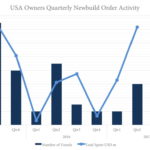

U.S. based owners remain active in the sale and purchase market for international tonnage. High replacement costs incentivise investments in existing tonnage

The total value of assets purchased rose to 2.86 bn $, more than 2 bn $ higher than was seen in 2016[ds_preview]. 2018 was off to a slower start, but the prospects of an improving offshore market could encourage more OSV transactions.

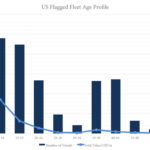

The age profile of the U.S. flag fleet shows a large number of older units. The high replacement costs for commercial vessels incentivise investments in tonnage on the water. The cost of building a vessel in a U.S. shipyard is about four times that of a comparable vessel in a large shipyard in Korea, Japan, or China.

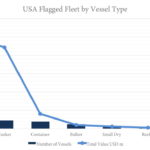

»Few large units remain on order at domestic yards as earnings for tankers have slipped flowing the late 2015 decision to authorise U.S. crude exports, and a Letter of Intent for up to four new container ships at a U.S. shipyard was allowed to expire at the end of January,« says VesselsValue analyst Court Smith. Valuations include all U.S. flagged ships registered with a class society, including several USNS vessels built to ABS standards. Large Articulated Tug Barges (ATBs) are not included in the valuation totals. The fleet profile serves as a reminder of the importance of the offshore markets to the U.S. flagged fleet, dwarfing the value seen in the other segments.