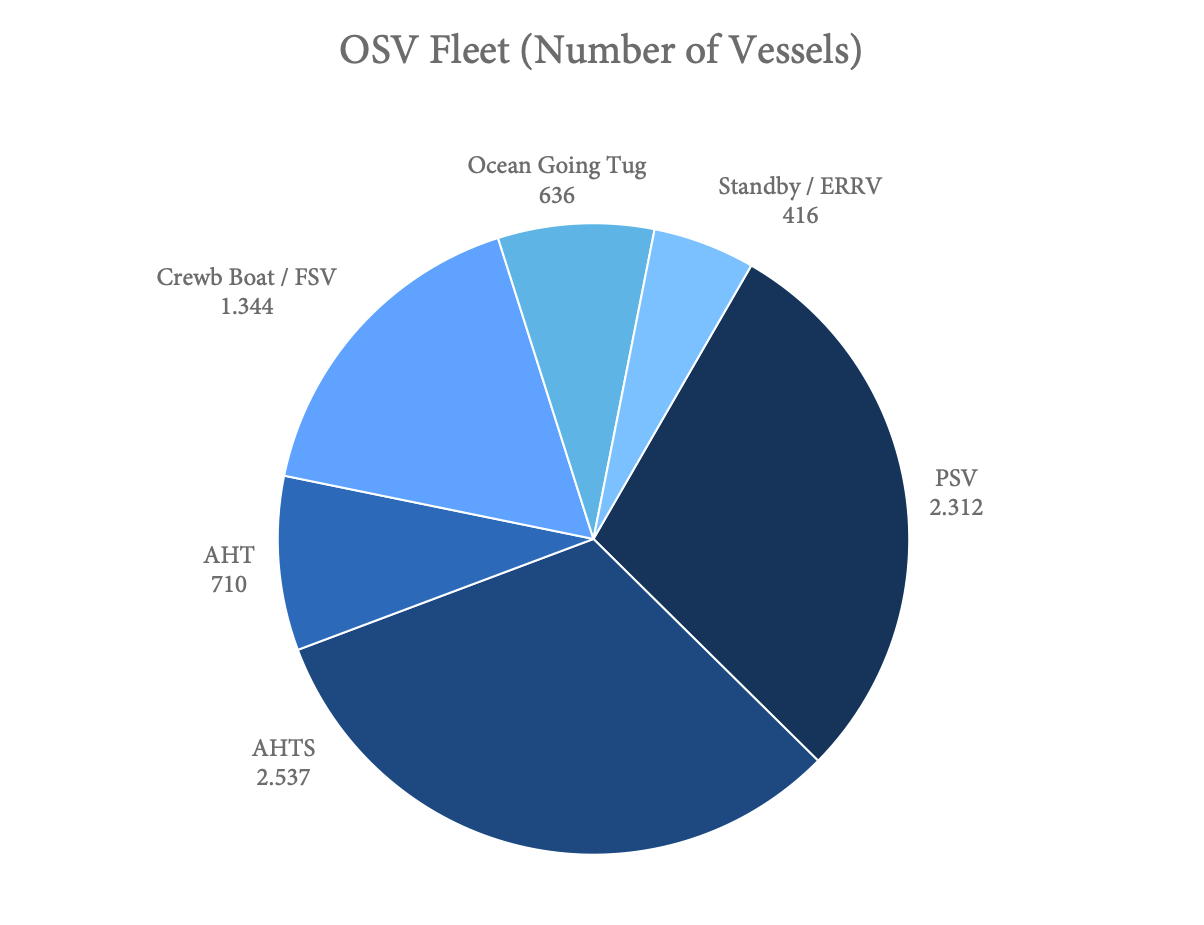

The global fleet of offshore support vessels (OSV) is dominated by Plattform Supply Vessels (PSV), Anchor Handling Tug Suppliers (AHTS[ds_preview]) as well as crew boats and Fast Supply Vessels (FSV). While AHTS hold the biggest share in terms of fleet size (2,537 vessels), the PSV segment is by far the dominating one when it comes to fleet value. The 2,312 PSVs are worth 12.9 bn $ altogether – almost half the value of the total OSV fleet is accumulated here –, AHTS are worth 8.4 bn $.

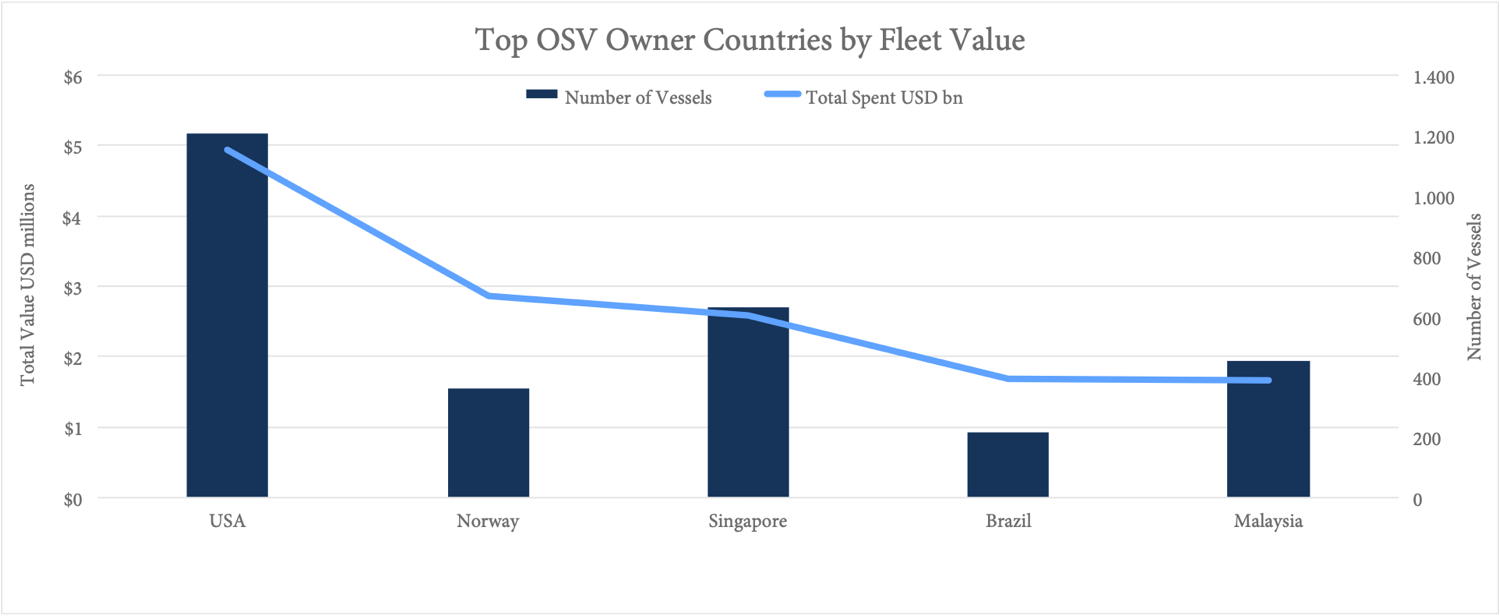

The US ist the top owner country both by fleet size and fleet value (1,207 vessels worth 5 bn $). Norwegian owners come in second with 363 vessels worth 2.9 bn $. This is remarkable since Singapore accounts for 629 ships worth »only« 2,6 bn $. Brazil on position four is then followed by Malaysia – again an interesting pair, because both countries’ fleets are valued at 1.7 bn $ with Brazilians owning 219 ships and Malaysians owning 452.

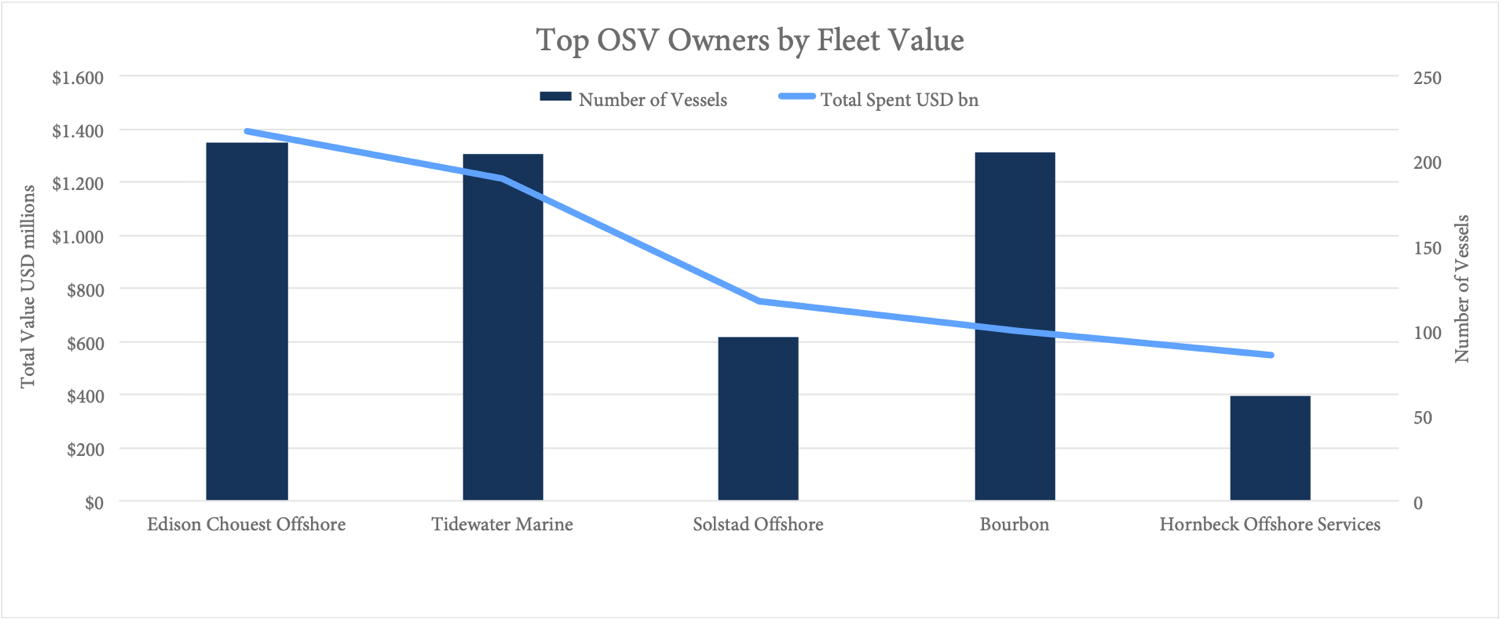

Top owners by fleet value are Edison Chouest Offshore (211 vessels worth 1.4 bn $), Tidewater Marine 204 / 1.2 bn $), Solstad Offshore (96 / 750mill. $), Bourbon (205 / 639mill. $) and Hornbeck Offshore Services (62 / 547mill. $).

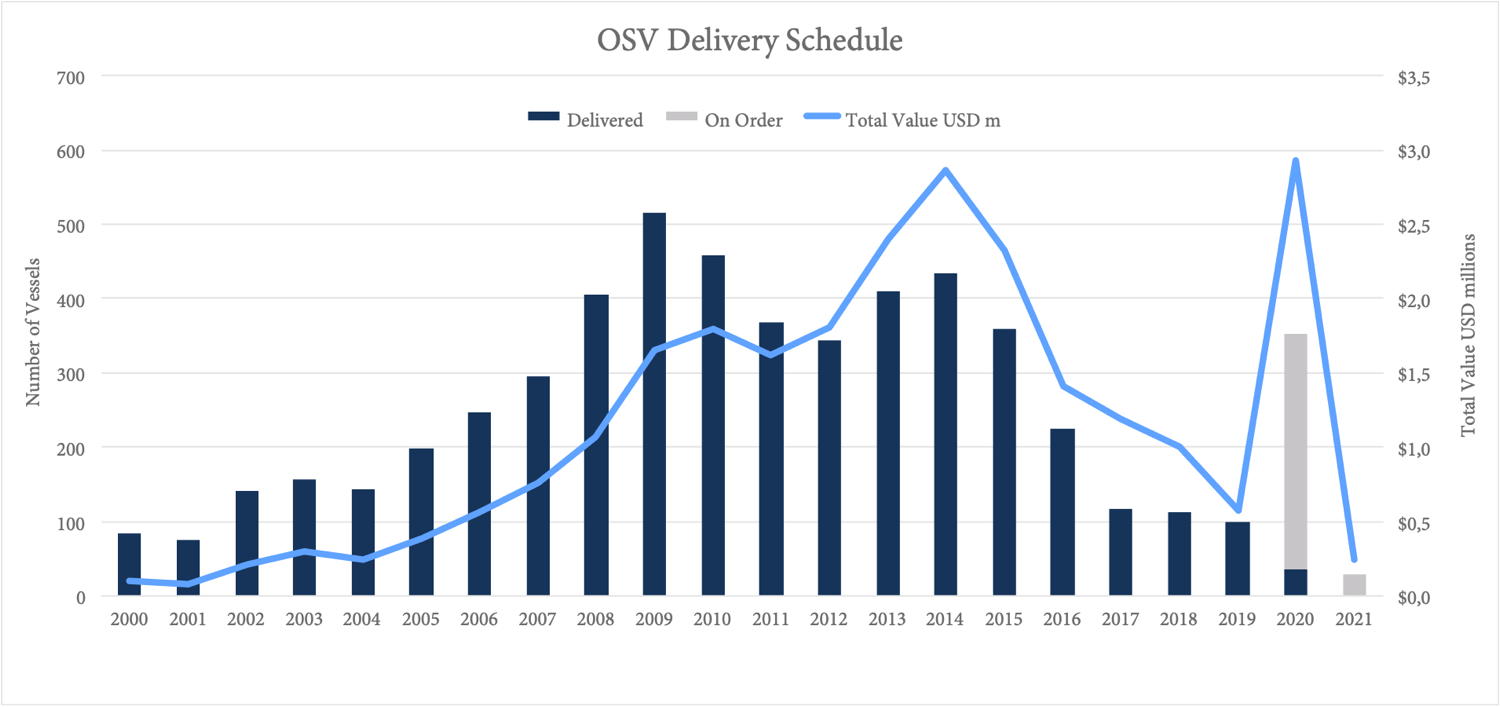

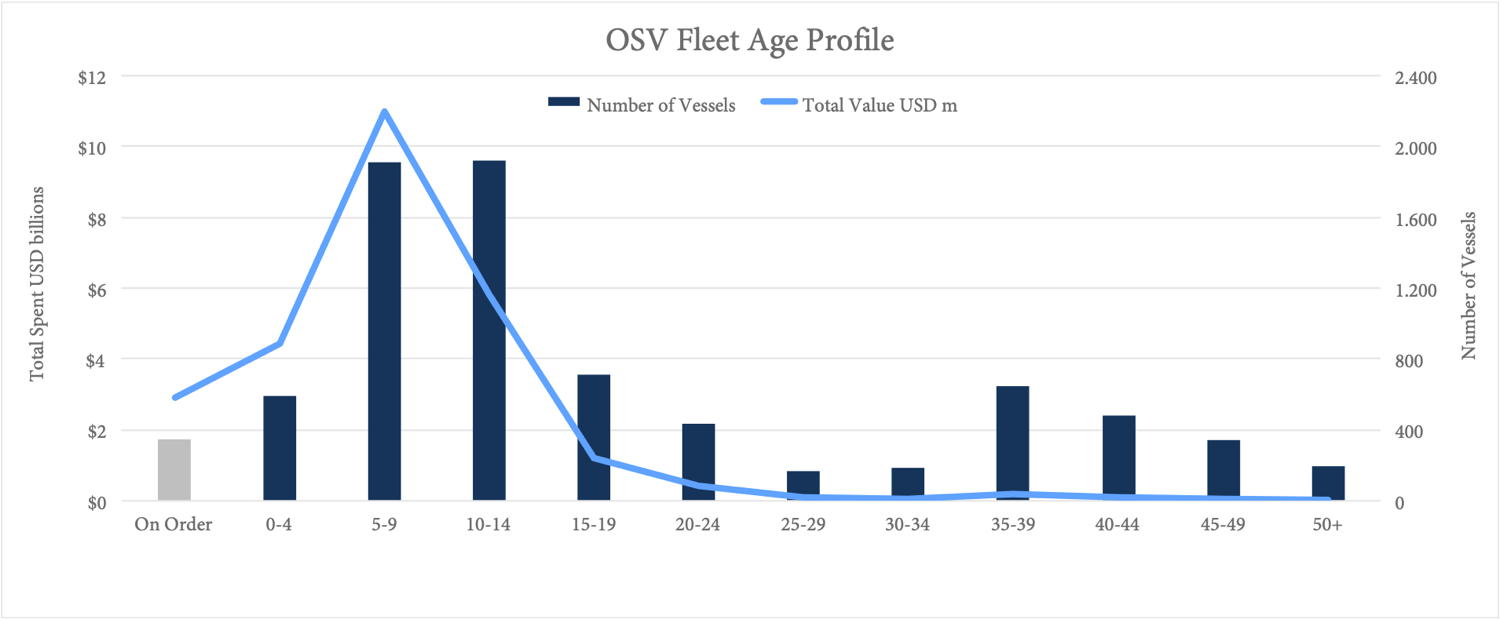

Most ships are between five and 14 years old. Deliveries of newbuild offshore vessels have seen a steep decline in recent years from record highs around 2009 and a recovery around 2013/2014 (when the orderbook value reached record highs of 2.86 bn $). Interestingly, ships on order for 2020 are even outperforming this number with a combined value of 2.93 bn $.