Adequate software technologies can help shipping companies be more competitive: faster at lower costs with a higher quality.

Introduction

The principles of using software technologies for business were understood long before computers existed. The Ford T[ds_preview]-Model was one of the most successful cars in history with market leadership over two decades. However, Henry Ford did neither invent the car nor assembly line production. When asked what made him so successful he answered: »We have put a higher skill into management, planning and tool building.«

In shipping, large budgets are handled. Even small vessels spend more than 1 mill. $ per year for manning, repair and maintenance, stores and lubes, insurance as well as other administrative costs. These costs have risen constantly over the past and will do so in the future. That is where shipping companies need »a higher skill« today.

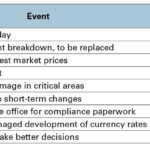

There are some 1,100 shipping companies (with more than ten vessels) acting in a difficult, volatile market today. However, this market environment offers not only risks, but also chances. We at Germanischer Lloyd (GL) believe that actively embracing software technologies improves a shipping company’s competitiveness. Just look at some typical events that impact your costs throughout the year. All these events can be avoided or handled better with the right software support. With the right technologies, shipping companies can be faster at lower costs with a higher quality.

Market overview

Each year an estimated 500 mill. $ is spent on core fleet management applications. So far, shipping has treated investments in software technologies very conservatively. In comparison with the oil and gas industry the difference is dazzling. For each 1,000 $ the oil and gas industry invests in new assets, 35 $ is invested in software technologies. In shipping, for each 1,000 $ capital expenditure, we see only 7 $ put into software technologies.

There is a lot of room for catching up –and next generation fleet management software will help shipping companies closing this gap. The change is already happening today, despite or because of the difficult overall market situation.

In two market snapshots in 2009 and 2011 with some 200 shipping companies involved across the globe we established some clear trends:

• IT (information technologies) budgets not reduced

Despite cost pressures across the board, more than 80 % of respondents did not cut back on their IT budgets, half of them even increased investment in software technologies.

• Generation change in management lowers barriers

A younger management generation has low or no barriers to computers anymore. In fact, having grown up with them they are surprised how much purely paperbased processes they find in a traditional shipping business.

• Software strategies converge from island solutions to integrated solutions

Shipping companies either look for one integrated solution or follow the »best of breed« approach (each function from a different vendor), rely on in-house developments or mix these strategies. However, with better solutions in the market, we observe a trend away from in-house developments and towards more integrated solutions from one vendor.

• Buying criteria are stable

Key buying criteria have been and will be quality of the product (in terms of content and technology), reputation of the provider, its service orientation, user-friendliness and value for money. A low price alone is rated as becoming less important, as it is often paid twice in the long run. However, respondents admit that price is so easy to compare.

• Many implementation projects fall short of expectations

Expectations on a software implementation project are generally high: Higher transparency, process efficiency, fewer interface communications, better compliance are all seen as results of successful implementations. However, the internal effort involved is often underestimated. In the end, the implementation support makes more of a difference rather than the functionality of the different solutions.

• Need for services around software is increasing

There is an increasing need for services, such as implementation and integration support, process consulting and decision support.

The demand is there. Now let’s see how the supply side responds to these trends.

Next generation

fleet management solutions

Next generation fleet management solutions are embracing new functionalities and technologies with a vengeance for the benefit of shipping companies. We see developments in several areas:

• Advanced technical management

On top of the commonplace planned maintenance systems (PMS), advanced technical management supports condition monitoring for both machinery and hull. The challenges and solutions are quite different. On the machinery side, the fleet management solution needs to integrate different manufacturers data (visual inspections, vibration measurements, oil analysis, crank shaft bearing wear monitoring, etc.). On the hull side, 3D structural steel models that integrate thickness measurement data are needed. Also the use of mobile devices will be supported and will increase.

• Additional functionality for quality/safety management

As many fleet management solutions stem from planned maintenance systems with following comprehensive purchasing functionality, the support for quality and safety management processes will get more attention. We see functionality for

incident and findings management and reporting, quality/safety KPIs (key performance indicators), risk assessment, certificates control, fleet-wide document handling, vetting support, etc. This also follows the rising importance of quality and safety departments in shipping companies.

• Support for crewing activities

In a market with less and less qualified crew, more and more shipping companies take control back of their crewing activities. Especially for officers, they no longer solely rely on crewing agencies. For this they need easy-to-use crewing and crew data management solutions. With the upcoming MLC 2006 standard, shipping companies need to provide evidence and document compliance. This is best done by a software solution with onshore/onboard functionality.

• Full use of already collected voyage/operational data

Today there is already a lot of voyage reporting. Noon, arrival, departure, stoppage, fuel change over, and bunkering reports (to name just a few) often compile data redundantly in different formats for different receivers. The contained highly valuable information (such as speed, position, fuel consumption) is only used for the moment and lost for further analysis. Next generation fleet management solutions will give these data a more structured way of reporting, storing, and reusing. This will also be crucial to support the compliance with upcoming environmental regulations, where exactly these data are needed.

• Use of standard technologies

Most of the current ship management applications are proprietary, i. e. they are built from scratch in a common development language. Only the provider knows what he did. The synergies to other applications, also from other industries, are zero. This will change. Most other industries already rely on standard technologies, i.e. systems that are used globally and can be handled by a wide network of experts in each local market.

We will see standard ERP (enterprise resource planning) systems being used in shipping. ERP systems support the core processes that every company no matter what industry has: buying something, »producing« something, selling something, employing personnel and using financial resources for this. We will also see standard BI (business intelligence) systems being used in shipping. BI systems sit on top of all operational process support systems and allow collection, aggregation and reporting of data and information, so far hidden in the ship management systems.

• Integrating e-commerce

Shipping has yet to develop full electronic connectivity to suppliers. What is known as EDI (electronic data interchange) for 20 years in manufacturing has not reached the maritime industry. With the rise of the Internet and the ease of using this technology, this will change. Maritime e-marketplaces connect shipping companies to their suppliers and open up the market of thousands of maritime suppliers globally at a mouse click.

• New deployment mechanisms

Traditionally, business software sits on a server run by the company’s IT department and the server supplies their data to the »client«, the workplace PC of the employee. With the rise of the »cloud« in the IT industry, the idea becomes widespread that this does not have to be the case. The server can sit anywhere and grant access from the company, its branches and employees across the globe via a secure internet connection.

Especially for medium sized companies, the availability and security of a server running at a professional provider will be much higher at lower costs. This is especially beneficial for shipping companies’ office systems. The onboard systems will not yet profit from this concept. However, the current »cloud hype« is a bit artificial from our point of view. Germanischer Lloyd provides fleet management applications as managed/hosted server (this would now be called »private cloud« as databases and systems are company specific) for more than ten years with 90 % of our clients using it.

Conclusions

All these developments and the current market situation will drive the consolidation in the currently young maritime software market with more than 100 providers, some very small, of fleet management solutions and connected systems. Shipping companies look for investment security of the provider (»Will he be around in five to ten years?«) and the rate of innovations he is able to deliver (»Will he support my competitiveness also in the future?«). The consolidation will benefit the market. Larger user communities mean more functionality for money and more stability (= investment security). Standard technologies decrease the dependence on a single supplier. New deployment models reduce the up-front investments in infrastructure and applications.

GL is at the forefront of these developments. With the most comprehensive software portfolio in the industry, it supports shipping companies in their efforts to achieve higher skills in management, planning and tool building.

Torsten Büssow