As one of three regions in Norway with a strong focus on the maritime industry, Bergen claims to be the »capital of industrial shipping«. At least with the amount of 510 vessels under national flag Bergen‘s shipowners and operators stay ahead of the shipping regions Oslo and Ålesund.

Forming a geographical triangle in the southern part of Norway, the country’s maritime industry focuses on three areas: Oslo in[ds_preview] the South, Ålesund and Bergen on the West Coast. Ranked by number of vessels and gross tonnage, the Bergen cluster could be the largest. However, taking a closer look, the regions differ in strength of the various fields of shipping, a fact that draws the final distinction between them.

The capital Oslo is not only seat of the government but also the centre for financial and legal services which also serve the shipping industry. Thus, it is not surprising that the Norwegian Shipowners Association is located in Oslo. The shipping industry in Ålesund is determined by the offshore oil and gas sector, particularly with regard to shipbuilding and equipment supplying. Naming only one, the Ulstein Verft, which is one of the world’s leading designers and builders of offshore support and construction units as well as seismic and research vessels, belongs to the Ålesund cluster.

The Bergen cluster, however, is dominated by shipping companies (»Shipping companies« including owners and operators of vessels and other floating units like rigs, floating production vessels, floatels and barges.). They control more than 1,000 vessels (>100 gt), thereof 510 units under national flag (registered in Bergen) and 530 in foreign registers.

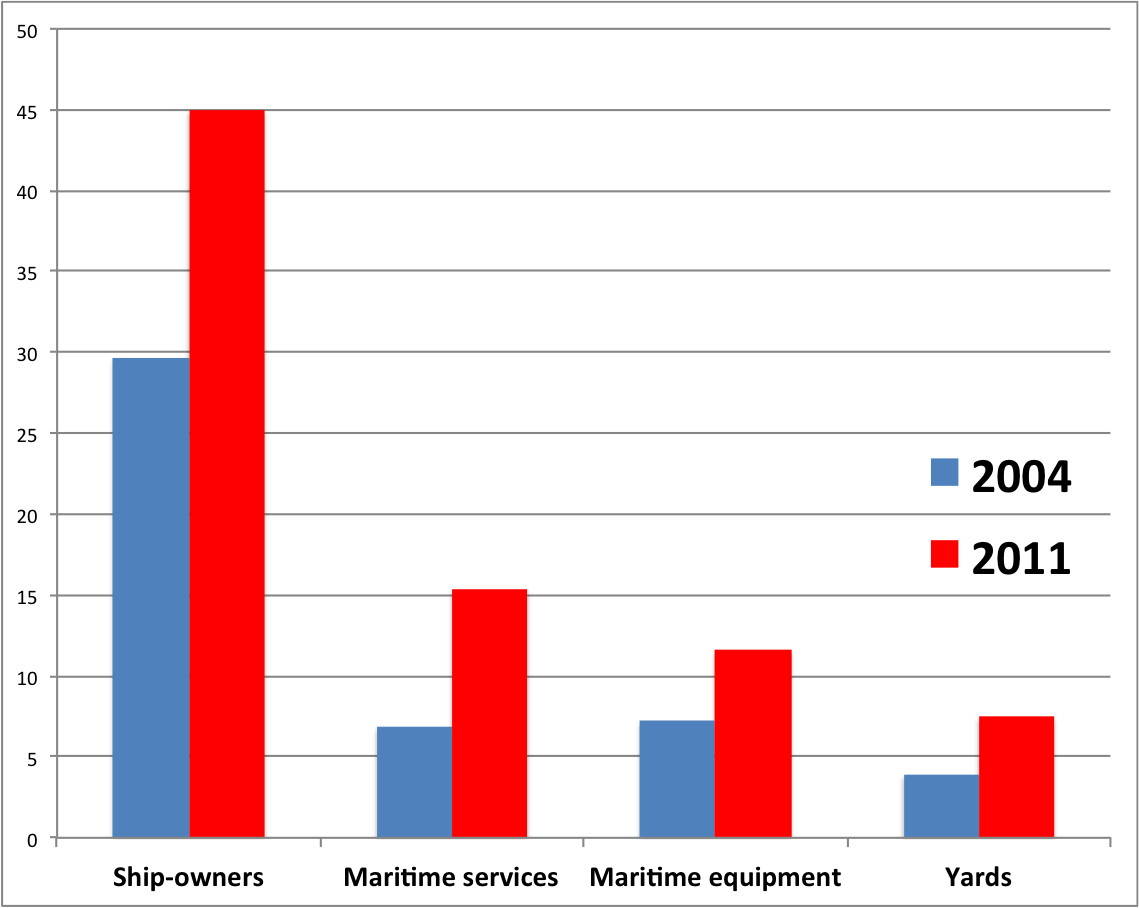

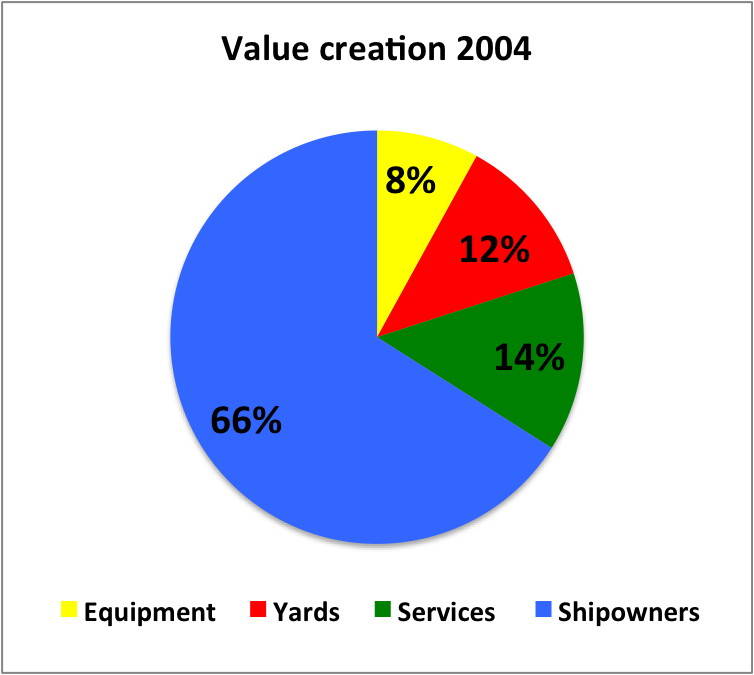

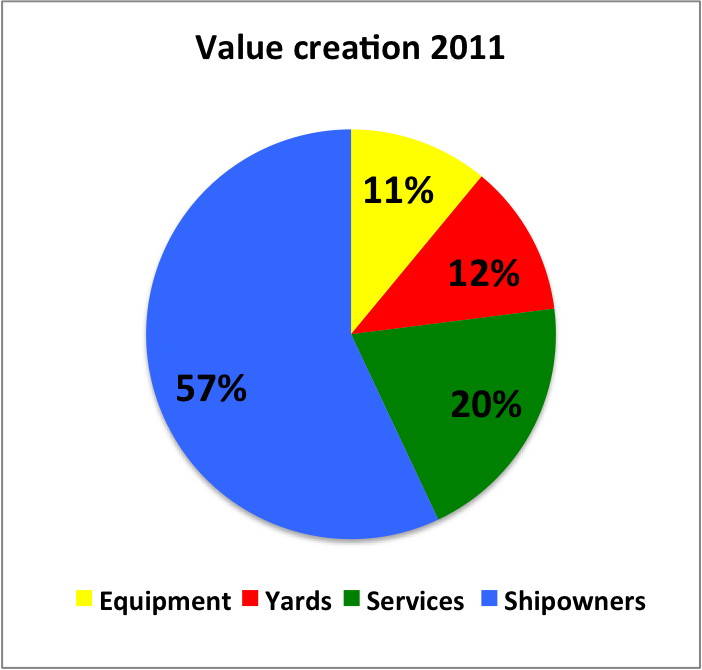

With nearly 80 bill. NOK (7.50 NOK = 1.00 €.) turnover in 2011, value creation (Definition of »value creation«: The performance of actions that increase the worth of goods, services or even a business. Many operators now focus on value creation both in the context of creating better value for customer purchasing their products and services, as well as for shareholders who want to see their stake increase in value.) of 27 bill. NOK and 20,184 employees (including the navy) the maritime industry is the second largest in the Bergen region after oil and gas. Considering the period from 2004 to 2011 value creation and turnover have picked up by 70 %, employment has grown by 20 %.

The region’s shipping companies alone had a total turnover of 45 bill. NOK in 2011 and made a value creation of 15.3 bill. NOK, the annual increase in turnover has been 5 % and value creation grew by 2 %. The shipping business may be split in two sectors where the majority of the value creation is derived from deepsea and shortsea shipping services, but where an increasing share derives from offshore.

While traditional deepsea shipping had been gradually scaled down globally, relocated abroad or turned in a financial direction like in Oslo, Bergen has been able to keep its position as a shipping centre, not least due to a relative high number of family-owned shipping companies fully integrated with chartering, technical management and operation within the organisation. Beyond the deepsea and shortsea players and to a certain extent the equipment suppliers, the other sub-groups are largely aiming at the offshore market.

Comparing the Bergen industry to the nationwide cluster, the regional activities mainly mirror the national. Three sub-groups have a certain larger importance in the region: rig companies, shipyards and financial/legal companies. As for shipping companies, it appears that deepsea shipping is far more important in Bergen. Bergen is, together with Oslo, the centre for deepsea shipping in Norway.

Leading in niche markets

Bergen’s shipping companies could be recognized by five main activities: specialized bulk carriers, chemical tankers, shortsea shipping serving Northern Europe, local shipping, as well as subsea, supply, seismic and oil drilling activities. While deepsea companies have taken a marginal decline in value creation, explained by the conditions in the global market, the growth has been high and sustained for the offshore shipowners.

Most of the shipowners have specialized on niche markets, particularly within the chemical trade and so-called open-hatch market as well as offshore and seismic operations on the other hand. Some of the world’s largest companies in specific segments are headquartered in Bergen: Odfjell, Grieg Star, Westfal-Larsen, Gearbulk, Kristian Gerhard Jebsen, Jo Tankers, GC Rieber Shipping, Atlantic Offshore, just to name a few. Most of them have a long tradition, partly founded decades ago, like Odfjell in 1914, Westfal-Larsen in 1905 or Grieg Star even 125 years ago. In addition to specializing in niche markets the recipe of success, compared to German shipping companies heavily shaken by the economic crises, of the predominantly family-owned companies probably relies on the ambition to make investments and to close contracts with a long-term perspective. Furthermore, the development of vessels is based on the close cooperation between shipowners, customers, designers and shipyards.

Odfjell, for example, was a pioneer in the market for chemicals and fluids and had their first stainless steel tanker delivered in 1960. With a fleet of some 100 vessels today Odfjell is one of the largest chemical carriers in the world. Although the market remains difficult the company’s order activity remains high, as the third of three 9,000 dwt stainless steel chemical tankers is expected to be delivered soon, as well as a 75,000 dwt tanker from Daewoo shipyard, which may be the world’s largest chemical tanker with 86,000 m3 cargo capacity and 31 zinc-coated cargo tanks. Moreover, the delivery of a series of four 46,000 dwt units – to be built by Hyundai Mipo – is scheduled for the first half of 2014. Also, Odfjell holds a share in ten tank terminals around the world.

Grieg Star’s executives have demonstrated to plan long-term as well: They invest 3 bill. NOK in ten new open-hatch ships to be delivered within 2014 by Hyundai Mipo. The new generation ships – equipped with slewing cranes – offer increased suitability for project cargo. These ships were part of the recent results of the joint industry project »Low Carbon Shipping«, funded by the Research Council of Norway. In collaboration of DNV’s research department and Grieg Star the application of a battery hybrid power production system to supply the electric cranes during port operations was tested. Model tests showed annual fuel cost savings of 110,000 $ (30 %) that had less than a year’s payback time.

The open-hatch carrier design with its wide hatches over the full ship’s width was developed over 40 years ago in Bergen, too. Typically fitted with movable gantry cranes, developed by Bergen engineering firm Sverre Munck, this ship type has proven to be perfect for commodities like pulp, forest products, steel and project cargo. Today, the three Bergen-based companies Grieg Star, Westfal-Larsen and Gearbulk control the majority of the global fleet in this segment.

Another segment with very high value and purpose-built tonnage is that for seismic and subsea operations. GC Rieber Shipping owns and operates three subsea vessels, three 3D seismic vessels, and five ice and support vessels. The company with an equity ratio of 50.6 % and a revenue of 781 mill. NOK in 2012 has its own in-house ship design and engineering department. Currently, two ships are under construction, a seismic and a subsea vessel. Based on an Ulstein design, the 800 mill. NOK subsea newbuilding is characterized by a high degree of commercial and operational flexibility for multiple market segments within the subsea industry.

Atlantic Offshore, owner and operator of plattform supply vessels and emergency response rescue and standby vessels, started off on the wrong foot as it was established in 2008, but could find well-heeled investors. Today Øgreid Eiendom, engaged in the real estate business, owns 80 % of the shares. At the moment Atlantic Offshore is in the process of undertaking a fleet renewal: Six newbuildings are under construction at the Norwegian yards Kleven, Simek Flekkefjord and Bergen Yard, and in Spain at Astilleros Zamakona.

Maritime service suppliers

The cluster’s sector »maritime service suppliers« includes ship designers, shipbrokers, marine insurances, financial and legal services, classification, port and logistic services, engineering, supply and service of equipment. With a turnover of 15.4 bill. NOK (2011) and 4,000 employees these members of Bergen’s maritime community have seen the strongest growth in turnover since 2004. The rise has in particular been driven by the financial and legal services. Behind Oslo, Bergen is the centre for those services directed towards the maritime industry.

The Norwegian Hull Club, for instance, ranks among the largest marine insurance institutions and underwrites more than 9,000 vessels from its Bergen headquarter. PricewaterhouseCoopers is represented with 280 employees – of 1,600 in total nationwide. Ship financing banks as DnB, Nordea and even German DVB are found in Bergen. DVB, as part of the large DZ Bank Group, has chosen Bergen as its main office for the Nordic region and focuses on shipping mortgage.

For Bergen shipping companies it is also typical to keep their own chartering department, rather than relying on shipbroker channels. Companies like Odfjell, Grieg Star and Westfal-Larsen, among others, are dealing directly with their customers through their own chartering desks and local offices.

Heavy ships equipment

Mainly producing »heavy ships equipment« the Bergen-based equipment sector contributes 15 % of the value creation, corresponding to 3.1 bill. NOK, and nearly 3,000 employees. Almost 70 % of the turnover is generated by Bergen Engines, owned by Rolls-Royce Marine, and pump manufacturer Frank Mohn. At its plant in the north of Bergen, Bergen Engines produces gas-fuelled engines. Already in 1991, the manufacturer – at this time owned by Ulstein – delivered its first lean-burn gas engine. Unlike other engine manufacturers Rolls-Royce focuses on gas as single fuel, not on the dual-fuel technology.

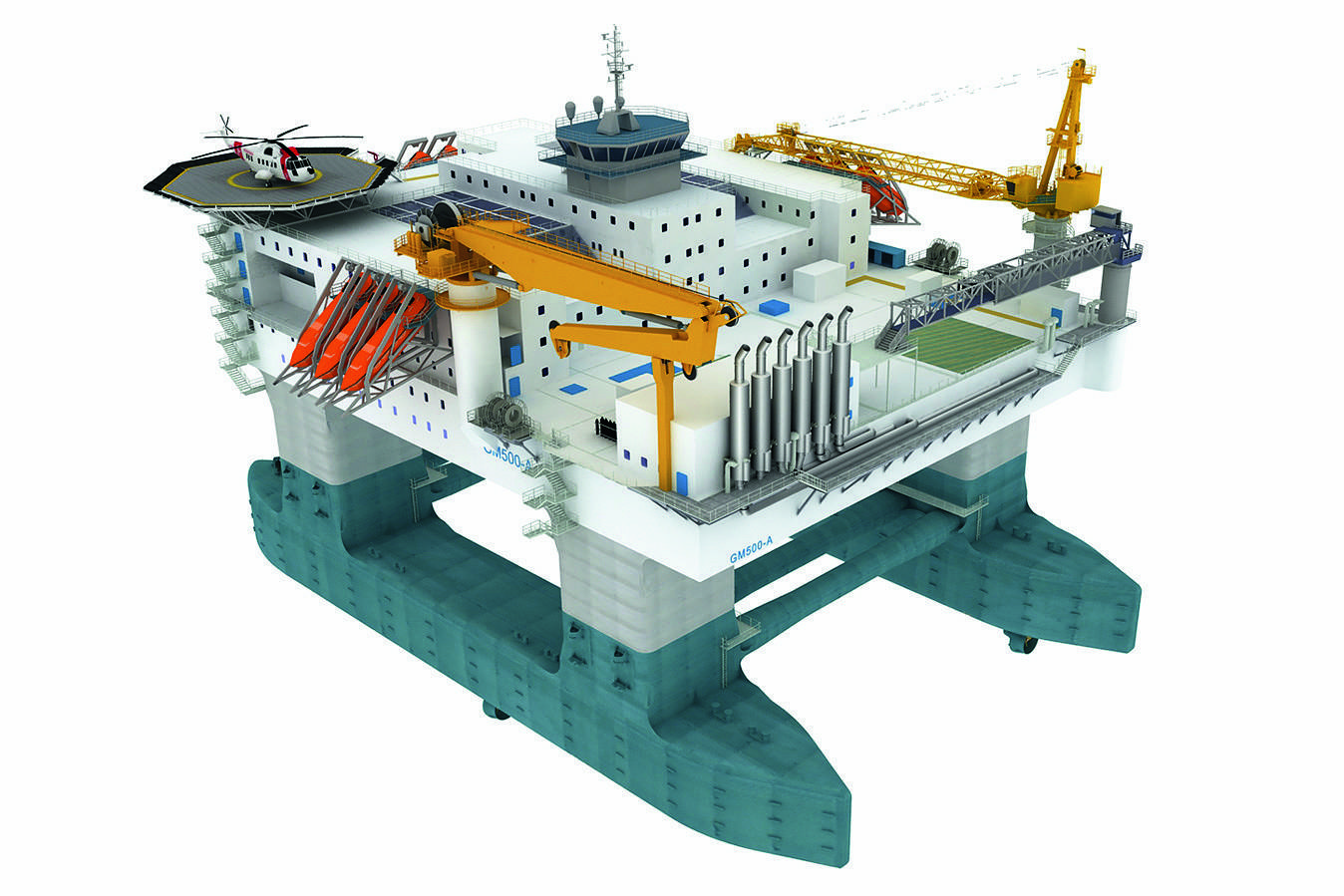

Claiming to be one of the top three suppliers in the specialized market for winches and cranes for the offshore industry, marine cargo handling and ro-ro equipment, ports and logistics equipment, TTS Group is also headquartered in Bergen. Since 1997 the company pursued an expansion with 30 acquisitions and establishments worlwide. The purchase of the German crane manufacturer Neuenfelder Maschinenfabrik (NMF), former part of the insolvent Sietas Group, is the most recent acquisition. According to TTS, China is one of the most promising markets. This is emphasised by a 50 mill. NOK contract, concluded in April this year, for the delivery of two offshore cranes for a newly contracted semi-submersible accommodation vessel.

The rig, ordered by Axis Offshore, a joint venture company between Danish J. Lauritzen and HitecVision in Norway, will be built at Cosco Shipyard in China. This is the first contract that the TTS Group has signed with the Cosco Group for offshore cranes. It is a result of the cooperation between TTS Offshore Handling Equipment (OHE) and TTS NMF.

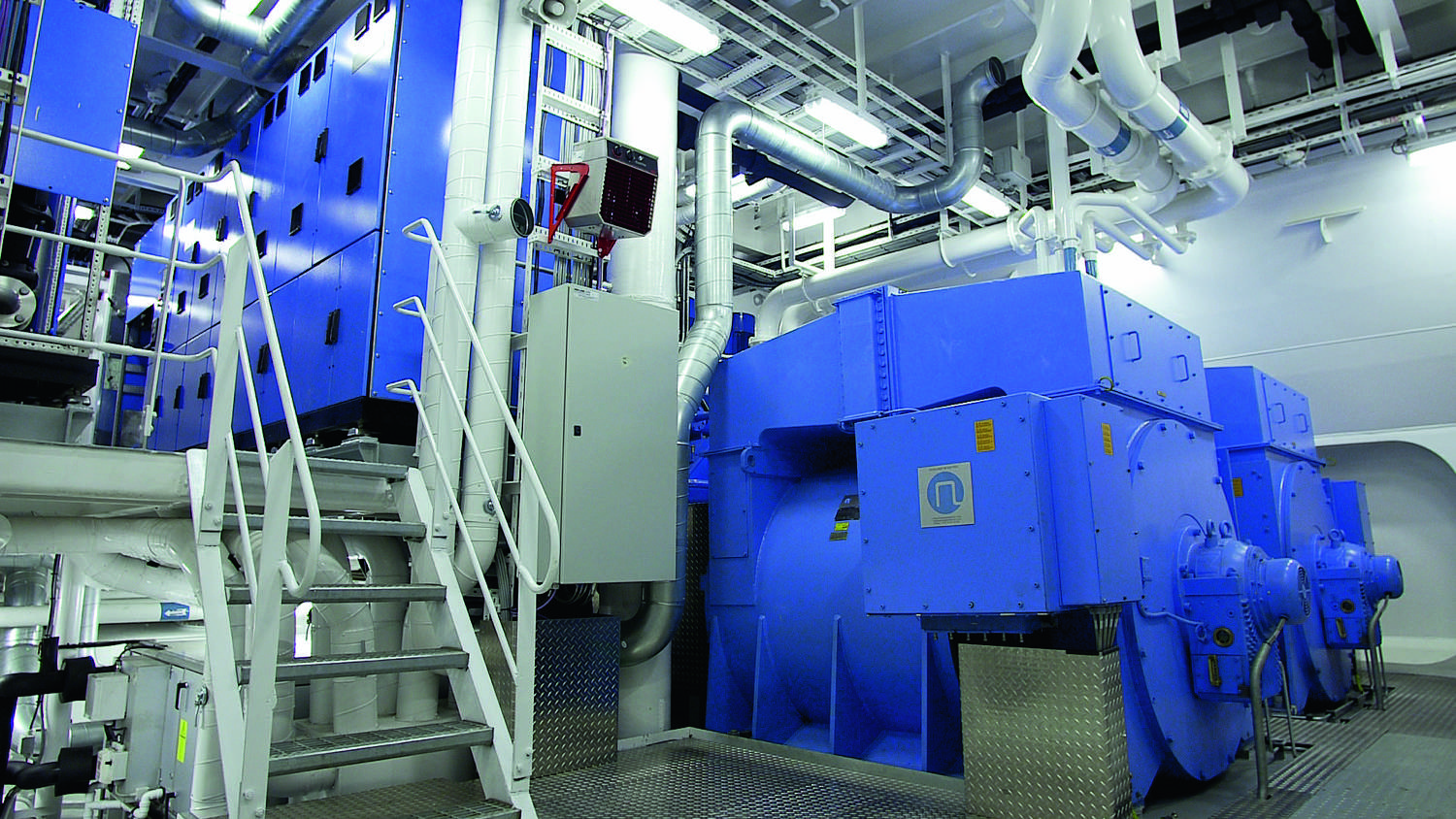

Among the Bergen-based suppliers for electrical equipment is a young company, though led by a management with long-time experiences in diesel-electric ship propulsion: Norwegian Electric Systems (NES). CEO and President Jan Berg founded NES in 2010, after he had sold his company Scandinavian Electric Systems (SES) to Rolls-Royce in 2008.

NES offers both low and medium voltage solutions, ranging up to 40,000 kW. In addition to the traditional market for solutions up to 5,000 kW, which are typical for offshore supply vessels, NES’s systems are applied in drill ships, semi-submersibles, conventional rigs, platforms, large tankers, and cruise vessels.

NES delivered the electrical package for the jack-up vessel »Seajack Zaratan« for instance and won the follow-up order for its sister vessel »Seajack Hydra«, which is planned to be delivered in the second half of 2014 by Lamprell Shipyard in Dubai. The 8 mill. $ order includes generators, main and emergency switchboards, NES’ black out safety system B.O.S.S., thruster motors and thruster drives (Quadro Drive). All will use the advanced NES ring-net switchboard solution. NES says that its switchboard solution provides high levels of protection for increased DP capability and redundancy, and the system should reach total harmonic distortion of under 2 %.

As a further part of maritime services, the Port of Bergen plays a significant role in the region: It had the largest turnover of coastal and international cargo in Norway in 2012. In addition, Bergen is even the largest port in Scandinavia regarding the handling volume of oil.

Shipbuilding

Shipbuilding in Norway is a business with a long tradition. The predominantly smaller shipyards in rural areas around the Bergen region are general employers, drawing on a broad range of specialized contractors and suppliers. Compared to other shipbuilding nations, wage costs in Norway rank among the highest all over the world. Here once again the characteristics of the Norwegian maritime cluster become apparent: Companies enjoy close relations to local shipowners and suppliers.

Bergen’s strategic strength lies in industrial shipping operations, often with vessels developed for special markets and individual customer’s requirements. The tonnage for niche markets is advanced and therefore more expensive.

In all, the Norwegian maritime economy ranks among the ones with the most potential for growth. Though it is no wonder that the second largest European shipping trade fair Nor-Shipping takes place in Oslo – alternating with the SMM in Hamburg.

Karina Wieseler