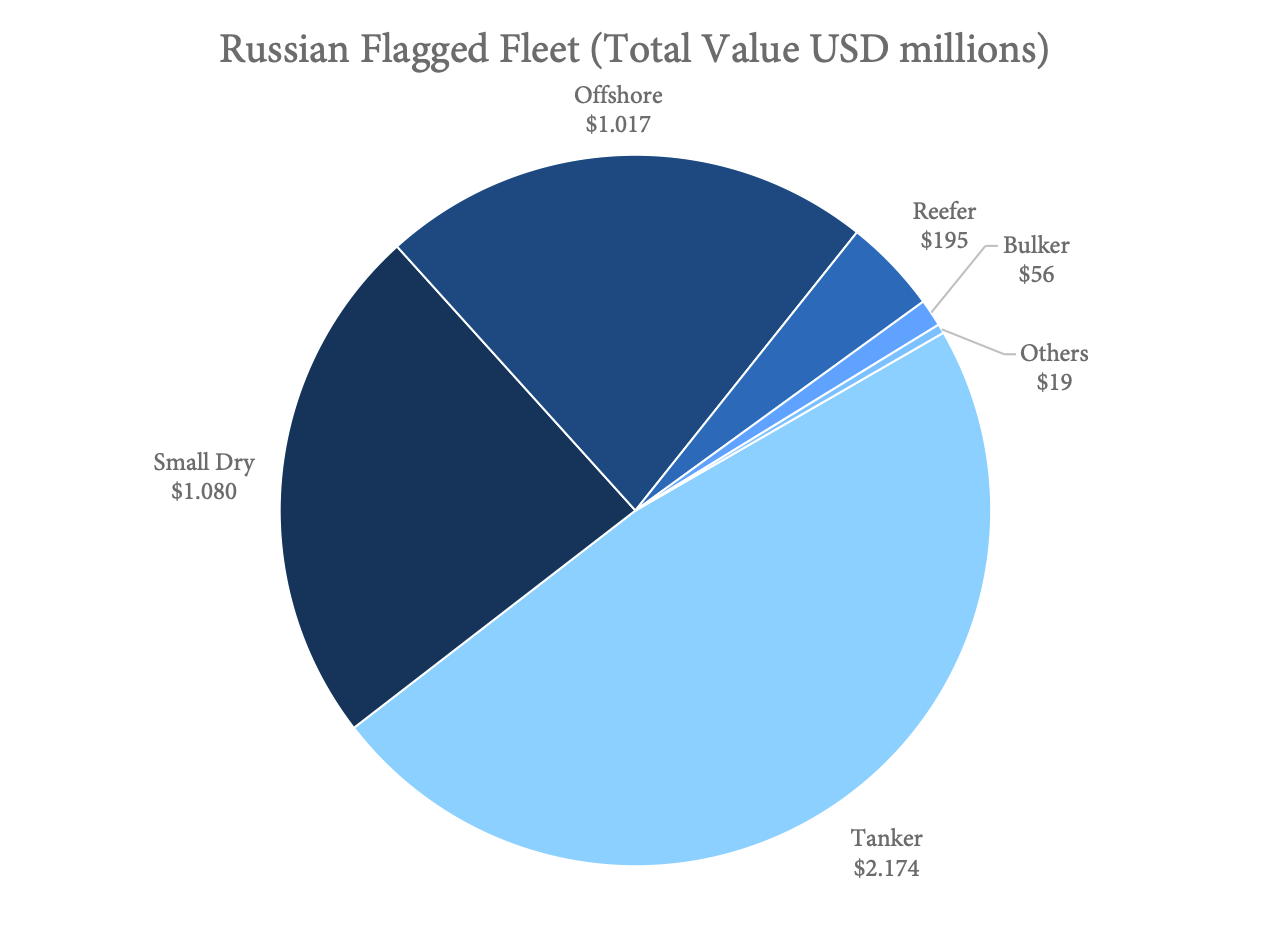

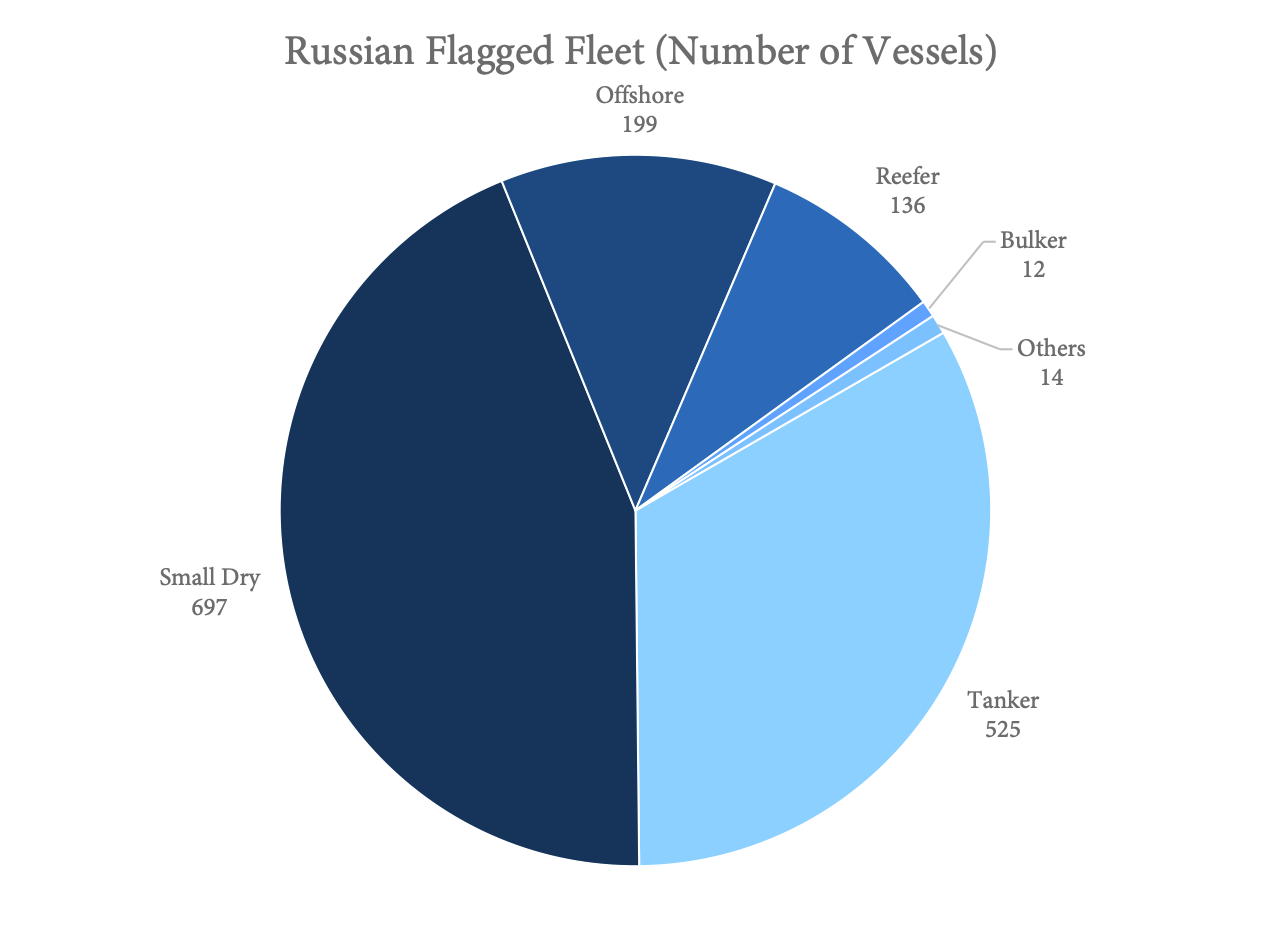

The Russian flagged fleet is dominated by vessel segments Small Dry (697 ships) and Tankers (525 ships). Offshore vessels (199[ds_preview]) and Reefer ships (136) are the third and fourth largest segments. Most value is accumulated in the Tanker segment (2.2 bn $) While Small Dry at 1.1bn$ accounts for about a fourth of the overall Russian flagged Fleet value, followed by Offshore (1 bn $).

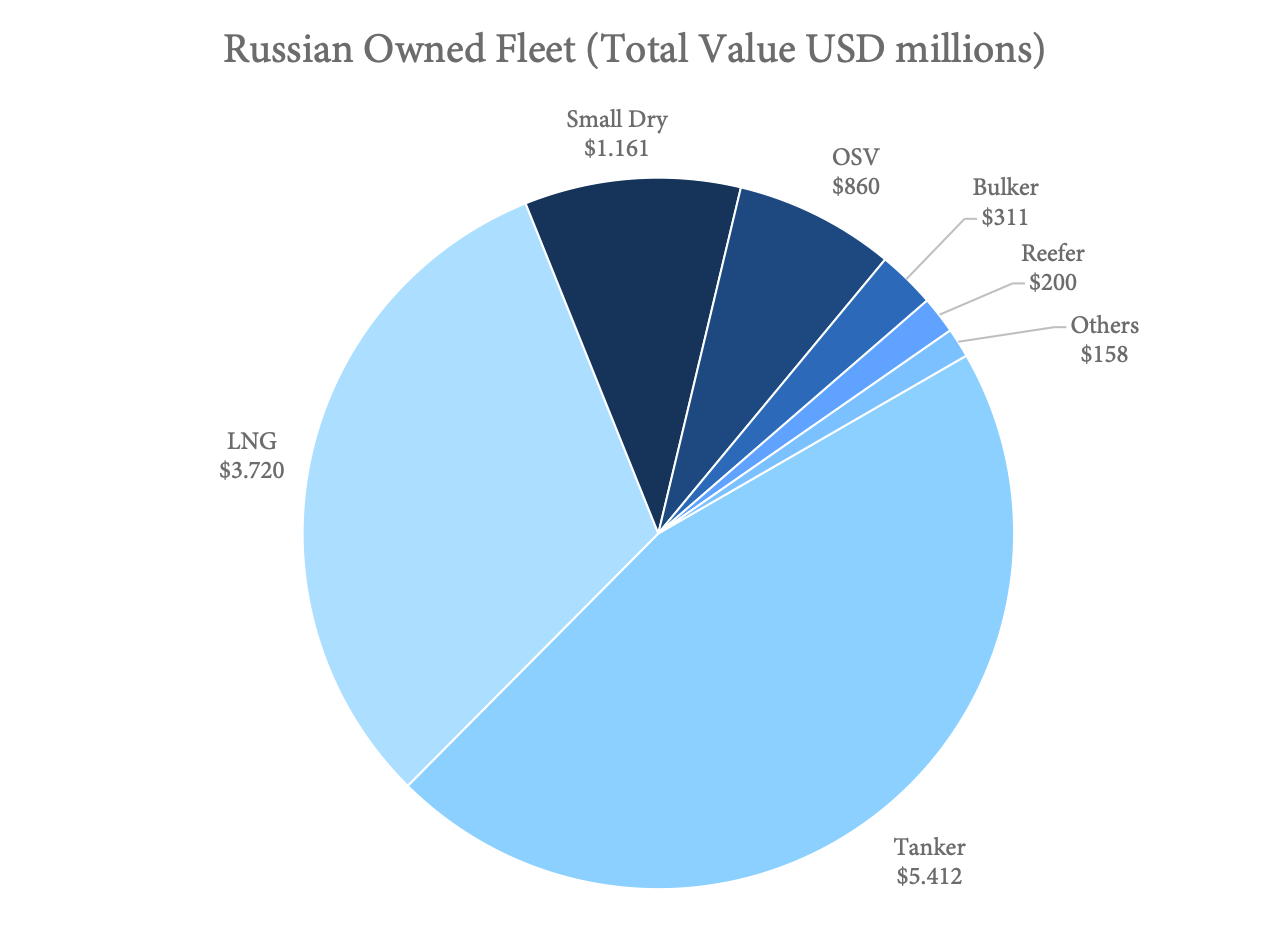

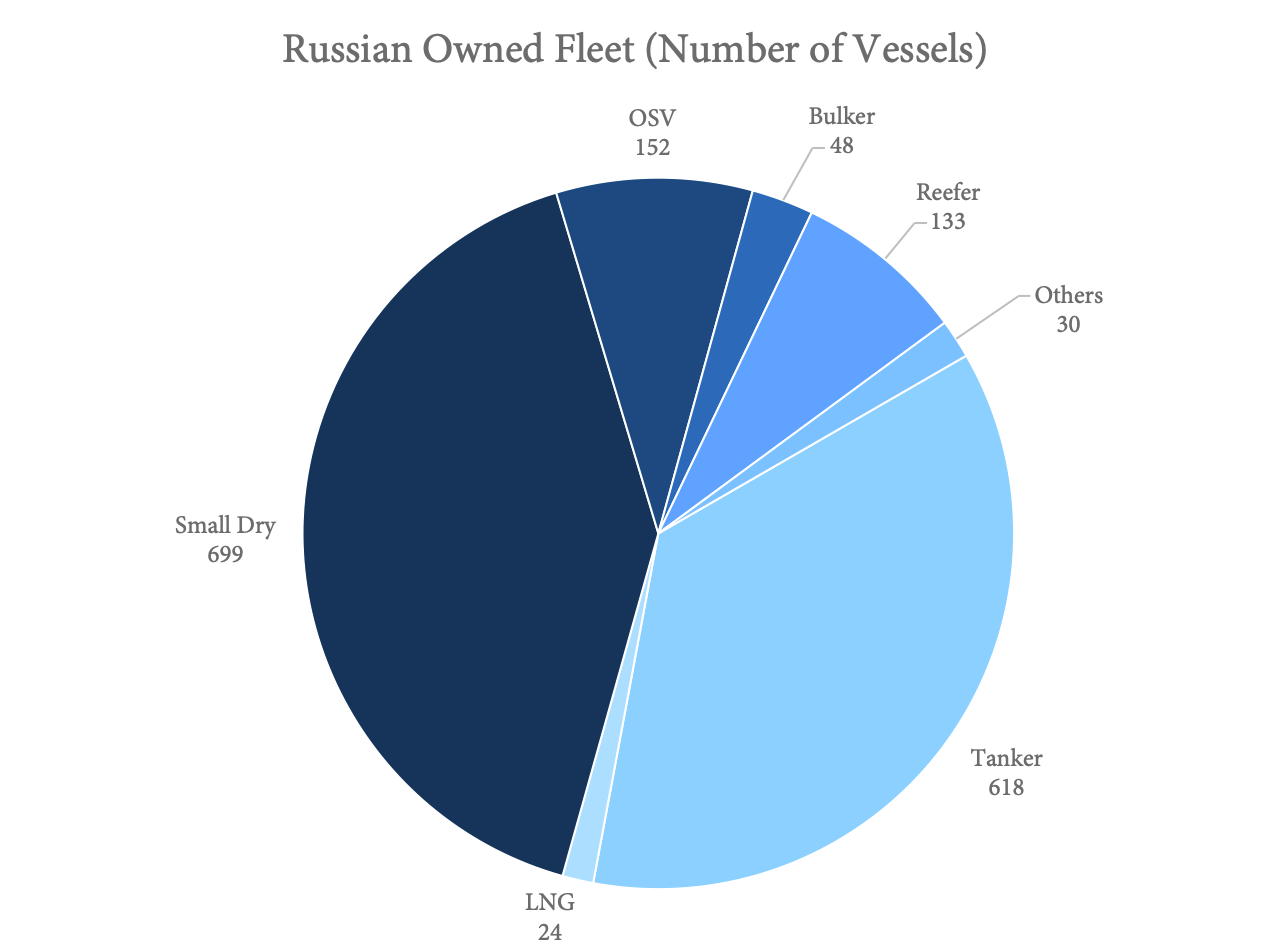

Looking at the Russian owned fleet, Small Dry (699) and Tankers (618) dominate the picture in terms of number of vessels. Again OSVs and Reefer vessels take up places three and four while other segments remain insignificant with regards to fleet size. This perspective changes quite drastically when comparing segments by value and not size. The Russian owned tanker fleet is worth 4.4 bn $ followed by LNG tankers worth 3.7 bn $ – at a fleet size of only 24 ships.

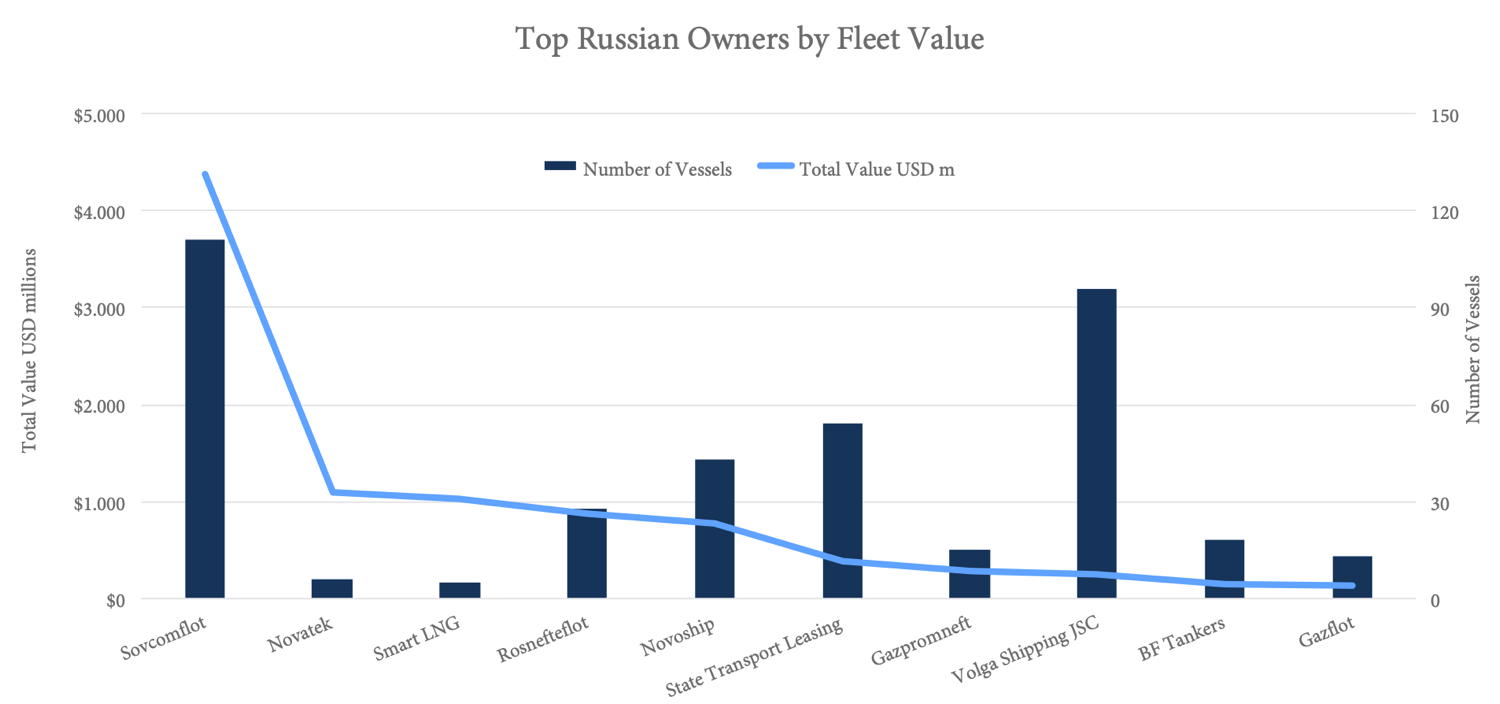

Top Russian owner is Sovcomflot with 111 vessels worth 4.4 bn $. Novatek follows in terms of fleet value with 1.1 bn $ for only six ships and Smart LNG with 1bn$ for five units. Rosneftflot comes in fourth with 28 ships worth 881mil. $.

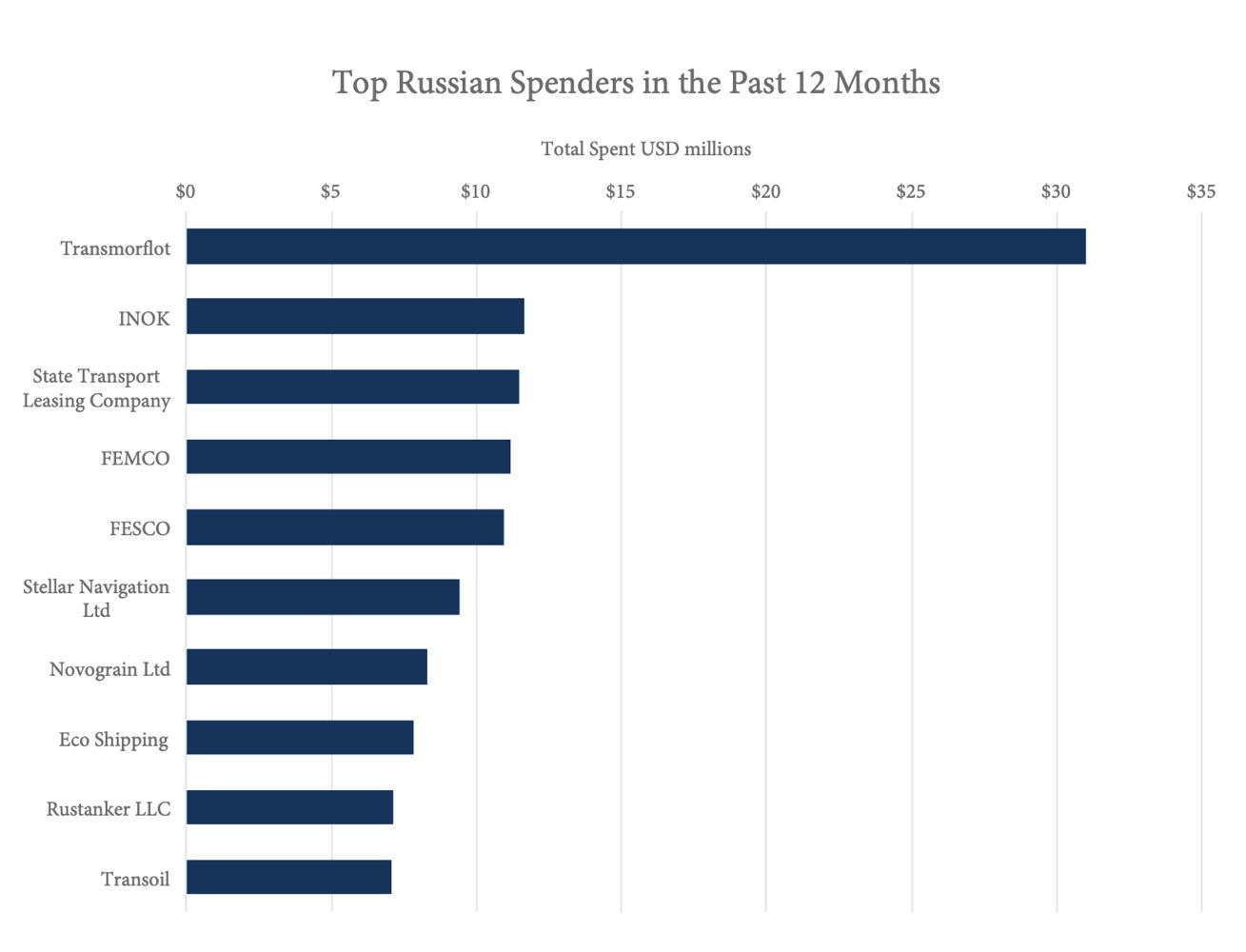

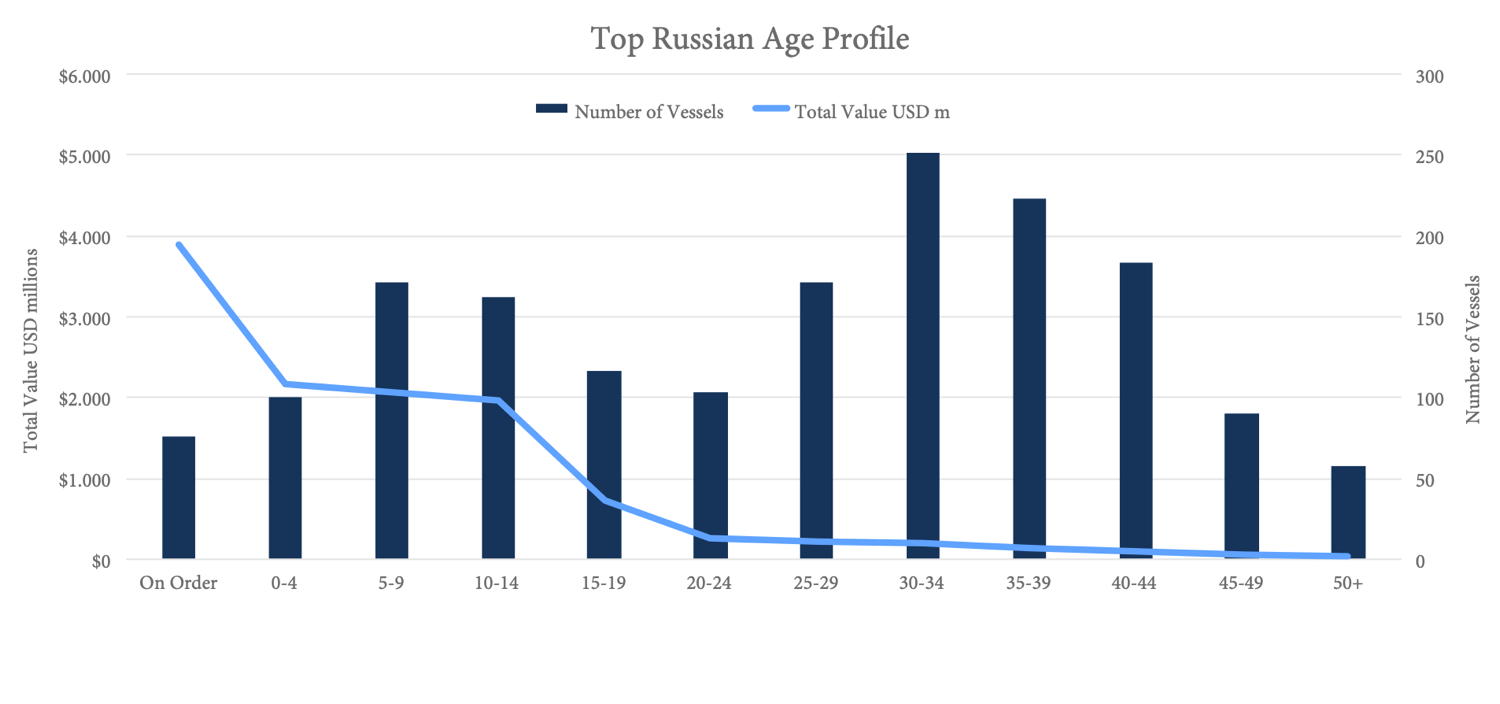

The age profile of the Russian fleet is characterized by a high numbers of medium aged and even higher numbers of old vessels between 25 and 45 years of service life. The value curve is highest for ships on order (3.9 bn $, 76 ships). The list of top spenders in Russia in the past twelve months is led by Transmorflot who invested 31mill. $ for two vessels. INOK, placed second has only invested a third of that sum over the period.