The German Shipbuilding and Ocean Industries Association (VSM), which represents the interests of German shipyards, marine equipment suppliers and ocean industries, presented a gloomy picture of the current situation already at its members’ meeting in June last year. Nevertheless the yards finish[ds_preview]ed around 60 seagoing vessels (~0.8 million GT; ~0.8 million CGT) of which not all were really taken over or fully paid by their owners by the change of the years. As not too many new contracts were placed, the order backlog diminished to about 100 ships (about 2 million GT; 2 million CGT) what is less than two years annual production, a very short period of time for planning, designing and constructing new more specialized vessels.

In statistical terms, the situation for the German shipbuilding industry was still not too bad for 2009. Shipbuilding companies, including yards building oceangoing, inland and naval vessels and engaging in repairs and conversions as well as boat and yacht builders sold much less than the necessary minimum of approx. € 10 billion only for newly to be built seagoing tonnage. Marine equipment suppliers were going to follow this trend with some time lag, what could mean much less contracts, production and consequently turnover. But due to their large export business they still had enough employment in 2009.

At the beginning of 2010, former and current statistics no longer reflect the real situation. The fact is that the market environment has fundamentally changed in the last eighteen months with a serious downturn in the entire maritime sector that has been faster and more dramatic than expected in the wake of the global financial and economic crisis. Global transport volume and charter rates have fallen since the beginning of the financial crisis, with worldwide demand for ships also plummeting by approx. 90 % since October 2008 and coming to a nearly complete standstill during the year 2009. Moreover, because of banks’ restrictive lending policy, shipyards and companies placing orders have had considerable difficulties obtaining the requisite finance for a shipbuilding contract.

World shipbuilding

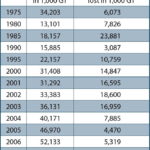

According to provisional statements during the first three quarters of 2009 more than 3,000 vessels (full year 2009 estimated) with around 80 million GT (45 million CGT) might have been finished, although its not safely known whether all have been taken over or correctly been paid by their contractors. A massive reduction in the order intake compensates partly the extreme high figures from the years before and the currently slightly slow deliveries. It can be estimated that the global order backlog can count around 9,000 vessels with about 300 million GT (150 million CGT). So, from these statistical figures the current crisis in world shipbuilding in general can not really be realized.

But problems occur from local details: 21 % of the delivered ships were bulk-carriers (2008: 14 %), 16 % product- and chemical tankers (2008: 16 %),16 % container vessels (2008: 23 %), 15 % crude oil tankers (2008: 9 %); 10 % gas carriers (2008:14 %), 6 % general cargo ships (2008: 6 %), 4 % Ro-Ro freight ferries (2008: 5 %), 3 % ferries and cruise ships (2008: 4 %) and finally 9 % non-cargo-carrying vessels (2008: 8 %). All figures are based to CGT-counting as they give better evaluations of the involved man-power.

World-wide competition is still very strong, and the shipyards in Far-East continue to produce more than 80 % of the globally delivered tonnage. Korea keeps 34 % of the market (2008: 34.7 %), China 27 % (2008: 21.6 %) and Japan 22 % (2008: 23.3 %). The European Union can be found in different counting with less than 10 % (2008: around 11 %).

German yards’ production in 2009

Following the a. m. figures of the global shipyard production with less than 10 % market share for all European yards, Germany holds with nearly 2 % (2008: 2.8 %) still the first position in Europe and third place globally in CGT-counting. Other nations follow closely, such as Turkey, Italy, Romania with 1–2 % each as well as Poland and others just below 1 % each. But also nations like India and Vietnam are coming into picture and they will try to receive their increasing market shares to the disadvantage of mainly European yards.

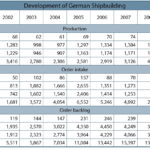

German shipyards building oceangoing vessels delivered a total of around 60 ships with approx. 0.8 million GT (0.8 million CGT) worth close to € 2.7 billion in 2009, thus just after achieving their best annual result since Germany’s reunification. In the same period, they booked new orders for about twenty units totalling less than 50,000 GT (70,000 CGT) worth € 0.5 billion only. Related to the whole of the past year, incoming orders thus declined to their lowest level since 2001. As a result of the declining order trend and numerous cancellations, listed orders on hand fell to slightly more than 100 units totalling close to 2 million GT (2 CGT) worth € 9.6 billion up to December 31st 2009, what seems to be acceptable under the current situation. There were about thirty cancellations valued at approx. € 1.4 billion during 2009. But it looks like that various owners are still not willing or are not in the position to really take over some of their contracted ships.

Looking to the types of vessels German yards produce mainly, there can be found still a quite high volume of container vessels (about 33 %) but which have been surpassed by passenger-carrying ships (yachts, ferries, cruise ships) with about 38 %. All other vessels are including general cargo ships and small bulker (4 % each), ro-ro-cargo ships (7 %), gas carriers (4 %), product tankers (3 %) and around 7 % of non-cargo-carrying units such as tugs, offshore supply vessels, pilot boats as well as patrol vessels.

Future problems might occur from the collapse of the demand in container ships, where German yards were mainly active. Of course it is easily said, that they have to concentrate on the production of special ships. But what is special? And special things need time to be created, and time is already rather short for most of the yards to survive.

Naval shipyards achieved stable sales in 2008 with sufficient production in the years to come. As demand from the German Navy alone does not suffice to utilise fully the available capacities of naval shipyards, these remain heavily dependent on export business. On top of this, TKMS the biggest group of German naval shipyards is on the way to change the ownership of its daughter companies Blohm + Voss in Hamburg, Howaldtswerke-Deutsche Werft in Kiel, Nordseewerke in Emden as well as HDW Nobiskrug in Rendsburg. The Nobiskrug yard has been sold to Abu Dhabi MAR and the main part of Nordseewerke has been sold to the wind energy plant supplier SIAG. Further sales are under negotiation.

Conversion and repair shipyards achieved sales topping the € 1 billion mark for the first time in 2008 after record levels already in 2006 and 2007. But the number of enquiries in this segment also tapered off significantly at the end of last year. Order volumes were in some cases considerably reduced and planned orders cancelled at short notice. So, in 2009, it would have been already very good to have reached the 2008-record.

After registering good results in 2008, shipyards building inland waterway vessels were also affected by the global financial and economic crisis at the turn of the year. For the first time for five years, fewer goods were transported than in the previous year. However, production reached its highest level for many years. Demand for river tourism vessels again claimed a high share of this total. Incoming orders remained well, as the yards have focussed their production mainly on specialized non-cargo-carrying vessels.

The boom in recent years enabled German marine equipment and offshore suppliers to achieve stable growth and further consolidate their position as export world champions. Business in 2009 was also very good with increasing sales and extensive orders on hand. However, the economic crisis also arrived this segment at the latest since the first quarter of 2009.

Unclear future

It was clear that 2009 would be a crucial year for the German shipbuilding industry. Numerous cancellations and the few incoming orders were causing gaps in companies’ employment planning, as well as making difficult the ongoing process of the necessary switchover of the product range.

»The continued switch to innovative, high-value, well-equipped special-purpose vessels is correct, but needs time. If we fail to give shipbuilding companies a breathing space with securing the remaining orders on hand, there will be location closures instead of new products,« warned VSM chairman Werner Lüken well in time. »Statistically, German shipyards have work on a CGT-basis for the next two to three years. But this order backlog is in fact accounted for by only a few companies. Many shipbuilders will soon no longer be able to achieve full capacity utilisation. Short-time working across the board and possibly redundancies will result,« continued Lüken.

The problems are exacerbated by the fact that in the current situation more and more commercial banks are withdrawing from ship financing. Shipyards face considerable difficulties procuring the necessary funds. This affects both liquid funds and procurement of credits by way of bank guaranty. These problems could not be solved just with the – welcome – explicit inclusion of German shipyards in the KfW (Reconstruction Loan Corporation) special programmes for company financing. Although these instruments offer a 90 % release from liability, in the final analysis they are too expensive, the decision-making procedures are too protracted and finding commercial banks prepared to bear the remaining residual risk of 10 % remains difficult.

Moreover, Asian countries in particular are focusing on continuing to expand their shipyard capacities as well as supporting their yards with massive assistance programmes, the latest example being South Korea, where the government has reportedly provided $ 7 billion to help out with loans and down payment guarantees. The Chinese government is also investing similar sums to assist its shipyards.

In view of the currently low international willingness to cooperate, the German shipbuilding industry – in close coordination with European shipbuilding countries – must develop its own strategies for overcoming the crisis.

What to do?

»The main task now is to generate new orders. In view of the high technical expertise of our industry, we see great opportunities in the construction of environment-friendly ships that are highly efficient in terms of energy consumption,« explained Lüken. Shipyards have already successfully diversified and switched their product range largely to high-tech vessel types.

The share of containerships declined within the last two years from lately about 42 % to approx. 14 % in the orderbok. Cruise ships and ferries, yachts and special-purpose vessels for offshore technology meanwhile account for two-thirds of future production. Container ships have been the »bread and butter« since more than twenty years. This development is reaching its end for the time being.

HANSA counted at least five specialized container vessels as »Ship of the Year« (1985: »Norasia Susan«, ship of the future; 1988: »President Truman«, at that time largest container ship of the world, Post-Panamax container vessel; 1992: »DSR Baltic«, Panamax container vessel with 12 instead of 11 containers side by side; 1994: »Norasia Fribourg«, open-top container vessel; 1999: »Dole Chile«, open-top reefer container vessel).

New production areas have to be found, and indeed there are some: German yards are already very good on passenger-carrying vessels, such as cruise ships up to 130,000 GT, car / passenger ferries up to 90,000 GT or yachts up to 170 m length. Icebreaking tonnage might be another goal German yards could reach easily due to very good experiences in this sector. The same goes for gas carriers and product / chemical tankers.

In front of the German coasts there are just now various wind-energy farms with numerous windmills coming into the construction phase. Shore-bases are under planning or already construction in Emden, Brake, Cuxhaven. Husum and Rostock. TKMS’s yard in Emden is on the way to be taken over by a steel-construction company to produce foundations and masts for offshore wind mills. The same is in full swing in Cuxhaven.

And where construction of these structures is planned ashore, various craft such as tugs, pontoons, floating cranes, heavy lift vessels as well as offshore service ships will be needed soon. It should be possible to involve German yards in this business. How did a well known international petrol company advertise it? There is much to do, let’s tackle it!

VSM/KN

VSM/KN