Though classification societies are able to compensate for the fifth year of the shipping crisis with new tasks in the offshore industry and on the LNG market, they would give a warm welcome to an increasing demand for ship classification.

Despite of the worldwide economic weakness, the international maritime trade turns out to be robust. The load volume grew about[ds_preview] 4% in 2012 and this positive trend goes on. However, the order activity was low in recent years due to financing gaps and has been picking up only since the last months. Classification societies were able to balance the weakness of merchant shipping with new business in the offshore sector, for instance. The number of orders of specialised offshore tonnage grew by 7 % in 2012. New type of ships and equipment are needed for deep-sea oil and gas as well as offshore wind energy. Another trend results from the very high fuel prices. They have a negative impact on the cost structure especially of older vessels. This situation urges owners to adopt fuel saving technologies and adapt in maintenance as well as research and development, all of which have become key business areas for classification societies.

Market change and market shares

The top news of the last twelve months has been the merger of GL and DNV. DNV-GL will take the lead of the industry due its presence in 100 countries and with the potential of 17,000 employees, 5,600 of whom are dedicated to the shipping industry. The DNV Foundation will hold 63,5 % and GL’ s owner Mayfair 36,5 % of the shares. The combined turnover will amount to some 2.5 bill. €.

So far the cartel authorities in the US, EU and South Korea have turned on their green lights for the merger while both companies are still waiting for the approval from China.

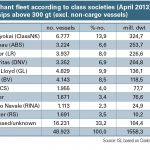

If the decision in China will be positive, the new company would be the new number one in classification business in terms of number of ships as well as in terms of dwt.

At combined strength it will reach a market share of 21,8 %. If you take the ISL-figures from April 2013 as a basis, Nippon Kaiji Kyokai (ClassNK) will no longer be the world’s leading class society (in dwt). But competition is stiff: ClassNK as the competitor closest to DNV-GL will breathe down the new class society’s neck with a market share of 20,8 %. Last fall they showed a strong performance adding 10 mill. gt to their portfolio in no longer than six months.

The American Bureau of Shipping (ABS) recently announced that its registered fleet has surpassed 200 mill. gt. Approximately 12,000 vessels representing 105 flag states are currently registered with ABS. The new Triple-E class by Maersk is part of this fleet, which is probably the most prestigious newbuilding contract of ABS in the last years. According to the American company, more than 21% of all new vessels on order are set for ABS class, which is the largest percentage of any classification society in the world.

Competition becomes more fierce

This year a new player entered the market. Tasneef classification society from the United Arab Emirates was established with support of Italian RINA Group. Located in Abu Dhabi, it will open offices worldwide. Both societies are finalizing a portfolio of 44 classification projects in 2013. Countries in the Middle East are the primary target market with their growing maritime industry including new ships as well as oil and gas systems.

China is also expanding its maritime business. During the last twelve months Chinese Classification Society (CCS) has got in touch with a lot of shipping companies inking agreements of technical and strategic cooperation. A highlight of these activities was a visit of a Maersk delegation in April 2013. Both sides exchanged views and information including the improvement of energy efficiency for vessels already in operation and energy-saving technology applied for newbuildings. Potential areas of future cooperation will be discussed soon.

Other class societies also turn their attention to new markets, especially to Europe. ClassNK is still the world’s largest classification society as long as the Chinese cartel authority continues to hold back its approval of the DNV-GL merger. Due to its strong growth, ClassNK announced to open five more offices in Europe. These new offices represent a 25 % increase in the size of its network in Europe. Additionally ClassNK said it had earned authorisation from Germany’s Berufsgenossenschaft Verkehr to carry out surveys on behalf of the German Government. Corresponding these activities ClassNK signalised it would expand staff in Hamburg in order to be closer to the clients.

ABS is also interested in Hamburg: The society relocated its Northern European regional marine operations office from London to Hamburg. »This relocation is part of ABS’ ongoing effort to place our frontline decision makers closer to our clients and be more responsive to their needs,« says ABS President and CEO Christopher J. Wiernicki.

Demand for service

With less newbuilding orders, the maritime service business becomes more important. »We are developing more new services needed during the global crisis and these will help to balance the smaller contribution made by marine business«, Ugo Salerno, Chief Executive Officer and President of the Italian classification society RINA, said when asked how to deal with the situation.

Consulting services to retrofit operating ships with more efficient technical solutions are more and more frequently asked for. The keyword is Green Shipping. In the last years, quality, efficiency and environmental consciousness have grown to be key qualifications for the business relationships and the economy of trading.

The Taiwan-based Wan Hai Lines has chosen the GREENship efficiency software as SEEMP (Ship Energy Efficiency Management Plan) for the first commercial installation on a container vessel. The efficiency tool was developed by ClassNK and the software company NAPA. This highlights the important role expertise could play in maritime services, said Sanders Jong, Vice President Marine Division Wan Hai Lines. Management and new bulbs for better efficiency Efforts to render ship operations more efficient are still going on. The crisis in world trading demonstrates the need to implement innovation in shipbuilding is as important as the need to counsel and train the crew, especially the bridge. Enhanced efficiency can be achieved via new equipment or more efficient operation processes. To this end the American Bureau of Shipping summarizes its expertise in an advisory paper, which describes the status of ship efficiency and gives guidance for future measures.

The machinery technology is dominated by the commitment to reduce NOx-emissions. For low-speed diesel engines – primarily used for commercial ocean-going vessels – a fuel efficiency of 55 % marks the state-of-the-art technology. Nearly every step to a higher efficiency by improving machine technology is expensive and limited in its impact. Regarding this the management of ship operations by different efficiency tools is moving into focus.

A huge potential is to be found in hull design especially of the bulb emphasized a study published by DNV. The Norwegian engineers evaluated 20 alternative bulb designs in order to adjust this element to the reduced speed of container vessels. They developed a bulb adapted to a lower speed and saving 5–7 % fuel. That means the payback time for a change of the bulb is less than a year. Recently GL conducted an appropriate study and came to a similar result in the context of slow steaming.

LNG for future applications

LNG shipping by sea will be, without any doubt, one of the main topics in the next years in classification activities. A number of states have recovered natural gas as indispensable part of a new low-carbon energy policy. This leads to an increasing demand of LNG shipping. Thus the expertise of classification societies is highly needed, not only in terms of ship propulsion but also in terms of tank technology and bunker infrastructure.

In June 2013 Gazprom Marketing & Trading (GM&T), Russian Maritime Register of Shipping (RS), JSC United Shipbuilding Corporation and Sovcomflot (SCF) signed an agreement to promote Russian content in LNG carriers construction projects. The construction of up to 13 LNG carriers during 2017 and 2021 was taken into account. Early in 2013 RS –which celebrates its centennial this year – completed the design and the approval in principle of an LNG carrier for the future needs of Gazprom. The current needs are covered by the building of an LNG carrier in South Korea under the supervision of RS and Lloyd’s Register of Shipping (LR).

At the end of June 2013 LR signed the classification contract for six 175,000 m3 LNG tankers. The vessels are to be built by Hudong-Zhonghua Shipbuilding. The last vessel of the series will be delivered by the end of 2017.

This coincides with news from Singapore: LR has won a contract of the Maritime and Port Authority of Singapore (MPA) to develop operational procedures and technical standards required to generate LNG bunkering capabilities in the Port of Singapore. Shipping LNG in carriers is one side of the coin, using LNG as low emission fuel is the other. New limitations for exhaust gases, which become mandatory in 2015, boost the development of LNG propulsion. GL together with MAN published a study with the conclusion that container-feeder could become pioneers in using LNG as fuel, because they are already exclusively operating in ECAs.

Booming new energy segments

There is no turnaround in energy policy without offshore wind technology. The revenues generated in this new business area are growing very fast. Until now seven platforms for the transformer stations of the German projects are ordered or have been delivered already. This results in a business volume of 770 mill. € for German shipyards. But the sky has become overcast. Insurance and grid connection issues caused delay of the development of German projects. Due to this delay companies, which are involved in offshore wind, get in difficulties. The markets in the UK, Belgium and China, which begin to flourish, offer an opportunity to compensate for the lack of orders at German projects.

These markets are very busy. ABS, for instance, signed a contract to class two Ulstein-designed PX121-type platform supply vessels (PSVs). They were ordered by Vroon Offshore Services in order to work offshore in Europe and in the North Sea. The bow design is impressive: »Owners and operators with vessels working in harsh environments select these types of designs to realise operational efficiency benefits and to better cope with harsh conditions,« Mike Sano, ABS Energy Project Development Principal Engineer, said.

Further, DNV doesn’t simply offer services for wind energy but also for photovoltaic systems and grid technologies. At the end of last year the society announced a 70 mill. € investment for the expansion of its High-Power Laboratory to create the first laboratory in the world in the extreme testing segment for the upcoming market for super grids. »There is a global need for extra capacity and modernisation of electricity infrastructure to meet the growing electricity demand«, CTO Bjørn Haugland said. Floating wind turbines constitute a new approach to install wind turbines in deeper waters. DNV Kema has released a new standard in order to ensure safety and reliability in floating turbines. Also GL’s daughter Noble Denton has drafted new guidelines for offshore operations. They include marine projects, submarine pipeline installation and wind farm infrastructure installation.

Conclusion

In the fifth year of the shipping crisis, the business environment is still harsh for the classification societies. However, a demand for Green Shipping solutions as well as the booming LNG and offshore markets help the companies to endure the crisis. Some like Bureau Veritas (BV) also profit from their broad service range that reaches far beyond shipping. BV, e.g., generates 92 % of its turnover with other industries like automotive, energy and certification in general. The more stable business in those industries enables them to invest heavily: The French society completed 14 acquisitions in 2012 whose full-year revenue totals to more than 210 mill. €.

Jörn Iken