Chinese New Year caused less of a damper on freight and charter markets than feared.

Now the signs are pointing up again in container shipping. By Michael Hollmann

General activity may have slowed down for Chinese Year but the impact on the container ship charter market was hardly notice[ds_preview]able. Fixing levels kept edging upwards over the past weeks. The increases were not always spectacular – except for high-spec, very modern vessels – but new benchmark-highs were set in one or the other segment week after week. The underlying fundamentals remain strong, with the RWI/ISL container throughput index seeing one of the strongest month-on-month increases ever during its 11-year history. The index pushed up from 131.9 to 134.4 in January, illustrating ongoing solid growth in world merchandise trade. No wonder that the utilisation of the world container ship fleet improved further, also aided by further tonnage injections by carriers amid the export cargo rush in China ahead of the Lunar New Year. By early February, the idle fleet ratio (share of container ship capacity in temporary lay-up or waiting for new employment) sank below 1.0% for the first time in years. Only around two dozen tramp ships were reported to be without charter, raising confidence among shipowners that »full employment« of the global charter fleet is in reach. Although there have been concerns over the spate of deliveries of ultra large newbuildings this year, analysts agree that cargo volume growth should surpass net fleet capacity growth in 2018 (circa 5.0% versus around 4.0%). Therefore the outlook continues to be favourable, with all ingredients in place for a further recovery.

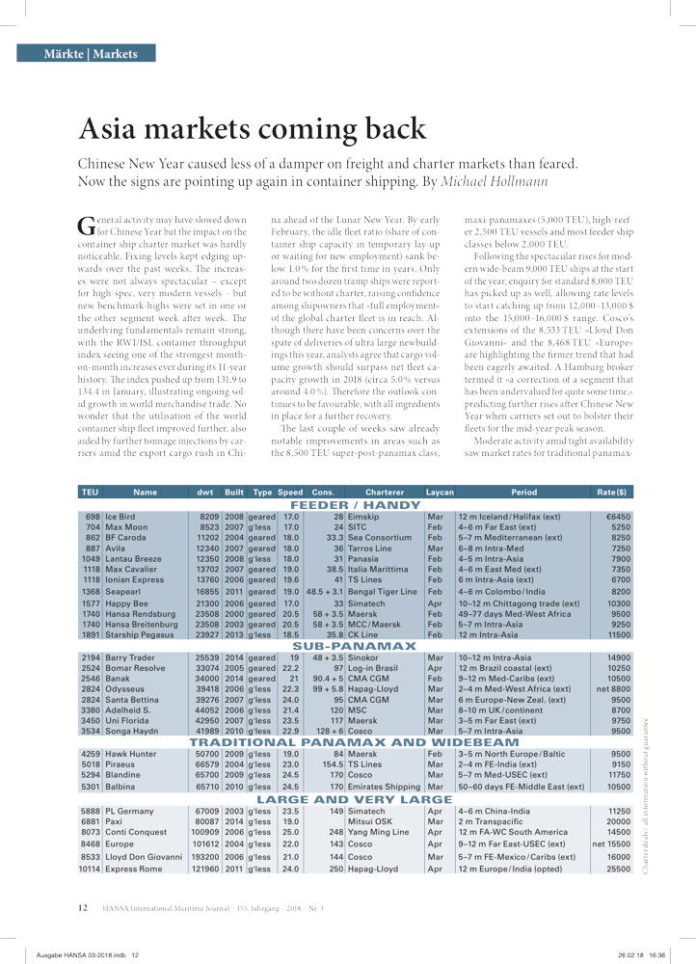

The last couple of weeks saw already notable improvements in areas such as the 8,500TEU super-post-panamax class, maxi-panamaxes (5,000TEU), high-reefer 2,500TEU vessels and most feeder ship classes below 2,000TEU.

Following the spectacular rises for modern wide-beam 9,000TEU ships at the start of the year, enquiry for standard 8,000TEU has picked up as well, allowing rate levels to start catching up from 12,000–13,000$ into the 15,000–16,000$ range. Cosco’s extensions of the 8,533TEU »Lloyd Don Giovanni« and the 8,468TEU »Europe« are highlighting the firmer trend that had been eagerly awaited. A Hamburg broker termed it »a correction of a segment that has been undervalued for quite some time,« predicting further rises after Chinese New Year when carriers set out to bolster their fleets for the mid-year peak season.

Moderate activity amid tight availability saw market rates for traditional panamaxes firming up as well. A breakthrough appears to have been achieved in the Atlantic with the reported extension of the 5,040TEU »CSL Virginia« at 11,500$ for one year by OOCL. Given the tight availability of open tonnage, brokers were confident that the 10,000$-mark was going to be reached also by smaller baby panamaxes possibly by the end of February.

Reefer and shallow-draft wanted

In the 2,000-3,000TEU »subpanamax« classes, the focus was very much on very modern economic types and high-reefer vessels for the busy southern hemisphere fruit export season. Rate levels for geared 2,500TEU tonnage with increased reefer intakes (600 plugs) seem to have quickly moved up from 10,500 to 11,000$ with the reported fixture of the 2556TEU »Bomar Calais« to CMA CGM for 12 months. Another fixture that raised eyebrows in the market in mid-February was the fixture of the SDARI 2100 type »Barry Trader« (2,190TEU, built 2014) at 14,900 for a Chittagong-related trade to Sinokor. Gearless 2,700/2,800 types gained a bit more ground as well and latest discussions show hire rates getting assessed at 9,700–9,800$, up from 9,500$, in Asia.

Below 2,000TEU, progress has been slow but steady and at differing speeds in the main regional markets of Asia, Europe/Mediterranean and Caribbean/US Gulf. In the 1,700TEU class, the Mediterranean was leading the way with rates of around 9,500$ for standard designs, a few hundred dollars higher than in other markets. However, just as this issue of HANSA goes to press, the torch has been handed over the Caribbean where the Kouan 1,800type »Melboure Strait« (1,795TEU, built 2008) has become the first vessel in this size to break the 10,000$-barrier, with a 5–7 month extension at 10,250$ with operator King Ocean. Meanwhile the most modern 1,700TEU types (Topaz, SPP 1700) succeeded in pushing rates to over 12,000$ in Asia.

The feeder sector of 1,100TEU and smaller has been kept very busy as well, resulting in successive increases for standard geared 1,100TEU ships (CV1100) in Asia from mid to high $6,000’s and finally above 7,000$, as illustrated by the 4-7 month extension of the »Frisia Alster« to Zim-affiliated Gold Star Line at 7,100$.

Demand for smaller vessels below 1,100TEU continued to be strong in all regions, with brokers reporting full employment for feeder ships in north Europe ahead of the main extension season in spring. The Caribbean soaked in further tonnage from other regions amid very high demand for vessels, with rate levels reaching very high $8,000’s, according to Ernst Russ Shipbroker. Reported deals include the 6-month period at 8,750$ on the geared 997TEU »Vega Scorpion« fixed by Caribbean Feeder Services (CFS). In Asia there were still open requirements for 700TEU vessels amid very short supply, raising expectations of a recovery in rates to mid/upper 5,000$ levels.

Michael Hollmann