Covid 19 has caused heavy financial losses for cruise companies. Nevertheless, the big players are currently reactivating their fleets, while the pandemic left a mark in the orders and deliveries schedules as well as in sales and scrapping figures. By Arnulf Hader

This yearly update is published in March in normal years. By M[ds_preview]arch 2021 we could only state that the cruise fleet is in the lock-down for one year and no end is in sight. That was the reason to postpone this update into the summer.

Meanwhile the pandemic is still somewhere in the world – more severe than ever in some countries – but normal life is hoped to return in major touristic markets. Progress in vaccination allow to open some destinations for foreign visitors, and the big operators are reactivating major parts of their fleets since June. There is no general restart for all regions and companies. Australia e. g. stays cautious and Cunard Line has further postponed the next trips. Otherwise, river cruises in national waters in Europe had been already allowed for a few months last year until a further lock-down in autumn. Some expedition cruise vessels with their small number of passengers were also able to operate in remote regions, but the majority of the seagoing fleet has been idle since March 2020.

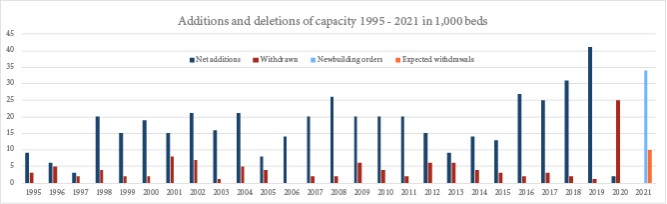

Today, there is no real use asking for the development of passenger figures. The results of three months activity in 2020 are very limited, operators can only hope to be able to cruise for six months with reduced guest numbers. But first, the fleets have to be reactivated ship by ship. This is a good time to check the effects of Covid-19 on the fleet development with a focus on company developments, newbuilding orders, newbuilding deliveries, ship sales and ship scrapping. By looking at these topics, one can explain the first stagnation in the fleet development within decades and why the number and capacity of ships will continue to increase in the near future.

Operators out of business

The major operators show different reactions to the crisis but will survive the pandemic in spite of heavy financial losses. Some casualties became already apparent during the first lock-down among smaller companies or such with elder fleets or business models without alternative earnings.

In July 2020, Finnish Birka Cruises announced to stop operating the only ship »Birka Stockholm« permanently. The fate of the ship is yet to be decided. In similar moves, the cruise ferry services of Finland had also reduced the number of sailings and are now slowly returning to business as usual.

German travel operator FTI decided to set an end to its cruise business. The only vessel, »Berlin«, was sold to a yacht chartering company for conversion.

Pullmantur Cruises had operated on the difficult Spanish market the years before. When the pandemic began to show its effects, the Royal Caribbean Group decided to set an end to this affiliate.

Cruise & Maritime Voyages of UK has been a rapidly expanding company with elderly ships on the British and German (TransOcean Tours with the »Astor«) markets. Two more ships of the Carnival Group had been earmarked to join the group in the coming months. However, bills could not be paid anymore, ships were arrested and auctioned in October 2020. The outcome of the auctions showed the drastic reduction of cruise ship values in the pandemic. Scrapyards were able to offer higher prices than potential operators, because buying a cruise ship could not be based on a viable business plan but only on pure speculation.

Newbuilding orders

The order book for new cruise vessels had been on a high level for years. The shipyards had full order books with delivery dates up to the year 2027 and the operators used every slot for early deliveries. This changed fundamentally within a few weeks and has a long-term effect. Suddenly it became impossible to organize gatherings of thousands of people like in cruise shipping. Big ships became Corona hot spots and the expedition vessels with a lower passenger density and small guest numbers showed to be less problematic. Delivery dates for new cruise ships were not only postponed, no new big ship was ordered since March 2020. There are only two exceptions in the whole cruise market: The old brand name Swan Hellenic had been brought to life again for two expeditions ships under construction in Helsinki when a third order was added in October 2020. In 2021, Meyer Werft of Papenburg was the only winner of a contract to build a new cruise ship up to now. The operator of the 744-bed vessel will be NYK Cruises of Japan.

While the order book cannot increase without new contracts, it is also not decreasing as it was expected. One reason is the postponement of deliveries, the other is the uncertainty of some contracts. It took some months to reach agreements between owners and ship builders. Some delays were caused when the shipyards had to stop working because of virus outbreaks among the working staff or when they had to wait for subcontracted parts. The ship operators could wait because they did not need the new ships, while the shipyards have wait for their money, since a major part of the contract value is paid upon delivery. For later deliveries, both were able to agree on new schedules, because the operators did not know when the markets would recover and builders feared not to win further contracts for several years. Stretching of the order books seemed to be a good compromise.

In general, no cancellations were reported, but for the Genting group, which is acting as owner, operator and shipbuilder at the same time, the situation became hard to survive. The group makes a major part of its money in casinos in Malaysia and was eager to broaden its presence in the cruise market. With other shipyards being fully occupied, Genting bought three shipyards in Eastern Germany and two series of ships were under construction when the pandemic led to a closure of the casinos and the shipyards. Genting had to stop payments and the State of Mecklenburg-Vorpommern was forced to support the shipyards to keep them alive.

The final outcome is not yet decided, but the first of three luxury expedition vessels left the Stralsund shipyard after long delays in June 2021. The contracts for two sister vessels were suspended when the shipyards ran short of money. The completion of the first of two giant mass market vessels for a maximum of 9,500 passengers will take some more time. Since the sections of the hull had already been joined together, it was too late to stop construction of the ship with the highest capacity worldwide. Its completion is now scheduled for 2022. Construction of the sister vessel had started but was also suspended.

Newbuilding deliveries

A lot of new ships were to enter service during 2020. By March, only a few of them had been delivered or where close to take up service. Many more had still been under construction when the shipyards or subcontractors had to halt operations. Some ships were taken over by the operators later in the year and went directly into lay-up. In other cases, the operators refused take-over until the following year. Finally, the list of new ships became considerably shorter than expected at the beginning of the year. Further nine ships were postponed to 2021 with the majority completed in the meantime and delivered to the owners, but not yet in service. Meanwhile, the multiple delays of the »Evrima«, the first in a series for Ritz-Carlton, were not only caused by the pandemic. In addition to the delayed ship deliveries, a lot more had been planned to happen in 2021. However, the 2021 list of deliveries will be shortened by delays from 2021 into 2022. Whether all 16 ships scheduled for this year will be delivered, will depend on the ability of the shipyards to continue to work. Whether the ships will carry passengers after delivery, is another question.

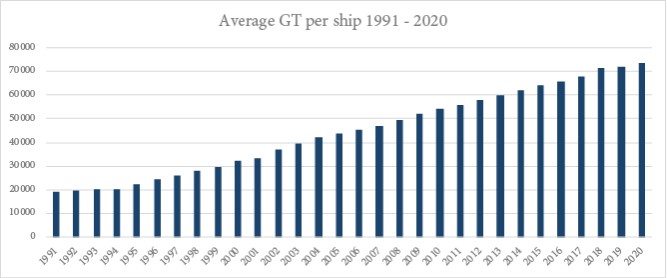

The size of 2020 deliveries and the mostly smaller ships which left the fleet could not change the trend of a further increase of the average tonnage of the ships.

Ships sold for further trading

Most of the sales of ships for further trading were initiated by the Carnival Group. Buyers were Seajets of Greece, Fred Olsen and others. The »Pacific Dawn« of the Australian subsidiary was set to become a »Crypto Cruise Ship« in Panama under the name »Satoshi«, but plans could not be realized and she was acquired by a British company which arose from the ashes of CMV. As »Ambiance« she will set sails again in 2022 for the new Ambassador Cruise Line. The latest sale is that of the first »Aida«. The Royal Caribbean Group reduced the fleet by eight ships when the affiliate Pullmantur was shut down and the majority of its fleet sold for scrapping; the Azamara brand was sold to the new owner Sycamore Partners who added a fourth ship of this class out of the Princess Cruises fleet.

Three second-hand ships will be added to the cruise fleet this year when they change from the Hurtigruten coastal service to the now separated organisation Hurtigruten Expeditions for permanent use as expedition cruise ships under new names.

Ships sold for scrap

Very few cruise ships had been sold for scrap in the years before. Demand for cruises and capacity had been strong and the normal life span of cruise vessels had grown to 40 years – this changed suddenly. The operators doubted they would need all their capacities after the pandemic and sorted out their oldest and least efficient ships. Carnival Cruise Line reduced their first large series of eight big ships by four and three of them were soon sent to the largest scrapyard of Turkey at Aliaga. The »Costa Victoria« was first laid up at San Giorgio, but ended also at Aliaga a few months later. At the same place two ships of the Royal Caribbean Group affiliate Pullmantur ended their lives. This multiplication of sales for scrap regarding the tonnage of cruise ships is caused by a drastic decrease of cruise ship values. On the other side, this created a chance to increase the fleet for operators who still had a few millions to spend. The auctions of the CMV ships were such examples. The two smallest ships were directly bought by scrapyards in Turkey and India. Two more were bought by the Greek ferry operator Seajets but ended a few months later on the beaches of Alang. Seajets bought a few more ships and is watching the market. Chances are good to find a buyer who is willing to pay a higher price in one or two years from now. Alternatively, Seajets could establish a new cruise brand with low capital costs.

Fred Olsen sold two ships to Turkey as accommodation vessels; one of them was also handed over to ship recyclers in the mean time. In the Fred Olsen fleet the pair was replaced by two younger vessels from the Carnival Group.

Japanese organisation Peace Boat acquired two ships on the second-hand market and sold the old »Ocean Dream« to the breakers. One of two ships of Bahamas Paradise Cruises arrived also in Alang. With the »Karnika« (ex »Pacific Jewel«) of the Australian Carnival subsidiary, an Indian newcomer had started a new cruise line which did not survive for long. She ended in Alang as well. This list could still continue if the fates of ships like »Marella Celebration«, »Marella dream« or »Horizon« are finally decided. A total loss is the small »Orient Queen« (ex »Vistamar«) which was scuttled by the disastrous explosion in the port of Beirut.

Japanese organisation Peace Boat acquired two ships on the second-hand market and sold the old »Ocean Dream« to the breakers. One of two ships of Bahamas Paradise Cruises arrived also in Alang. With the »Karnika« (ex »Pacific Jewel«) of the Australian Carnival subsidiary, an Indian newcomer had started a new cruise line which did not survive for long. She ended in Alang as well. This list could still continue if the fates of ships like »Marella Celebration«, »Marella dream« or »Horizon« are finally decided. A total loss is the small »Orient Queen« (ex »Vistamar«) which was scuttled by the disastrous explosion in the port of Beirut.

Shipyards

The discussions about the sale of a significant stake of Chantiers de l’Atlantique to Fincantieri seemed to have ended several times but came to an unexpected end after all. Authorities did not greenlight the deal and uncertainties caused by the pandemic also acted a a show-stopper.

Lloyd Werft of Bremerhaven which has just delivered another mega yacht is up for sale and buyers have shown interest. MV Werften in Eastern Germany provided a lot of question marks about its future since the pandemic had stopped production in March 2020 and the owner Genting had problems to keep the operation running. At the yard at Stralsund the most luxurious polar expedition vessel of the world, the »Crystal Endeavour« – 20,000 GT for 200 guests – was delivered at the end of June 2021, one year later than planned. The completion of the largest cruise ship of the world – the 208,000 GT »Global Dream« for up 9,500 pax – was also postponed and delivery is now scheduled in 2022. The federal German government and Mecklenburg-Pommerania provided financing to make the completion possible when Genting ran out of money. However, the planned sister vessels of these two types were »suspended«.

At the occasion of the christening of »Crystal Endeavour«, the Genting Group spread new hope: Following a financial reorganisation, a sister ship is scheduled for 2023, the second of the big ships is now on the agenda again and the pre-pandemic project of providing cruise ships for hotel groups with no own ship operating company is revived again. A new type – 90,000 GT for 2,000 pax – had already been under discussion, but Genting is now also offering sister ships of the »Crystal Endeavour« to hotel groups with day-to-day ship management by the Genting group ship operators. The first 90,000 GT ship could be delivered by 2025 in case an owner can be found.

Neptun Werft, the third shipyard in the Meyer Group, was forced to reduce the manpower. Building of the floating engine room sections for the two other yards goes on in a stretched time schedule, but no more contracts for river cruise vessels are in the order book. The recently won contract for tanker hulls for the German navy may save jobs.

Restart of main markets

Following many controversial discussions between coastal states and the Centres of Disease Control and Prevention in the USA or regarding the vaccination of crews and passengers, some facts prove the restart of maritime cruises about 15 months after the first lock-down:

»MSC Virtuosa« set sail on May 20 at Southampton as the first ship to leave an U.K. port in 14 months. Operations are limited to a maximum of 50 % of the ship’s capacity.

Cruising is back in the U.S. as »Celebrity Edge« sails from Port Everglades on 26 June 2021 with an occupancy of 41 %, all crew and most pax being vaccinated.

The Port of Barcelona is reopened to cruising end of June with »MSC Grandiosa« carrying guests from Spain and other countries.

»Artania« is the first ship of the year at Bremerhaven Cruise Center on 12 July.

Since Canada has closed its ports for large cruise ships until 2022, the US Senate had to provide a waiver of the U.S. cabotage laws: until 2022 vessels under foreign flag can operate directly between the state of Washington and Alaska.

Fleet statistics

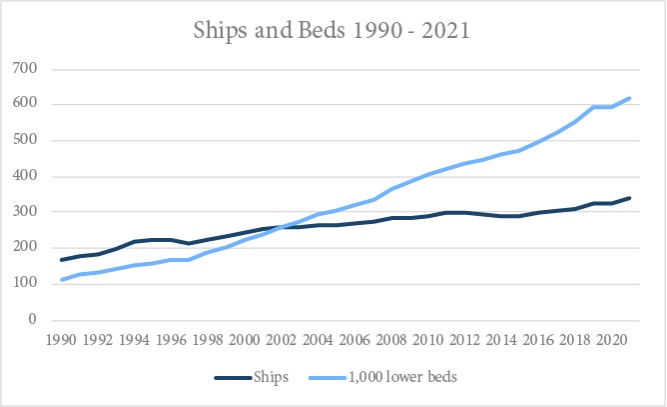

While the fleet stagnated last year due to many sales of ships for scrap and slowed-down newbuilding deliveries, it grew by about ten ships until end June 2021. By mid-2021 the key figures are 334 ships with 24.4 mill GT and 610,000 lower beds. It could increase by another ten ships until end of the year in case a further 15 ships are overtaken by the owners as planned actually and some others will leave the fleet the future of which may by a scrapyard, but they didn’t arrive there up to now. A further and more precise forecast would be too much speculative.

By mid-July the first part of this forecast becomes already truth: The »Albatros«, well known to her German fans, is on the way from Egypt to an Indian scrap yard.

The coastal cruise fleet

In addition to the ocean cruise fleet, there are about 900 cruise ships with a minimum of 40 beds on the rivers globally and the fleets are growing. Besides Ocean cruising and river cruising there is a third segment which is hardly known but also growing quickly: the coastal cruise fleet counting another 300 ships. They are operating along the coasts of the continents or among islands in protected waters and most of them are only allowed to operate in a distance of just a few miles from the coastline. Over the last decade, coastal ships developed into small luxury cruise ships whose comfort level is comparable to big ships or expedition cruise ships. Such ships have a minimum of 16 cabins/32 lower beds.

While such coastal cruisers are rare in most regions of the world, two countries have built up major fleets recently. In the EU the rules regarding coastal ships limit the number of passengers to 36 and many new ships follow this limitation in Croatia. The design is similar to private yachts. The other hot spot is the famous Ha Long Bay in Vietnam where comfortable cruise ships were first based on traditional junk designs, but today various types are being added including yacht-like luxury ships. The capacity is larger than in Croatia and nears about 100 beds. The growth of this coastal fleet is proven by two figures: Only 93 of the actual 307 ships were built before 2010 but 214 during the last twelve years.