With less incidents reported at Lloyd’s Open Form and less to recover, the salvage industry faces more complex tasks than ever.

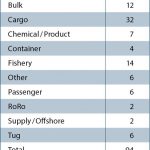

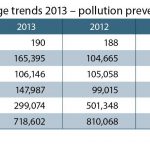

When the International Salvage Union (ISU) published latest figures on salvage trends in March, the »slight decline« in total salvage[ds_preview] incidents had already been obvious: Nearly three quarters of a million tonnes were salvaged by ISU members in 2013. The total of all pollutants salved last year was 718,602t compared to 810,068t in 2012.

The trend of a decreasing number of casualties chiefly reflects improvements to ship and operational safety over the past years. However, there are new peaks: The quantity of oil cargo incidents rose from 104,665t to 165,395t and at chemicals there

was an increase from 99,015t to 147,987t. In both cases only few incidents caused dramatic statistical change.

So there is not necessarily a new trend. The quantity of »other« cargoes salved went down by 40% from 501,348t in 2012 to 299,074t in 2013. In the ISU statistics this category included coal in bulk in 2012 for the first time and there were two large coal cargoes included in that year’s numbers. In all, there were 190 services carried out by ISU members.

The Japanese contract was the most widely used with in total 54 services, many of which were relatively small cases involving fishing vessels. Lloyd’s Open Form salvage contract accounted for 44 services compared with 52 in the previous year. 31 services were carried out under towage contracts (32 in 2012). Wreck contracts accounted

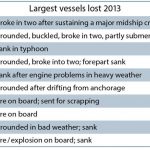

for 31 of the services (42 in 2012) and fixed price, day rate and other types of contract were used in 30 services. Basically, vessel safety has improved. But there is still a lot of potential for improvement: The 100 th loss of a passenger vessel since 2002, which is likely to occur this year, is thus a matter of statistics.

Relevant change in salvage is not defined by quantity but the new quality of removing mega cruise ships and comply with more regulation. The industry is »innovative and capable of meeting the most demanding challenges at sea,« United Kingdom’s shipping minister Stephen Hammond recently characterized the state of the international salvage industry. This estimation paid tribute to the most prominent event, the removal of »Costa Concordia«.

At a spring meeting in May, Lindsay Malen, Director Business Development at Titan Salvage, reported to the Maritime Law Association on escalating costs of wreck removals. The growing size of vessels and their increasing complexity concern the salvage industry. Malen: »The industry expects us to prepare for increasing ship size casualties but there is limited broader backing for the salvage industry. Just to put it into perspective, the Triple-E ships are much larger than the largest cruise ships, so in our view, the entire industry needs to step up and see how we can handle these increased risks.« According to ISU it may take a year until all containers are removed in case of a mega ship accident. As for supersized container vessels, »no one can tell us exactly what we are exposing our people to,« Malen said.

Ulf Teske, Head of Salvage Academy and Public Relations at Svitzer, agrees to growing complexity: »On paper we see less salvage recently but incidents turn out to be more and more complex as demanding salvage is on the rise. We at Svitzer had a big project of ordnance removal in Iraq recently. Furthermore, there was an LNG incident, and we had an emergency ship-to- ship transfer – the first since 1976.« Svitzer, which claim a 30% share in the emergency response market, are willing to specialize responding to more complexity. To be ready for the new supersized container vessels, the company is working on a container offload system with Maersk as a partner.

Another important recent development in salvage is based on increasing regulation in the US, the new OPA 90 (Oil Pollution Act of 1990). According to Malen from Titan Salvage it proves costly to salvagers to have the right equipment available at any point in time.

»We at Svitzer entered the OPA 90 market with success, however, real work is just getting started and we had our first real case where our performance was acknowledged by the US Coast Guard,« Teske said. As a special feature, experts at Svitzer are working on a strategy to offer clients a global preparedness cover modelled after OPA 90. »For this new programme we already have more than two dozen partners who have accepted our strategy,« Teske said. Finding new partners characterizes the salvage industry now that OPA 90 comes into force: T&T Salvage announced a new response partnership with Long Beach Fire Department in April following combined exercises in March.

Both Titan and Svitzer currently invest much money in new equipment. The task is, according to Malen, »not just buying it but rather adapting it to the specific circumstances needed in a particular operation.«

New vessels, however, are not big on the salvagers agenda, as the overall salvage market saw a decline. »Our goal is to have low assets, not to maximise ressources but rely on local partners like Harms Bergung,« Teske from Svitzer said.

More than ever, networking is key to salvage operators: Titan was working on the wreck removal of the »Costa Concordia« and about 30 other operations simultaneously. To do so, they worked closely with partner Micoperi, an Italian company, to remove the wreck. As a document of the company’s success at the wreck of »Costa Concordia«, Titan Salvage was presented the Maritime Casualty Response Award handed over by Lloyd’s Register in February 2014.

The project is considered one of the largest wreck removal projects in history. According to Titan, however, it is not primarily the lessons learned with this prominent wreck that show latest salvage trends but e.g. the successful refloating of »Danio« off England’s Northumberland coast in March 2013. As Malen said, »Danio« remembered the industry that »environmental factors and the public perception have the largest influence on salvage costs today«.

All in all, the industry is not troubled by a decrease in incidents. Boskalis, for example, announced »Towage & Salvage had a good year« through daughter Smit. Here, the outlook is »stable compared to 2013«. In 2013, Smit formed an alliance with Donjon to assist shipowners with OPA 90 services. Beyond such alliances, new business is emerging with decommissioning old offshore facilities, »a billion dollar market calling for new tools,« Teske said

Sverre Gutschmidt