The 7th Hull & Propeller Performance Insight Conference took place in Tullamore. Experts from shipping companies, service providers and other stakeholders discussed how to tackle emission regulations and improve performance data management. By Richard Marioth

It is a town many whiskey connoisseurs have heard of: Tullamore[ds_preview]. Very friendly people live here and when asked about the location of the best pub in town, they may walk with you while explaining the directions: »You turn left, right, then at the pharmacy right again and then after 600 feet again left, then you could actually see it on the right, if it isn’t so foggy, you know?« – Well, not having a clear map of where to go can be quite a challenge – not just in finding pubs.

Many shipping companies lack exactly that when it comes to the recently introduced regulation frameworks for Carbon Intensity Indicator (CII) and Energy Efficiency Existing Ship Index (EEXI). The International Maritime Organization (IMO) has begun the journey towards zero carbon emissions with its EEXI and CII announcements towards January 2023, even though some parts of the regulations are not yet finalized.

To exchange views and receive guidance, shipping companies, paint manufacturers and other vessel performance experts gathered in Tullamore for the 7th Hull & Propeller Performance Insight Conference (HullPIC). The event took place in the Bridge House Hotel in Tullamore, built in 1910, a grand hotel in a small town. Grand chandeliers, red carpet and a bar with friendly shadows. The Irish hospitality and friendliness were felt by all and contributed to making this HullPIC so special. But at the core was, of course, the high-level program.

Everyone left the conference with a better understanding of some of the hurdles and possible solutions. »As an operator we are thankful for the presentations on hull performance data management and compliance to the new regulation frameworks, this will help us in the future,« summarized Ivana Melillo (Fleet Performance Manager at d’Amico Shipping Group) a widely shared sentiment.

The top theme of HullPIC 2022 was compliance to the upcoming technical requirements. While EEXI compliance will be achieved by many stakeholders through Engine Power Limitation (EPL) or alternatively Shaft Power Limitation (ShaPoLi). About two thirds of the conference surveys responses from shipping companies state that they felt »almost ready«. On the long run, EEXI compliance might be more of an entry ticket for shipping companies to managing CII requirements which will become increasingly strict over the years. Hence a large part of the panel discussion was focussed on this topic.

At first glance, CII regulations appear rather simple. Ratings from A to E, just like school grades, are given to ships based on the Annual Emission Ratio (AER). For the AER, the yearly CO? emission of the vessel is divided by the total sailed distance and its theoretical capacity (for cargo vessels this is the deadweight).

Practically, this means that the CII is strongly impacted by the operational profile of the vessel. Generally, the more the vessel sails each year the better. In ballast conditions, vessels like bulk carriers or tankers use 10 % to 30 % less fuel than in laden condition. So, the more a vessel sails in ballast each year the better its CII will be. This may be counter intuitive as vessels are made to transport cargo.

Shipping companies are generally worried that CII may lead to situations where they are getting deselected at a charter contract or for a certain transport operation, when their vessel has a CII rating of »D« or »E«. A good rating is required in their books to achieve compliance. It may also be required for good financing conditions in the future.

Hence clauses are added to charter contracts right now forcing ship operators and charterers to ensure that a vessel which was delivered with a CII rating of C or better is returned with a rating of C or better. There is a danger that this behaviour will lead to additional CO? emissions by shipping.

Using efficient vessels for sailing long distances and less efficient vessels for shorter distances leads in a global fleet operation of many vessels to the lowest fleet wide net CO? emissions, where some vessels have an »A«-CII-rating, others an »E«. However, when one operates the same fleet in a way that all vessels get a »C« by having inefficient vessels sailing more and longer distances, then this causes higher net emissions of the fleet.

»We need to avoid running into a system where vessels are operated to please a regulation at the expense of the environment«, was commented by Anders, H. Møller, Fleet Performance Manager (MOL Chemical Tankers). However, not everybody shared this concern as shipping companies have an interest to optimize their fuel expenses as well.

Many hope exemptions, currently discussed in IMO technical groups, will move the market to more level playing field. Rumors say that there will be at least an exemption for emissions related to certain cargo operations, such as cargo heating (in tankers) or refrigeration (in reefer containers).

A positive aspect of the regulation is the expected increase in transparency between charterers and owners. Similar developments can be noticed on the supplier’s side. »The demand of shipping companies to exchange data is increasing tremendously. Requests to us to share data between two parties have doubled as compared to one year ago,« explained Hauke Hendricks (Hoppe Marine Systems).

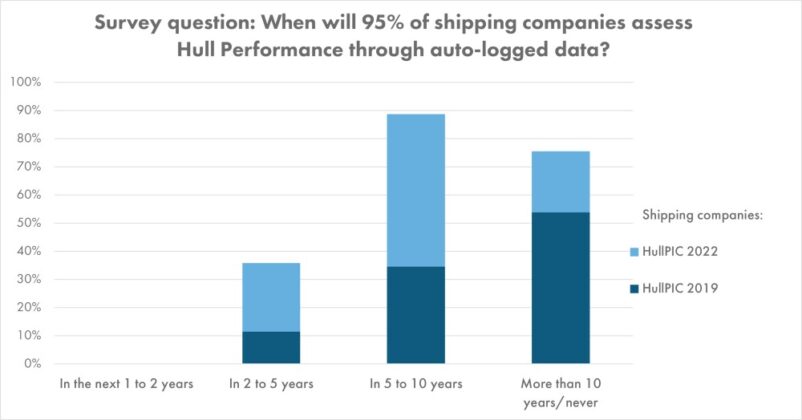

In fact, there is a movement within shipping towards using more data and getting high-frequency data from the vessels ashore. Back in the 2019 HullPIC survey, most shipping companies predicted that it would take more than 10 years, or it might likely never happen that 95 % of the shipping operators would use high-frequency data for analyzing fleet performance. Now most shipping companies voted that this will be the case in the coming 5 to 10 years. Good news – as more data, used and analyzed correctly, results in better performance monitoring, higher accuracy and faster trouble spotting. This will lead to better decisions by shipping companies regarding hull management, resulting ultimately in lower fuel consumption and emissions.

Performance data has also proven the value of premium antifouling solutions, which have become more sought after by the market. »We see a fundamental change in behavior of owners, when it comes to discussions about premium antifouling solutions at dry dock. Earlier we had to convince owners to invest in this, now they come to us and ask for advice,« exemplified Martin Köpke (Hapag-Lloyd). For sure, the past HullPICs have facilitated this trend. »At HullPIC, we have collectively evolved. One can sense an agreement between participants that certain things make plenty of sense and others don’t,« said Prof. Volker Bertram, the organizer of the conference.

So, what would the HullPIC participants recommend to IMO to do in order to actually lower carbon-based emissions? The predominant answer of the HullPIC survey was the introduction of a CO? levy. However, money alone doesn’t seem to be the issue.

A wider change in the mindset and knowledge in the industry will be needed, beyond HullPIC. As Carsten Manniche (Vice President, Ultragas) pointed out: »Since I started my career about 30 years back, fuel prices have changed by a factor of 15. Our behavior of operating the vessels however has remained consistent. Perhaps this is where the greatest saving potential can be found.«

For the time being, one can conclude that it is always better to operate vessels efficiently and keep the consumption low through proper antifouling and performance management. »Regular vessel performance monitoring reveals for shipping companies where to act and how to act, also in regard to CII,« said Soren Vinther Hansen (founder of VesOps). Having good data to monitor vessels and being on top of the data will be key to succeed handling future emission regulations. Maps start to evolve – at least at HullPIC, which will be held next in August 2023 in Italy.