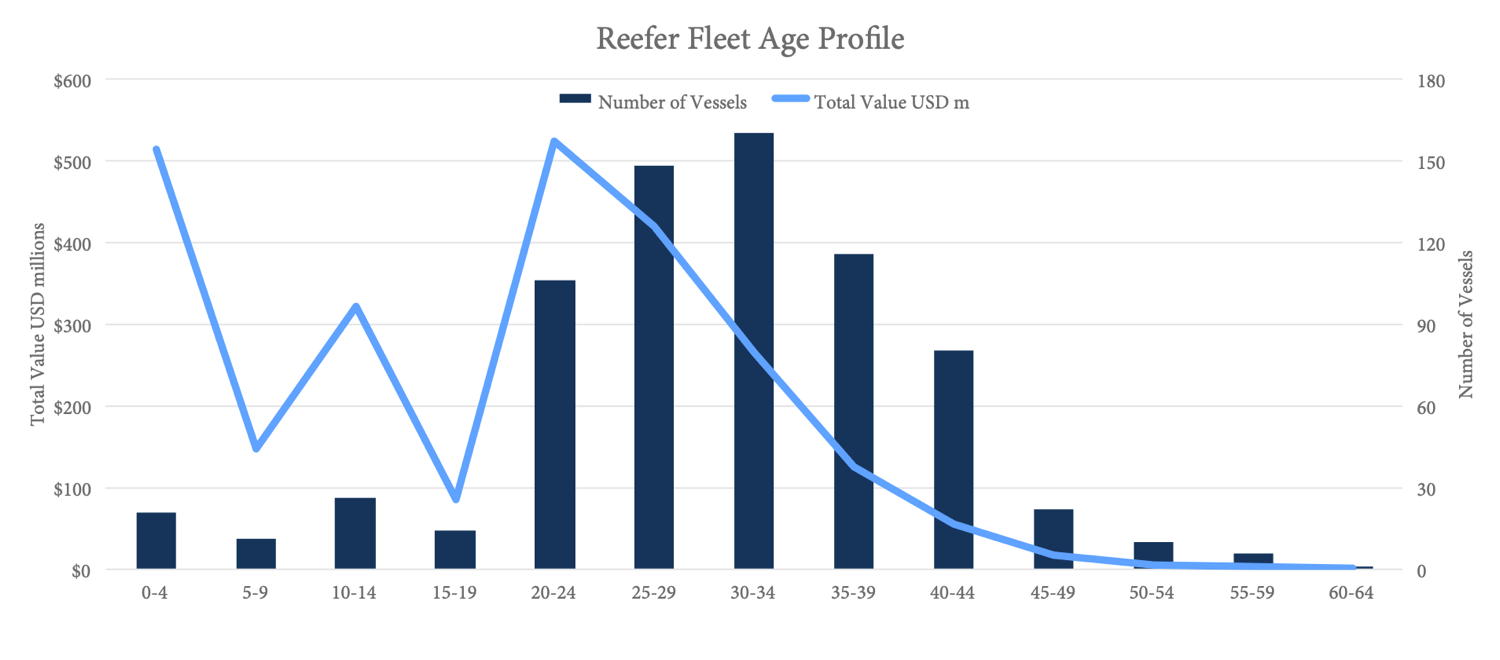

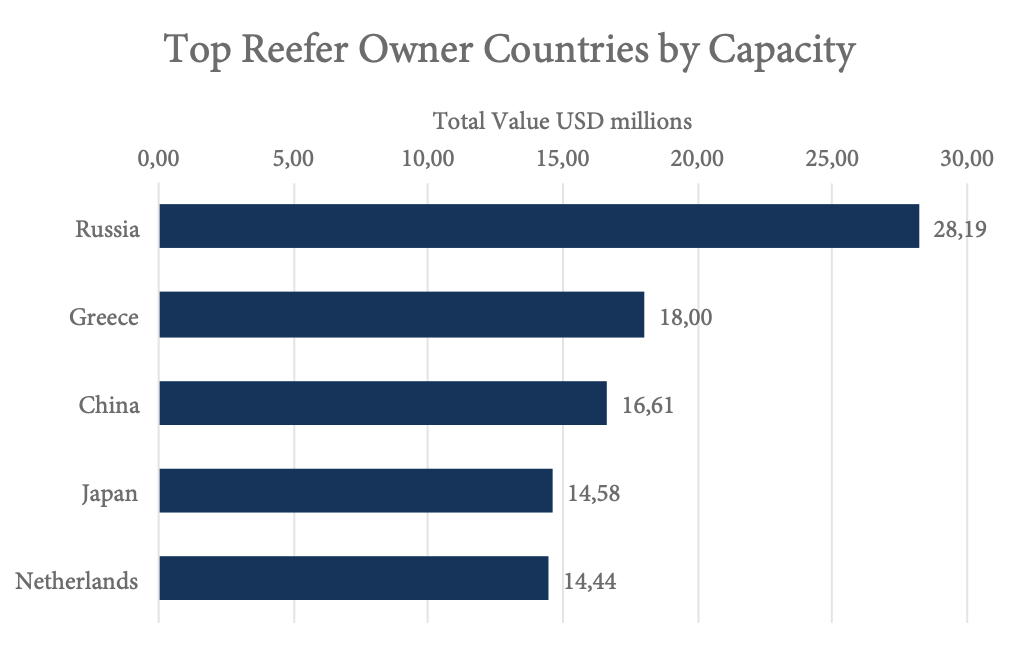

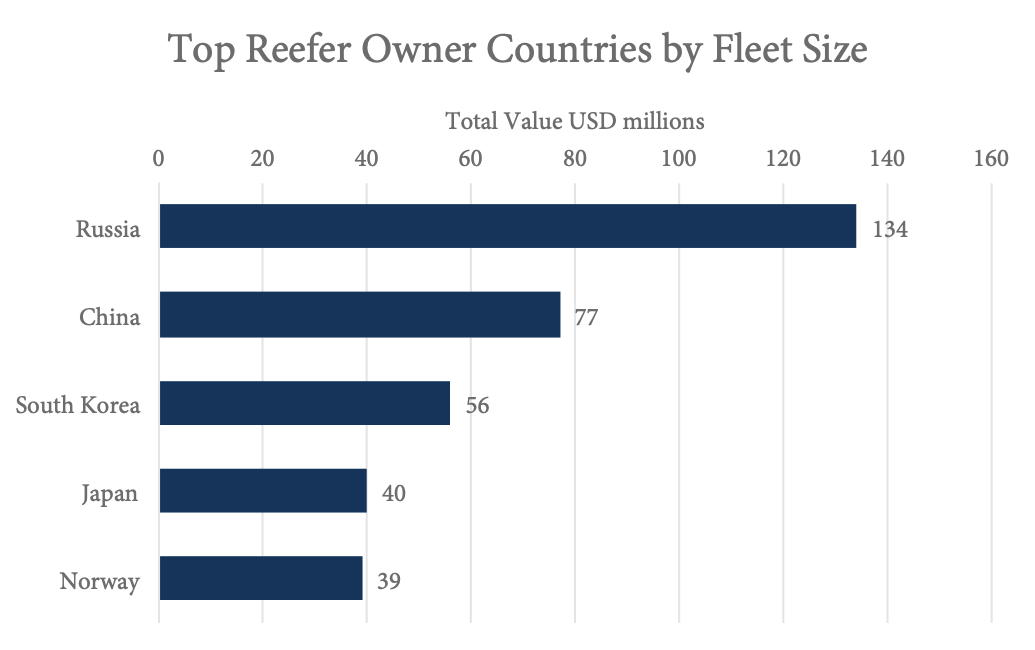

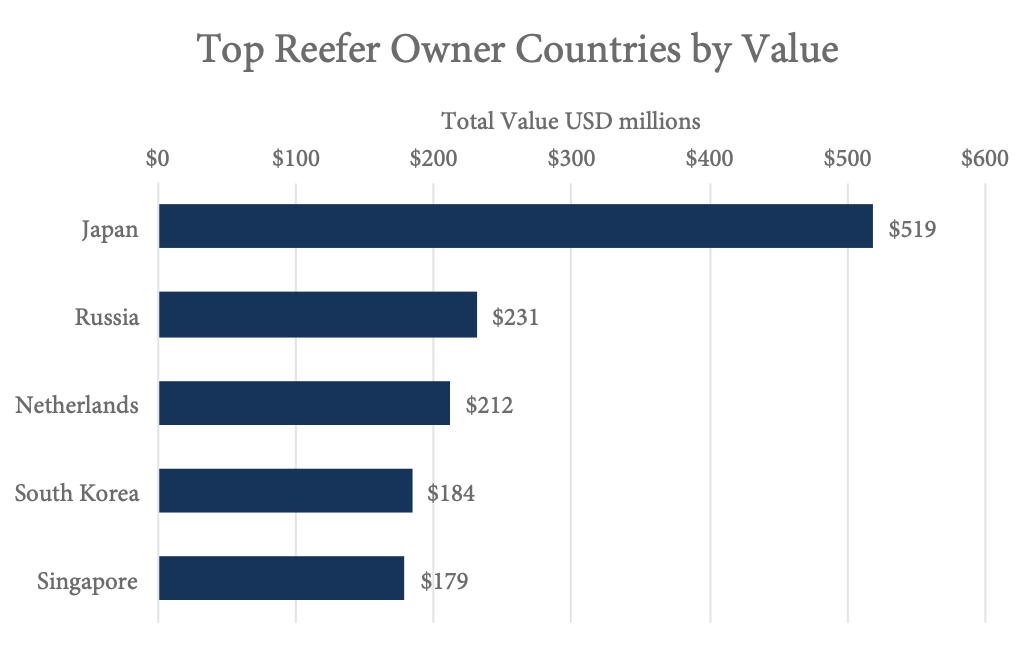

A look at the global reefer fleet’s age profile reveals that young ships are quite rare in this sector. The[ds_preview] largest total capacity (cft) is accumulated in the 20 to 44 years range. Japan is leading the top five list ofreefer owner countries with a fleet worth 519mill. $, followed by Russia (231mill. $), the Netherlands, South Korea and Singapore. In terms of fleet size by number of vessels, Russia is the leading with 134 vessels, followed by China (77), South Korea (56), Japan (40) and Norway (39). Russia is also at the top when it comes to capacity at 28.19mill. cft. Greece is ranked second at 18mill. cft followed by China, Japan and the Netherlands.

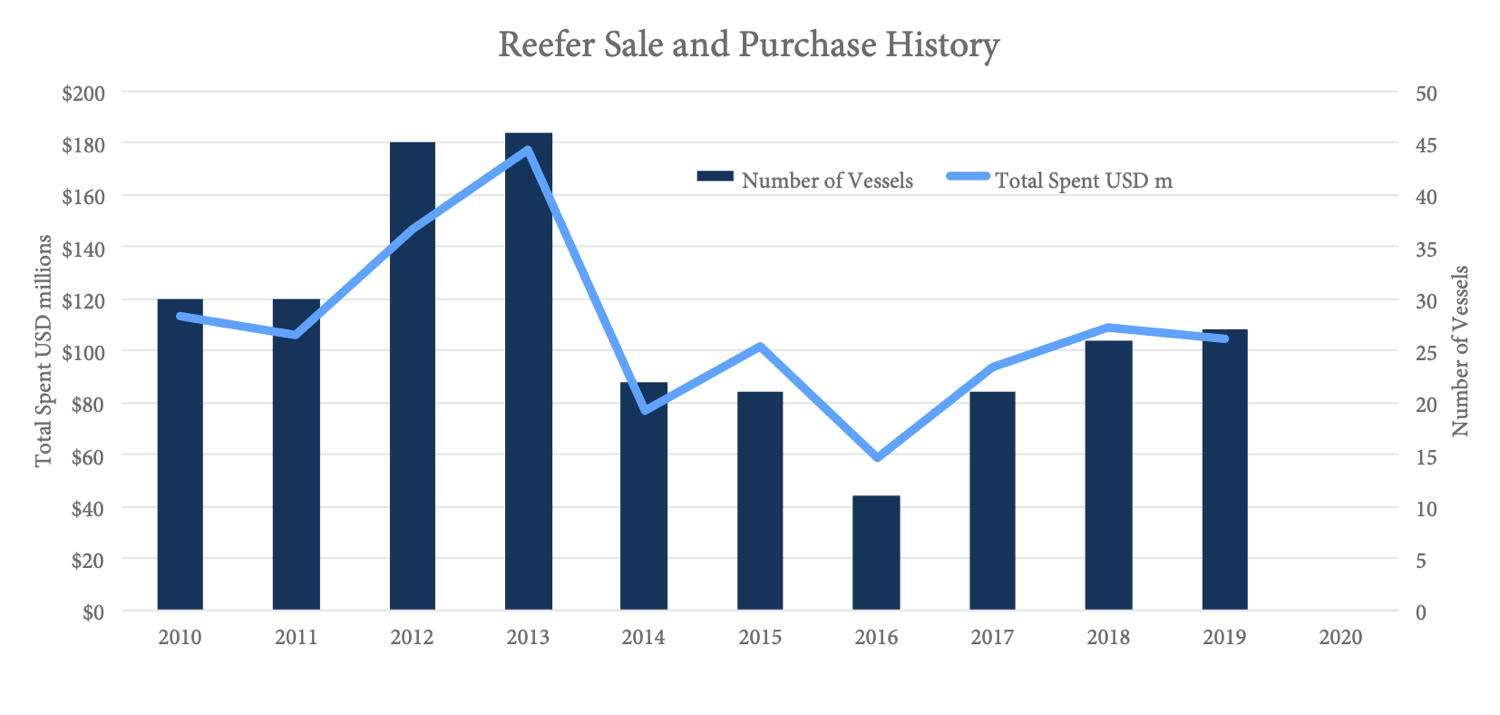

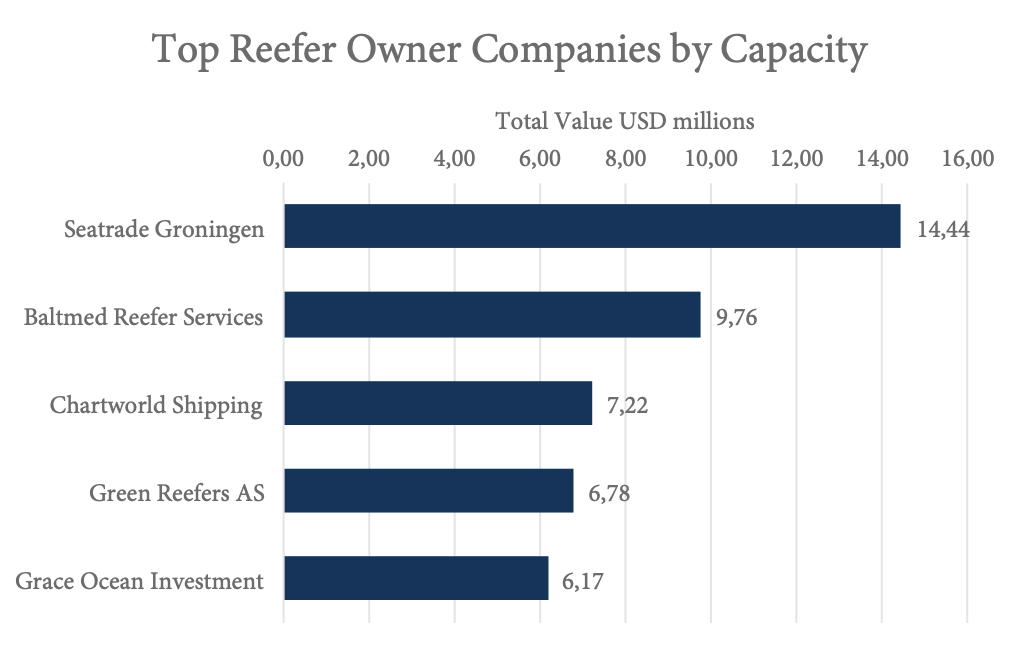

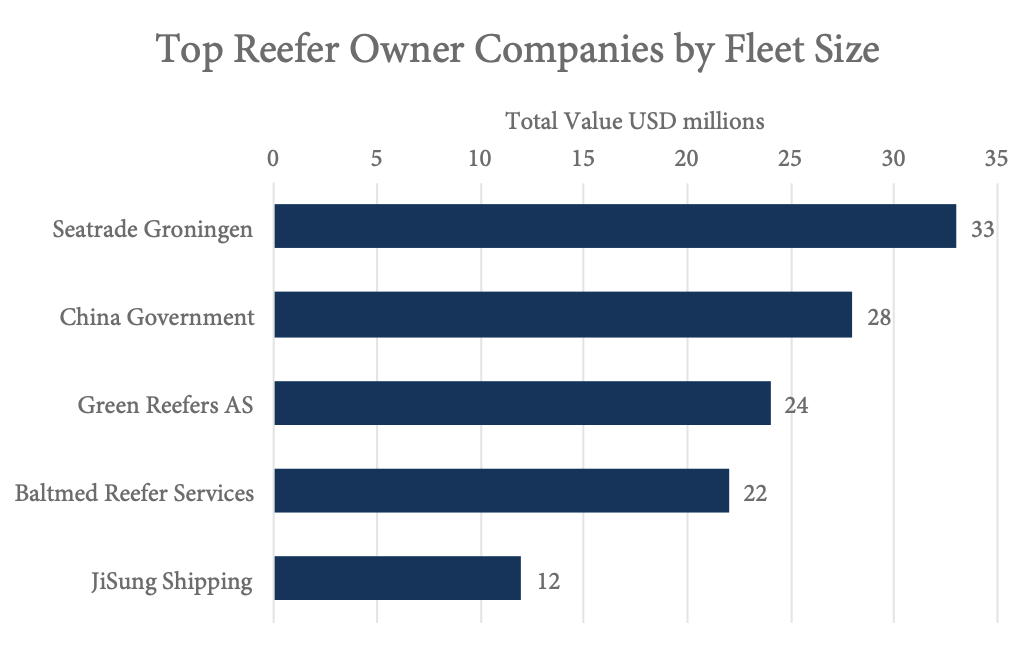

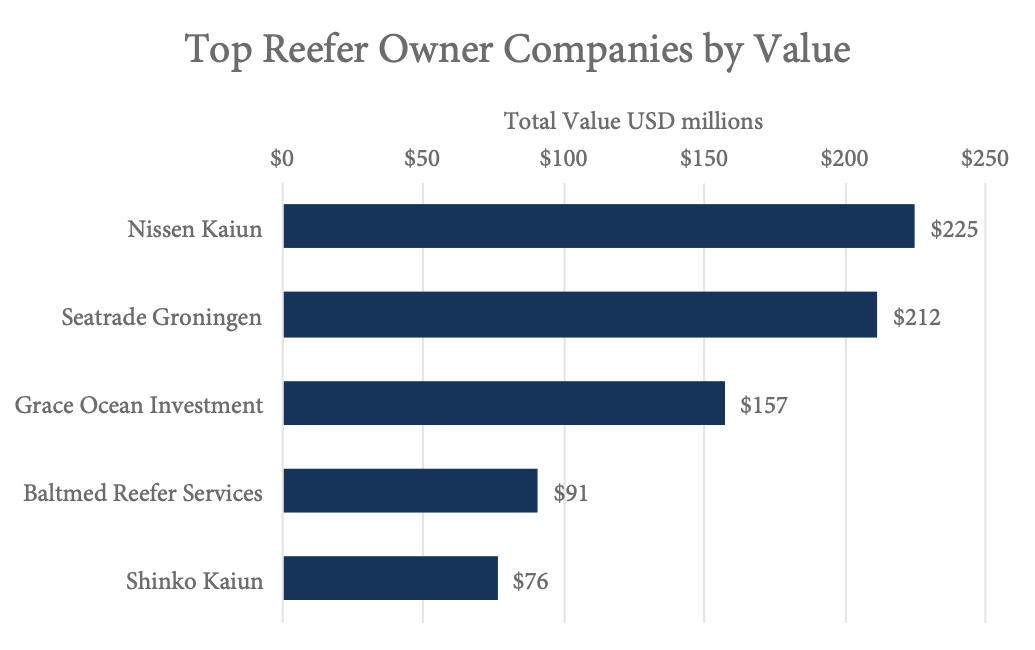

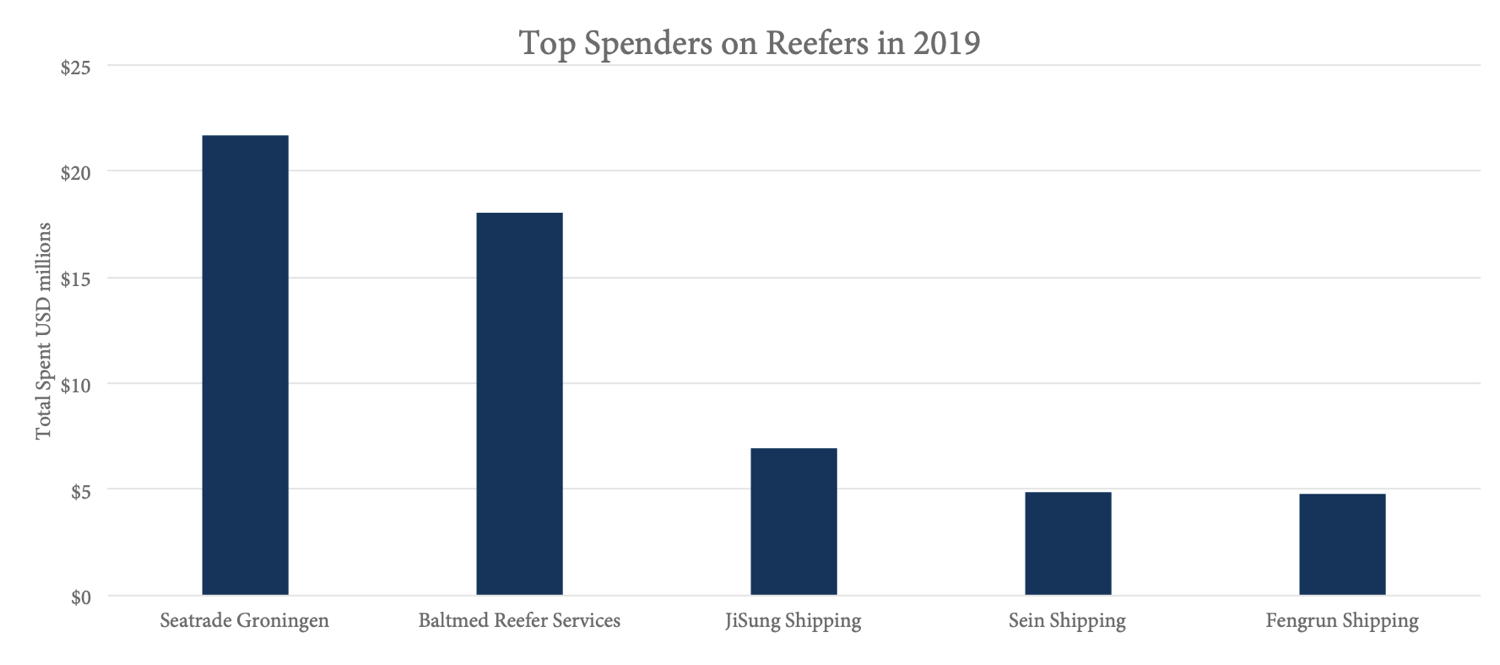

By fleet value, Nissen Kaiun (225mill. $) is number one, with Seatrade Groningen, Grace Ocean Investment, Baltmed Reefer Services and Shinko Kaiun on ranks two to five. Seatrade Groningen has the largest fleet in terms of number of vessels as well as capacity (33 ships, 14.44mill. cft). The Chinese government owns 28 ships but doesn’t make it into the top five in terms of capacity. Second in the top five by capacity is Baltmed Reefer Services, followed by Chartworld Shipping, Green Reefers and Grace Ocean Investment. After a high in 2012 and 2013, second hand reefer sales and purchase activity had slowed down quite a bit to pick up again after 2016. Top spenders in the reefer segment in 2019 were Seatrade Groningen (4 ships, 21.7mill. $), Baltmed Reefer Services (4 ships, 18mill. $), JiSung Shipping, Sein Shipping and Fengrun Shipping.

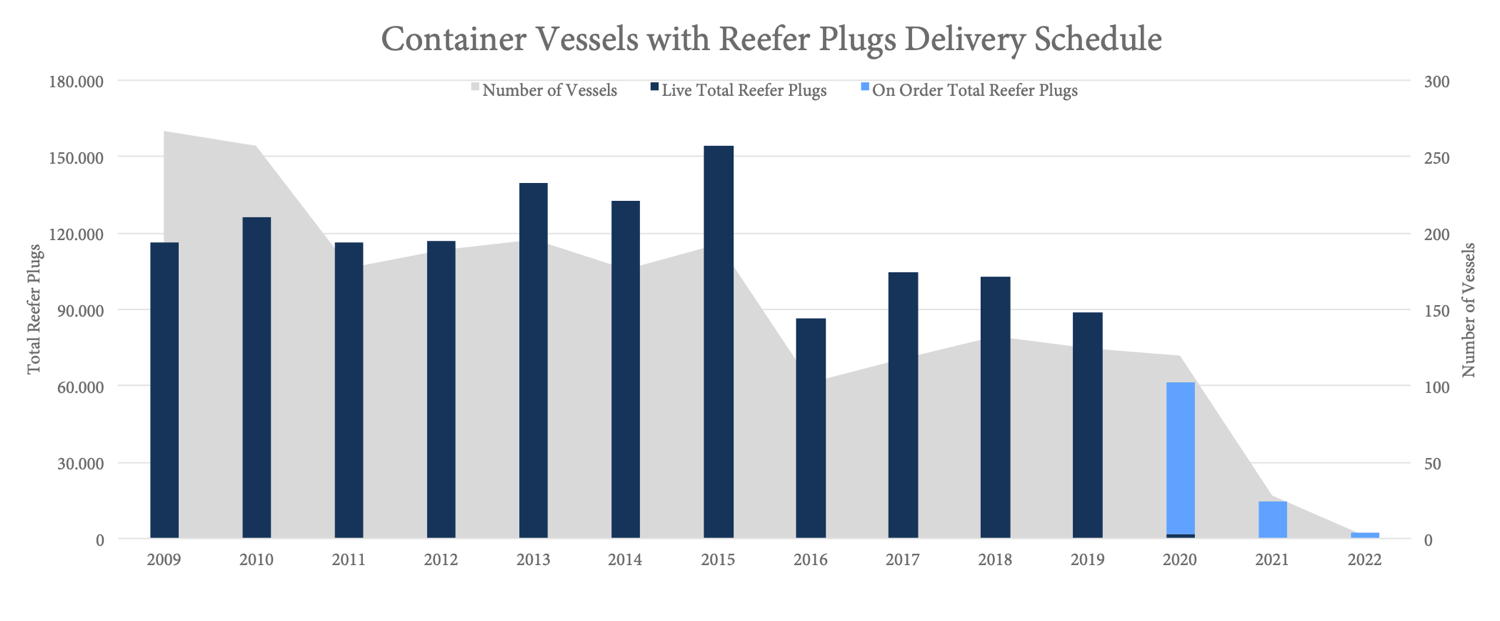

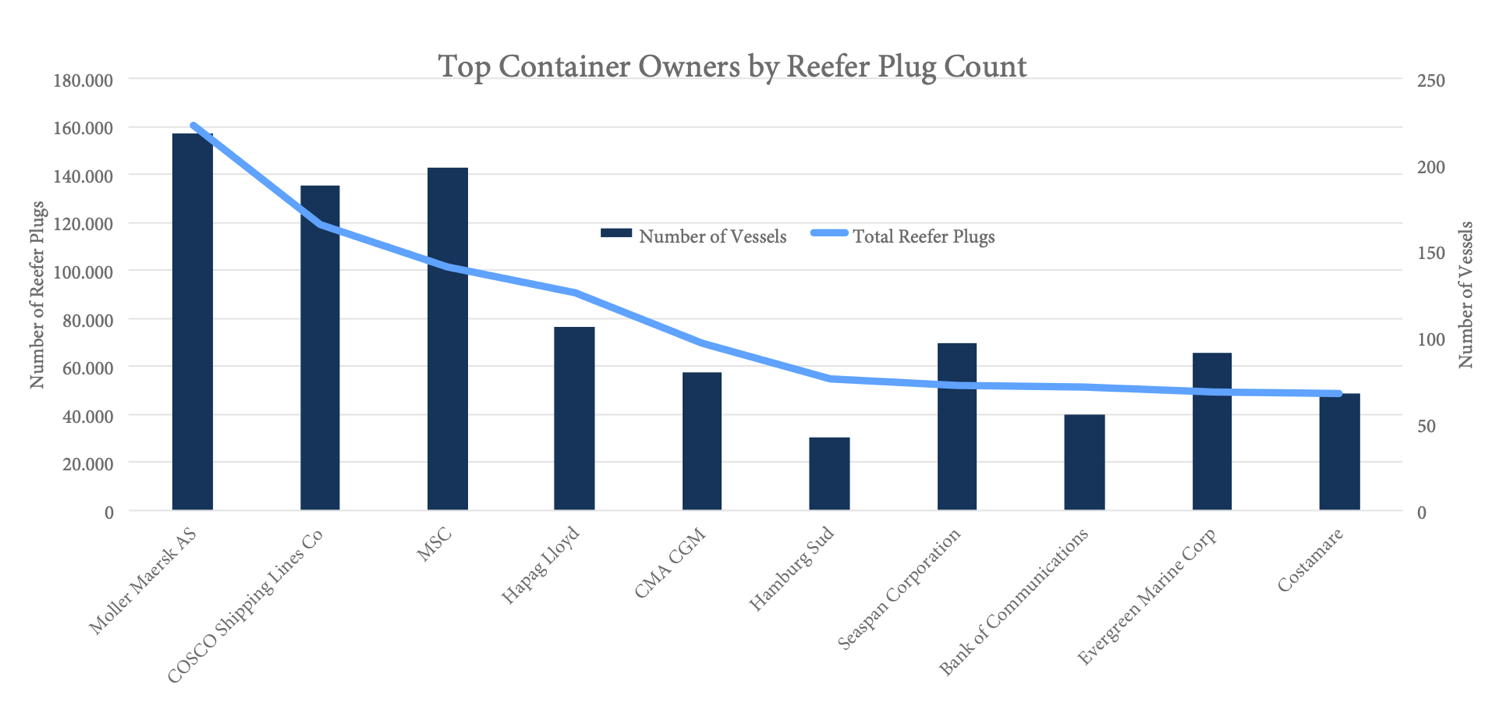

It is no secret that traditional reefer ships face fierce competition from the container sector. Over the last ten years the number of reefer plugs on newcontainer vessels has gone up and still is high compared to the number of vessels delivered – although the overall trend seems to be slowing down a bit now. The top owners by reefer plug count are Maersk, COSCO, MSC, with Hapag-Lloyd coming in fourth and CMA CGM fifth – both with an over-proportionate number of reefer plugs compared to number of vessels.