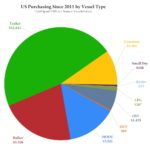

U.S. shipowners have hardly invested anything in ships in the past year. According to VesselsValue, S&P activities almost came[ds_preview] to a standstill. Only 66mill. $ were spent, far less than the 1.35 bn $ in the previous year. The peak of investments was four years ago. In 2014, more than 7.4 bn $ were spent on the purchase of about 190 ships.

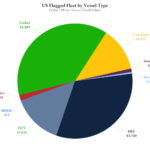

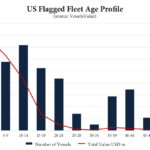

US owners continue to rely primarily on tankers, which account for almost half of all ships with a total value of 11.6 bn $ followed by bulkers (5.3 bn). Tankers are also dominating units under U.S. flag (1,230 units) with a total value of 4.4 bn $ (75 ships), this time followed by OSV worth almost 3.75 bn $ (942 ships). Container ships play a rather minor role in U.S. shipping. Most of the U.S. flagged ships are between 0 and 24 years of age, a quarter (326) are 25-55 years old.

The U.S.’ exposure to the offshore markets, which have suffered severe asset value declines, has knocked the nation down to sixth place in terms of corporate ownership with a fleet valued at 44.52 bn $, according to VesselsValue.

in coopeartion with VesselsValue