German shipbuilders are busy! Well-filled orderbooks are creating new jobs, and some shipbuilders are fully booked until the middle of the next decade. However, this positive trend in the German and wider European shipbuilding industry is the great exception within the global shipbuilding market which continues to suffer from poor demand

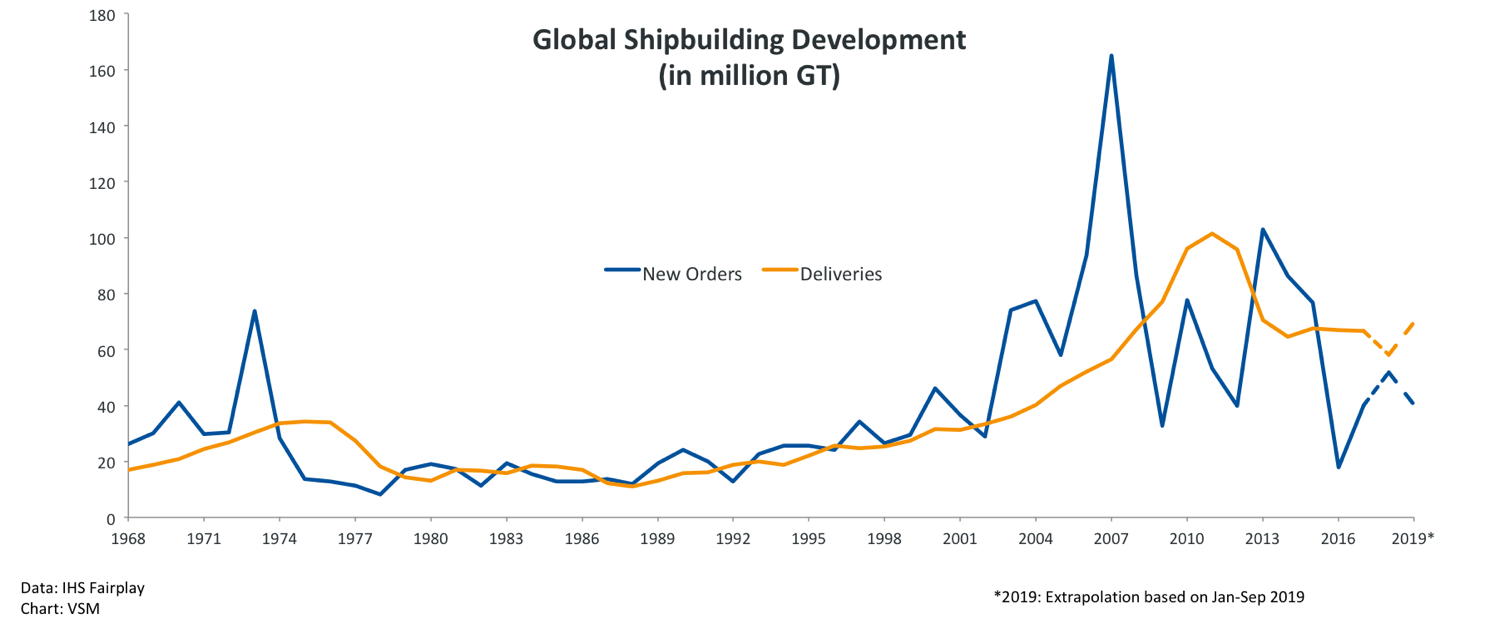

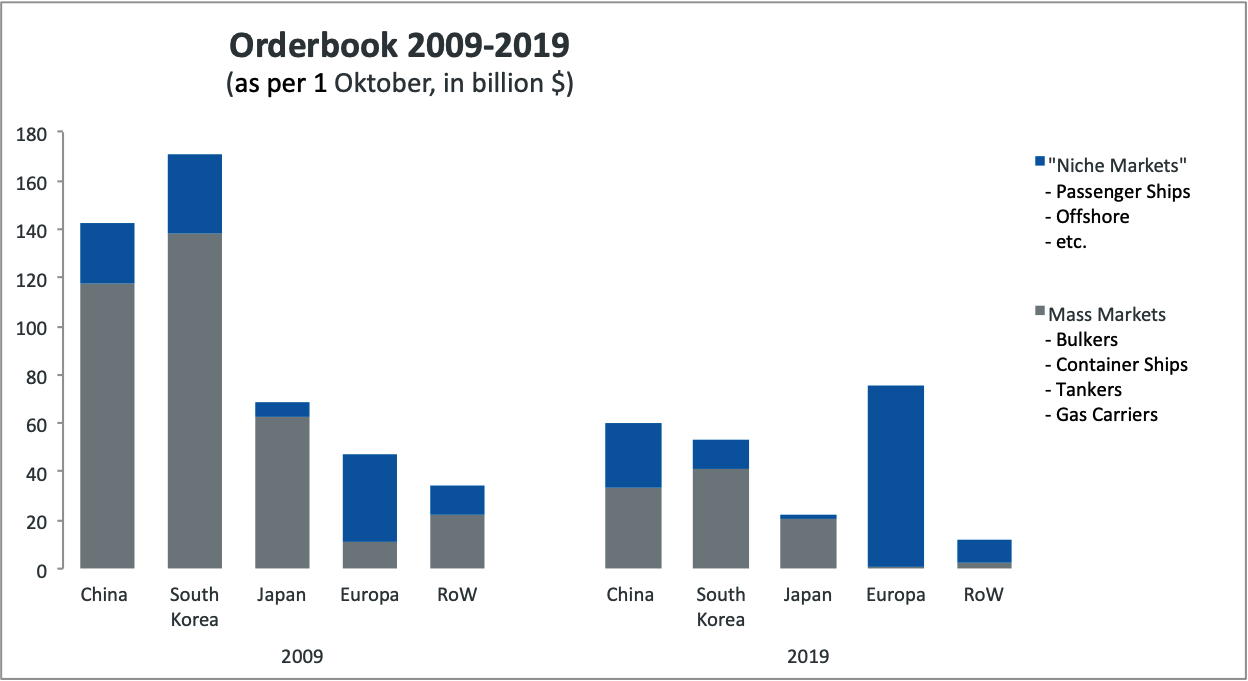

During the first three quarters of 2019, orders received by shipyards globally amounted to 16.7mill. Compensated Gross Tonnes (CGT), 23[ds_preview]% below last year’s figure. The volume of new orders received was even 38% below the total volume of deliveries, further accelerating the shrinkage of the global orderbook. The weak demand spells trouble for shipyards and suppliers around the world. The difficult position of the industry is reflected by statistics. According to industry associations, shipyard payrolls have shrunken by roughly 350,000 employees in China and South Korea alone since 2011. Facing these tough challenges, restructuring and consolidation have become a constant topic for the industry. According to Clarksons Research, the world’s ten largest shipyard groups now control nearly two thirds of the global orderbook, compared to only one third in 2007 – and this does not yet take into account the merger of China’s two leading shipbuilding groups, China Shipbuilding Industry Corporation (CSIC) and China State Shipbuilding Corporation (CSSC), which took place in late 2019. The formation of the new China Shipbuilding Group aims at increasing the competitive power of the Chinese maritime industry on the global stage, especially in more sophisticated, high-value segments. Similarly, South Korea’s largest shipbuilder, Hyundai Heavy Industries (HHI), is pursuing the acquisition of compatriot Daewoo Shipbuilding & Marine Engineering (DSME), strongly supported by their largest shareholder, state-owned Korean Development Bank. This would create a giant controlling roughly 18% of the new orders in CGT.

Great demand in niche markets

By September 2019, the global shipbuilding orderbook was at a low 79.6mill. CGT, 6% less than at the end of 2018. China continues to lead the pack, holding a 34% share in the global orderbook by CGT, followed by South Korea (26%), Japan (16%), and Europe (EU 28 + Norway) (15%). The aggregated orderbook of German shipyards reached a volume of about 2mill. CGT at the end of the third quarter 2019. The structure and product range of the German shipbuilding industry has changed significantly since the beginning of the economic and financial crisis in 2008. Apart from a number of consolidations, the industry has largely turned away from building standard ships, focusing on niche markets instead, especially cruise ships, ferries, yachts and other specialised tonnage. By the end of September 2019, these technically highly sophisticated passenger ships accounted for about 97% of the German orderbook. Just 15 years ago, that figure was less than 30%.

For decades the global shipbuilding market has been suffering from overcapacities and poor prices. With competition intensifying, safeguarding a level playing field internationally is a matter of growing urgency for the industry. To make matters worse, a weakening global economy leaves little hope for a recovery any time soon. Trade conflicts and political tensions have caused experts to revise downward their global economical and trade forecasts. For 2019, the Organization for Economic Cooperation and Development (OECD) now estimates the growth rate of the global gross domestic product at no more than 2.9%, the weakest since the financial crisis. The forecast for the next two years likewise remains stagnant around 3%. The assessment of global trade does not look any better: As the year progressed, the World Trade Organisation (WTO) revised its prediction for 2019 downward by more than 50% to a mere 1.2%. Expectations for 2020 are likewise lower than previously forecasted, assuming a trade growth by no more than 2.7%.

Increasing investments in green shipping

For decades the maritime industry has made a significant contribution to growing global trade and wealth. One of the key global challenges it now faces is green shipping as an important measure to support climate and environment protection. Under the current conditions in most freight markets, which are characterised by overcapacities, weak prices and poor profitability, it is extremely difficult for the industry to make the enormous investments necessary to fulfil the green shipping promise to society. Therefore, it may not come as a surprise that cruise lines with their healthy earnings are often pioneering the implementation of clean ship technologies. In fact, emerging technologies and the smart use of digitalisation harbour great potential for growth, progress and more effective environment protection. Meanwhile, stricter international environmental standards and emission limits leave no other option than to reduce the industry’s ecological footprint.

On 1 January 2020, a new regulation by the International Maritime Organisation (IMO) took effect that lowers the permissible sulphur content of fuel for oceangoing ships from 3.5% to 0.5%. There are several ways to comply with this regulation: Ships may use low-sulphur fuel or marine gas oil instead of the conventional HFO, or install exhaust gas cleaning systems (so-called scrubbers). According to DNV GL, 3,756 ships equipped with scrubbers were in service or on order globally by September 2019. Three quarters of these scrubber installations where retrofits of vessels in service. Using LNG as an alternative fuel is another way to reduce sulphur emissions. 354 LNG-powered ships were in operation or on order. Another 141 ships were designed for conversion to LNG and have »LNG ready« status. The number of orders of LNG-fuelled vessels grew substantially during the year 2019. Battery power is currently used by 369 vessels (in service or on order). Other promising alternative fuels, some of which are being used by several ships already, include LPG, methanol, hydrogen and ammonia. Flexibility and innovation are key to an efficient and sustainable future for the maritime industry.