Under the severe impact of the international financial crisis, the global shipping market -continues to slump which leads to a series of problems, including serious shortage

on newbuilding orders, decreasing of newbuildings, and exacerbation caused by

over-capacity. As a consequence, the de[ds_preview]velopment of the shipbuilding industry is facing

unprecedented challenges not only in China, but throughout the world, CANSI reports

1. Current situation of Chinese shipbuilding industry

1.1 Main achievements

Chinese shipbuilding industry has seized great opportunities in this new century, and has entered into the fastest growing period of all time. A positive attitude towards the impact of international financial crisis gains China a fast and steady growth.

1.1.1 Industry scale expands rapidly. The world market share increases significantly on the shipbuilding completions, newbuilding contracts and order book.

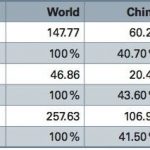

Chinese shipbuilding industry has made accelerated development since the new era. Until 2008, Chinese shipbuilding completions have replaced Japan becoming the world’s second. Both newbuilding contracts and order book are in the first place in the world in 2009. All of the three major indexes of shipbuilding have surpassed Korea as the world’s first place in 2010. The rapid development in Chinese shipbuilding industry made China a large shipbuilding country in the prosperous times. Basing on the three major indexes of the shipbuilding market in 2012, China continues to keep the first place in the world.

1.1.2 Industry structure adjustment has been accelerated. Mainstream ship types form domestic brands. New progress has been made in the equipment research and development for high-tech ships and offshore equipment. Marine equipment supporting ability has also been enhanced dramatically.

Shipbuilding industry has accelerated the pace of structural adjustment and has made remarkable achievements simultaneously with the rapid development of Chinese shipbuilding industry. China has complete design technologies on the three mainstream ship types, and will continuously optimise them according to new international maritime standards and specifications. The green environmental-friendly Capesize bulk carrier continuously consolidates its position in the international marine shipping arena. 200,000–500,000 dwt class ore carriers are unique in the world. The product oil carrier and the ultra large crude carrier are improving their performance ceaselessly. Construction technology of 10,000 TEU class container ship is increasingly mature. The 16,000 TEU container ship has earned its recognition in the global market.

In the field of offshore equipment, Chinese designed 6th generation deep water semi-submersible drilling platform »CNOOC 981« has been successfully delivered and started drilling. It marks the beginning of China’s deep sea exploitation of oil and gas. Many shipbuilders in China could design jack-up independently. For example, Dalian shipbuilding industry co. ltd. (DSIC) has jack-up design ability and EPC ability (Engineer, Procure, Construct). FPSO are undergoing design-building serialization, and are going to operate in the deep seas and ice fields. The number of newbuilding contracts for the offshore support vessels accounts for more than 30 % of global market share.

In the field of marine equipment, China developed the medium speed engine and offshore cranes with independent intelligent property right. The productions of low / middle / high speed diesel engines, ship-mounted cranes, windlass, and steering engines are doubled in 2010 compared to the year of 2006.

1.1.3 Industrial layout has been optimised. City shipyards have been relocated successfully. Three major shipbuilding bases are all well developed. Development quality has been improved significantly.

Under the integrated planning and guidance of Chinese governments and competent departments, three major shipbuilding bases in China have been formed, namely the Bohai Bay, the Yangtze River Delta and the Zhujiang River Delta. Research institutes and marine equipment manufacturers around these three bases have formed large scales and the industrial layout has been optimised as well. Meanwhile, the relocation of city shipyards proceeded in an orderly way. Bases, such as the Qingdao west bay and Tianjin Lingang, have been put into operation.

1.2 Main problems

1.2.1 Chinese shipbuilding industry lacks in innovation, and is weak in high-end products.

Currently, the high-tech and high value added ship design in China still relies on other countries. Technologies need to be imported to manufacture major marine equipment. Products with independent intellectual property rights are few in the market. The research results of advanced technologies about ship performance and structure can be only applied to conventional ships not to high-tech ones. In basic research, due to the lack of comprehensiveness, systematics and foresight, technology accumulation on the ship development is insufficient – little innovation but too much imitation.

1.2.2 Structural problems, such as marine equipment industries lagging behind, and low integration level.

In the past decade, most of the marine equipment in China lacks sufficient technology tracking and importation, especially failing to adapt to the development trend of large-size ships and high-tech ships, and to engage in targeted research and development for marine equipment from a high starting point. The current average loading rate of domestic equipment lies between 30 %–50 %.

China has numerous shipbuilding companies, however, the scale of each company is not large, the structure of industrial organisation is unconsolidated, and the industrial concentration is low. According to the statistics, the ship completions proportion of top ten shipbuilding enterprises reaches 97.6 % in Korea, 73.5 % in Japan, while 49 % in China in 2010.

1.2.3 Extensive industry management style, low production efficiency.

Due to the inharmonious relations between software and hardware technologies in shipbuilding enterprises, the scheduling construction orientated extensive management, and the unfulfilled target refined just-in-time production, manufacturing equipment fails to give a full play for shipbuilding enterprises, which leads to low production efficiency and multiple times of man-hour over Japan and Korea. The application of new technologies are lagging, for instance, the accuracy control technology, advanced outfitting and unit assembly technology, modular shipbuilding method and hull process lane construction technology. The management of information resources for shipbuilding enterprises is not centralised. Consequently, it is hard to realise the information integration and difficult to utilize the integrated information. Most of the resources are divided separately and used independently.

2. Challenges and opportunities for the development of the Chinese shipbuilding Industry

2.1 Challenges

2.1.1 Global shipping overcapacity and shipbuilding overcapacity exist simultaneously. The shipbuilding market demand will continue to slump in the next few years.

Affected by the financial crisis, the global seaborne trade remains sluggish in recent years, while the shipbuilding completions continue to stay high. This phenomenon causes an overcapacity shipping market which is also the main crux of the shipping market development problem. According to market analysis in 2013, the shipping market overcapacity is still the main theme.

In the shipbuilding market, the newbuilding contracts continued to decline in the past two years. It was only 47 mill. dwt in 2012 while the global shipbuilding capacity conservatively estimated at 200 mill. dwt, indicating the newbuilding orders far from satisfying the needs of the shipyards and an existing severe industry overcapacity issue. In this manner, under the circumstance of low demand in downstream and high overcapacity within industry, it is reasonable to predict a difficult increase in the shipbuilding market in the upcoming few years.

2.1.2 New international shipping and shipbuilding codes, conventions and standards successively issued.

With the EEDI, Ballast Water Convention, SOLAS V/19 Amendment, ship noise protection etc. being put into force, new challenges for the shipbuilding industry will arise, especially in China. Given the circumstances of some gaps still existing compared with Japan and Korea in the design and construction technology area, how to deal with the new standards and new codes will be one of the difficulties during the process of sustainable development in future.

2.1.3 Upgrading of ship demand structure accelerated.

Under the combined impact of cost, safety and other factors, the shipbuilding demand is definitely in a high-end direction in the future. Low fuel consumption ships, low emission ships and green ships are becoming mainstream products. In this way, Chinese shipbuilding enterprises must fully prepare for technology accumulation and ship-type development. As ships are a long-term investment product, shipowners should focus more on operating costs throughout the life cycle instead of merely the price when ordering a new ship. Considering the energy saving and environmental protection technology of newly developed ships, it is foreseeable that Chinese shipbuilding industry will gradually lose its market share if a wide gap exists between Chinese companies and competitors.

2.1.4 The major shipbuilding countries strengthening policy support and market development.The Korean government encourages its shipbuilding enterprises to transfer into offshore engineering. The Japanese government changes the trend towards a currently declining international market share by promoting restructures, exploring overseas markets and cultivating new economic growth points. The global shipbuilding industry has entered into a new round of profound adjustment, a fierce competition about technology, products and markets.

2.2 Opportunities

2.2.1 China is equipped with a high level of shipbuilding infrastructure, owning complete upstream-downstream industry chains and abundant labour resources. Comparative advantages are still outstanding.

After years of development, China has already constructed a great number of high level shipbuilding infrastructure. Besides, many companies own advanced lifting equipment and other infrastructure as well. Meanwhile, looking from the great industry chain outside the shipbuilding industry, China has furnished a complete up-downstream industry chain, which is a fantastic opportunity for the Chinese shipbuilding industry. Upstream, there are a bundle of advanced steel manufacturing enterprises, such as Baosteel and Anshan Iron. Downstream, there are many shipping companies. Additionally, an abundant labour resource is another advantage for the development of the Chinese shipbuilding industry. Although shipbuilding costs are rising in recent years, comparative advantage is still outstanding against the global shipbuilding market.

2.2.2 With the further implementation of industrialisation, urbanisation and agricultural modernisation, the Chinese domestic market will release great potential.

Under the above-mentioned background, tremendous domestic demands for steel, oil and coal will continuously arise. As a consequence, domestic seaborne trade will be boosted undoubtedly and demand for more newbuildings will be triggered.

3. Focus and primary mission of the development of the Chinese shipbuilding industry

3.1 The Chinese government thinks highly of the development of the shipbuilding industry

In March 2012, the Ministry of Industry and Information Technology issued the »Twelfth Five-Year Development Plan for Shipbuilding Industry«. The plan points out great effort must be made to transform our country from a large shipbuilding country to a powerful one. It also sets the development goals of shipbuilding economy quality, technology level, industrial structure, efficiency, and marine equipment manufacturing capability that should be reached in 2015.

In July 2013, the State Council promulgated the »Implementation Methods of Shipbuilding Industry Accelerating Structural Adjustment to Promote Transformation and Upgrading«. In face of current situation and deep-rooted problems, this document proposes major tasks and policy measures, focusing on the key points of transformation and upgrading.

3.2 Primary missions of Chinese shipbuilding industry development

Chinese shipbuilding industry will focus on structural adjustment and ability improvement, specifically on adjusting structure in four aspects and enhancing ability in five areas.

3.2.1 Adjusting structure in four aspects.

i. Technical structure: Driven by innovation, vigorously develop green technology and deep-sea technology, fully meet new international standards and accomplish the transformation from ›importer‹ or ›follower‹ to ›leader‹.

ii. Product structure: Following the technical structure adjustment, vigorously develop green ships, high-tech ships, specialised ships, high-end offshore equipment and domestic marine equipment, and promote the upgrading of product structure to meet the market demand.

iii. Industrial structure: Complete restructuring development policy system of shipbuilding industry. Promote reformation in key areas and innovation in institutions. Improve enterprises management and industry service quality. Boost coordinated development of shipbuilding industry and self-development capability.

iv. Capacity structure: By controlling the new added shipbuilding capacity, promote merging and reorganisation issues, encourage transformation, optimise production structure, eliminate outdated shipbuilding capacity and accelerate industrial integration level.

3.2.2 Enhancing ability in five areas.

i. Innovative ability: Meet the green environmental protection requirements of three major ships. Make a breakthrough in the research of key technology for high-tech ships. Improve the conceptual design level of offshore equipment. Enhance the design level of pelagic fishing vessel and administration vessels. High-tech ships and offshore equipment international market share has to reach more than 25 % and 20 % respectively.

ii. Manufacturing ability: Main enterprises need to establish a modern shipbuilding mode with the efficiency reaching 15 h/cgt (around 30 h/cgt currently) and the average steel utilization rate reaching 90 % (around 88 % currently).

iii. Marine development ability: By eliminating the outdated ships, investigating fishing equipment and marine science, and developing both survey equipment and oil/gas equipment, significantly improve the marine developing equipment level.

iv. Marine safeguarding ability: Meet the needs of marine law enforcement and emergency rescue. Increase the number of administrative ships at sea and the level of ship equipment. Upgrade rescue and salvage vessels. Overall, significantly increase the ability of marine safeguarding and emergency rescue.

v. Marine equipment manufacturing ability: Through research and technical breakthrough in the sectors ships and offshore equipment improve the capacity of both. Increase the loading capacity of major shipping equipment from currently 50 % to 60 % to 80 % instead. Increase the localisation rate of marine engineering equipment to 30 %.

4. Policy measures

4.1 Encourage financial institutions to increase the credit funds for the buyers of ship exports. Provide export buyers’ credit for main domestic shipbuilding companies and offshore oversea shipowners alike. Support financial institutions to diversify financing channels and raise funds in various ways.

4.2 Increase credit financing support and innovate financial support policies. The credit financing support includes mergers and reorganisation among shipbuilding enterprises, acquisition among international enterprises, business transformation and structural adjustment among middle/small shipbuilding companies.

It also helps main shipbuilding companies issue non-financial corporate debt financing instruments and corporate bonds as well as supporting ship exporting by export credit insurance models.

4.3 Emphasis on technological progress and technology innovation.

Guide enterprises to increase investment in Research & Development (R&D). Enhance the innovation ability in high-tech ships and offshore equipment. Implement the transformation of the production process. Strengthen the professionalisation of high-tech ships, offshore equipment, and marine equipment. Import high technology, understand the key points and then innovate new products to fill the gaps of domestic industrialisation projects.

4.4 Control the newly added shipbuilding capacity, and help adjust capacity structure.

Promote the ability to integrate and improve large-scale infrastructure after meeting overall control requirement, layout planning requirement, merging and acquisition requirement. Accelerate the elimination of outdated shipbuilding capacity and support enterprises with business transformation.

Author:

Lijuan Nie Vice Secretary General of China Association of the National Shipbuilding Industry (CANSI)

Lijuan Nie