The global container ship charter market is in robust shape as early autumn fixing resumes, writes Michael Hollmann

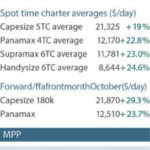

Fixing activity and tonnage tightness continued to beat expectations over the past month, with charter rate levels still nudging upward[ds_preview] during September. The upward momentum decreased a bit, yet average rates for the main charter vessel sectors from 1,100TEU to 4,250TEU are up 2.6% month-on-month, according to the New ConTex which climbed from 388 to 398 points over the past four weeks. Demand for large and very large gearless ships in excess of 5,500TEU continues to be a major driver for the latest strength in the market. However, the New ConTex also reflects significant improvements for panamax and midsize vessels, with 12 month periods for geared 1,700TEU types lifted by 4.2% to over 7,900$/day and 12 month periods for 4,250TEU baby panamax types pushing up 11% to almost 9,000$/day.

Global container traffic remains on track for much-improved growth this year as economic activity based on purchasing manager indices (PMI) gained further strength across most major economies. PMI’s for the US and for Europe remain at multi-year highs and still improving while the situation in China, India and Brazil brightened up again, too, after a weaker patch in May, June and July. The result has been a formidable rise in the JP Morgan Global PMI to 53.9 points in August, indicating the strongest growth push in the world economy since early 2015. All this is good news for container shipping, of course, which is set for a 5.0% increase in cargo liftings on fronthaul routes this year, according to London shipbroker Howe Robinson. Fittingly, the idle container ship fleet witnessed another contraction to just 143 units with an aggregate capacity of 355,250TEU in early September based on data by Alphaliner. This represents just 1.7% of the total cellular fleet worldwide. Concerns over a seasonal decline in charter demand proved unfounded so far, although there is no doubt that it is going to happen to some degree during the fourth quarter, as every year.

In the largest sectors, Seaspan is reported to have already fixed a quartet of 10,000TEU newbuilding due for delivery from February 2018 for long periods. Market sources say that the ships are hired out to CMA CGM ex yard for 36 month periods at rates around 28,000$/day. This compares favourably with other recent fixtures of even larger vessels, fixed at lower rates, albeit for shorter periods that would allow owners to re-employ them at higher rates if the market picks up in the meantime. Some 2011-built 10,000TEU tonnage got covered at 21,000-22,000$/day while the Costamare-managed »Cape Kortia« (11,010TEU, 2017) secured a 12 month employment for transpacific trading with Evergreen at 27,000$/day. Latest megaship orders by CMA CGM and MSC further testify to the continued appetite for this type of capacity although the ripple effects on charter demand remain to be seen.

Surprisingly, conventional panamax tonnage has seen quite a fixing spree and rate improvements over the past months although charterers now seem to adopt a more cautious approach as volumes seem to have peaked. Nevertheless, the facts are quite stunning: Spot/prompt supply of panamaxes including laid up ships fell sharply from 34 in July to 13 ships in mid-September. At the time of writing, rate levels in Asia were hovering around 9,000$/day.

Below 4,000TEU, tonnage demand has been quite brisk as well, especially for gearless 2,700/2,800TEU units and for geared/gearless 1,700TEU ships.

Weekly fixture lists continued to show good fixing volumes in the gearless 2,800TEU sector, with rate levels still north of 9,000$/day for requirements in Asia but much lower (in the 7,000’s $/day) in Europe. Brokers are warning now that growing redeliveries of ships may apply greater pressure on rates unless fixing activity increases further. In the 1,700TEU segment, availability is reported to have gone up again, too, although this is not reflected in rates so far. »The market remains very balanced,« commented one leading international broker who still counts a number of uncovered requirements for this type of tonnage by charterers. One standard 1,700TEU Wenchong type meanwhile got fixed at more than 8,000$/day in the Pacific, but this was for trading to and from Australia (a more regulated, expensive trade in terms of opex). Other ships pushing for 8,000$/day for delivery in Asia have failed so far, with owners realistically rating their vessels at high $7,000’s $/day, brokers said. Modern, economic 1,700TEU types such as the Topaz design meanwhile recorded further slight improvements up to mid $9,000$/day, it was reported.

Michael Hollmann