Despite trade conflicts and protests by local residents, after a very good year and a subsequent weaker year, the St. Lawrence Seaway, as an important gateway to the Great Lakes and North American markets, now expects transport growth again.

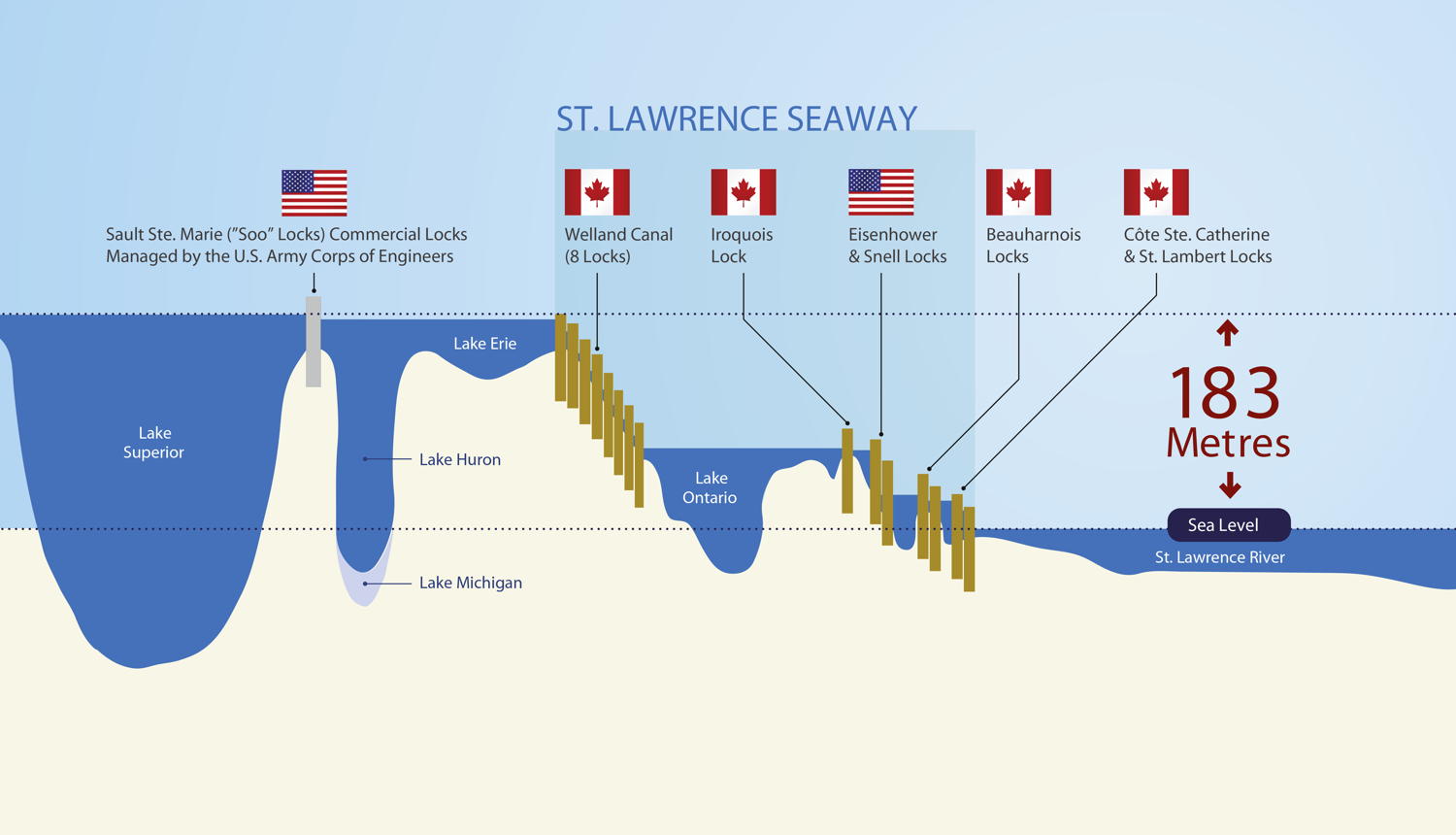

Job creator, economic engine, climate protector – in marketing the 3,700km long cross-border shipping route with 15 locks, the overall[ds_preview] social and industrial significance of the St. Lawrence Seaway plays a major role, if not the decisive one.

While the rest of the not (maritime) world knows about all the large container ports on the east and south-west coasts as well as some commodity ports in the south as gateways to the North American markets, the waterway and Great Lakes system in the border area between the USA and Canada sometimes comes off a little short in public perception.

However, a large number of ports – up to 40 locations, depending on the way they are counted – and shipping routes testify to very good location factors of the river and the Great Lakes. But lately there have been problems in water transport. The volume of goods shrank by 6.43% to 38.38mill. t over the past year.

Less transports

Throughout 2019, high water levels on Lake Ontario and the St. Lawrence River made the navigation season very challenging. »The SLSMC, in concert with the U.S. Saint Lawrence Seaway Development Corporation, worked quickly and collaboratively to support the IJC’s International Lake Ontario St. Lawrence River Board efforts to grant shoreline communities the greatest possible relief from high water levels,« the Canadian St. Lawrence Seaway Management Corporation said. Special mitigation measures were taken, such as reduced speed limits and one-way navigation in certain sectors of the river. »From farmers eager to realize the sales of their crops to municipalities dependent upon ships for the supply of road salt, the Seaway demonstrated its ability to serve as a sustainable and reliable transportation artery for a vast array of clients,« said Terence Bowles, President and CEO of the SLSMC.

The number of ship transits declined by 5.8% to 4,136. In detail, the transport of grain dropped by 15% to 38.4mill. t. The General Cargo segment even experienced a slump of 34% to 2.2mill. t. Shipments of iron ore (6.9mill. t.) and coal (2.4mill. t) were also down at year-end. Growth was only recorded in the liquid bulk segment that was up by 2.35% to 4.7mill. t.

When assessing the transport figures, SLSMC considers it important to take account of external circumstances and to include special features. »The 2019 tonnage results on the Seaway reflected the more challenging conditions encountered last year as compared to 2018, in which Seaway tonnage was at a ten year high,« SLSMC said. The waterway is not the only one experiencing this. In 2018, major US container ports also recorded strong growth. However, there was no repeat of the cargo front-loading that took place in the last quarter of 2018 to avoid the punitive import tariffs that were to be imposed on Chinese imports to the US.

But trade disputes are not considered to be the only cause of the declines. »Trade tensions, difficult navigational conditions due to very high water flows within the St. Lawrence River, combined with adverse weather conditions impacting grain harvests, all served to restrain total cargo volumes,« it is said, adding that »there is little doubt that trade tensions certainly were felt within the shipping industry.«

Confidence is back

For the current year, SLSMC is not too pessimistic. Like the US port association AAPA, the border region is waiting for a new North American trade agreement following the rapprochement between the US government and China (»Phase One«). Businesses bet on the House and Senate approved US-Mexico-Canada Agreement (USMCA) which is described as »an important step for enhancing the ability of seaports to deliver jobs, economic opportunities, and efficient movement of goods and people«. SLSMC states: »We earnestly hope that the implementation of the USMCA will be one of several improvements within the global trading arena, providing for a better cargo outlook in 2020.«

In the course of the water level development, those responsible in politics and industry had to deal with an additional challenge.

Despite all the obvious advantages for the economy of the region, there is also a headwind for shipping. Last year, for example, there were resident protests along the Upper St. Lawrence River between Montreal and Lake Ontario because of the elevated water levels in the river. The shipping industry had argued that higher water levels were needed to be able to sail fully loaden down to Montreal with bulkers. Residents, however, are concerned about the safety of their properties, as even small waves are crossing on to their waterfront properties. Some of the critics argue that bow waves from passing ships have eroded significant proportions of their waterfront properties. For a moment it seemed it would be difficult to find a compromise. Hydraulic engineering experts proposed measures to increase the productivity of shipping without requiring higher water levels. Ideas included innovative pumping systems for the locks, coupled systems for ships, bow wave deflectors and ship wake deflectors.

So far, there is no official statement of the SLSMC regarding the progress of safety measures or talks with navigation stakeholders.

For the St. Lawrence Seaway and the Great Lakes region (that would allegedly be the fourth largest economy in the world if it were a country) the development also depends on the global and regional trade (and environmental) policies in the US and Canada.

US presidential elections are pending in November, it remains to be seen which impact the election campaign will have on the rhetoric and on the activities of the political leaders involved. Despite the shifts in trade policy and in trade flows, those responsible do not expect any significant changes in cargo types and all in all they are more confident when looking into the future.

Fleet additions

In the meantime, shipping companies work on the modernization of their fleets. For example, Italian shipbuilding group Fincantieri works on a Great Lakes bulker for Interlake Steamship at its subsidiary site Bay Shipbuilding in Wisconsin. It is the first time in 35 years, a new bulk carrier is being built for the Great Lakes in North America. The vessels will operate as a river-sea vessel under US flag – with 195 m length, 24 m beam, almost 14 m draught and a deadweight tonnage of 28,000 dwt. For Interlake Steamship Company this is the first newbuilding since 1981. Completion of the bulk carrier is scheduled for 2022. According to Interlake, the self-unloader has a »unique cargo bay layout and hatch cover designed for maximum space and the ability to handle difficult loads.

The Canadian shipowner Fednav operates a large fleet of mostly ice-class and ice-breaking bulk carriers in Arctic waters and around the world. The latest delivery, their 50th vessel classed by DNV GL, is aid to set new standards for efficiency, cutting greenhouse gas emissions by 30%. In August 2019 the Canadian shipowning company took delivery of its latest 34,500 dwt ice-class handysize bulk carrier »Federal Montreal« from Oshima Shipbuilding.

»Federal Montreal« is a so-called laker, with proportions specifically designed to navigate the St Lawrence Seaway and the Great Lakes. Compared to typical bulk carriers which have a length-to-beam ratio of 5.5 or 6 to 1, lakers are narrower, with a ratio of roughly 9 to 1. This results in structural challenges requiring very careful design considerations, DNV GL states. Federal Montreal will trade internationally as well as up the St Lawrence River and the Great Lakes region and is one of six newbuilds contracted to Oshima Shipbuilding as part of Fednav’s vessel replacement programme.

The industry is facing huge challenges, says Tom Paterson, senior VP Ship Owning, Arctic and Projects, at Fednav: »The short-term challenge is cash flow. The medium-term challenge is knowing when and what to build. We are now looking at ‘Generation 4’ lakers which will be Tier III-compliant and only consume about 19 tonnes of fuel per day at 14kn, instead of 29t of fuel per day like our first-generation lakers built 20 years ago.« These new vessels shall have the same length and beam as their older sisters, but the new design is supposed to result in »huge savings in fuel costs and emissions«.

Michael Meyer