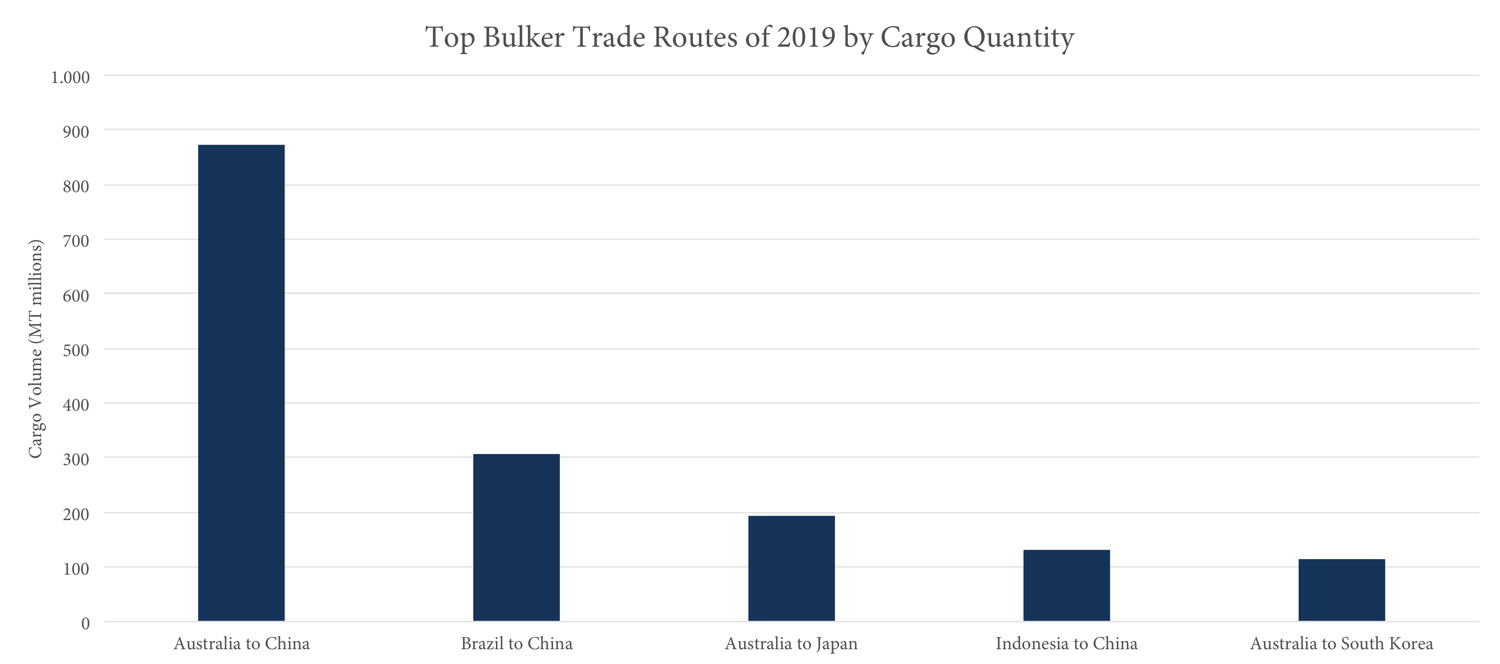

The top bulker trade route in 2019 was from Australia to China with 873,343,192mill. t of cargo moved. Brazil-China[ds_preview] came in second at roughly only a third of the above volume (306,065,368mill. t), followed by Australia-Japan, Indonesia-China and Australia-South Korea. Meanwhile, the supply demand balance has changed compared to three years ago. The fleet is growing and so are the cargo miles that remain mostly on top of the supply. However, 2019 has shown a more volatile picture than the years before.

On the second hand market most money was spent on Panamax bulkers (122 ships, 9,497.800 DWT, 1.564 bn $). More vessels were bought in the Supramax and Handy segments although at a lower total price. Top spending countries on the S&P market were China at 1.8 bn $ followed by Greece at 1.6 bn $. Japan, Norway and Hong Kong came in third, fourth and fifth. China Development Bank was the biggest spender buying used ships for 394mill. $ – that is almost 2.5 times as high as the second in the ranking, China Merchants Bank with 163mill. $. The other three in to top 5 are Avic Leasing (148mill. $), Eagle Bulk Shipping and Ocean Yield (each 144mill. $).

Looking at the 2019 newbuild bulker investments by size segment, Panamaxes are leading in terms of number of vessels with 42 ships at 3.5mill. DWT. Number one in terms of deadweight tonnage and Number three in terms of number of vessels are Capesize ships (30 units, 6.2mill. DWT). The top newbuild ordering are China, USA, Taiwan, Greece and South Korea, with China outclassing the others at an ordering volume of 42 ships at 5.3mill. DWT. Only six ships have been ordered out of the US (550,000 DWT) similar to Taiwan and Greece. South Korea at position five in terms of number of vessels is at position two when counting deadweight with 780,000 DWT in only four ships.