Norway has always lived and still lives with and from the sea. Today, petroleum products exploited from the bottom of the North Sea stay more for the main national income than fishing and shipping.

Producing and delivering all kinds of energy to global consumers is booming currently and furthers Norway’s wealth. How will this be in future? Today’s and future maritime trends are on show again during this year’s »Nor-Shipping« week (week no. 21, May 24–27, 2011) in Oslo.

For over 150 years, Norway has been and still is one of the world’s leading maritime nations. With a[ds_preview] population of only 4.7 million inhabitants, living on 324,000 km2 ground (14.5 persons /km2), the sea has a strong influence on the nation’s income and consequently the gross national product (GNP) which is around 36,270 € / inhabitant (USA 32,665 €; Germany 29,613 €) in 2009. So, Norway seems to be comparatively rich.

Norway

Norway comprises the western part of Scandinavia in the north of Europe. The rugged coastline, broken by huge fjords and thousands of islands, stretches for 25,000 km without and for 83,000 km long including the fjords and islands.

The country shares a 1,619 km long land border with Sweden, 727 km with Finland and 196 km with Russia. At 385,252 km2 (including Svalbard and Jan Mayen) much of the country is dominated by mountains (up to 2,500 m high) or high terrain (around 1,000 m high) with a great variety of natural features caused by prehistoric glaciers and varied topography. Norway lies between latitudes 57° and 81° North and longitudes 4° and 32° East.

Since the discovery of North Sea oil in Norwegian waters during the late 1960s, exports of oil and gas have become very important elements for the economy of Norway. With North Sea oil production having peaked, disagreements over exploration for oil in the Barents Sea, the prospect of exploration in the Arctic, as well as growing international concern over global warming, energy in Norway is currently receiving close attention.

Norway has extensive reserves of petroleum, natural gas, minerals, forests, freshwater, and hydro power. The country is the world’s 8th largest producer and the third largest exporter of oil. Norway produces around 3 million barrels (477 million litres) of oil per day. Besides this, it is the world’s sixth largest producer of natural gas, having significant gas reserves in the North Sea. Norway also possesses some of the world’s largest potentially exploitable coal reserves on earth (located on Svalbard and under the Norwegian continental shelf).

Offshore energy

In May 1963, Norway asserted sovereign rights over natural resources in its sector of the North Sea. Exploration started in July 19, 1966, when floating platform »Ocean Traveller« drilled its first hole. Initial exploration was fruitless, until »Ocean Viking« found oil on August 21, 1969. By the end of 1969, it became clear that there were large oil and gas reserves in the North Sea. The first oil field was »Ekofisk«, producing 427,442 barrels (68 million litres) of crude oil in 1980. Since then, large natural gas reserves have also been discovered.

Against the backdrop of the 1972 Norwegian referendum to not join the European Union (EU), the Norwegian Ministry of Industry moved quickly to establish a national energy policy. Norway also decided to stay out of OPEC (Organization of the Petroleum Exporting Countries), keep its own energy prices in line with world markets, and spend the revenue – known as the »currency gift« – in the Petroleum Fund of Norway. Consequently, Norway is still using its own currency Norwegian Krone (Nkr or NOK; 100 NOK 12.66 €) and has voted against the Euro (€). Since 1949, Norway is a founding member state of NATO (North Atlantic Treaty Organization).

The Norwegian government established its own oil company »Statoil« and awarded drilling and production rights to »Norsk Hydro« and the later newly formed »Saga Petroleum«. The North Sea turned out to present many technological challenges for production and exploration, and Norwegian companies invested in building capabilities to meet these challenges. A number of engineering and construction companies emerged from the remnants of the meanwhile largely lost shipbuilding industry, creating centres of competence in Stavanger as well as the western suburbs of Oslo. Stavanger also became the land-based staging area for the offshore drilling industry.

In March 2005, the Norwegian Ministry of Foreign Affairs stated that the Barents Sea, off the coast of Norway and Russia, may hold one third of the world’s remaining undiscovered oil and gas. The same year, the moratorium on exploration in the Norwegian sector, imposed in 2001 due to environmental concerns, was lifted following a change in government.

A terminal and liquefied natural gas (LNG) plant was started to be built at Melkøya Island near Hammerfest, where gas and oil condensate from the three fields »Snøhvit«, »Albatross« and »Askeladd« shall be processed. Production started for the first two named fields and will continue for the third location after 2014/15. All three fields can be found 140 km northwest of Hammerfest, they operate in water depths of 250–345 m. During about six months of the year the climate is very cold, rough and mainly dark there.

Positive arguments for building this terminal under very difficult conditions at this very strange and dangerous place were, that the Arctic ice cap shrinks due to global warming, and it is thought that »Snøhvit« may also act as a future staging post for oil exploration in the Arctic Ocean.

Electricity versus carbon emissions

In Norway, electricity generation is almost entirely from hydro-electric power plants. Of the total production of around 150 TWh (Terra-Watt hours = 10¹² Wh) 98.7 % is from hydro-electric plants, less than 0.5 % from thermal power and another minor part from wind generation. Norway became the first country to generate electricity by commercially using sea-bed tidal power. All this energy is generated without any carbon emissions.

Despite producing nearly all of its electricity from hydro-electric plants, Norway is ranking 12th in the list of countries by carbon dioxide emissions per capita and 37th by ratio of GDP to carbon dioxide emissions. Norway is a signatory to the Kyoto Protocol, under which it agreed to reduce its carbon emissions to no more than 1 % above 1990 levels by 2012, and this is rather close now.

Just before »Nor-Shipping 2007« (Review see HANSA 8/2007, page 14–21), Prime Minister Jens Stoltenberg announced to the Labour Party annual congress that Norway’s greenhouse gas emissions would be cut by 10 % more than its Kyoto commitment by 2012, and that the government had agreed to achieve emission cuts of 30 % by 2020. He also proposed that Norway should become carbon-neutral by 2050, and called upon other rich countries to do likewise. Zero emissions became the aim for future development. Today, carbon dioxide producing combustion engines are still in service and no answer is concrete, how to move in the air, across the oceans and on land by plane, ship or car.

Since 2005, this carbon neutrality was announced to be achievable partly by carbon offsetting, a proposal criticised by Greenpeace, who also called on Norway to take responsibility for the 500 million tonnes of emissions caused by its exports of oil and gas. The World Wildlife Fund (WWF) Norway also believes that the purchase of carbon offsets is unacceptable, saying »… it is a political still birth to believe that China will quietly accept that Norway will buy climate quotas abroad«. In the beginning of 2008, the Norwegian government went a step further and declared a goal of being carbon-neutral by 2030. But it has not been specified how to reduce emissions at home; the plan is based on buying carbon offsets from other countries.

On the other hand, Norway was the first country to operate an industrial-scale carbon capture and storage project at »Sleipner« oilfield, dating from 1996 and operated by Statoil. Carbon dioxide is stripped from natural gas with amine solvents and is deposited in a saline formation. The carbon dioxide is a waste product of the field’s natural gas production; the gas contains 9 % CO2, more than is allowed in the natural gas distribution network. Storing it underground avoids this problem and saves Statoil hundreds of millions of Euros in carbon taxes. »Sleipner« stores about one million tonnes of CO2 a year.

Norwegian shipping

The Norwegian Shipowner’s Association, which was founded in 1909, is a trade organization representing Norwegian companies engaged in the shipping and offshore industries. Norway is one of the few countries, which has a complete, all encompassing maritime industrial environment, including shipowners, brokers, banks, shipyards, a classification society, maritime research, design and engineering, specialized lawyers, marine insurers and underwriters.

A recent research project concluded that this »cluster« of related enterprises is the most internationally competitive environment in the country, along with the offshore energy creating oil and gas industry. This maritime sector accounts for 15 % of Norway’s total exports.

The mainstay of the maritime industry is shipping, that are ship-owning or operating companies. Norwegian companies own and / or operate some 1,400 vessels which total around 48 million deadweight tons. 75 % of these ships and floating units fly the Norwegian flag. The Norwegian-controlled fleet represents approximately 10 % of the world’s total merchant fleet and makes Norway one of the four largest shipping nations around the globe.

In some areas of the market, Norway’s relative position is stronger than what the gross average figures indicate. This is especially the case in trades which require relatively complex, specialized vessels. For example, Norwegian companies control approximately:

• 23 % of the world’s cruise ships

• 19 % of the world’s gas carriers

• 19 % of the world’s chemical tankers and

• 10.5 % of the world’s crude oil tankers.

Norway is also one of the leading nations in the offshore oil industry. The fleet of 200 offshore service vessels comprise supply, seismic, pipe-laying and other service ships, which is the second largest in the world. In addition to this, there are 75 mobile offshore units, i.e. jack-up and semi-submersible rigs, which operate in the North Sea, the Gulf of Mexico and in the Far East.

More than 90 % of the Norwegian fleet is engaged in cross-trading, what means operating outside of Norwegian waters, for example by carrying crude oil from the Middle East to Europe, or transporting cars from Japan to the USA.

The increasing age of the world’s merchant fleet is widely recognized as a major problem, both in terms of safety and as an environmental hazard. With an average age of just over 12 years, the Norwegian fleet is younger than the world’s average, but there is nevertheless a need for tonnage renewal. In financial terms, the necessary upgrading and renewal of the Norwegian fleet is estimated to come to some 150 billion NOK (19 billion €) over the next five years. Will this help the Norwegian or even the European shipyards? Most probably not, as the required tonnage is of a much larger size than the yards in Europe are able to build competitively.

Building ships in Norway

Ships were built in Norway already by the Vikings. Today it is a long-established industry and an important branch of Norwegian maritime activity. In the 1980s and 1990s the Norwegian shipbuilding industry managed to survive against increasing international competition and various losses of market shares by re-adjusting production towards the national offshore industry.

Today more than 80 % of the output from Norwegian yards is for the offshore segment. The production of offshore and oil-related ships and equipment has thus been vital for the industry’s survival and as such it still relies heavily on a relatively large domestic market.

On the other hand, since the early 1980s almost three-quarters of all domestic production of ships have been commissioned by foreign parties. At the same time, and in the broad view, the industry’s international market share has steadily dropped the last half century.

Today the shipbuilding industry in Norway consists of a few medium and many small companies, and between them there is a large degree of domestic competition. For the large majority of shipyards, specialization has been the most important factor in survival. Few yards – if any – are building hulls anymore. Hulls are imported from cheaper low cost countries, such as Poland, Baltic States, Romania and also China, and outfitting takes place at Norwegian yards.

The majority of the offshore service vessels are platform supply vessels (PSV), anchor-handling tug supply (AHTS) ships and other offshore sub-sea construction vessels. But also the production of chemical tankers is an area in which specialization has brought success to some Norwegian shipyards.

Specialization has taken place in other areas as well, such as in the production of research ships and for a period of time high-speed aluminium ferries (single-hulls or catamarans). In addition, the production of fishing vessels has also been important for Norwegian shipyards.

The Norwegian shipbuilding industry is marked by relatively high wage rates and costly production, which many commentators have regarded as an impediment to growth and to the industry’s international competitiveness. On the other hand, there is a close relationship between Norwegian maritime research and development institutions, ship-owners and shipbuilding companies, in a deliberate attempt to be at the forefront with regard to new developments and innovation.

As such, technological innovation and professionalism have been seen as the Norwegian shipbuilding industry’s main competitive advantage, and the main reason why it has been so adaptable and willing to readjust production in the face of increasing international competition.

STX Europe ex Aker Yards

Aker Yards (see HANSA 6/2001, page 46; 6/2005, p. 14; 6/2007, p. 24; 5 /2009, p. 20; and lately in 9/2008, p. 79) was created in 2004 by combining shipbuilding activities of well-known maritime groups Aker and Kvaerner. Aker ASA was until 2007 the company’s main shareholder. After having reduced its ownership share from 50.4 % to 40.1 % in in Aker Yards, in January 2007, Aker divested its total shareholding in March 2007.

Aker Yards had structured their maritime activities in Cruise & Ferry, Merchant Marine Ships, Offshore & Specialized Vessels and Other Operations. In October 2007, Korean STX Business Group secured a 39.2 % stake in Aker Yards. Later, STX increased their ownership step by step to 92.4 % until September 1, 2008. Consequently Aker Yards changed their name to STX Europe and STX acquired the remaining shares till January 2009.

STX Europe AS, a subsidiary of South Korean industrial chaebol STX Corporation, is the largest shipbuilding group in Europe and the fourth largest in the world. With headquarters in Oslo, Norway, STX Europe operates 15 shipyards in Brazil, Finland, France, Norway, Romania and Vietnam. In addition, STX Europe held a 30 % ownership share in Wadan Yards, which comprised two yards in Germany and one in Ukraine (Merchant Marine Ships); these yards were formerly wholly owned by Aker Yards. Although STX Europe announced to have sold these shares middle of July 2009, they were notified by June 5, 2009, that Wadan Yards MTW GmbH had filed for bankruptcy. The insolvent German part entered into newly founded Nordic Yards middle of August 2009.

Anyhow, STX Europe advised in their 4th quarter 2009 report, that they may have to record additional losses in relation to bankruptcy of Wadan Yards MTW GmbH. Norwegian Wadan Yards Group AS filed for bankruptcy on March 16, 2010. In early December 2009, the former main owner of Wadan Yards, Andrey Burlakov was arrested in Moscow due to illegal businesses.

STX Finland

The Cruise & Ferry division of STX Europe constructs vessels mainly at shipyards in Finland and France. This business area had poor results recently, reflecting low order intake and a reduced order backlog, leading to reduced utilization level and increasing capacity costs at the yards in Finland and France.

At Finnish Turku shipyard, the »Allure of the Seas« (225,282 GT; see HANSA 3/2011, page 36), sister vessel of »Oasis of the Seas«, the world’s largest and most impressive cruise ship was successfully delivered to her owner Royal Caribbean International (RCI) in October 2010. Sadly enough for STX Finland, Royal Caribbean Cruises Ltd. signed a letter of intent with German Meyer Werft middle of February this year, to build the first of a new generation of RCI cruise ships (158,000 GT). Developed under the code-name »Project Sunshine«, the new vessel design incorporates new and exciting features that take advantage of the best Royal Caribbean’s experience and imagination.

In December 2010, STX Finland secured a long awaited and strongly needed contract from Finnish Åland-Island-based Viking Line for the production of a large cruise ferry (57,000 GT; 214 m long; 2,800 pass. in 880 cabins + 200 crew-members; 1,275 m truck-lanes + 500 m car-lanes). This contract includes an option for a sister-ship. This agreement represents approximately 2,600 man-years employment. The ferry will be built in Turku and shall be delivered beginning of 2013. More details of this super-ferry are mentioned in a special article about Baltic Sea ferries in this issue.

On March 22, 2011, Galamare Ltd. (Meriaura Group) signed a contract for the construction of an innovative and versatile multi-purpose deck cargo vessel (105 m long; 19 m wide) with STX Finland. This environmentally friendly ship will provide work for about 300 persons and is scheduled for delivery during spring 2012. The vessel is designed for transportation of demanding project cargo, such as offshore wind farm structures, and is also suitable for transporting energy wood in the Baltic Sea region.

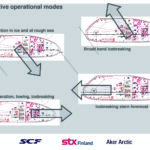

The ship will be ice-strengthened according to Finnish / Swedish ice class 1A. Propulsion will be diesel-electric burning alternative bio-oils as fuel and driving two electric rudder-propellers aft as well as two bow thrusters. The vessel can be operated in DAS (double acting ship) mode, what means the operation in open waters with higher speed bow forward and under ice-breaking conditions with the stern forward.

Besides these two comparatively small contracts, the activity level at Turku shipyard has been materially reduced with a significant number of temporary lay-offs until start-up of Viking Line vessel production. Currently, the Turku shipyard has approximately 1,200 people in temporary lay-off. So, additional contracts are strongly needed for Turku shipyard.

At Rauma shipyard, after delivery of Ro-Pax ferry »Spirit of Britain« (47,600 GT; see separate description in this issue) beginning this year, another car passenger ferry is under construction for P&O Ferries with scheduled delivery in third quarter 2011. Rauma yard’s order-book also includes the construction of an advanced polar research and supply vessel for South Africa to be delivered in spring 2012. This ice-strengthened vessel will be approximately 134 m long and will have accommodation for 100 researchers or passengers and 45 crew-members. In February 2011, Namibia ordered a fishery research vessel (62 m long; accommodation for 45 crew-members and research personnel) to be delivered in spring 2012.

Archtech Helsinki Shipyard

On December 10, 2010, STX Finland and United Shipbuilding Corporation (USC), a state-owned Russian shipbuilding corporation, formed a 50/50 % joint venture company – Archtech Helsinki Shipyard. This joint venture will focus on arctic maritime technology and shipbuilding and is going to unify Russian and Finnish maritime clusters existing in St. Petersburg/Murmansk and Helsinki. It will start building highly sophisticated vessels such as icebreakers and other icebreaking special vessels.

The joint venture also has an option to buy 20.4 % of the shares of Aker Arctic Technology Inc. (AARC; see HANSA 5/2006, page 21) from STX Finland, which will still remain the majority share holder of AARC. This research and development centre with own ice-laboratory is a world leading player in arctic maritime technology research and development.

Arctic Helsinki Shipyard Oy will be a 50/50 % joint venture company owned by two of the largest shipbuilding corporations in the world: United Shipbuilding Corporation is the state-owned Russian shipbuilding corporation, which was formed in 2007. The company has 42 shipyards in Russia and it focuses on developing the Russian civilian and military shipbuilding industry. STX Finland belongs to the before mentioned STX Europe group comprising 15 Yards around the globe and having around 16,000 employees. Main shareholder of STX Europe is the international conglomerate STX Business Group of Korea having all together 54,000 employees.

The joint venture agreement is an important indicator of the powers of the traditional Russian-Finnish cooperation within the maritime industry. Finnish shipyards delivered more than 1,500 vessels to Russia after 1945. They built 60 % of all icebreakers in the world including most of the Russian conventionally powered icebreakers.

On December 16, 2010, Arctech Helsinki Shipyard received its first contract, an order for two new multi-functional icebreaking supply vessels (MIBSV), from Russian customer Sovcomflot. These ships are registered as newbuildings of the newly formed yard. The vessels will be delivered from the yard in Helsinki during spring 2013 and they are going to operate in the Sakhalin-1 Arkutun Dagi gas field as supply ships for Exxon Neftegas Ltd.’s platform. The vessels will be similar to »Fesco Sakhalin« (see HANSA 9/2005, page 25). Their dimensions will differ only slightly: 99.20 m length; 21.70 m width; total diesel-electric power of 4 x 4,500 kW or 13,000 kW of propulsive power.

End of May last year Finnish companies STX Finland Oy, Aker Arctic Technology Oy (AARC), Southeast Trading Oy (SET Group), and the Russian companies OAO Sovcomflot and FSU Rosmorport signed a cooperation agreement, with the purpose of developing and building a new type of oil spill icebreaker for Sovcomflot, the largest Russian shipping company. The new innovative type of vessel is a major breakthrough in the icebreaking technology and for the protection of the Baltic Sea. Furthermore, this is seen as a big step forward in strengthening the Finnish-Russian cooperation in the field of shipbuilding.

STX France

STX France (see HANSA 9/2008, page 82) delivered two large cruise ships during 2010. »MSC Magnifica« (95,128 GT) came into service in March last year being the tenth cruise ship being finished for Italian/Swiss Mediterranean Shipping Company (MSC) by the St. Nazaire yard. »Norwegian Epic« (155,873 GT; see HANSA 8/2010, page 30) was delivered in June 2010 to Norwegian Cruise Line (NCL). This giant cruise ship is the largest new-building the yard ever finished.

The yard managed to secure contracts for further three giant cruise ships: two to be built for MSC (133,500 GT) until end of spring 2012 as well as – astonishing enough – Libyan state-owned GNMTC shipping company (139,400 GT) scheduled for delivery in December 2012 and finally super-luxury smaller cruise ship »Europa 2« (39,500 GT) to be finished in 2013 for German Hapag-Lloyd Cruises.

The St. Nazaire yard is also constructing a helicopter carrier for the French Navy for delivery in mid-2011. The smaller Lorient yard works on a patrol vessel for the Moroccan Navy. In addition the yard also secured a contract to build a sand-dredger, with construction starting early in 2011 and delivery in mid-2012.

STX OSV

In November 2010, STX Europe listed its Offshore & Specialized Vessels division on the Singapore Exchange. The name of the listed company is STX OSV Holding Ltd. The OSV business area consists only of the shareholding in STX OSV. Currently, STX Europe holds 69.02 % of the shares in STX OSV. The new holding controls nine shipbuilding facilities worldwide: five in Norway, two in Romania, one in Brazil and one in Vietnam.

The order book of STX OSV consists of 49 vessels by the end of 2010, of which 37 are of own design, mainly produced in Norway. Five vessels were delivered in the fourth quarter of 2010 and all together 21 new-building projects were completed.

The five Norwegian yards are located in Aukra, Brattvaag, Brevik, Langsten and Søviknes, most of them along the west-coast around Ålesund. Normally they prepare own designs in cooperation with ship-owners, classification authorities and chartering clients. According to these designs hulls and steel-structures are built abroad in low-cost countries, for example a cooperating yard in Braila, Romania. The semi-finished hulls are towed then to Norway to be outfitted and delivered by the a.m. yards. The order backlog of most yards reach till end of 2012, Søviknes till autumn 2013.

The newly built yard in Vietnam is now in nearly full operation. The yard’s capacity is about 7,000–10,000 t steel-weight of finished products per year. This is done by 650 employees. Hull production and outfitting is planned for about three to four vessels annually. Since the start-up phase in 2008 two new-buildings were delivered successfully. Four out original six AHTS still have to be finished in 2011 and 2012. Two new PSV contracts have been secured in December 2010 for delivery in 2012 and 2013.

The existing yard in Niterói, near Rio de Janeiro, Brazil, is placed on 65,000 m2 effective working area and has a 210 m long quay. The yard has about 6,000 t/year steel processing capacity which is done by about 1,250 workers. There are plans for another newly to establish yard in Suape, Pernambuco district, north-eastern horn of Brazil. The total company ground is 250,000 m2 with 26,000 m2 covered ground. The steel processing capacity is planned with 20,000 t/year what could require a larger quantity of skilled workers. There will be an outfitting quay of 300 m length. STX OSV is developing this new shipyard in Brazil together with its Brazilian long-time partner PJMR Empreendimentos Ltda. STX OSV owns 50.5 % of Estaileiro Promar S.A.

On July 9, 2010, Estaleiro Promar S.A. signed eight contracts to build LPG carriers for Transpetro, the shipping arm of the Brazilian oil giant Petrobras. The contracts comprise the construction of two different types: fully pressurized with cargo capacity of 7,000 m³ (4 units) and 4,000 m³ (2) as well as semi-refrigerated with 12,000 m³ (2). These vessels are part of PROMEF 2, the second phase of the ambitious Transpetro’s fleet modernization and expansion programme. The ships are planned to be delivered from third quarter 2013 to fourth quarter 2015.

DNV – Managing Risk

DNV (Det Norske Veritas) is an independent foundation with the purpose of safeguarding life, property, and the environment. Their history goes back to 1864, when the foundation was established in Norway to inspect and evaluate the technical condition of Norwegian merchant vessels. Since then, their core competence has been to identify, assess, and advise on how to manage risk. Whether they classify a ship, certify an automotive company’s management system, or advise on how to best maintain an aging oil platform, their focus is to safely and responsibly improve business performance.

While headquartered in Oslo, Norway, DNV has worked internationally since 1867 and has established approximately 300 offices in 100 countries. As a knowledge-based company, their prime assets are the creativity, knowledge, and expertise of their 9,000 employees from more than 85 different nations. While many of their services, such as management system certification and corporate responsibility, can be applied successfully in any industry, their main focus industries are:

• Maritime

• Oil, gas and energy

• Food and beverage

• Health care

One of the most important competitive advantages of DNV is their investment in research and innovation that will safeguard life, property and the environment. Since 1954 DNV has had a dedicated research department that has enhanced and developed services, rules and industry standards in multiple fields. Many of the technology solutions developed by DNV have been so precise that they have helped define internationally recognized standards. At present, the most important research programmes in DNV are:

• Arctic

• Bio-risk management

• Information processes and technology

• Maritime transport

• Multi-functional materials and surfaces

Today, one of the burning problems in maritime transport and international shipping is seen in, what is named »Green Shipping«.This is clearly expressed by DNV’s Segment Director LNG, Lars Petter Blikom, as rapidly growing interest in LNG. Historically, stringent environmental legislation has not really applied to the shipping industry. As a result, while the land-based and transport industries have managed to reduce their emissions of local pollutants, the shipping industry has continued to increase its emissions.

This can not be the case any more, as IMO is already enforcing SOx emission restrictions in certain geographic areas. More SOx and NOx emission restrictions are due, and it seems to be only a question of how, before a form of CO2 tax is imposed on global shipping. Natural gas is the only realistic fuel that meets the forthcoming required reductions in emissions of local pollutants without any form of exhaust gas cleaning system (see HANSA 9/2008, page 124–130 and 8/2010, page 142–151).

Judging by the growth of interest in LNG, it seems just the right time, as the shipping industry is realising, that this fuel offers both, the best overall economics and the best environmental performance of all realistic fuel options. Over the past ten years, significant experience of LNG-fuelled ships has been accumulated; more than 20 ships are now in operation and an equal number is on the order books, which now span a wide variety of ship types and engines.

The volume of orders for LNG-fuelled ships signed over the past six months resembles the beginning stages of a period of exponential growth. And these are not just ships sailing in Norwegian coastal waters any more, as evidenced by Fjord Line’s Ro-Pax ferry contracted for the Norway-Denmark route, NSK Shipping’s coasters to be built in Turkey, Viking Line’s recently ordered cruise ferry for the Sweden-Finland route and – surprising enough – Incat’s high-speed catamaran ferry interest. So, everybody can look out for many more LNG-fuelled ships to come into operation in the near future.

The surfacing of LNG as a maritime fuel is not only motivated by environmental requirements. The fact that natural gas has a considerably cheaper per energy content than oil-based fuels is perhaps an even more forceful reason. The same price advantage also applies in relation to oil burning power plants and land-based transportation sectors.

Putting all these »new« markets together creates a strong foundation for future growth in the global demand for natural gas in general and LNG in particular. Therefore the rapid development in the downstream application of LNG is a huge opportunity for gas producing companies to reach new markets, including markets willing to pay premium prices for the environmental advantages.

Nor-Shipping at a glance

Nor-Shipping, originally planned as a maritime exhibition by Norges Varemesse, is a biennial event taking place in every irregular year, this time during week number 31, May 24–27, 2011, in Oslo, although the new exhibition centre is located in Lillestrøm some 30 km northeast of Oslo city-centre by airport-express train half the way out to the airport Gardemoen. Nor-Shipping was first staged at Sjölyst-Centre in Oslo’s west-end in 1965 and today is a leading meeting place for the world’s shipping industry. It aims to bring together the best and the brightest of the maritime industry worldwide.

The theme of Nor-Shipping 2011 is »Next Generation Shipping«, looking at both the way maritime business is run and the latest advancements in technology. One of the great technical themes is also seen in »Green Shipping«, avoiding as much as possible all kind of harmful emissions into the air, water or also to the shore. Currently, nobody really knows the answer what the next energy can be in future. One – for the time being, insufficient – response is given by natural gas (LNG) allowing operators to speak of a cleaner or even »Green Shipping«.

The layout of Nor-Shipping 2011 follows the style of 2009 to combine companies of similar products in one hall. So, it can be found:

• IT and Navigation in Hall B

• Safety and Rescue in Hall C

• Shipbuilding and Repair in Hall D

• Maritime services and Logistics in Hall E

• Propulsion and Machinery in Hall E

Moreover, the exhibition features five theme parks in four halls laid out in an easy-to-navigate way. This branding of industry segments allows visitors to quickly find exhibitors that are most relevant to their business.

KN