The achievements of Piraeus Container Terminal are remarkable, Orestis Schinas from the Hamburg School of Business Administration says

Undoubtedly, the entrance of Cosco in the port system of Piraeus is a very positive sign for the Greek economy[ds_preview]. It is a sign of confidence to the reforms propelled by the Hellenic government. Furthermore, there are many press releases and articles that indicate a bright future of the seaport in Piraeus and the related logistic chains in the Balkans. Is the enthusiasm reflected in the press and expressed by officials well justified?

Cosco set up the fully owned subsidiary Piraeus Container Terminal (PCT) in 2009.PCT operates Terminal 2; Terminal 3 is at the final stages of construction. Super-post-panamax cranes are already in place and the aim is to handle volumes up to 3.7 mill. TEU. The achievements of PCT are remarkable: Reconstruction and modernization of the Terminals along with handling of 2.1 mill. TEU in 2012, an increase of 77 % from 2011, and a transferring of hub operations by some of Cosco peers. On the other hand, the state-owned yet public listed Piraeus Port Authority (PPA) operates Terminal 1 and handled ~640.000 TEU in 2012. Trenose (the state-owned rolling stock operating company) will be privatized, as a part of the reforms of national economy, and an efficient rail connection of the Piraeus Port with the Balkan hinterland is planned.

Port and logistics renaissance

It was also announced that PCT, Trenose and Hewlett-Packard have agreed to establish and operate a seaport-rail chain that facilitates the flows from Asia to the markets of Central and Eastern Europe. Cosco has expressed an interest to operate all terminals in Piraeus and along with a Chinese rail operator to acquire the rights and operate the freight trains from Piraeus. Some logistics facilities are already available in the PCT zone.

»Should one expect modal shifts and impacts similar to those experienced when the Italian port industry was deregulated some years ago?«

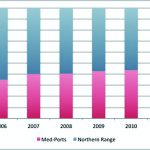

Are we experiencing a renaissance of the Greek port and logistics system? Is this a worrying signal for competing ports and terminals? Should one expect modal shifts and impacts similar to those experienced when the Italian port industry was deregulated some years ago? A careful view at the statistics suggests that the Mediterranean ports are constantly gaining significance in terms of container throughput. Volume data compiled on the basis of the most important ports (>1 mill. TEU throughput) suggest that the Med-ports increase in total their market share (see graph on the right). This development does not impose a threat to the dominance of the northern continental ports though; there is a substantial potential of growth in these regions. Demographics and macro-economic factors suggest and justify this potential. Potential gains of terminals, such as the ones reported by PCT, should be viewed as intra-Med gains, where major carriers reallocate their interests and terminals compete fiercely.

It is the author’s opinion that the map will not change and the northern ports will not experience a threat unless the infrastructural projects in the Balkans will be completed. The TEN-T axes are not finished yet, and even if the Greek government speeds up the construction of major highways and rail connections along with the privatization of the operation of freight trains and rail hubs, the central and eastern European markets cannot be accessed unless the projects in the rest Balkan States will be completed. Having a look at the official maps of the TEN-T programme (released in May 2013), most of the rail connections in Greece, Bulgaria and Romania should be constructed or reconstructed in order to provide efficient logistics connections from Greek ports to the central and eastern European regions. Even if these projects are planned, the construction might not be finished before 2020, so there is time for competing ports to respond to these challenges. Taking into account the dire economic situation in most southern European states, the completion of these rail projects within planned time frames seems unattainable.

Influence of the EU

One should not forget the European regulatory pattern on competition. The European Commission might oppose the dominance of a single operator in the port of Piraeus. A private monopoly might be more dangerous than the former public one. Agents and users of the terminals in Piraeus complain that PCT demands the handling fees before the delivery of the service, as PPA used to and still requires. This unique practice dates back to the state monopoly and both terminal operators have an interest to retain. On the other hand, a Chinese dominance in freight rail operations to and from the Piraeus terminals might be highly disadvantageous for PPA and other terminal operators in Greek mainland, say in the Port of Thessaloniki.

It seems that the Greek government is faced with a very complicated problem; the exceptional performance of PCT so far connotes a bright future in terms of volumes handled, attraction of hub services and generation of feeder and short-sea shipping activity. On the other hand, permitting the Chinese penetration further into the market either by granting the freight rail operation rights or by the concession of the rest of the Piraeus Port may distort competition. High volumes induced by Cosco presence cannot be ignored but should also not lure the decision makers. Once the decision is made it is difficult to revoke and the competition pattern will be set for both international and regional actors.

Orestis Schinas