The operators typically report best ever results, higher daily rates and increased bookings for the next season. Accordingly CLIA expects a further growth to 25.3 mill. passengers in 2017, the 2016 preliminary figure being 24.2 mill. The euphoria regarding additional capacities for the Chinese market seems somewhat declined. By Arnulf Hader

The world cruise fleet is growing fast again, faster than ever before. While we noted the mark stones 300 ships / 500,000 beds[ds_preview] / 20mill. gt for 2016, the expected figures for 2017 are 311 ships / 525,000 beds / 20.9mill. gt. The data of new cruise ships joining the world fleet in 2017 are known while withdrawals of older ships are currently negligible. The average size rises to 67,200 gt per ship.

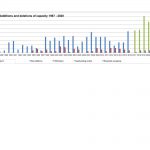

The fat line indicates that the total capacity of the vessels has always been rising during the last 20 years. Since the number of ships in service is growing slower, the average capacity is increasing.

In 2002 the number of lower beds per ship was more than 1,000 for the first time. In 1986 when the Bremen-based Institute of Shipping Economics and Logistics (ISL) started to count the beds the average number was 638 now it is 1,685 lower beds per vessel.

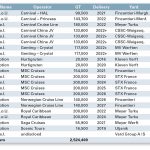

Until 2020, the order books already show more orders for cruise vessels than ever before in a such a short period. That will result in high net additions of capacity because the number of withdrawn ships is expected to be low for a few more years. Cruise ships have a life expectation of about 40 years and around 1980 not many were built.

The high number of withdrawals 2001/02 was caused by some bankruptcies as a consequence of the 9/11 terror attacks and a high oil price; the scrapping activity in 2009/10 was due to new SOLAS requirements and the retirements from 2012 to 2014 correspond to the deliveries of the first modern cruise ships 40 years earlier. The year in which the tonnage was withdrawn means not always the year of scrapping but the last year in cruise service. Afterwards many ships are laid up or serve other duties.

The Eastern Mediterranean Sea looses more and more attractive destinations. The war in Syria and the IS terrorism need no further explanations; calls at Ukrainian ports are sanctioned by the EU and the worries in Turkey result in cruise lines avoiding Istanbul and other Turkish ports. Now a Russian company announced to start cruises in the Black Sea in the 2017 season. The »Royal Iris« (ex »Azur«, 14,717 gt/1971) is said to be acquired by the Russian Ministry of Transport.

China is still regarded as the market with the greatest potential, but the recent developments do not seem to satisfy the expectations. At least two companies have revised their plans to bring further ships to China: In 2015 Aida Cruises decided to base one vessel in Shanghai beginning in spring 2017. By autumn 2016 this plan was cancelled because the profits were higher in the western Mediterranean.

MSC will use the »Splendida« in China in the summer of 2018 but the following winter she will be based in Dubai. Carnival replaces the CEO of Carnival Asia by Michael Thamm who first was the CEO of fast growing Aida Cruises and later brought the Costa brand back on track as CEO of Costa and Aida.

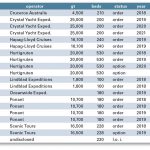

A location of interest is Cuba. The Carnival Group started Cuba cruises under the socially conscious brand »Fathom« aboard the »Adonia«. Since bookings are not sufficient the vessel will return to P&O in 2017 and »fathom cruises« will be offered on several other ships. Pearl Cruises’ coastal vessel »Pearl Mist« is the second ship to make regular US–Cuba cruises. Between January and April, twelve trips start from Port Everglades to visit seven Cuban ports. Royal Caribbean Cruise Line (RCCL) and Norwegian Cruise Line (NCL) also received approval by the Cuban Government to operate cruises to Cuba in December 2016. During 2017, NCL, Oceania, Regent Seven Seas and RCCL will offer single cruises to the new destination.

The potential of the Indian market is nearly untapped mainly due to the lack of suitable ports and infrastructure. Most companies only make single calls at one or two ports when ships travel from Europe to Southeast Asia or v.v. Two exceptions are known: Costa’s »neoCLASSICA« offers a series of trips from Mumbai to the Maldives and the »Super Star Vigo« is chartered for eight cruises to Monarch Cruise of India.

Operators

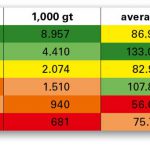

For many years the »Big Three« operators had been much bigger than number four. Now the distance to MSC is not big anymore. The six top ranking companies comprise 206 of 311 ships (66,2%) and 465,000 beds of a total of 525,000 beds (88.6%). The smaller companies have the smaller and often older ships.

Our figures show that the Carnival Group provides the largest fleet by number, tonnage and capacity. However, the Royal Caribbean Group has the largest ships by tonnage and MSC the largest average number of beds. The bed count is always regarding the lower beds only. With about 20 ships on order – excluding the Chinese joint venture – with delivery dates between 2017 and 2022, Carnival will keep the leading position for many more . During the fourth quarter of 2016 the group has ordered three 180,000 gt/5,000 pax vessels which will be operated with LNG as fuel. Further orders were published in January 2017 with the remark that the confirmation would follow soon. This relates perfectly to the results of the 2015/16 business year. The turnover of 16.4 bn $ is the best ever, as was the fourth quarter’s turnover. Regarding China, the optimism seems to dwindle a little bit. Carnival admits that sub-charters are offered to fill the available capacity. According to a contract with Shell, Aida and Costa will use LNG from 2019 onwards and the latest new orders are also planned to use LNG.

Some highlights from Carnival:

– Carnival Cruise Line will receive the next ships in 2018 and 2019, both of the 133,550 gt/4,000 pax »Vista« class. In 2020 the first 180,000 gt/5,200 pax giant will be delivered from Meyer Turku with an option for a sister vessel in 2022.

– Costa Crociere has to wait until 2019 and 2021 to commission the 5,000 pax class while Costa Asia expects two 4,200 pax sisters. Costa uses a fourth German port in summer 2017 when »Costa Magica« offers about ten departures from Bremerhaven.

– Aida Cruises has announced to stop the year-round trip from Hamburg in autumn 2017, citing passengers who want to see the new ship on other routes like the Canary Islands. Sister vessel »AIDAperla« will enter service in a few months. In 2019 and 2021 two 5,000 pax units will follow.

– Holland America Cruises continues the »Konigsdam« class (99.000 gt/2,650 pax) by »Nieuw Amsterdam« in 2018 and a third sister in 2021.

– Princess Cruises gets an own design of about 144,000 gt and 3,600 pax. Two of them are in service, the »Majestic Princess« follows this year and three more in 2019, 2020 and 2022.

– P&O Cruises (UK) will participate in the flood of 5,000 pax newbuildings from 2020 onwards.

– P&O Australia gets the »Dawn Princess« from Princess Cruises in June this year replacing the »Pacific Pearl« which was sold to Cruise & Maritime Voyages of the UK, to be renamed »Columbus«. The planned first newbuilding for the brand was recently switched over to Carnival Cruise Lines. Instead, the »Carnival Splendor« will go »Down Under«.

– The smallest class has 600 beds and 40,000 gt. In early 2018 the »Seabourn Ovation« will follow the just delivered »Seabourn Encore«.

– The 3,560-bed »Royal Princess« will be the first ship to test the »Ocean Medallion« of the Carnival group in late 2017. The medallion is a chip which the passenger will wear to enjoy a lot of services. A passenger who has booked a cruise has to fill in a questionnaire with personal data, preferences, hobbies etc. These are printed on the medallion together with the cabin number and sent to the passenger. On board the chip is scanned for faster check-in and can be used for booking a restaurant, room services, getting information about the board program or finding friends.

RCCL reports higher profits than expected and a solid development. Surprisingly high is the growth in North America. As No. 2 in the ranking of operators the Royal Caribbean Group has about 31,000 beds on order. The order book consists of the 4th and 5th ships of the »Quantum«-class (Meyer), the 4th and 5th ships of the world record »Oasis«-class and four 2,900 pax ships of a new type for Celebrity Cruises (all STX France).

Memorandums of understanding were signed for two units of a new class of 200,000 gt/5,000 bed vessels from Meyer Turku. In 2017 these two brands will not get a new ship, only the German joint venture TUI Cruises will accept »Mein Schiff 6« (2,500 beds). The »Legend of the seas« (1,800 pax) will soon be transferred to TUI’s Thomson Cruises as »Discovery 2« like the sister vessel last year. The French brand Croisieres de France is to be closed down and the two ships »Horizon« and »Zenith« integrated in the fleet of the Spanish affiliate Pullmantur.

The order book of Norwegian Cruise Line stretches only into 2019 comprising three more »Breakaway plus« class vessels for 4,200 pax. Unsurprisingly, rumours exist about negotiations for a new series of ships.

Five NCL vessels will spend the summer of 2018 in Europe. Three will operate in the Mediterranean, one from Hamburg and the big »Norwegian Breakaway« from Rostock-Warnemünde. The new »Norwegian Bliss« goes to Alaska. The affiliated upper market brands Oceania Cruises resp. Regent Seven Seas expects one 700 bed vessel in 2020.

After the lengthening of the smallest class of Mediterranean Shipping Cruises (MSC) the 12-strong fleet has now a high average capacity. The latest new ship was built in 2013 but this year two new vessels will make their first trips. They represent the start of two new classes, the »Meraviglia«-class with 4,500 beds and the »Seaside«-class with 4,120 beds. Then the average capacity will be the highest of all operators. The »Seaside« is intended for Caribbean trips, winter and summer, while her sister, »Seaview«, will start in the western Mediterranean and spend the winter in Brazil.

The »MSC Meraviglia« will be followed by the »MSC Bellisima« next year and two enlarged sisters. Moreover, MSC has signed letters of intent for four more vessels of 177,000 gt and nearly 5,000 beds. Their deliveries would stretch into the year 2026, far beyond the planning of the competitors. The »MSC Meraviglia« will be based in the port of Hamburg in summer 2018.

Constant expansion brought the TUI Group to rank 5 globally. By summer 2017, the TUI/RCCL joint venture TUI Cruises will operate six ships, two second hand ones and four new ones with 2,500 beds, named »Mein Schiff 1« to »Mein Schiff 6«. Two slightly larger ones will follow. When these are delivered »Mein Schiff 1« »Mein Schiff 2« will be transferred to the British TUI brand Thomson to replace two older ships chartered from the Louis Group. The traditional TUI brand Hapag Lloyd Cruises comprises »Europa« and »Europa 2«, the two luxury ships with the highest rating by Douglas Ward, and two luxury expedition ships. After a long planning time the expedition cruise department has finally got the go ahead for two 240 bed newbuildings by 2019. Thomson Cruises, the TUI brand in Great Britain, adds the »TUI Discovery 2« to the fleet this year by transfer from RCCL, increasing the fleet to six.

Whether Quark Expeditions will stay part of the TUI Group is under discussion. Quark charters small ships from other owners for certain periods.

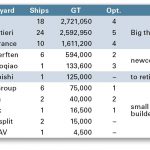

Last year it was reported that the Malaysian Genting Group had acquired the Lloyd Werft in Bremerhaven for fitting out new ships for the own cruise brands. This story has now some more chapters: Genting also needed shipyards to provide the hulls for fitting out – and they found them. The Russian owner of three yards in Eastern Germany was willing to sell them because the offshore market and the trade embargo against Russia led to a lack of orders in his markets. So Genting also became owner of three shipyards with different facilities and capabilities and called the group MV Werften. The yard in Stralsund with a shiplift will be used to build the first four 135m river cruise ships for Crystal River Cruises and the yard in Wismar will deliver the first unit of the 200,000 gt/5,000 bed »Global«-class to Star Cruises in 2020.

Meanwhile, Meyer Werft of Papenburg has delivered »Genting Dream« (151,300 gt/3,360 pax) to the new Genting brand Dream Cruises. The sister vessel »World Dream« will follow late 2017. The first new seagoing vessel will be the 200 bed »Crystal Endeavour« for Crystal Yacht Expeditions in 2019 while Crystal Cruises has to wait for the 117,000 gt class for 1,000 pax until 2022. Series building of all these types will fill the capacities of all three shipyards. As result of an intensive study Crystal has dropped plans to modernise the famous US liner »United States«. It turned out to be prohibitively costly.

The next company in the size ranking is Disney Cruises. They have only four ships with 8,500 beds but two more with 2,500 beds each are under construction in Papenburg for completion 2021 and 2023.

The newcomer of the year is the Virgin group. Their intention to enter the cruise market is not new, but now three ship orders are confirmed. Fincantieri will deliver the 110,000 gt/2,800 pax vessels by 2020, 2021 and 2022. The name Virgin Voyages is intended to show a difference to »normal« cruise companies.

As usual, only a few ships are on order for the smaller companies and these contracts date from previous years. Activity is currently high in the expedition market. Therefore, the ships on order and intended to order are listed here as well.

Meanwhile, Clive Palmer, who announced to built a technically improved replica of the »Titanic«, has postponed his project. But another »Titanic« will be completed in autumn of 2017. This life-sized replica will be built by Wuchang SB Industry Group to be moored in a theme-park in Sichuan where visitors will be able to experience the collision through a high-tech simulation.

Shipyards

The leading cruise shipbuilding company by gross tons is the Meyer Group comprising the Papenburg shipyard, the wholly-owned Turku plant and the Warnemünde factory which contributes engine room blocks. Fincantieri uses five shipyards in Italy and is also majority owner of the Vard group of shipbuilders. No. 3 in the world league is the still Korean-owned STX France of St. Nazaire, builder of most MSC vessels and the »Oasis«-class of RCCL. The majority in the yard is still for sale and Fincantieri is the preferred bidder. However, the French state wants to keep its 33% of shares in a multiple ownership. If Fincantieri acquires also the majority of STX France, the ranking will chance again. While Fincantieri is still the main provider of Carnival tonnage, Meyer Papenburg and Meyer Turku now have the 180,000 gt, 5,000 pax class in their order books.

The MV Werften in Eastern Germany make good progress to get a place among the leading builders. Lloyd Werft of Bremerhaven, like MV Werften owned by Genting, will not build cruise ships but focus on repair and mega yachts. For the inexperienced Waigaoqiao shipyard it will take a longer time up to the first delivery, but as a member in a Chinese-Italian-American joint venture chance s are good to become a successful competitor. Mitsubishi has not accepted further contracts and will disappear from the listing in a few months. The other five shipyards are focusing on smaller tonnage and are profiting from the current run for expedition cruise ships.

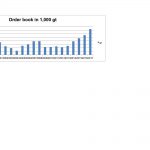

The global order book is once more the highest ever, summing up to 185,000 lower beds, the options and letters of intent not included. It stood above 80,000 beds just before the terror attacks of New York and close to 100,000 before the world financial and economic crises. By mid 2015 it reached 120,000 and surpassed the 150,000 barrier early 2016. A further increase is still possible, however, the deliveries will also increase this year. The graph »Capacity on order« shows that the ship operators react carefully if demand lessens like in 2001 and 2008. They wait over years to be sure that demand has really recovered before ordering new tonnage. Is this still the case? Other shipping markets show that it can be too much one day.

The usual capacity growth has been 20,000 new beds per year before 2010. The current order book stretches over more than five years, with Letters of Intent or Memorandums of Understanding up to 2026. In 2017 and 2018, nearly 30,000 beds will be added and 45,000 more in 2019. The traditional markets of America and Europe will hardly absorb so many new beds, but will the Chinese market?

Arnulf Hader