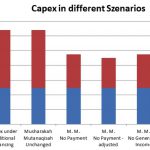

In the last issue, Alexander Riecke explained »musharakah

mutanaqisah« as an alternative financial product for

shipping companies. In the second part of the report

he shows different scenarios and their implications

on the capital expenses (capex) that may occur

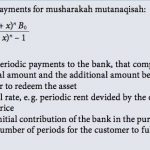

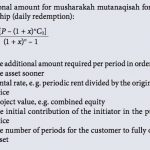

In short, musharakah mutanaqisah is a Shariah-compliant financing method, particularly suitable for assets; thus also ships. In such a[ds_preview] structure, equity from an Initiator and Bank are combined and opportunities and risks are shared. Whilst there is no payment of interest, rent is paid from the Initiator to the Bank and the Initiator additionally buys back shares until the vessel is wholly owned. Moneys received from chartering the vessel out are shared, after the deduction of opex, on a pre-agreed basis, whilst losses are distributed according to the equity ratio at the time.

Since the repayment structure can be closely linked to the financial situation of the vessel, different factors will influence the amounts that are transferred from the Initiator to the Bank. Those factors are of high importance, when it comes to stress advantages and disadvantages of musharakah mutanaqisah, when compared to the traditional financing.

In a market environment with a relatively high income in comparison to the opex, the application of musharakah mutanaqisah results in a negative daily redemption. This means that the Initiator is able to build up their cash reserves whilst gradually increasing ownership of the vessel.

Although it is profitable, profits have to be shared with the Bank, whereas under a conventional financing scheme the profits are not indicative of the payments to the Bank, since the conventional scheme usually relies only on fixed instalments and interest payments. Nonetheless clauses such as »cash-sweep« or »pay-as-you-earn« can be implemented into a conventional contract.

If the income is relatively low compared to the opex, the daily redemption rate may, at a certain point, become positive. This can either be caused by a bearish market environment resulting in decreasing income or by unforeseen circumstances leading to increasing opex. Thus, the Initiator is not able to build up cash reserves, but is forced to make payments from existing liquidity.

This is rather similar compared to the Western approach of financing. As soon as the income does not generate enough money to cover opex, as well as other costs, the interest payments and the instalments, existing cash reserves need to be used in order to fulfil the contractual obligations of the repayment plan.

Independent of the market situation, however more likely to occur under a recession and a slump, there is a theoretical possibility of the charter rate being equal to the opex. Under musharakah mutanaqisah an immediate consequence would be that there is no daily redemption to be paid, since there are no profits to be shared between the partners. Nevertheless, given that enough cash reserves are available, the Initiator is still at liberty to purchase shares of the vessel. Supposing that the payment plan remains unadjusted and no shares have been purchased, future payments of the daily redemption will increase, as soon as the generated income exceeds the value of the opex again.

Under a conventional Western financing scheme this scenario would result in the inability of settling the payment of interest and instalments; assuming that there are no cash reserves which can be allocated to interest and instalments. If this were the case, a standstill agreement would become necessary or the loan would default and it were up to the parties to negotiate further steps. One solution could then be to adjust the payment plan, albeit incurring higher costs for the Initiator as fees for restructuring and legal assistance for writing up a new addendum would be accrued.

Under certain circumstances the forced sale of the vessel might even be a result if the Initiator and the Bank cannot agree on a strategy. In such a situation the outstanding interest payments and the loan would be attended to with priority since it is senior to the equity; very differently to a sale of an asset under musharakah mutanaqisah, where splitting the generated liquidity according to the prevailing ratio would ensue.

Theoretically it is also possible that opex exceed charter income. In such a situation both parties need to evaluate whether it is feasible to continue the venture or if it were less costly to liquidate the vessel. Under a musharakah mutanaqisah contract both parties share the profits and losses according to the equity distribution including the adjustment for the management fee. This proportion remains as long as the venture continues. Only if finally a loss is realised the ratio will be based purely on the equity distribution. Since that is the case, negative income will result in no daily redemption payments and the incurred losses on a daily basis will be shared between the Initiator and the Bank. Thus neither party fully bears the costs on their own.

If the vessel were financed through a traditional Western method, the Initiator would have to solely bear the high costs and additionally would need to pay the interest and instalments.

A contractual possibility under musharakah mutanaqisah is to have varying amounts for the daily redemption. If there is a shortfall in liquidity, the length of the payment plan may be prolonged in response to the changed environment without incurring any administrative costs or expenses for legal advice. As a consequence, the financial burden for future payments is not as high, as it would be, if the length of the payment plan were to stay the same.

This is a flexibility that does not exist within the regulations of a conventional loan agreement, where a fixed repayment amount and regular interest rates are a common occurrence and any adjustment will usually result in costs towards the Initiator. Analogously, if the Initiator has a surplus of liquidity at hand, the length of the payment plan can be shortened by buying more shares per period through increasing the daily redemption. Musharakah mutanaqisah allows for this adjustment devoid of any fees beyond what was agreed initially, whereas in a traditional financing scheme shortening the period of the loan could result in a prepayment penalty.

It is apparent that the flexibility of musharakah mutanaqisah is a key advantage. Without the issues revolving around negotiations of addenda and the correlating costs, capex can simply be adjusted to match the income situation. The amount of reduced capex will however vary, depending on the specific situation. If for example payments are only stopped once and the repayment period is extended, there will hardly be a significant change in the average capex. If however several payments are omitted and the original timeframe is kept, the next payments will be higher.

Concluding, one can say that financing a vessel through musharakah mutanaqisah does provide an alternative for financing ships. Leaving the less tangible factors aside and concentrating purely on the tangibles, the Western approach presents itself as more lucrative under market conditions with an income high enough to exceed all costs. One negative aspect in a high income situation would however be the potential payment of a prepayment penalty in a conventional financing scheme if the Initiator wishes shorten the length of the loan. Such a penalty would not occur in a musharakah mutanaqisah agreement.

Such a scenario aside, it is in meeting the special circumstances that can occur throughout a vessel’s lifetime that most advantages of musharakah mutanaqisah are being showcased.

In fact, it appears that particularly in more challenging situations there are advantages in using musharakah mutanaqisah over the conventional approach due to the broad flexibilities of the agreement.

On a general level it should be pointed out that rental is highly suitable for Islamic finance, since it is measured from the true usufruct of the asset, unlike interest charges that are not tied to the asset’s usufruct. Furthermore, since the Bank and the Initiator engage into the enterprise together, both will participate in the winnings and losses.

Especially when compared to traditional financing, being based on the principles of Islam, musharakah mutanaqisah makes it easier to resolve situations in which there is a liquidity shortfall. Of course some situations may also call for the sale of the vessel, but unlike in the Western approach the losses are shared according to the equity distribution and there is no borrowed capital to be paid back with priority to the own capital. This in turn reduces the risk of total loss of equity for the investor. One of the major advantages of musharakah mutanaqisah is the flexibility of the legal framework regarding the repayment plan and the fact that due to the nature of Shariah, there can never be a point where interest and compounded interest needs to be paid, nor will there be the need to spend large amounts of money on restructuring a loan. This is particularly important in shipping, as the international shipping market is highly volatile and the reoccurring cycles may always impose the risk of a liquidity shortfall to happen. Another major advantage of utilising musharakah mutanaqisah is the fact the there is no senior loan involved that needs to be attended to before the equity. Whilst this can be considered a very fair and thus potentially more ethical approach of doing business, it may be less lucrative than conventional financing, which, based on interest and instalments, focuses on making money from money.

Especially in times of uncertainty and a preference towards risk-averse investments, musharakah mutanaqisah presents itself as a more suitable option than the conventional approach of financing vessels.

Since profits and losses are shared in a musharakah mutanaqisah partnership, neither of the involved parties has to shoulder the risks alone. This fact could be especially appealing to institutional investors, such as pension funds that put a strong emphasis on a reliably solid likelihood of a return. On the other hand this reduction of risk may be offset by the potential returns to the Initiator, as shared profits in a flourishing market result in higher payments to the Bank than pure interest on a loan.

Whilst the financial aspects may not be as appealing to risk takers in contrast to cautious investors, the application of musharakah mutanaqisah allows investors to tap into new markets when it comes to raising equity for projects and thus present an opportunity to realise projects that may otherwise not be possible.

Alexander Riecke