The increasing importance of environmental, social and corporate governance criteria marks a radical shift for commercial shipping. A report from international law firm Watson Farley & Williams (WFW) examines the shipping world’s views on ESG

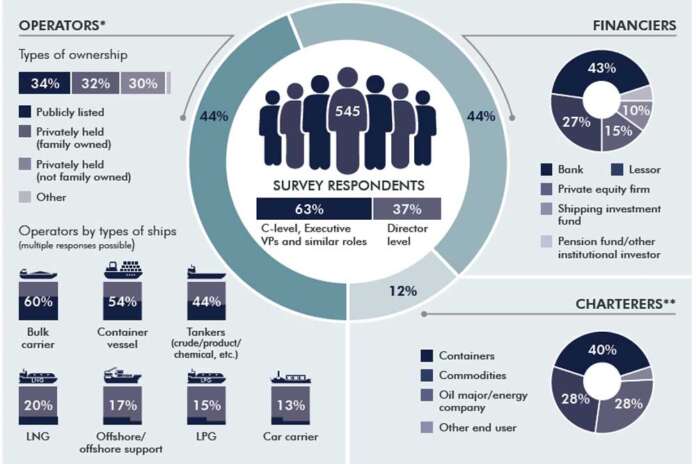

[ds_preview]The report seeks to define the gap between ambitions and actions on ESG, between what various stakeholders want to achieve and what they are willing to risk and contribute. It examines the interplay between ship operators and finance, and how this is likely to change as ESG gains traction. Besides a survey of 545 executives and senior managers, further investigation was conducted via ten in-depth interviews with senior figures from shipowning companies, chartering companies, financial institutions and a leading IACS member classification society. WFW’s key findings are:

Reducing shipping’s carbon footprint is the main and most immediate challenge. Trade tensions, COVID-19 and access to finance are also flagged, but respondents across all regions and stakeholder groups are most concerned about emissions.

There is a big divide in the importance that operators and financiers attach to sustainability. Almost a third of shipowners say that ESG criteria barely influence their investment decisions, whereas nearly 90 % of financiers regard ESG as having some or even crucial importance.

Financing remains a sticking point. Despite a commitment to sustainability, traditional ship finance banks seem to have limited appetite to fund new clean-technology upgrades themselves or to accommodate their financing by others on ships financed by them.

Decarbonisation looks set to drive greater cooperation among industry participants. Almost two thirds of shipowners suggest they would form joint ventures to invest in innovation over the next five years and they lean towards teaming up with other industry participants rather than »outsiders«.

The industry looks to governments to lead funding of clean technology and fuel research. Almost half of our respondents take this view, roughly four times more than those that prioritise other options such as private investment or a carbon levy.

Shipowners are wary of committing to many new green technologies. Over half do not contemplate using a non-hydrocarbon fuel in the next ten years and a similar number do not contemplate installing fuel efficiency hardware in the next five years.

The results of the survey show a clear recognition within the industry that we are on the cusp of a new era and while there is an understandable reluctance to being the first mover, especially when it comes to new technologies, that recognition itself suggests we are likely to see significant changes in the coming years that will reshape the industry.

HANSA can only present a choice of the survey’s results. For the full report please visit https://www.wfw.com/reports/the-sustainability-imperative/

To read the article including pictures, please click here.