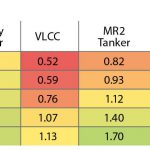

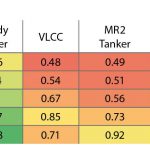

Using the ratio of Discounted Cash-Flow (DCF) value/Market Value, market intelligence firm Vessels Value identifies buying and selling signals. Long-term »heat maps« show that values are not as volatile as one might expect

While the container, tanker and bulker markets have all changed a lot in the past two years, long-term value[ds_preview] analyses for October 2014 and 2016 show quite similar results. »Despite the market being severely depressed, a lot of the DCF heat-map is green. This is because long-term average rates are higher than short-term rates. Therefore the earnings potential is quite high«, Vessels Value Senior Analyst, William Bennett, explains. »Given the low market values too, these vessels can be bought at a significant discount and thus are bullish. At the same time, tankers are bearish. The rates are coming down as are the values. Containerships are suffering from the same problem: Rates and values are suffering offering very little positive sentiment.«

The method combines both a market value module and a DCF value module. The market value module uses real market transactions and adjusts for a vessel’s type, size, age, features and the current state of the market. The vessel is assumed to be in good condition and the transaction is assumed to be a fair market transaction between a willing buyer and willing seller.

The DCF module looks at what a vessel may expect to earn over its remaining life down to its residual value. The basic principles of the module are straightforward. For each period or year in the life of the asset the anticipated revenue and expenditure, after inflation, are determined. The net cash flow, that is revenue less expenditure, is then reduced by means of a discount factor.

Using the measure of DCF value divided by market value, Vessels Value essentially is looking at what the long-term value is compared to a short-term value. »The rationale behind the ratio is that a score of 1 essentially means if you buy the vessel at 6mill.$ and the DCF value is 6mill.$ then you can hope to earn back that money exactly through its lifetime. Now, if that ratio is above 1 then the earnings on the vessel will make profit over the initial outlay cost if it is traded until the end of its useful life, hence making the vessel an attractive buy«, Bennett explains.

»Both models have their advantages and disadvantages«, the Vessels Value analyst says. »Market value does not consider the future earnings potential of the vessel and whereas the DCF does. But the Discounted Cash-Flow method is based heavily on assumptions.« But the similarity of results for both years reinforces the long-term validity of this type of insight, Bennett is convinced. fs