It is the north Europeans, and the Norwegians in particular, who are spearheading the drive to adopt liquid natural gas (LNG) as an alternative to traditional bunker fuels. And some experts believe that it is only a matter of time before most owners order new vessels that are capable of running on LNG.

So far, however, the new propulsion technology has only caught the attention of a handful of owners whose vessels mostly[ds_preview] operate on the Norwegian coast – notably ferries and passenger craft – and on dedicated short-sea routes. Some Norwegian offshore operators have also embraced the technology and a number of dual-fuel units have been operating successfully in the North Sea, principally on LNG, for several years.

Norwegian classification society DNV, the first to publish rules for LNG-fuelled ships in 2001, has been a pioneer of the new propulsion technology. It classes all but one of the 20-odd LNG powered vessels in operation today and came up with a new super-fuel efficient concept design for the LNG-powered »Quantum« container ship earlier this year.

Now though, LNG propulsion technology is approaching a watershed as its supporters seek to widen its appeal and attract the support of deep-sea owners and operators. Early in December, DNV unveiled a preliminary design for a 290,000 dwt VLCC, named Triality and powered by LNG, to journalists in London. DNV chief executive Henrik Madsen says the class society has already spoken to three leading shipbuilders and he is hoping that Triality will be developed into a fully fledged design over the coming months, with the first new vessels possibly being commissioned before the end of 2014.

»I am convinced that gas will become the dominant fuel for merchant ships,« Madsen declared. »By 2020, the majority of owners will order ships that can operate on liquefied natural gas.« One of the key drivers, he believes, will be the creation of new Emission Control Areas (ECAs) such as the new North American ECA, already approved, due to enter force in mid-2012 and extending 200 nautical miles from the coast. Other regions, such as the Mediterranean, Singapore, Hong Kong and Japan, are likely to follow suit, creating a patchwork of ECAs and a major operational challenge for ship operators.

But the proliferation of ECAs is only one part of the problem. Their emissions reduction requirements will gradually be stepped up over time, making compliance even more of a headache. The sulphur content of ships’ fuel used in ECAs after 2015, for example, will be capped at just 0.1 %, or else a ship’s exhaust gas will have to be purified to an equivalent level. Meanwhile, from 2016, NOx emissions from new ships must be cut by some 75 % compared with levels todeay. The cost implications for low-sulphur fuel in the future are obviously far-reaching.

Announcing the new gas-powered VLCC concept, DNV’s Madsen pointed to the benefits of burning LNG as a principal fuel. The Triality VLCC, which incorporates a range of other innovative design features in addition to its radical new propulsion system, will have two high-pressure dual fuel slow-speed main engines fuelled by LNG, with marine gas oil as a pilot fuel. Compared to a traditional VLCC, the Triality will emit 34 % less carbon dioxide, 80 % less NOx and 95 % less SOx and particulates. Overall, the tanker will use 25 % less energy.

The LNG will be stored in two IMO type C pressure tanks, each of 6,750 m³, located on deck forward of the superstructure. This will give the vessel a range of 25,000 nautical miles, providing the same operational flexibility as standard VLCCs, with sufficient fuel for a round trip from the Arabian Gulf to the US. Until now, sceptics have pointed to the lack of availability of LNG at bunkering facilities around the world, and it is certainly true that ready supplies of the new fuel presents a challenge, at least in the short term. No more so than the availability of petrol in the early days of the motor car, counter the fuel’s proponents. And DNV points out that LNG is already available in the principal regions in which VLCCs trade – out of the Arabian Gulf to reception facilities in Europe, the US and Asia.

The class society is already working with a number of key clients on the implementation of LNG infrastructure in Singapore and elsewhere in Asia. It has brought together oil majors, engine builders, owners, designers and regulators in a joint industry project which is likely to result in LNG bunkering facilities being made available at Singapore’s first LNG terminal. Participants in the project include BW Maritime, Rolls Royce, Wärtsilä, the National University of Singapore and the Nanyang Technological University.

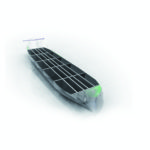

Other features which DNV has incorporated in the Triality design concept demonstrate the benefit of some radically new thinking. One aspect is a completely different hull form, enabling the ship to operate without any ballast. This compares with a conventional vessel of similar carrying capacity which would require capacity for about 80–100,000 tonnes of ballast. This is needed to avoid slamming and ensure that the propeller remains submerged when the vessel is without cargo; and also during cargo operations to reduce bending moments on the hull and compensate for trim and heel.

The V-shaped hull of the Triality VLCC means that the vessel will have a significantly lower block coefficient, as compared with a conventional VLCC. But it also means that a much lower wetted surface area in an unloaded condition will mean less resistance and much better fuel economy. Other benefits of a ballast-free VLCC include the elimination of the risk of invasive species transfer and the fact that there will be no need to ship large volumes of dead weight on ballast legs, thereby saving energy. Costly maintenance and coatings upkeep of ballast spaces will also no longer be required.

A further departure from conventional designs is the capability to recover volatile organic compounds (VOCs) in the form of hydrocarbon gases from the ship’s cargo. According to DNV’s Madsen, this would typically amount to around 500 tonnes of VOCs on a routine voyage from the Middle East to Rotterdam. But DNV’s idea goes one step further: not only are the VOCs recovered, they are liquefied and stored in deck tanks to be used as fuel for the ship’s boilers during cargo operations. The rest can be returned to the cargo tanks or delivered to shore during oil cargo discharge, according to DNV.

So what about the cost implications of such a vessel? First cost is higher than a conventional VLCC, Madsen admits, perhaps by a margin of 10–15 %. But a discounted cash flow calculation assuming 20 years of operation and a discount rate of 8 % gives a net present value benefit of $ 24 million. This suggests that the Triality VLCC meets a key DNV project objective – not only that the result should be environmentally superior and capable of design and construction using technology available today, but also that it should be financially attractive to owners, operators and, of course, charterers.

But it is the emission reducting potential that is likely to spark the interest of progressive tanker operators. According to DNV’s figures, annual savings of the Triality VLCC as compared with a conventional VLCC of the same capacity would be 25,900 tonnes of carbon dioxide, 1,785 tonnes of NOx, 1,500 tonnes of SOx, and 180 tonnes of particulates. Multiplied by the 500-strong VLCC fleet – to say nothing of other tanker sectors – these become some very big numbers.

P. Bartlett