River cruise KGs are afflicted with the bad reputation of ocean cargo KGs, although being of a non-speculative nature. Bonds could be an attractive alternative, suggest und

The European river cruise industry has reported strong growth over the past decades with more upcoming capacity entering the market[ds_preview]. Especially the English speaking source markets show increasing demand for river cruises within Europe. A river cruise offers to visit various cities without having to unpack and pack every day as the passenger travels along with the hotel. Furthermore, the comfortable journey itself is experienced as a calm and peaceful time to relax. River cruise passengers highly appreciate the spectacular views from the rivers as well as the high quality of offered culinary experiences. Many historically and culturally attractive cities, capitals and tourist destinations are settled along the rivers.

As the market grows and industrialization of this tourism niche market increases, consolidation occurs within this sector. River cruise-related companies specialize themselves to either become river cruise operator (marketing), management company (operations) or fleet owner (financier). Interrelated capital requirement of all related parties oftentimes cannot be met by the companies’ own funds anymore and consequently involves third parties’ investments.

KG-model in river cruise industry

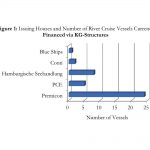

For many years the German »KG-model« was used to finance new vessels or refinance existing vessels by private German investors and was quite successful both for cruise lines and private investors. Initially, the KG-model gained its popularity by being widely used in the ocean cargo vessel business. In this model various private investors invest into a single purpose company (SPC) with only limited liability up to the amount of their invested capital. This model was introduced to the river cruise industry by the issuing house Conti in 1997 with issuing KG-shares of the »Delphin Queen« (today »Primadonna«). Since then, more than 40 river cruise vessels, either new vessels or existing vessels, made use of the KG-model. Figure 1 depicts issuing houses with their corresponding amount of river cruise vessels currently financed via a KG-structure.

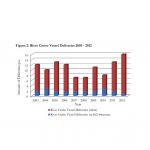

Within the past ten years about 18 % of delivered river cruise vessels were financed through this investment structure. The total number of river cruise vessel deliveries and the proportion of KG-financed units of the past ten years are shown in Figure 2.

In the beginning, KG-structures as SPC were used for financing of usually one ship at a time. Later, issuing houses pooled two to four river cruise vessels to gain a higher volume and hence decrease the administrative expenses per vessel.

For many years, this model produced sound financial results and kept investors satisfied. However, with the combination of the financial recession and the still continuing shipping crisis, the KG-model gained disreputability as many cargo vessel companies (SPC) produced harsh deficits and some investors lost their money. Reasons for the failure of ocean cargo KGs added up. Too many ocean cargo vessels were speculatively ordered without having a secured employment (fixed charter). Furthermore, the financing for the ordered vessels in many cases was not in place on the date of the order. Consequently, as the shipping crisis hit the market players, too many ships were on order and respectively new ships joined the fleet at a time where additional capacity was not at all needed. Demand did not correspond to the flood of new capacity and freight rates dropped.

Due to these developments and negative media coverage, KG-funds are not marketable anymore as too many investors made losses with their investments. Although this negative development is relevant for the ocean cargo business only, the negative image had an impact on the (river) cruise business as well as private investors do not differentiate between the two completely different industries.Unlike the ocean cargo KG-structure setup, river cruise KG-concepts are set up differently as a contractual and fix long time employment (charter) usually is part of the arrangement and the financing of the vessel is contractually secured and in place when an order is placed.

River cruise versus ocean cargo KG

The most important difference between river cruise KGs and ocean cargo KGs is the non-speculative nature of river cruise KG-structures, which is of vital importance for potential investors. Another advantage of river cruise investments is the high residual value of the asset. This has proven in many cases when river cruise ships from various KG-funds were sold close to or above original building price. In the KG-model this brings excess earnings for investors. Issuing houses just recently published very positive performances of their river cruise KGs with projected and even above projected earnings for their investors. Most river cruise KGs worked out well. Exceptions to this resulted only in less payout of dividends than prospected, but not in margin calls for investors as seen in the ocean cargo business. However, media coverage of failing ocean cargo KGs is high compared to only little but existent news about positive accounts of river cruise KGs. Although constructed differently, alternative financing structures are required for the river cruise sector as investors are hesitant and intimidated by the developments of the ocean cargo business. It is still challenging to communicate the substantial differences between the cargo industry and the tourism (river cruise) industry to potential investors. As a consequence of investors being swayed by the shipping crisis, the largest river cruise KG-initiating company, Premicon, ceased its financing business in December 2012 after unsuccessful attempts for KG pools in 2010, which had to stop in 2012 due to insufficient participation.

Meanwhile, issuing bonds is a new and attractive alternative to the established financing schemes via KG-structures. This way of fund-raising has proven to work well for different industries and purposes and is going to be used for ship financing as well. Bonds act as a conjunction between a bank loan and liable equity, as it is non-liable capital, but subordinate loan. Investors can expect an attractive interest payment of 6–8 % per year. River cruise bonds offer investors higher security than equity finance and higher security compared to traditional bonds as the bond is protected by the exceptionally high residual value of the vessels. It also provides a high grade of reliability as a bond is a highly regulated financing instrument, which may only be offered by licensed institutions.

Adding to changes in financing structures, commercial banks hesitate to finance vessels and restrict their engagement in the (river) cruise industry. On the one hand, some banks do not distinguish between ocean container vessel KG-structures and river cruise KG-structures. On the other hand, stricter regulations of financial markets and corresponding banks’ portfolio adjustments lower the priority of the shipping industry and consequently the river cruise industry.

Nevertheless, there is an unbowed need for financing due to an increasing demand in river cruising and the ambitious growth strategies of river cruise lines. Thus, large private equity companies and other investors discovered the high sustainable attractiveness of the river cruise industry.

One recent example is the US- and Europe-based Viking River Cruises. Within a short period of time Viking River Cruises was able to sell bonds worth 250 Mill $. Rumors say that bonds multi-oversubscribed within just days.

Prior to this, the private equity investment group Waterland facilitated a management buyout with the management team of A-Rosa in 2009, where A-Rosa was split from its former ties to DSR to follow A-Rosa’s growth strategy.

Another most recent example is the purchase of the majority of the river cruise operator Nicko by Capvis, a leading private equity company from Switzerland. These examples underline that especially private investors are discovering and shaping the river cruise industry at the moment.

Recent developments in the river cruise business demonstrate that availability and feasibility of various financing structures are changing. Classic financing instruments are not practicable for the river cruise industry anymore, even though reasons for this may not accrue from the river cruise industry itself. A solution to this challenge may be found in the creation of new financing opportunities involving institutional and bank independent investors, who recognize the sustainable attractiveness of an investment into the growing river cruise business.