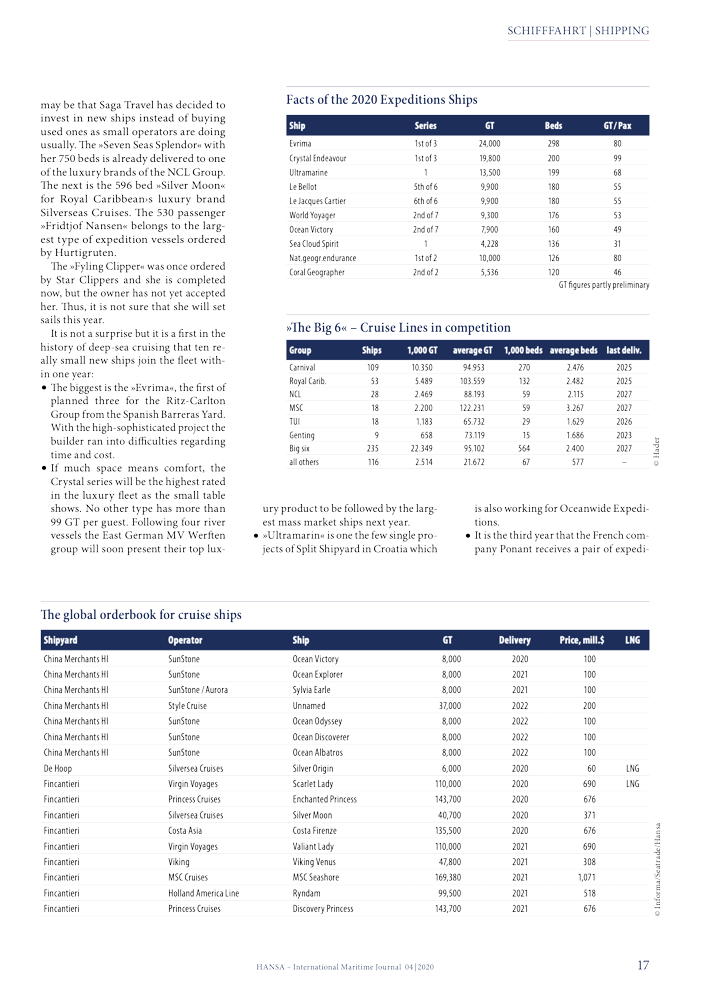

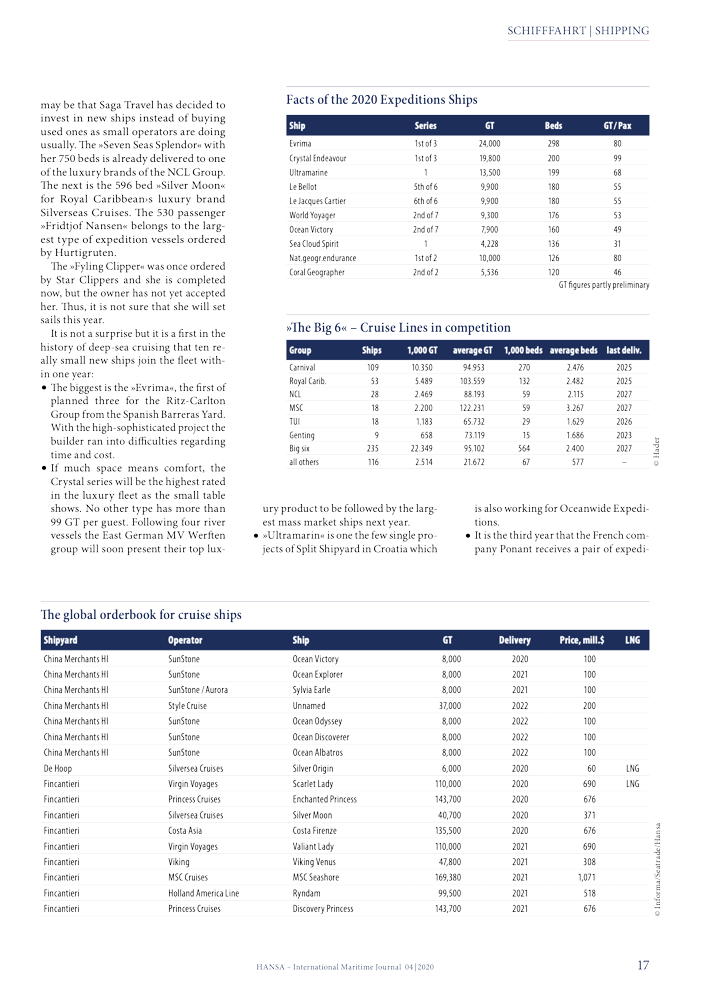

The average GT size of ships in the world cruise fleet will decrease over the course of 2020

for the first time in decades.

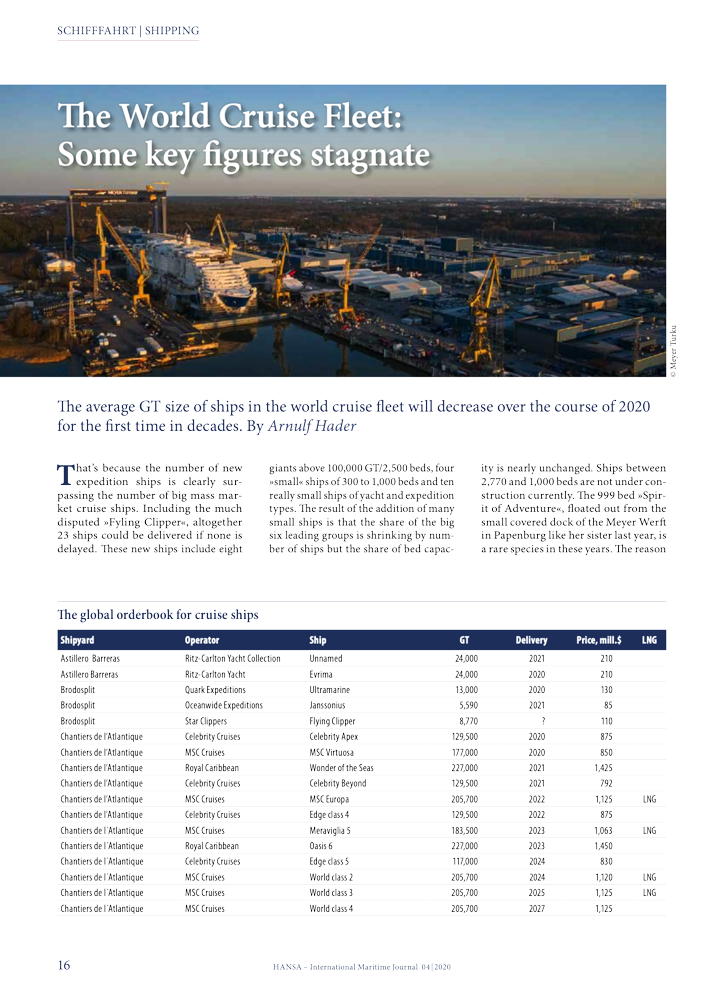

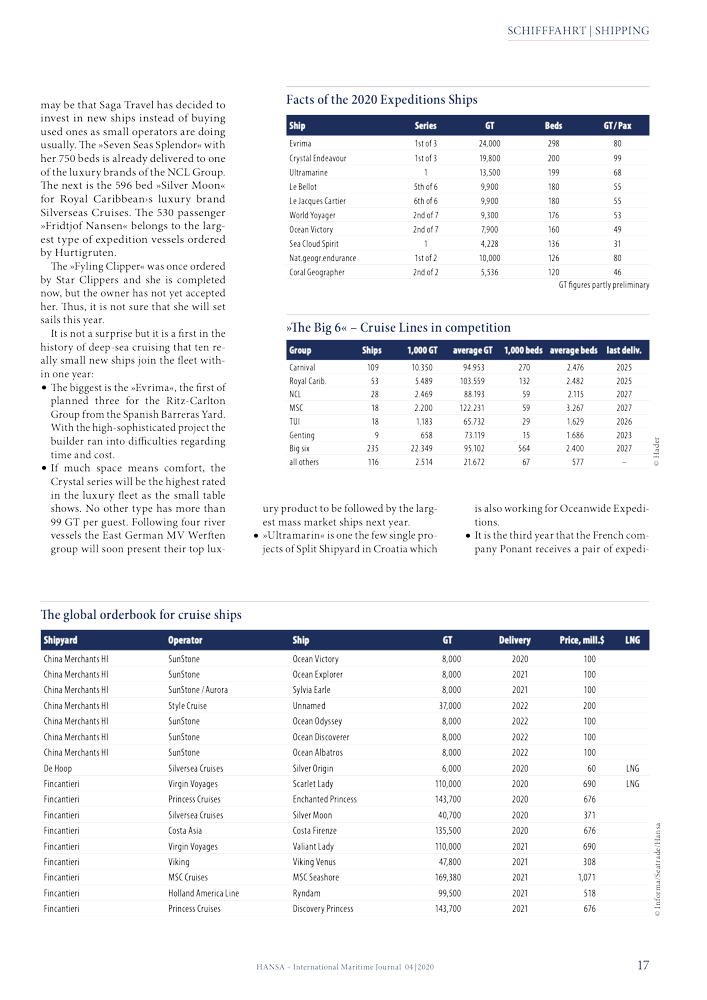

That’s because the number of new expedition ships is clearly surpassing the number of big mass market cruise ships. Including[ds_preview] the much disputed »Fyling Clipper«, altogether 23 ships could be delivered if none is delayed. These new ships include eight giants above 100,000 GT/2,500 beds, four »small« ships of 300 to 1,000 beds and ten really small ships of yacht and expedition types. The result of the addition of many small ships is that the share of the big six leading groups is shrinking by number of ships but the share of bed capacity is nearly unchanged. Ships between 2,770 and 1,000 beds are not under construction currently. The 999 bed »Spirit of Adventure«, floated out from the small covered dock of the Meyer Werft in Papenburg like her sister last year, is a rare species in these years. The reason may be that Saga Travel has decided to invest in new ships instead of buying used ones as small operators are doing usually. The »Seven Seas Splendor« with her 750 beds is already delivered to one of the luxury brands of the NCL Group. The next is the 596 bed »Silver Moon« for Royal Caribbean›s luxury brand Silverseas Cruises. The 530 passenger »Fridtjof Nansen« belongs to the largest type of expedition vessels ordered by Hurtigruten.

The »Fyling Clipper« was once ordered by Star Clippers and she is completed now, but the owner has not yet accepted her. Thus, it is not sure that she will set sails this year.

It is not a surprise but it is a first in the history of deep-sea cruising that ten really small new ships join the fleet within one year:

• The biggest is the »Evrima«, the first of planned three for the Ritz-Carlton Group from the Spanish Barreras Yard. With the high-sophisticated project the builder ran into difficulties regarding time and cost.

• If much space means comfort, the Crystal series will be the highest rated in the luxury fleet as the small table shows. No other type has more than 99 GT per guest. Following four river vessels the East German MV Werften group will soon present their top luxury product to be followed by the largest mass market ships next year.

• »Ultramarin« is one the few single projects of Split Shipyard in Croatia which is also working for Oceanwide Expeditions.

• It is the third year that the French company Ponant receives a pair of expedition vessels from the Norwegian Vard Group, »Le Bellot« »Le Jacques Cartier«. The yards hopes to finish the third pair a few weeks before the contract date.

• The Portuguese Mystic Group announced to build up to ten expedition vessels and seven orders are already fixed. »World Voyager«, the second one, will also be marketed by Nicko Cruises of Germany, but the others are for the American brand Atlas Ocean Voyages. For the first ship of the series the operators had to wait longer than expected and Quark Expeditions was forced to cancel the first winter season.

• »Ocean Victory« is also the second of seven as long as the series is not extended to ten as planned. Builder is China Merchants Heavy Industries and the design with the unusual X-Bow is developed by Ulstein. Operator SunStone is modernizing its collection of elderly and converted expedition ships which are operated by various charterers.

• »Sea Cloud Spirit« is the long expected third sailing ship for the German owner of the famous »Sea Cloud«.

• Following several second-hand acquisitions, Lindblad National Geographic joined the other operators in the newbuilding rush. Lindblad has already commissioned two coastal ships from an U.S. builder and now too ships are launched in Poland for completion by Ulstein.

• The »Coral Geographer« follows last year’s »Coral Adventurer« of the Australian company which expands from Australian coastal shipping to Indonesian island hopping. The builder Vung Tau in Vietnam is member of the Vard Group.

• The completion of Glen Moroney’s »Scenic Eclipse II« is postponed. The construction of the first ship by Uljanik Shipyard took much more time than expected and recently the yard was declared bankrupt finally. The keel of the sister ship is not yet laid apparently; otherwise one had not taken the decision to entrust the construction to 3 Maj Shipyard of Rijeka for launching in 2021.

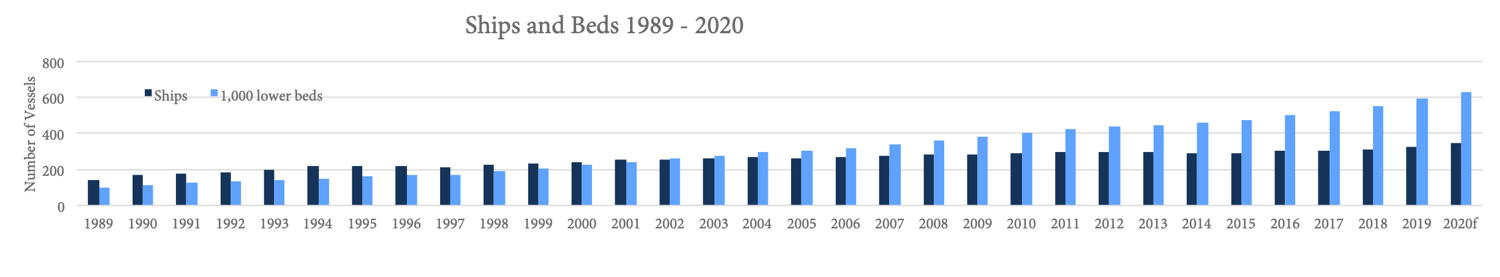

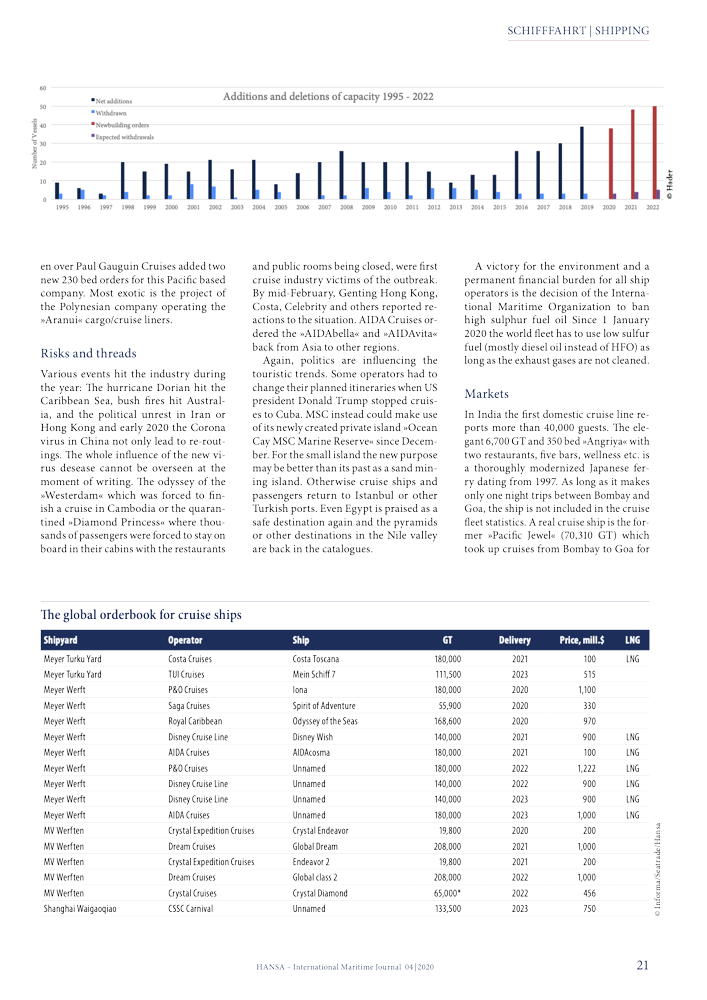

If all these 23 ships in the orderbook will be delivered as planned until December, the world fleet could increase by 1.5mill. GT and 38,000 lower beds. The new total fleet size could reach 25.1mill. GT and 631,000 beds in 350 ships. The next months will show. Probably a few ships will leave the actual fleet. Up to now, no definite withdrawals have been announced, but a few old ships the future of which is not yet decided are already out of order. Among these is the »Delphin« of 1975 which is still waiting in Rijeka for a new charter or owner. The »Saga Pearl II«, formerly the first »Astor« of 1981, is offered for sale by Saga Travel. And the sale for scrap of a few more small ships would not surprise.

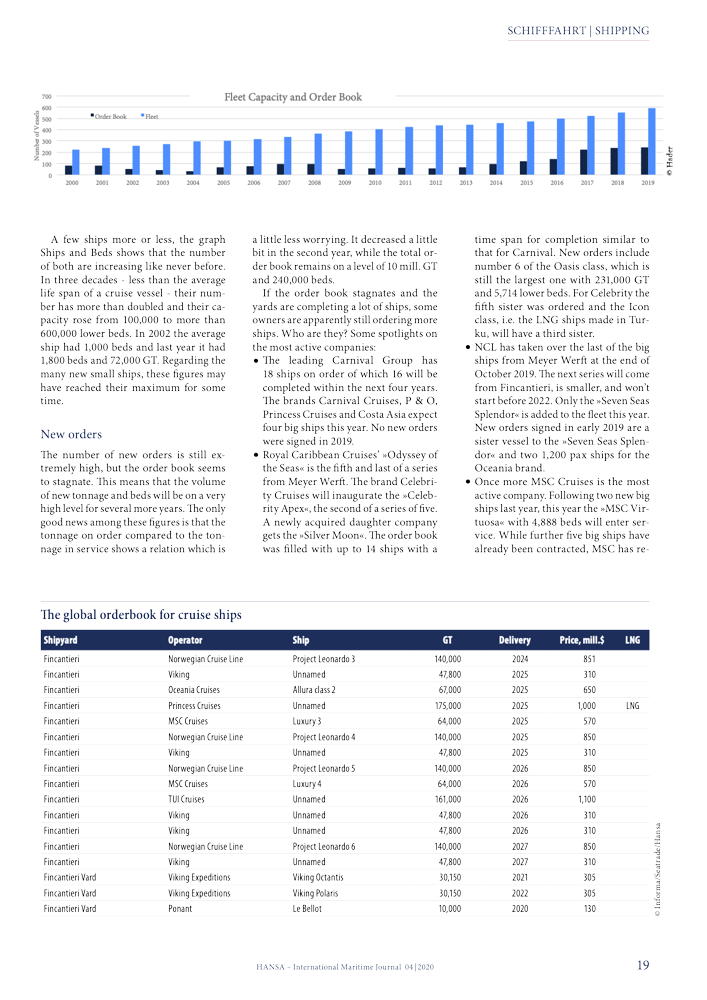

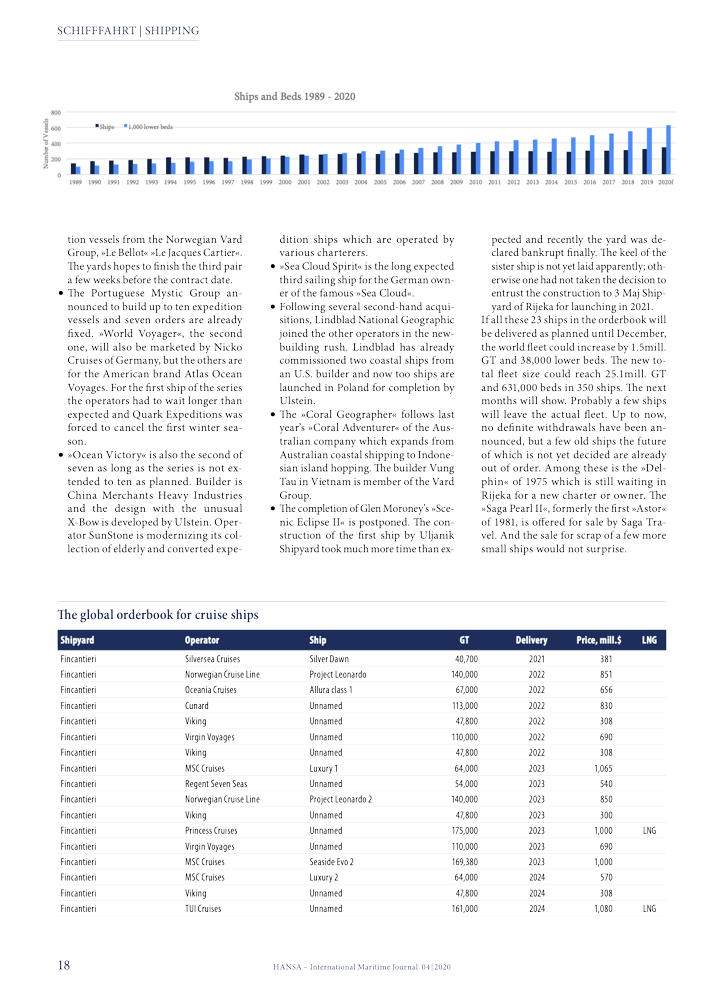

A few ships more or less, the graph Ships and Beds shows that the number of both are increasing like never before. In three decades – less than the average life span of a cruise vessel – their number has more than doubled and their capacity rose from 100,000 to more than 600,000 lower beds. In 2002 the average ship had 1,000 beds and last year it had 1,800 beds and 72,000 GT. Regarding the many new small ships, these figures may have reached their maximum for some time.

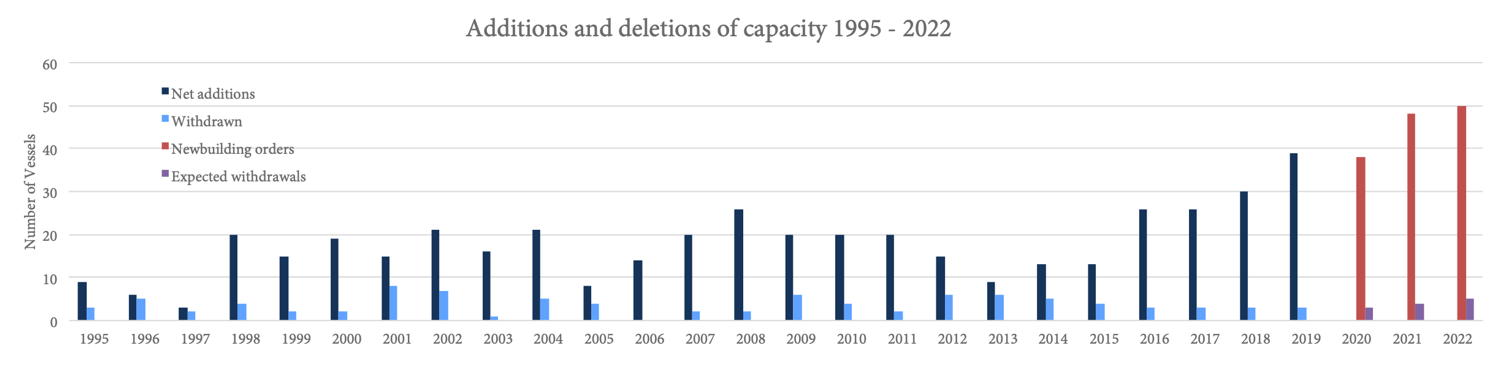

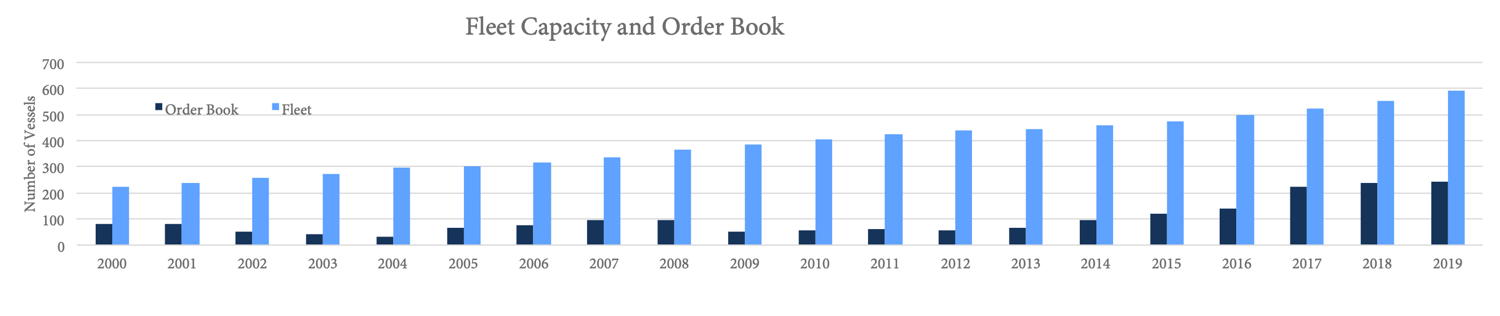

New orders

The number of new orders is still extremely high, but the order book seems to stagnate. This means that the volume of new tonnage and beds will be on a very high level for several more years. The only good news among these figures is that the tonnage on order compared to the tonnage in service shows a relation which is a little less worrying. It decreased a little bit in the second year, while the total order book remains on a level of 10mill. GT and 240,000 beds.

If the order book stagnates and the yards are completing a lot of ships, some owners are apparently still ordering more ships. Who are they? Some spotlights on the most active companies:

• The leading Carnival Group has 18 ships on order of which 16 will be completed within the next four years. The brands Carnival Cruises, P & O, Princess Cruises and Costa Asia expect four big ships this year. No new orders were signed in 2019.

• Royal Caribbean Cruises’ »Odyssey of the Seas« is the fifth and last of a series from Meyer Werft. The brand Celebrity Cruises will inaugurate the »Celebrity Apex«, the second of a series of five. A newly acquired daughter company gets the »Silver Moon«. The order book was filled with up to 14 ships with a time span for completion similar to that for Carnival. New orders include number 6 of the Oasis class, which is still the largest one with 231,000 GT and 5,714 lower beds. For Celebrity the fifth sister was ordered and the Icon class, i.e. the LNG ships made in Turku, will have a third sister.

• NCL has taken over the last of the big ships from Meyer Werft at the end of October 2019. The next series will come from Fincantieri, is smaller, and won’t start before 2022. Only the »Seven Seas Splendor« is added to the fleet this year. New orders signed in early 2019 are a sister vessel to the »Seven Seas Splendor« and two 1,200 pax ships for the Oceania brand.

• Once more MSC Cruises is the most active company. Following two new big ships last year, this year the »MSC Virtuosa« with 4,888 beds will enter service. While further five big ships have already been contracted, MSC has recently added two more contracts of its biggest class (205,700 GT / 5,264 beds) and four 960 bed luxury ships to its order book. Plans for another four giants and a new class of sail-assisted vessels are being discussed. MSC is ready to push NCL from the third rank of the world’s biggest operators. The latest four contracted ships and the two series in planning stages comprise a volume of 6.5 bn €.

• The German TUI Group is also not able to report new contracts. The spectacular news is that TUI has sold 50% of the tradition-rich German brand Hapag-Lloyd Cruises to Royal Caribbean Cruises who are holding already 50% in the JV TUI Cruises, the operators of the »Mein Schiff« series. The third brand under the roof of TUI is the British subsidiary Marella Cruises. TUI plans to invest the new liquidity in more new cruise ships.

• The Genting Group is building up the workforce of its shipyards at the German Baltic Sea coast and two projects are nearing completion: The first ship of the Crystal Yacht Expedition series is due in summer and the first of the 205,000 GT giants is in the covered outfitting dock in Wismar. It will debut next year as cruise ship with the highest number of beds – 9,500 including upper beds. A new series was announced with 2,000 beds on 88,000 GT ships.

These new contracts of the big groups alone add up to 33,000 beds and keep the order book on its high level. It may be expected that the biggest groups order most new ships, but first of all Mediterranean Shipping Cruises (MSC) seems not to see any limitations of cruising. Not the fight against air pollution, not the over-tourism in famous ports and not world-wide influence of young climate activists seem to delay the expansion of the company in any form. The order book of MSC reaches already as far asr 2027. Has MSC recognized the problems before they announced that all emissions would be compensated by programmes for reforestation and protection of the seas costing many millions per year?

Some more projects are worth mentioning. The shipyard group China Merchant Industry Holding has won a new contract plus options from Shanghai Style Cruise for a 37,000 GT / 660 beds ship. Last year it successfully completed the »Greg Mortimer« (7,892 GT / 160 beds) for SunStone Ships as first deep-sea cruise ship from a Chinese shipyard and as first of a longer series. Contrary to several European builders delivery was on time.

The river cruise operator Vodohod of Russia joined the run for expedition ships and contracted two of them with 148 beds with Arctech of Helsinki. The French company Ponant which has taken over Paul Gauguin Cruises added two new 230 bed orders for this Pacific based company. Most exotic is the project of the Polynesian company operating the »Aranui« cargo/cruise liners.

Risks and threads

Various events hit the industry during the year: The hurricane Dorian hit the Caribbean Sea, bush fires hit Australia, and the political unrest in Iran or Hong Kong and early 2020 the Corona virus in China not only lead to re-routings. The whole influence of the new virus desease cannot be overseen at the moment of writing. The odyssey of the »Westerdam« which was forced to finish a cruise in Cambodia or the quarantined »Diamond Princess« where thousands of passengers were forced to stay on board in their cabins with the restaurants and public rooms being closed, were first cruise industry victims of the outbreak. By mid-February, Genting Hong Kong, Costa, Celebrity and others reported reactions to the situation. AIDA Cruises ordered the »AIDAbella« and »AIDAvita« back from Asia to other regions.

Again, politics are influencing the touristic trends. Some operators had to change their planned itineraries when US president Donald Trump stopped cruises to Cuba. MSC instead could make use of its newly created private island »Ocean Cay MSC Marine Reserve« since December. For the small island the new purpose may be better than its past as a sand mining island. Otherwise cruise ships and passengers return to Istanbul or other Turkish ports. Even Egypt is praised as a safe destination again and the pyramids or other destinations in the Nile valley are back in the catalogues.

A victory for the environment and a permanent financial burden for all ship operators is the decision of the International Maritime Organization to ban high sulphur fuel oil Since 1 January 2020 the world fleet has to use low sulfur fuel (mostly diesel oil instead of HFO) as long as the exhaust gases are not cleaned.

Markets

In India the first domestic cruise line reports more than 40,000 guests. The elegant 6,700 GT and 350 bed »Angriya« with two restaurants, five bars, wellness etc. is a thoroughly modernized Japanese ferry dating from 1997. As long as it makes only one night trips between Bombay and Goa, the ship is not included in the cruise fleet statistics. A real cruise ship is the former »Pacific Jewel« (70,310 GT) which took up cruises from Bombay to Goa for Zen Cruises under the brand name Jalesh Cruises. Besides Goa, she offers also other destinations like Muscat. According to CLIA Asia’s second tier cruise markets developed in the five years up to 2018 as follows: India plus 19% p.a. to 221,000, Hong Kong plus 36% to 250,000, Japan plus 10% to 266,000, Singapore plus 22% to 373,000 and Taiwan plus 24% to 391,000 passengers.

Royal Caribbean Cruises, to mention just the second largest operator as an example, reported that the wave season 2020 brought higher rates and a better load factor than the year before.

Shipyards

Fincantieri together with Chantiers de l’Atlantique and the Meyer Group are still the leading shipyards for big cruise vessels. The largest ship by capacity is nearing completion at MV Werften, the German group of shipyards belonging to the Malaysian Genting Group.

In Croatia another one of the traditional shipyards, Uljanik, was finally declared bankrupt. Since subsidies are no more allowed in EU member countries, the Croatian ship building industry is shrinking. The »Scenic Eclipse«, with 77 GT per guest one of the most luxurious ships of the world, called discovery yacht, thus is the final delivery of its builders. The already ordered sister ship will be built in Rijeka. The privatized Split Shipyard (DIV Group) surprised by buying the Norwegian competitor Kleven Verft which ran into difficulties with the hybrid expedition ships for Hurtigruten.

Croatia is also the center of development for a new class of cruise ships. They are too small to be part of the deep-sea fleet – in fact they are cruising among the Croatian islands and along the coast – but with their yacht-like comfort they are totally different to the traditional motor sailers or gulets. 500 GT and 36 beds are a welcome alternative to big mass market ships (see www.river-cruise-fleet.com).

In China the Waigaoqiao yard of the state-owned ship builders is building ships of 135,500 GT in a long-term project with Italian assistance and a completion date not before 2023. The China Merchants SB Group is building a series of 8,000 GT ships according to Norwegian plans and has already completed the first unit on time. Now they are keen to finish the first of a series of 37,000 GT ships for a Chinese owner by 2022. And Huanghai has got a contract from Polynesia for the 280 bed pure cruise ship »Aramana«. Another good reason to order in China is the financing period which can be longer than the twelve years in Europe.

CLIA figures

Based on the fleet growth, CLIA is now expecting a result of 30mill. passengers in 2019 and 32mill. this year. The number of guests is growing much faster in Germany where CLIA Germany is watching 17% more guests last year and expects a result of 2.5million for 2019. Regarding the environment, CLIA reportss significant progress: 44% of new build capacity uses LNG fuel; 68% of global capacity currently uses exhaust gas cleaning systems, 100% of new ships will have wastewater treatment systems and 88% of new build capacity will have or are configured to add ability to use shore-side power.

Progress is made to solve environment impacts. Let’s hope that no other political, health or other impacts destroy a strong development of the branch which grants happiness and relaxation to a growing part of the population. Local over-tourism and a industrialized cruise branch should not be final destiny of the once wonderful sea tourism.

Arnulf Hader